Upstox Originals

Erratic monsoons, real consequences: Tracking the economic impact

.png)

5 min read | Updated on May 28, 2025, 19:36 IST

SUMMARY

Unseasonal rains have arrived early across the country, disrupting crops, pushing food prices. This could hurt demand in sectors like consumer durables, automobiles, pumps, and even ice cream. So, this isn't just about bad weather; it's affecting what we purchase, how much we pay, and leading to a ripple effect across the economy.

Unseasonal and heavy rainfall across India has led to a spike in food prices

For the first time in over a century, monsoon has arrived almost 16 days early in Mumbai. But it’s not just Mumbai—Delhi, Gujarat, and Madhya Pradesh have also been caught in a whirlwind of unseasonal and heavy showers that have led to flooding in many cities.

As the rains set in early, their economic impact is already being felt across sectors from agriculture to consumer markets

Agriculture: Mixed impact

The immediate impact is seen in agriculture, with damaged crops leading to a sharp rise in food prices. Key crops like onions, tomatoes, leafy greens, chillies, peas, and french beans have been hit hard, with damaged harvests leading to price surges. So far, the following updates have been reported:

-

In Maharashtra, India’s onion belt, crop damage now stands at approximately 34,842 hectares, versus earlier estimates of ~31,889 hectares, due to consistent rain in districts like Amravati, Jalgaon, Buldhana, and Ahilyanagar.

-

Tomato prices have seen a sharp spike. In Pune, they have increased almost 4-5x from ~₹5/kg wholesale to ₹20–₹25. Supply has been impacted as farmers struggle to harvest due to ongoing rains

-

In some areas, kharif sowing has taken a hit as wet soil has made it difficult to operate tractors

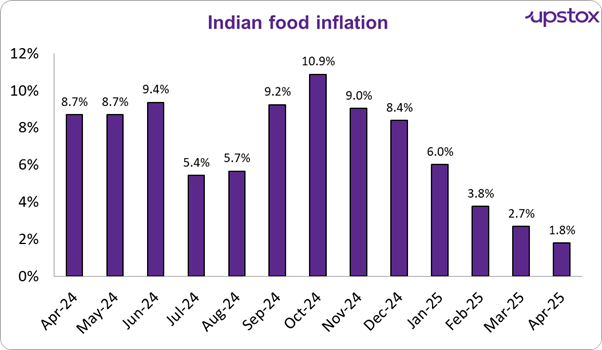

We’ve seen this play out before. Last year, when unseasonal rains struck in August and September, food inflation doubled compared to previous months. If history repeats itself, consumers may find their grocery bills climbing faster than expected.

Source: Trading Economics

However, it's not all bleak. The IMD and other agencies have predicted an above-average rainfall this year across most of the country. About 60% of India’s agriculture is still rain-dependent. While the challenges due to early rainfall are noted, an overall strong monsoon can improve overall strong agricultural output.

A strong rainfall ensures that groundwater fills up completely and also irrigation facilities for the rest of the year are robust, which should also help overall agricultural output.

On a separate, albeit important note, healthy levels for groundwater as well as other water bodies should help with hydroelectricity generation. About 8-12% of India’s electricity needs are met by hydroelectricity.

Impact on rural demand

Unseasonal rain has a significant negative impact on farmers' earnings, directly impacting rural spending and consumption. Since 2024, as highlighted by many market experts, rural consumption has been outpacing urban consumption. A trend that persists. As such, any adverse impact on rural incomes can have a much wider negative impact on overall consumption. This remains a key monitorable.

A strong rainfall can lead to healthy agricultural output and positively impact rural demand. However, it can also lead to flooding-like situations which can put a dampner on demand.

Sectoral impact

Before we look at the sectoral impact, we would like to say that we are still in the early days. As such, it is difficult to be entirely sure how these sectors are going to be impacted. As such, while we have presented data below, we would advise readers to take this as a start and keep monitoring the underlying data.

Microfinance

The microfinance sector could also get affected by unseasonal rains, if it impacts the farmers’ earnings. According to CreditAccess’s May 2025 earnings call, the Tamil Nadu region saw a higher portfolio at risk in the 90-day bucket, meaning more borrowers struggled to meet their repayment deadlines.

However, unseasonal rains weren’t the sole culprit; other factors, such as heatwaves, overleveraging by borrowers, and unseasonal flooding cyclones, also played a role in pushing delinquency rates higher.

Consumer durables

Cooling products like air conditioners, refrigerators, air coolers and related compressor products could see a decline. Usually, the April to June quarter contributes to more than 50% of their sales. With summer being cut short, their business is also expected to be impacted.

As per the May 2025 concall of Aditya Vision Limited, mentioned that their sales for air conditioners usually “peaks out in May and throughout June,” but currently this has not been the case. Similar sentiment has also been echoed by the management of Blue Star.

Ice cream & beverages

Ice cream sales were doing pretty well for the summer, with April 2025 delivering strong numbers. However, weather disruption towards the end of April and into May has taken a toll, leading to a clear decline in projected sales.

Manish Bandlish, Managing Director of Mother Dairy, has made it clear that the momentum has slowed, stating that unexpected weather shifts have reduced anticipated growth by around 10% as stated in his interview with the business line.

Top beverage brands have also voiced their concern about demand taking a hit in April-May 2025 by 15% as it was cool most days.

Similarly, demand for talcum powder is also expected to be impacted.

Automotive

Like other sectors, even auto sales aren’t immune to the downpour. Adverse monsoon in 2024 led to a strong pile-up in investors and hurt sales, which declined 5% YoY as per FADA. Low agricultural productivity can also impact tractor sales.

Pump Industry

Typically, the pump industry sees strong sales during the April-June and January-March quarters of the financial year, when demand is higher due to summer. This year, however, demand is expected to slip by 10–15% YoY. The industry was also impacted by poor liquidity among farmers.

Outlook

As unseasonal rain becomes more frequent, its economic impact is getting harder to ignore. From hurting farmers’ income to disrupting consumer trends, this causes a ripple effect. Unless better safeguards and planning are in place, this kind of weather disruption could keep straining both our wallets and business forecasts.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story