Upstox Originals

Amul flexes muscle in India’s protein market

5 min read | Updated on August 21, 2025, 18:35 IST

SUMMARY

India’s protein market is growing fast but still underpenetrated, with most people unaware of their protein needs. Amul has jumped in with affordable, everyday protein products that are already selling out. With its unmatched access to raw materials and massive retail reach, it has a clear edge in making protein truly mainstream.

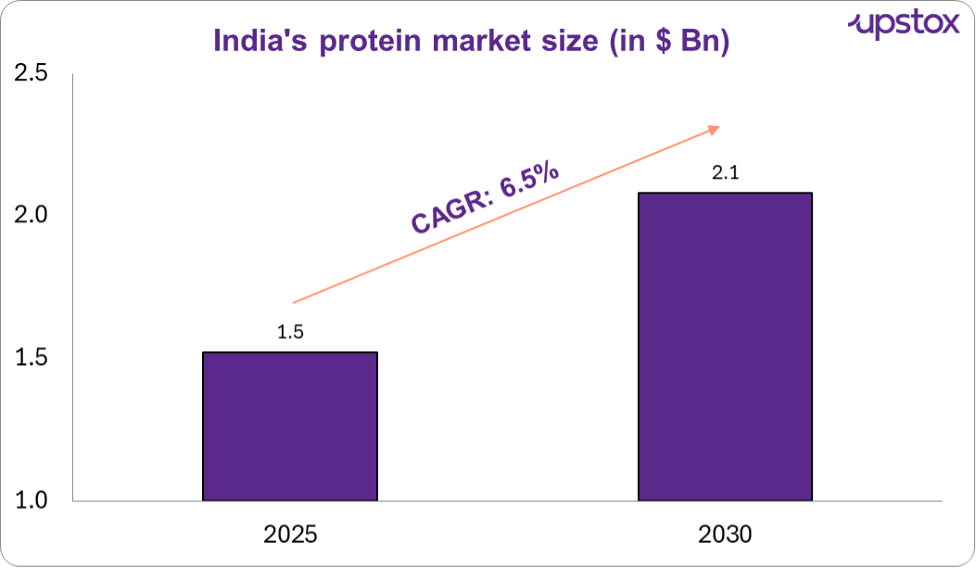

The Indian protein market is expected to grow at a 6.5% CAGR by 2030

With its extensive dairy network behind it and one of India's best-trusted brands, Amul is now looking to dominate India’s protein market. With 35 million litres of milk sourced every day and a reach across 50 lakh retail outlets, the cooperative has the scale and the commitment to redefine the manner in which Indians consume protein.

India’s protein market

Source: Mordor intelligence

The Indian protein market is expected to grow at a 6.5% CAGR by 2030, driven by rising health awareness, urbanisation, and lifestyle changes. Despite being the world’s largest milk producer, 73% of Indians are protein-deficient, and 93% don’t even know how much protein they need.

The ICMR recommends 60 grams/day, but the average Indian consumes just 37 grams/day. This gap is driven by low awareness, affordability challenges, and a lack of practical vegetarian protein options.

Clearly, the market has huge scope to grow if protein can be positioned as an everyday dietary need rather than a niche fitness product.

What exactly is whey protein?

Whey protein is the liquid by-product left behind when milk is curdled to make paneer or cheese. Instead of being wasted, this by-product is filtered and dried into a powder that’s rich in all nine essential amino acids, making it one of the most complete and easily digestible sources of protein available. Globally, it’s a staple for athletes and health-conscious consumers because it supports muscle recovery, strength, and overall nutrition.

In India, though, whey protein has long carried the tag of being a “gym supplement” rather than a basic dietary need. This perception has limited its adoption, leaving a big opportunity to bring whey into the everyday diets of ordinary households.

The pricing problem

Protein powders in India usually cost ₹3,000–₹5,000/kg (₹3.2–₹5.4 per gram). At these prices, protein remains out of reach for middle-class families, limiting adoption mainly to urban fitness enthusiasts.

This is where Amul spotted its opening

Enter Amul

In 2022, Amul entered the protein market with the aim of breaking the price barrier and expanding access. With its 35 million litres of daily milk procurement, Amul has direct access to nearly 3 million litres of whey per day, giving it an unmatched raw material advantage over competitors.

While the launch was significant, the real buzz has come more recently. New products like protein lassi, high-protein paneer, and even mango kulfi have caught consumer attention, with many reportedly selling out soon after hitting shelves. This wave of innovation, paired with strong social media chatter and consistent stock shortages, has pushed Amul’s protein play back into the spotlight.

By moving beyond powders and embedding protein into daily staples that consumers are already comfortable with, Amul is targeting the white space of mainstream Indian households, not just gym-goers.

Comparative pricing of different brands

| Product | Amul | Optimum nutrition | MuscleBlaze |

|---|---|---|---|

| Whey protein | ₹ 2.67 | ₹ 5.08 | ₹ 3.43 |

| Protein shake | ₹ 2.50 | N.A. | ₹ 3.96 |

Note: All prices are per gram; Source: financialexpress.com

Other examples include:

- High-protein paneer: 25% protein, ₹150 for 205g

- High-protein mango kulfi: 10g protein per 60g pack, ₹40

- Protein-rich lassi: 15g per 200ml, ₹30

This aggressive pricing is possible because of Amul’s strengths:

- Brand trust: a household name that Indians already rely on.

- Access to raw material: whey is a natural by-product of its vast dairy operations.

- Distribution scale: 87 branches, 15,000 dealers, 1 million retailers.

- Cost advantage: Amul can price whey at ₹2.7/g compared to ₹3.2–₹5.4/g for competitors.

The big question is whether Amul can sustain this edge. Challenges remain, its dairy-first brand image, low consumer awareness about protein, and the need to ensure taste and affordability all at once. Its next move, however, offers a possible answer.

The D2C strategy

Amul isn’t just relying on retailers. It is going direct-to-consumer (D2C) through Amul shops, its mobile app, and website.

This ensures two things:

- It reaches serious health-conscious consumers directly.

- It builds a loyal base + valuable consumer insights for product innovation.

Once the category scales, Amul can then deploy its massive retail muscle across India.

Lessons from Patanjali

Patanjali’s rise in FMCG offers a cautionary parallel. It captured attention by tapping into cultural pride and Ayurveda, quickly scaling with rapid product launches and wide distribution. But over time, it struggled to maintain momentum due to over-diversification, quality concerns, and regulatory setbacks.

For Amul, the lesson is clear: disruption creates a strong entry, but sustainability depends on consistency. To avoid Patanjali’s mistakes, Amul must:

- Maintain quality and taste across its protein portfolio.

- Stay focused on core strengths rather than stretching too thin.

- Build long-term trust, not just short-term price advantage

Reception so far

Despite these challenges, the early signs are promising. Amul’s protein products are consistently selling out, which is a strong indication of pent up demand for affordable and trusted protein options. For a category long considered niche and premium, this shows Amul may already be widening the market beyond the fitness circle.

So, what does the future look like ?

Going forward, Amul is targeting a five fold growth in its protein production capacity.

The real test, however, will be whether it can shift consumer perception, from seeing protein as a supplement for gym-goers to accepting it as part of everyday diets. If Amul manages that while keeping its products tasty and affordable, it won’t just capture market share, it could redefine how Indians think about nutrition.

That, perhaps, would be the real muscle gain.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story