Upstox Originals

Dollar in reverse: Dollar Index falls back to 2022 territory

.png)

6 min read | Updated on July 14, 2025, 15:53 IST

SUMMARY

The mighty dollar is having a wobble, tumbling back to its 2022 levels amid Fed flip-flops, tariff drama, and a gold rush. As other currencies steal the spotlight, India stands to gain on cheaper imports, but there’s no guarantee the ride will stay smooth.

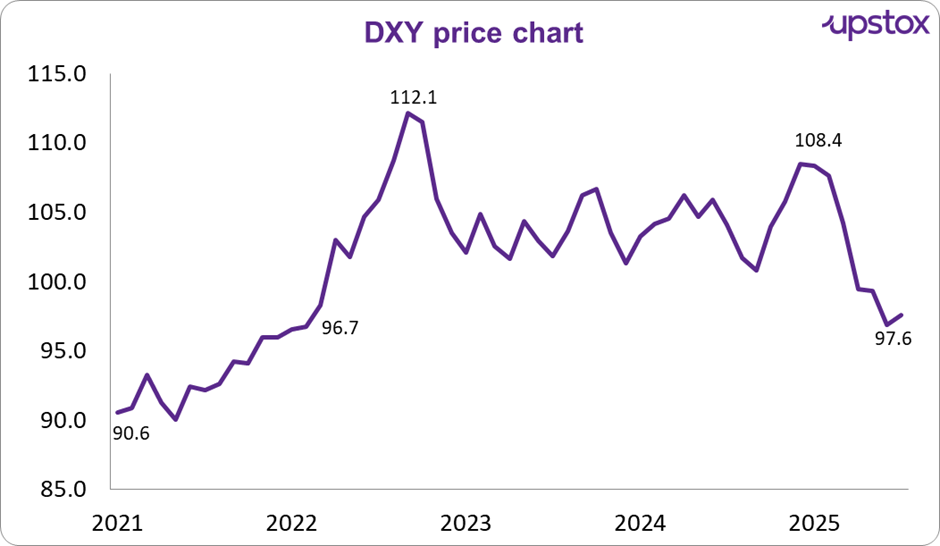

The dollar index is currently trading around its 2022 level

The U.S. dollar has slid back to levels last seen in 2022, driven by a mix of market volatility, shifting Fed expectations, and global policy twists. In this article, we will explore the key drivers behind this move, why these levels are significant, and what lies ahead for the greenback.

What is DXY and why does it matter?

The U.S. Dollar index (DXY) measures the U.S. currency strength against a basket of six major currencies like the Euro, Yen, Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. It’s widely watched to check the dollar's strength.

A rising DXY signals that demand for dollars across the world is in and vice versa. Key drivers include interest rate moves, world tensions and or changes in investor sentiments. DXY flows can impact everything from commodity prices and foreign trade to the price countries have to pay for oil or gold imports.

Source: Investing.com, Data as on 09-07-25

If you look at the chart above, you’ll see the DXY is currently trading around its 2022 levels. That’s quite a shift in sentiment, especially given the current administration’s focus on maintaining America’s global strength. The market is not responding the way the government would like it to. Let us explore what is driving this downward movement of the DXY.

Drivers behind this weakness

Events around the FED

After close to 100 bps of rate cuts in 2024, the Federal Reserve (FED) has paused its rate cuts in 2025. Against expectations of continued rate cuts in 2025, the FED has so far, maintained rates at 2024 levels only.

Uncertainty around government tariff policies has made it harder for the Fed to forecast inflation reliably. As a result, policymakers have held back from delivering the rate cuts investors had priced in, which in turn has drawn criticism from the government.

As irony would have it, the current government has been insisting on rate cuts to push up growth, but it's their policies that have stopped FED from cutting rates further.

Adding to the uncertainty are the President’s recent digs at Fed Chair Jerome Powell and speculation that he might replace him prematurely, which have further rattled investors. The concern? A Fed seen as politically compromised could undermine its independence, shake confidence in U.S. monetary policy, and make the dollar a less attractive bet on the global stage.

Tariff’s, fiscal policy and debt

President Trump’s approach to tariffs in 2025 has kept markets on edge, with frequent announcements, delays, and sudden shifts creating ongoing volatility. Recent measures, like a 50% tariff on copper and threats of up to 200% duties on pharmaceuticals, have fuelled uncertainty and left investors bracing for sudden changes in trade dynamics. The government has recently announced intentions to slap tariffs on countries like Brazil, Malaysia, while setting an August 1 deadline to evaluate other countries.

On the fiscal front, the U.S. deficit remains elevated with no concrete steps taken to address it. A new tax and spending bill passed in July is projected to add over $3 trillion to the national deficit over the next decade. By the end of May, the cumulative federal deficit for fiscal year 2025 had already reached $1.4 trillion, up 7% from the same period last year. Meanwhile, interest payments on the national debt have surged to $776 billion, now accounting for 16% of total federal spending, underscoring the growing burden of servicing America’s debt.

Investors eyeing other safe havens

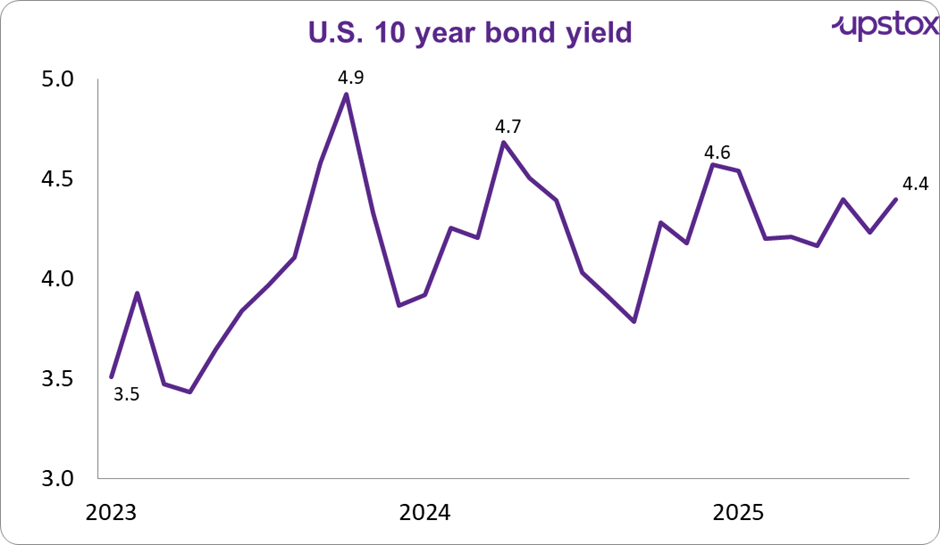

Beyond politics and Fed policies, U.S. 10-year bond yields have slipped from highs above 4.9% to around 4.3% in the current year, reflecting lower rate expectations and rising demand for safer assets.

Source: Investing.com, Data as on 09-07-25

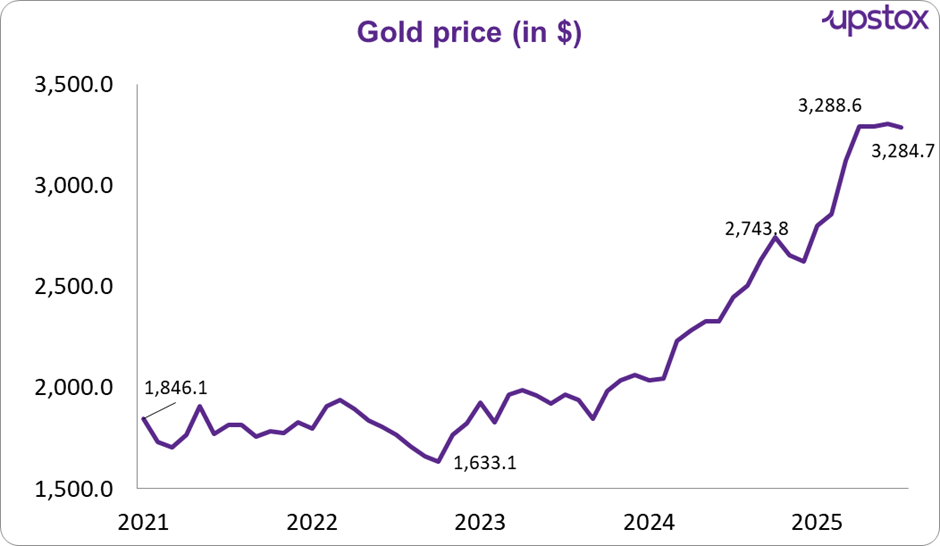

Meanwhile, gold has reached a record $3,335 per ounce, and silver has climbed to $36 per ounce, as investors diversify into alternative assets and seek stability amid shifting market conditions.

Source: Investing.com, Data as on 09-07-25

What does the past tell us?

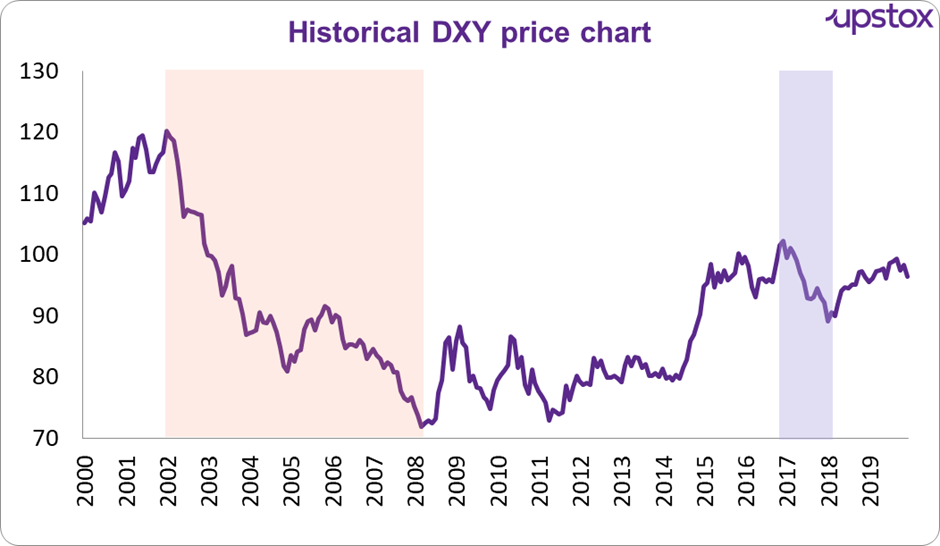

This isn’t the dollar’s first big stumble. History shows several episodes when the DXY lost significant ground.

If we look at past data, we can see that first, in the early 2000s till 2007 the dollar fell by over 40% due to large capital outflows from the U.S. to emerging markets, driven by the desire to take part in the rapid growth of these markets.

Source: Investing.com

Later we saw the US dollar decline in 2017 primarily due to low inflation affecting expectations for Federal Reserve rate hikes, and strong economic performances by countries globally which made the dollar less attractive. A significant contributor was also the euro's strength, as the eurozone experienced its best economic year in a decade

How is it compared to other currencies?

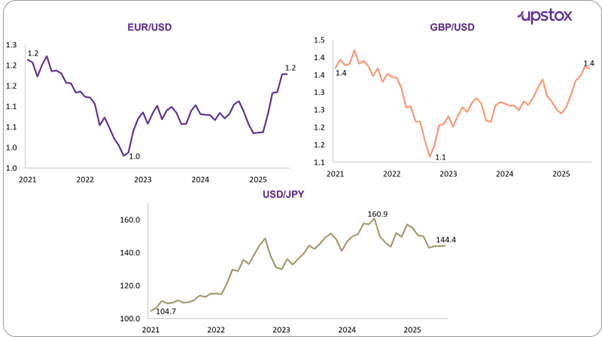

When compared to major currency pairs, the dollar has definitely lost some ground. Currencies like the euro, pound, and yen have strengthened significantly, with pairs such as EUR/USD, GBP/USD, and even USD/JPY seeing notable moves.

Many of these non-dollar currencies have been making new highs, reflecting a shift in sentiment away from the dollar as investors seek opportunities elsewhere.

Source: Investing.com, Data as on 04-07-25

And that shifting balance among major currencies has ripple effects for emerging economies like India.

How does this affect India?

A question that comes to mind after this read is - if the dollar has fallen against other countries, why has the Indian rupee not gained ground? Well, from the heights of ₹87.51, the exchange rate at the time of writing this was ~₹85.9. To a certain extent, the INR has also benefited from the weakness in the dollar.

However, even in India, constant global uncertainties, looming threat of tariffs on key industries like agriculture, IT, etc have weighed on the markets. While domestic investors have remained resilient, FII investment has not been as robust.

Parting thought

The dollar’s journey is expected to be bumpy in the near term as policy uncertainty continues to weigh on investors. America’s decision to unilaterally impose global tariffs has also not been well received by global investors, who are now looking for alternatives.

That said, the underlying US economy continues to be robust, with inflation under control and employment stable. As signs of stability emerge, the dollar could once again see some reversal in fortunes.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story