Upstox Originals

An overview of 2025 - Growth, volatility and everything in between…

8 min read | Updated on January 05, 2026, 19:38 IST

SUMMARY

If growth was strong and inflation cooled, why did markets still feel uneasy in 2025? Beneath the calm macro numbers, money kept moving, currencies wobbled and trade rules kept changing. Global headwinds persisted, but India leaned on policy reforms and deal-making to push back.

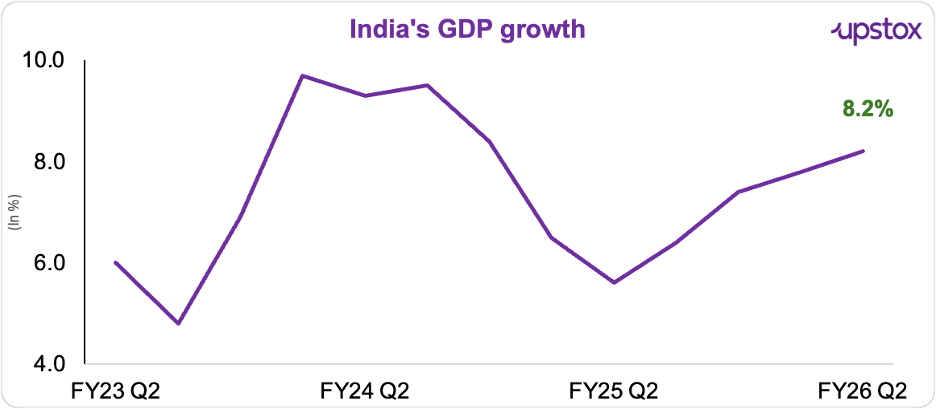

Between July and September 2025, India’s GDP expanded by a sharp 8.2%

2025 was a complicated year.

India grew fast, among the fastest in the world. Inflation cooled. Rates came down. Government spending stayed strong. On paper, the macro picture looked solid. And yet, markets were volatile, foreign money kept moving in and out, the rupee stayed under pressure, and global trade rules kept shifting mid-game.

So what really defined 2025?

Growth surprised

India’s growth story didn’t just hold up in 2025; it surprised on the upside. Already the world’s fourth-largest economy, India is now firmly on track to become the third largest by 2030, with GDP projected at $6.6 trillion, according to the IMF.

Between July and September, the economy expanded by a sharp 8.2%, a big jump from the 5.6% seen in the same quarter last year. So what drove the upside? Central and state government capital expenditure in H1 FY26 rose 18.7% YoY, led by sustained infrastructure push in roads, railways, and energy.

Manufacturing GVA grew 9.1% in Q2 FY26, driven by auto, electronics, and capital goods output, and construction

Real private final consumption expenditure grew 6.8% YoY in H1 FY26, the fastest pace since FY23, helped by rural income stabilisation, moderating food inflation (~4.8% CPI average in H1), and higher vehicle and consumer goods sales.

Gross fixed capital formation rose 10.2% in Q2 FY26, buoyed by double-digit credit growth and private investment in renewables, semiconductors, and logistics.

Source: RBI

Inflation cooled

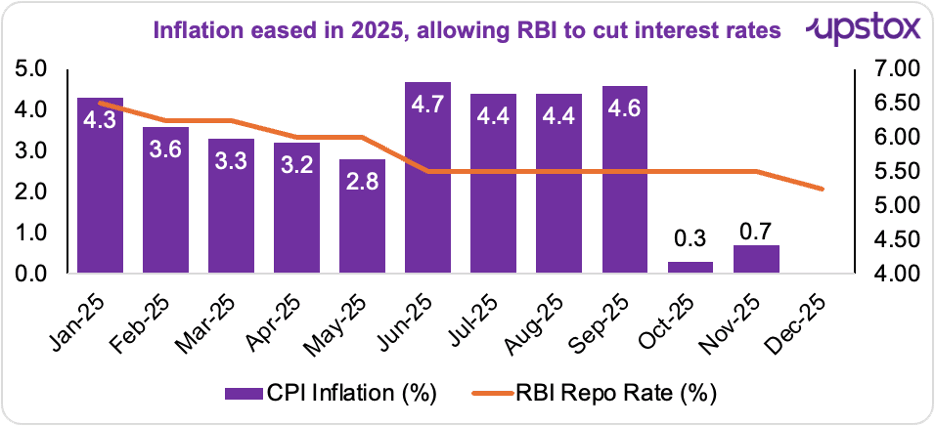

With inflation slipping well below the RBI’s 4% target, monetary policy quietly changed course in 2025. By the end of the year, policymakers had signalled a return to easing, with the RBI cutting the repo rate by a total of 125 basis points totally, bringing it down from 6.50% to 5.25%.

Source: MosPI, RBI

Rupee under pressure

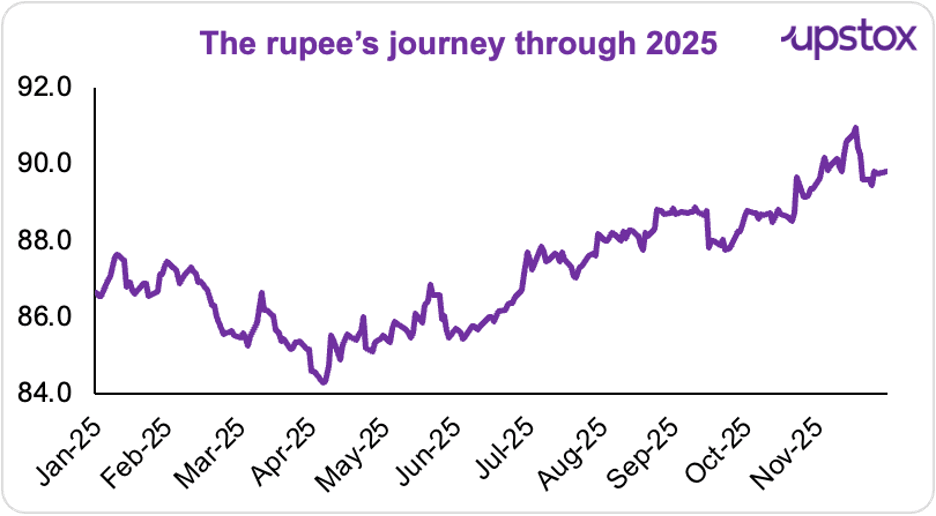

The rupee had a rough 2025. It weakened by over 5-6%, making it the worst-performing major Asian currency. A delayed India–US trade deal, stretched valuations, and India’s limited exposure to the global AI rally pushed foreign investors toward other Asian markets, accelerating outflows.

Source: Investing.com

Further, rate cuts often weakened the currency. A softer rupee made imported commodities more expensive in local terms, pushing up domestic metal prices. So, even as headline inflation cooled, asset prices told a more complicated story; especially in commodities.

Thankfully, oil was supportive

Global crude prices softened through the year, with Brent averaging $68–70 per barrel and sliding to around $60 by December, amid oversupply, weak demand and easing geopolitical risks. That alone reduced India’s import bill pressure.

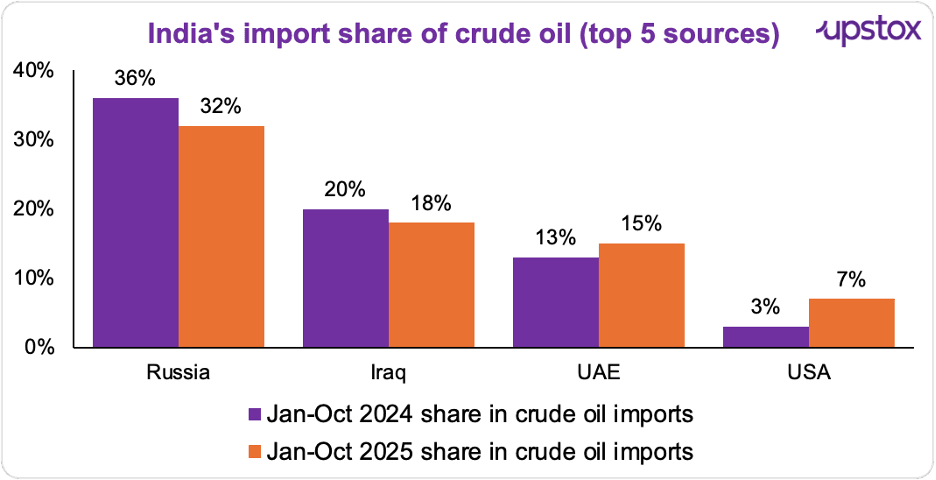

At the same time, India adjusted its sourcing mix to manage sanctions risk. Between January and October:

- Imports from Russia fell 17.8% YoY to $37.1 billion, reducing its share to 32%

- Imports from the US jumped 83.3%, from $4.25 billion to $7.8 billion

- Imports from the UAE rose 8.7% to $12.5 billion

This shift toward “clean” barrels allowed refiners to maintain export access while still benefiting from discounted supplies.

Source: PIB

Commodities had a strong run

Metals had a strong run in 2025, led by precious metals. By late December 2025:

- Gold climbed to ₹1.38–1.40 lakh per 10g, delivering 50–70% YoY

- Silver outperformed, crossing ₹2.3 lakh/kg in December 2025, posting 100%+ YoY gains and pushing the gold–silver ratio to around 68. -Industrial metals were mixed: copper rose over 40% YoY, aluminium saw mild gains, nickel edged up modestly, while zinc posted only limited increases

Pitfalls along the way (and how India managed them)

Global headwinds

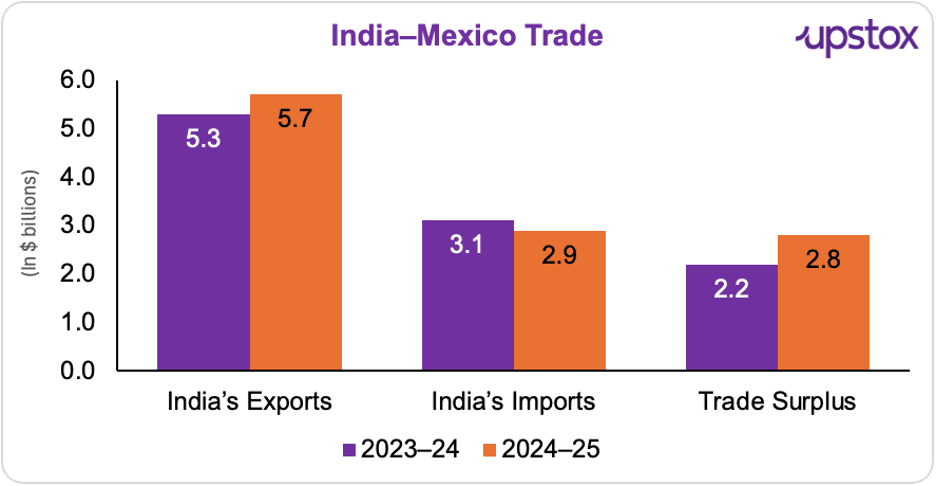

US tariffs (nothing new here!!) - Trade tensions lingered through 2025. Oh, and Mexico too. In December, Mexico announced a sharp tariff hike of up to 50% on imports from non-FTA countries, a move aimed at blocking Chinese trans-shipments from entering the US duty-free. Since India doesn’t have a free-trade agreement with Mexico, it landed squarely in the crosshairs.

The new regime applies to around 1,463 product categories, with duties ranging from 5% to 50%, and is set to take effect from January 1, 2026. According to estimates by the Global Trade Research Initiative (GTRI), nearly 75% of India’s $5.75 billion exports to Mexico could be affected, as tariffs jump from 0–15% to nearly 35% in many cases.

There is a possible off-ramp, though. India and Mexico are preparing to begin talks on a bilateral free trade agreement, with negotiation parameters expected to be finalised soon.

Source: TOI

So how did India respond to these tariffs?

-

In September 2025, India rolled out a major GST reset to ease household pressure, simplify compliance and revive consumption (explained in detail here).

-

Labour reforms followed soon after. By November, four new labour codes replaced 29 older laws, streamlining wages, industrial relations, social security and working conditions. (unpacked here).

-

In 2025, India signed four FTAs and opened talks with the US, Mexico and Canada to strengthen supply chains, while reviving or advancing negotiations with Israel, the EU, GCC, ASEAN, Chile, Peru and Australia. For a deeper understanding, read here.

Note: Trade impact indicates the estimated FY25 effect on exports, imports, trade balance and investment due to each FTA.

The story didn’t end at the economy…Markets had their own say

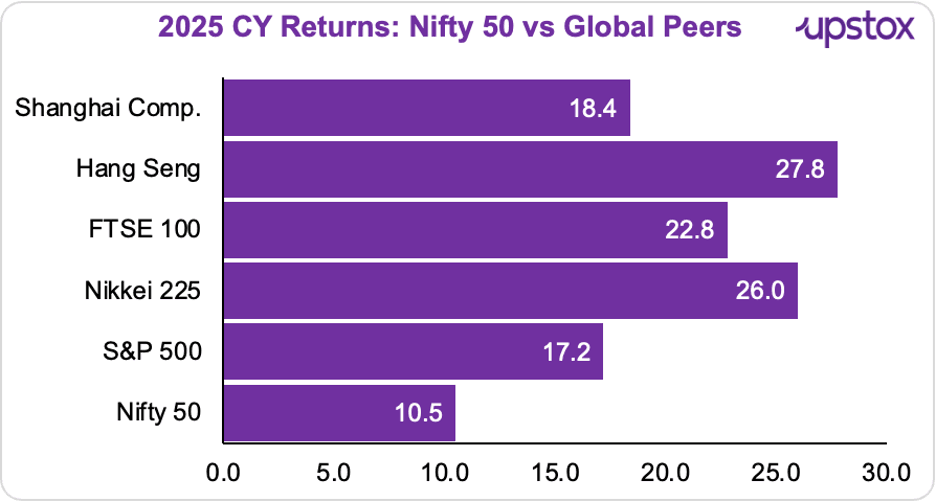

India’s equity markets delivered 10.5% returns in 2025; solid but underperforming select global peers amid contrasts of record highs, global shocks, and late-year caution.

Source: ET, Investing.com, Global indices tracking data Note: Returns are approximate based on closing data from late Dec 2025

India's relative underperformance vs select global peers reflected stretched starting valuations and rupee headwinds, but resilience points to a constructive base for 2026 amid global uncertainties.

What the data says about FPI outflows

While domestic markets held up, foreign investors were net sellers through most of 2025. In fact, the year saw the largest-ever FPI outflows on record.

| Year | FPI Equity Flow (₹ cr) | DII Equity Flow (₹ cr) |

|---|---|---|

| 2023 | ~(16,325) | ~181.482 |

| 2024 | ~(304,217) | ~527,438 |

| 2025 | ~(306,419) | ~788,184 |

Source: Moneycontrol

On a positive note, SEBI steps in to make India easier to invest in. Over the year, SEBI rolled out a series of relaxations aimed at reducing friction in FPI onboarding and compliance:

-

Introduction of common KYC to simplify documentation

-

Proposal to align KYC norms with banks, in coordination with the RBI

-

Launch of Swagat-FI, a single-window framework for trusted FPIs such as sovereign wealth funds, pension funds and government-owned entities

-

Extension of FPI registration validity from 3 years to 10 years under Swagat-FI

-

A one-time $2,500 KYC fee for a 10-year period instead of repeated renewals

-

Exemptions from the 50% aggregate investment cap applicable to NRIs and OCIs

-

Faster grievance redressal, with Sebi now proactively reaching out if registration delays cross one month

SEBI also approved allowing retail schemes in GIFT-IFSC, backed by Indian sponsors or managers, to register as FPIs; widening the investor base further.

The good news? IPOs stayed busy

Even as FPIs pulled back from listed stocks, the primary market remained a bright spot. India’s IPO activity hit a record in 2025, with companies raising ₹1.95 trillion across 365 public issues, making it the strongest year ever for equity fundraising.

Large listings dominated fundraising in 2025, with 106 mainboard IPOs accounting for nearly 94% of total proceeds, while SME IPOs formed the bulk of listings by number but contributed a much smaller share of total capital raised, as highlighted in the same analysis.

In a nutshell

In many ways, 2025 was a year of contrasts. Growth held up, policy stayed supportive, and the economy kept moving forward; but markets never fully relaxed. Money moved cautiously, currencies stayed under pressure, and global rules kept shifting mid-stride. What stood out was India’s ability to absorb shocks through policy, domestic demand, and institutional depth.

The economy did its part; markets simply took longer to trust the story. And that tension; between resilience at home and uncertainty abroad; is what ultimately defined 2025.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story