Upstox Originals

A new challenger in food delivery: Rapido aaya, khaana bhi laya

.png)

8 min read | Updated on June 13, 2025, 19:37 IST

SUMMARY

Rapido is making a bold move, shifting from bike taxis to biryani delivery with its new platform, Ownly. It aims to offer cheaper, transparent food delivery in a market dominated by two major players. This food-tech industry is known for its slim profit margins, demanding customers, and the constant pressure to improve last-mile delivery and overall consumer experience. The question is, has Rapido bitten off more than it can chew, or can it truly disrupt the industry?

Stock list

Rapido is entering the foodtech segment via its platform Ownly

Have you noticed that your food delivery bills from Swiggy and Zomato have started creeping up? And let’s be honest, those once generous discounts seem to have mysteriously disappeared. If your wallet feels lighter and your takeout feels pricier, you’re not alone.

Well, just as you were struggling with fewer promo codes and higher delivery charges, there's a new player revving up to shake things up in the food delivery space—Rapido. Yep, the bike-taxi giant isn’t just carrying passengers anymore; it’s got its eyes on delivering your favorite biryani, pizza, and paneer tikka right to your doorstep. But what does this mean for the food delivery space, and more importantly, for your pocket? Let's dive in.

Is there room for another delivery app?

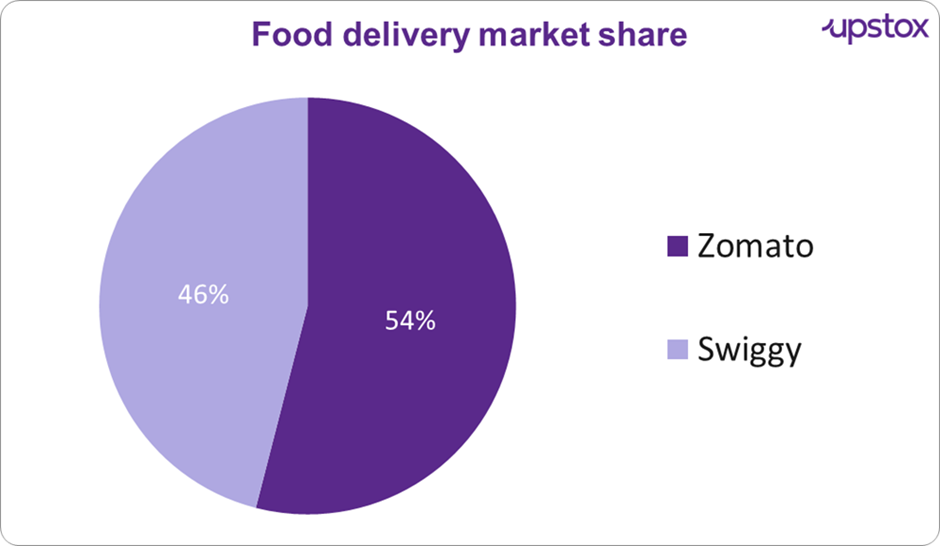

Source: The Economic Times; *Data as of Q4FY25

For nearly a decade, India’s food delivery business has been comfortably ruled by two giants (duopoly) Swiggy and Eternal’s Zomato. These two platforms control virtually the entire market space, but Rapido, a unicorn known for zipping commuters on two-wheelers, believes it can carve out a piece of the pie.

The company will pilot its food delivery business in Bengaluru and operate it under the brand of Ownly.

So, what is Rapido doing differently to enter this space?

Flat fees instead of commissions

Restaurants will pay a fixed charge of ₹25 for orders below ₹400 and ₹50 for higher orders. In contrast, Swiggy and Zomato typically charge between 16% and 30% per order. This could make Ownly extremely attractive to small eateries battling tight margins.

This strategy is akin to what they deployed when they entered ride-hailing. Incumbents Ola and Uber charged drivers commissions as a percent of the fare, while Rapido introduced a fixed commission. So far this strategy has been operationally successful for the company, which has over the years become a strong challenger to Ola and Uber.

No hidden customer charges

Customers won’t pay platform or packaging fees, which have become common complaints on rival platforms. Only small delivery charges on low ticket orders apply.

No platform fees

Unlike its competitors, the company will not charge any platform fees.

Pricing parity mandate

Rapido mandates that online menu prices must match offline prices, targeting a transparent, no markup experience for users. Rapido will ask restaurants to list up to 4 orders below ₹150. The idea is to cater to customers looking either for a cheap or quick meal and not wanting to spend a lot of money on this. That said, it will be interesting to see how the company can deploy this strategy at more premium restaurants

Self-delivery support

Restaurants with their own delivery fleets can use Rapido’s tech layer for free, saving on delivery commissions entirely. Alternatively, some news reports suggest that Ownly will subsidise food delivery costs as well.

So, how do the numbers compare?

| Fees break up | Swiggy | Zomato | Ownly |

|---|---|---|---|

| Cost Of McChicken Meal | ₹199 | ₹199 | ₹199 |

| Dish Cost On Platform | ₹315 | ₹315 | ₹199 |

| Delivery Cost (For 5 km)* | ₹78 | ₹35 | ₹25 |

| Packaging Cost | ₹29 | ₹29 | ₹0 |

| Platform Fees | ₹12 | ₹10 | ₹0 |

| GST (as applicable) | ₹17 | ₹13 | ₹10 |

| Total | ₹451 | ₹402 | ₹234 |

Source: Agnidev Bhattacharya, NDTV Profit; * May differ if you are a part of their privilege programs

There is approximately a 40% difference between Ownly and Swiggy and Zomato for the exact same meal. Where we can see that, a customer ordering through Ownly could save over ₹200 on just one meal. Multiply that over a few weekly orders, and the savings add up quickly. Lower restaurant commissions and fewer added fees explain the difference.

How will Rapido pull this off?

-

The current bike taxi fleet will serve as an in-built delivery fleet as well. Rapido is already present in 100+ cities with an existing bike rider base. These riders can be redeployed during off-peak hours for food delivery, enhancing their utilisation rate and keeping delivery prices minimal. The company already has a ~4- 5mn strong fleet, which makes about 3- 3.5 million daily trips.

-

Value-based customer acquisition: Rather than deep discounts, Rapido is counting on lower prices to win over customers irritated by high fares elsewhere. It's pretty simple: "Same food. Lower prices."

-

Subscription revenue down the line: Once the user base is established, Rapido will introduce flat-fee subscription plans to restaurants so that restaurants have predictable revenue without upfront costs per order.

Now let's talk about Rapido itself

Rapido is a Bengaluru-based mobility startup founded in 2015, offering bike taxi, auto-rickshaw, and last-mile delivery services across 100+ Indian cities. It operates on an asset-light, gig-economy model, connecting users with a large fleet of ~4 - 5 mn bike taxis and ~7 lakh auto rickshaw riders for affordable urban transport.

Here is a quick financial summary of Rapido for FY24

| Metric | ₹ Crore |

|---|---|

| Revenue | 6,925.6 |

| Operating EBITDA | -4,114.1 |

| Operating EBITDA (%) | -63.5% |

| PAT | -3,707.2 |

Source: Private circle

The company is loss-making with an annual cash burn of ~₹400 crore annually, which are driven by operational costs and new investments such as the food delivery segment. Despite the losses, Rapido has maintained investor interest through its growing user base and aggressive market reach.

Funding information

Below are the last 3 years' funding rounds. Overall, they have had 12 rounds of funding, where they raised a total of ₹4,800 crore with their latest round they raised ₹250 crore. Rapdio had also picked up funding from Swiggy for about ₹1,300 crore which did not have any exclusive clause to the investment.

The last 3 years' funding rounds

| Date | Round | Investors/Buyers | Deal size (₹ Cr) | Post-money valuation (₹ Cr) |

|---|---|---|---|---|

| 12-Feb-25 | Series E | Prosus (Naspers) | 250.5 | 8726.0 |

| 18-Jul-24 | Series E | Westbridge Capital Partners, Think Investments, Nexus Venture Partners+1 more | 1,461.3 | 8,575.3 |

| 17-Jul-24 | Rights | Aravind Sanka, Pavan Guntupalli | 315.6 | 4,063.5 |

| 10-May-23 | Secondary | Munjal Family Trust & Abhimaniyu Munjal, Dharmapal Satyapal Limited, Sumit Mahajan | 27.2 | 5,943.9 |

| 01-Dec-22 | Secondary | Pawan Munjal Family Office | 2.7 | 5,381.4 |

| 23-Sep-22 | Secondary | Classic Stripes Private Limited | 89.3 | 5,928.5 |

| 26-Aug-22 | Secondary | Integrated Public Safety Systems Private Limited | 7.0 | 5,927.8 |

| 11-Aug-22 | Secondary | Bharat Parekh | 0.5 | 5,908.2 |

| 15-Jul-22 | Secondary | Saurabh Gupta | 7.0 | 5,927.8 |

| 26-May-22 | Secondary | Minds Overthetop Consultants Llp | 2.5 | 5,913.3 |

| 02-May-22 | Secondary | Varun Jaipuria, Richa Global Exports Private Limited, Gajinder Kumar Nagar+6 more | 20.5 | 5,929.2 |

| 13-Apr-22 | Series D | Bundl Technologies Private Limited, Westbridge Capital Partners, Tvs Motor Company Limited+3 more | 1,365.5 | 5,944.8 |

Source: Private circle

What's the competitors' margins like?

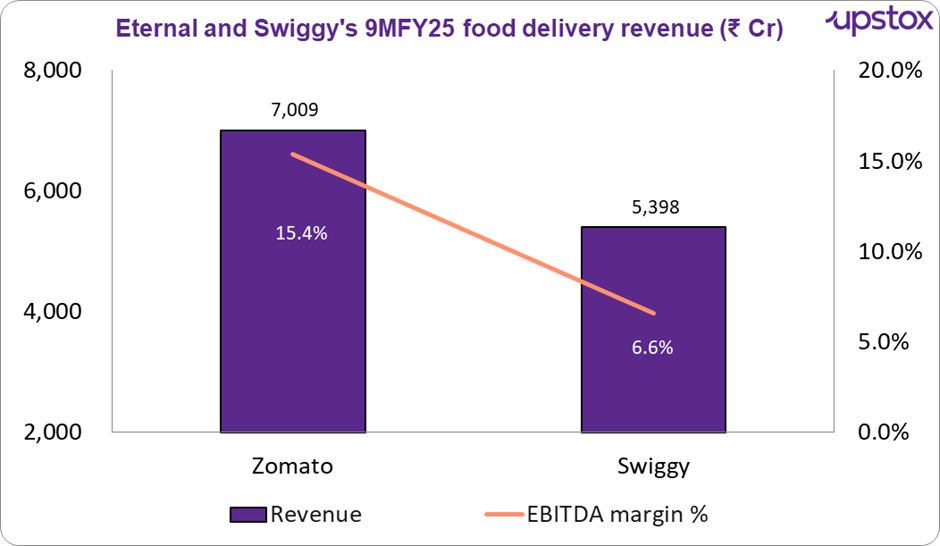

Eternal, even though profitable for the last few years their margin when it comes to Zomato is very tight, the same goes for Swiggy as well when it comes to their food delivery segment.

The average margin for FY24 remains thin and under pressure. On the other hand, Ownly (Rapido) isn't focused on margins yet. With a cash burn of ₹400 Cr annually and a large fleet ready to serve, their goal appears to be aggressive market capture rather than profitability. Whether this works out is yet to be seen in the near future.

Source: Company presentation.

Attempts were made by other companies but here is a short note on how it went for them.

Several major players—including Uber Eats, Foodpanda, and Amazon—have exited the food delivery market in India (and other countries) after struggling to gain traction.

-

Uber Eats burned through capital with deep discounts and delayed branding, ultimately exiting after incurring losses of over ₹2,000 Cr in India.

-

Foodpanda suffered from fake orders, technical faults, and poor management oversight, leading to chaotic operations and unsustainable losses.

-

Amazon Food entered the Indian market late, with limited restaurant partnerships and minimal marketing, which led to a quiet exit during strategic business realignment.

Across these exits, a common theme emerges: unsustainable discounting, operational mismanagement, limited market share, and intense competition in a low-margin business.

Outlook

Rapido’s entry is more than just a price war — it signals a push for transparency, fairer pricing for restaurants, and better value for consumers. If this model holds, it could pressure existing giants to rethink their economics and open up room for more innovation in this space. But the big question remains: can Ownly scale without falling into the same profit traps as their competitors?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story