Upstox Originals

BESS revolution: Battery energy storage could power India’s green future

7 min read | Updated on September 14, 2025, 19:27 IST

SUMMARY

The Battery Energy Storage Systems (BESS) is the talk of the town in 2025. And why not? It is a crucial component of the renewable energy future that India envisions. India’s BESS market is on the cusp of unprecedented growth. Let’s find out: How big is this market? What is its potential? And what challenges does it face?

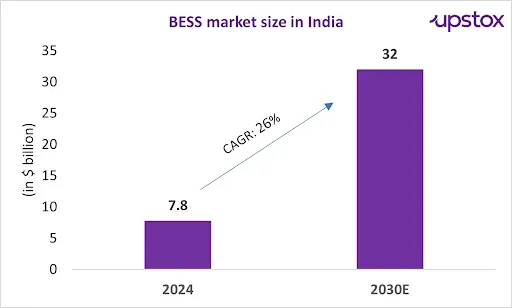

India’s BESS market was valued at around ₹65,130 crore in 2024 and is projected to reach ₹2.67 lakh crore by 2030.

You’ve installed solar panels. They work great when the sun is shining. But what happens when the sun goes down or clouds cover the sky? No sunlight = No power production. That’s exactly where the problem lies! And if you look at the larger picture, it’s an even bigger challenge for industries and power stations that rely on renewable energy for round-the-clock power. But every problem has a solution! And India has got one: Battery Energy Storage Systems (BESS).

Let’s decode everything around India’s Battery Energy Storage Systems.

What is BESS and how does it work?

BESS is an advanced system that captures surplus energy generated from renewable energy sources (sun and wind) during peak production times and stores it in rechargeable batteries for later use. Think of it as an inverter that stores and releases electricity when needed.

For households, it means uninterrupted energy and lower grid dependence. For industries and commercial setups, it means stable power, reduced peak-time costs and greater energy efficiency.

As India shifts away from fossil fuels toward a greener and more sustainable energy future, BESS is emerging as a critical solution for energy storage, grid stability and the integration of renewable energy. That brings us to the question: How big is India’s BESS market?

BESS market size in India

India’s BESS market was valued at around $7.8 billion (₹65,130 crore) in 2024 and is projected to reach $32 billion (₹2.67 lakh crore) by 2030. That’s an impressive compound annual growth rate (CAGR) of 26%.

As of December 2024, India’s installed BESS capacity reached 442 megawatts (MW). It is projected to reach 74 gigawatts (GW) by 2032. And guess what? The shift has already begun. In H1 2025, India’s BESS capacity saw major expansion, with 7.6 GW allocated to developers, marking the country’s highest BESS allocation to date.

What is driving growth in BESS?

Well, there are several factors.

BESS solutions are pivotal in India’s energy transition journey. This is the main reason why the BESS market is booming.

BESS plays a crucial role in managing the intermittency of solar and wind power. It helps provide 24/7 energy and keeps the power supply stable. Apart from grid stability, BESS is essential for ancillary services like voltage support, peak shaving and frequency regulation.

- National Framework for Promoting Energy Storage Systems (2023) to encourage the use of BESS by mandating a 4% energy storage obligation by FY 2030 from 1% in FY 2024.

- ₹18,100 crore Production-Linked Incentive (PLI) scheme for advanced chemistry cell battery manufacturing.

- ₹3,760 crore Viability Gap Funding (VGF) to support the installation of 4 GWh of BESS by FY 2031. An additional ₹5,400 crore funding to support 30 GWh of new standalone BESS development. Under the VGF program, the government will provide up to 40% of capital cost for BESS installation to developers.

- Waiver of Inter-State Transmission System (ISTS) charges for projects commissioned before June 2028 to lower BESS project costs for developers.

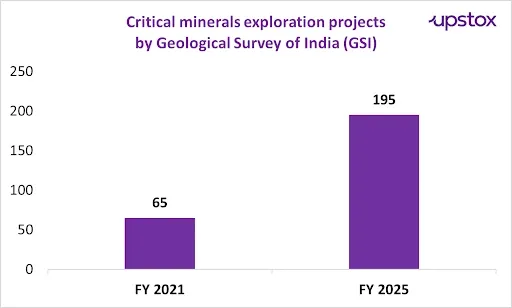

- Increasing focus on building domestic supply chains for sourcing critical minerals to reduce import dependence and boost local production capabilities.

While the BESS market is growing strong in India, it is also surrounded by several challenges. Let’s talk about them.

Challenges in the BESS market

Lead-acid and lithium-ion batteries pose environmental hazards when their components leak or spill out. The leakage of harmful substances can contaminate soil and groundwater.

To minimise these risks, there is a need for a robust infrastructure and policies for safe disposal and recycling of used batteries.

India’s projected annual requirement of critical minerals in the next few years (in tonnes)

| Mineral | 2025 | 2026 | 2027 | 2030 |

|---|---|---|---|---|

| Cobalt | 17 | 49 | 147 | 3,878 |

| Lithium | 58 | 174 | 517 | 13,671 |

| Nickel | 2,629 | 3,057 | 6,663 | 17,492 |

While the government is focusing on building domestic supply chains to reduce import dependence, it will take some time to establish them. Besides, recent mineral discoveries in India hold strong long-term potential, but slow progress in infrastructure and commercialisation is holding back short-term results.

Given these challenges, India still has a lot of work to do.

Probably, India can think beyond lithium-ion batteries and explore next-generation battery technologies by looking at other fast-growing markets like China and the US.

For instance, China actively uses sodium-ion batteries, the raw material reserves of which are abundant in India. Moreover, it is low-cost and easy to extract. It could offer India a path to reduce its dependence on lithium and make energy storage more affordable. Likewise, California relies on flow batteries that offer longer duration storage at a lower cost. If India can incentivise research and development in this area, it could emerge as a great alternative battery storage option.

Long story short, India’s BESS market is undoubtedly set for exponential growth, driven by ambitious renewable energy goals, critical need for grid stabilisation and strong supportive policies. But, for India to emerge as a global leader in this space, it needs to invest in innovation for newer battery technologies and ramp up its infrastructure to support rapid deployment of storage solutions.

For now, let’s keep our fingers crossed and hope for the best!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story