Upstox Originals

50% tariffs, 100% opportunity?

7 min read | Updated on August 22, 2025, 17:14 IST

SUMMARY

Tariffs are climbing, and India’s exporters are in the line of fire, nearly $87 billion worth of goods suddenly look vulnerable. But here’s the thing: India has faced bigger storms before — from food shortages in the ’60s to the balance-of-payments crunch in ’91. Each time, it turned the crisis into a reset. Could this tariff shock be the spark for India’s next big leap?

Historically, India has not only survived crises, but it has also reinvented itself to grow faster

Tariffs are exploding, and India’s exporters are feeling the heat! One minute it’s 26%, then 25%, and now a staggering 50%!

But here’s the thing: India has seen this movie before. And each time, it has found a way to turn a crisis into a comeback. As Albert Einstein once said, “In the midst of every crisis, lies great opportunity.”

Remember the mid-1960s food shortage? Remember 1991? Remember 2008? So yes, tariffs hurt. But history says India doesn’t just survive crises, it reinvents itself through them.

India's three great recoveries: From hunger, to bankruptcy, to meltdown

The green revolution

By the mid-1960s, India was facing a serious food crunch. Can you guess how millions were surviving? They relied heavily on US wheat through the PL-480 program.

Then came back-to-back droughts in 1965 and 1966, significantly affecting crops. On top of that, wheat exports were temporarily restricted to India during the Bangladesh war. And remember the 1965 conflict with Pakistan? That stretched resources even further.

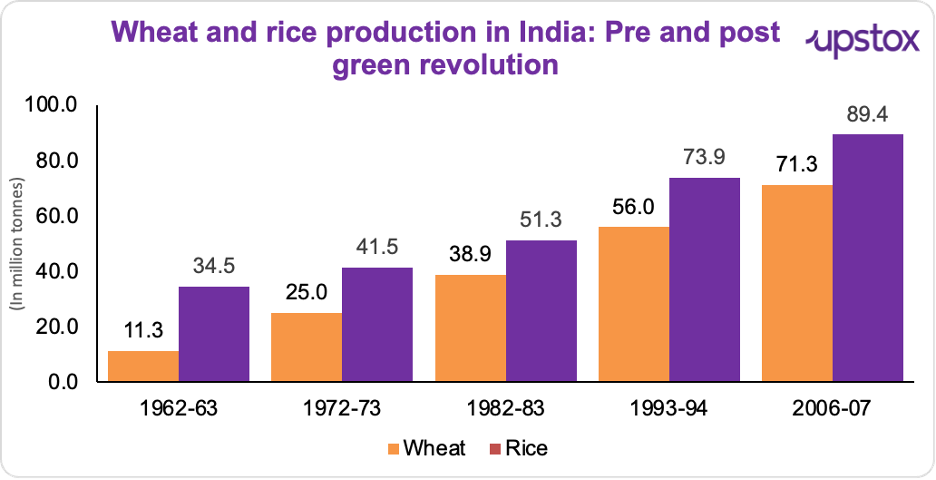

The fix? Green Revolution, 1966. Dr. M.S. Swaminathan teamed up with Nobel laureate Dr. Norman Borlaug. Their formula: high-yield wheat and rice seeds + fertilizers + irrigation + modern farming = massive harvests. But this wasn’t just about imported science; it was India’s ingenuity that made it work.

Farmers adapted new seeds to local soils, scientists fine-tuned practices for Indian conditions, and policymakers built support systems around credit, procurement, and distribution. Against food shortages and limited resources, India stitched together its own model of the Green Revolution, turning a crisis into self-reliance.

The results? Wheat went from 6.46 million tonnes (1950–51) to 11.39 million tonnes (1966–67). By 1971–72, it more than doubled to 26.41 million tonnes, with yields jumping from 663 kg to 1,380 kg per hectare. Rice surged too.

Source: Business Standard

And it wasn’t just wheat and rice. The Green Revolution rewired India’s entire grain basket. In a few decades, the country went from waiting for wheat ships to arriving from abroad to feeding itself, and even exporting. Fast forward to 2025: India is set to produce a record 115.4 million metric tons of wheat, according to the farm ministry. Not only this, wheat exported from India amounted to over $56 billion in FY2024.

In just a few years, India turned near-starvation into self-sufficiency. Lives saved. Innovation proven. Pressure turned into progress.

Balance of Payment crisis

The 1991 crisis wasn’t a sudden thunderbolt. It was years of slow imbalance catching up.

In the 1980s, India wanted growth, but paid for it with debt. The government borrowed heavily, spent more than it earned, and kept industries strangled under the “license raj.” Productivity sagged, competitiveness slipped.

At the same time, the import bill exploded. Oil, machinery, technology, India was buying more than it could afford. Exports stayed weak.

Then came the knockout blows:

- The Gulf War sent India’s oil import bill soaring to ₹10,820 crore (a 72% jump from ₹6,273 crore the previous year), underscoring the severity of the external shock.

- The Soviet Union’s collapse wiped out one of India’s biggest export markets.

By June 1991, the situation was dire. Forex reserves had fallen below $1 billion (₹2,152 crore), barely enough for three weeks of imports. India was standing on the edge of default.

Let’s see how fragile things were, and how reforms slowly turned the tide:

| Year | External Debt ($ bn) | Debt to GDP (%) | Forex Reserves to Debt (%) | Short-term Debt to Forex Reserves (%) |

|---|---|---|---|---|

| 1990-91 (Crisis) | 83.8 | 28.7 | 7.0 | 146.5 |

| 1995-96 (Early reform gains) | 93.7 | 27.0 | 23.1 | 23.2 |

| 2000-01 (Stability) | 101.3 | 22.5 | 41.7 | 8.6 |

Source: ET

Then, the government scrambled to act:

- Pledged 67 tonnes of gold (47 tonnes to the Bank of England, 20 tonnes to UBS Switzerland) to raise $600 million

- Negotiated a $7 billion IMF loan, with $2.2 billion released immediately

- Devalued the rupee twice - 9% on July 1 and 11% on July 3, 1991, to boost exports

Then came the LPG (Liberalise, Privatise, Globalise) reforms :

- Businesses no longer had to wait years for licenses.

- Imports became cheaper, and industries became sharper.

- Dollars started flowing in, and investments took off.

The results were transformational: GDP surged from $266 billion in 1991 to $4.1 trillion in 2025. Alongside GDP, India's forex reserves stand at 693.6 billion, ranking 4th largest in the world.

Global financial crisis

It all came crashing down in September 2008. Lehman Brothers collapsed, and suddenly the global financial system froze. What triggered it? Years of subprime mortgage lending, sky-high leverage, and blind deregulation.

The fallout was brutal:

-

Global stock markets wiped out $30 trillion in value.

-

The S&P 500 plunged 57%, erasing $11 trillion of US household wealth.

-

Economies worldwide went into a tailspin.

India wasn’t spared either.

-

Foreign investors pulled out $13 billion, hammering the stock market.

-

The rupee sank from ₹39.4 to ₹50.6 per dollar.

-

Banks struggled with a liquidity crunch.

-

The trade deficit doubled to $60 billion in just six months.

-

GDP growth slipped from nearly 9% to 6.8%.

-

Agriculture slowed to 1.6% growth.

-

Jobs vanished in export-heavy sectors like textiles, leather, gems and jewellery.

So, how did India fight back? It tightened banking rules with the adoption of Basel norms (global banking safety standards), created a new watchdog - the Financial Stability and Development Council in 2010 (to monitor risks across regulators), and later put in place stricter checks to control inflation.

At the same time, the RBI freed up ₹2 lakh crore for banks by cutting reserve requirements. The government rolled out three big stimulus moves, ₹30,700 crore for infra, housing and autos, allowed IIFC to raise ₹30,000 crore via bonds, and slashed excise duty from 10% to 2% with extra tax breaks.

The result? By 2009–10, growth roared back to 8.6%.

Now.. What can India do?

History shows India can fight its way out of a storm. But tariffs are a different beast. So, how do we play this round?

-

India’s playbook could start with trimming costs. Every ₹1 spent on infra adds ₹2.5–₹3.5 to GDP, yet logistics still eat up 8–9%, far higher than peers.

-

Streamlined GST reforms, including the proposed abolition of the 28% slab on cars, ACs, and refrigerators, and the shift of 99% of items like butter and fruit juices into the 5% bracket, mark the biggest tax overhaul in eight years and could ease consumption from October.

-

India is widening its export base to 50+ countries in West Asia and Africa, which already take nearly 90% of shipments, giving some cushion against tariff shocks.

-

Beyond goods, the rise of 1,700+ GCCs (headed to 2,100–2,200 by 2030, creating $99–105B and 2.5–2.8M jobs) hints at India’s potential shift from factory to innovation hub.

Put together, these steps suggest how tariff pressures could be turned into longer-term opportunities.

Parting thought

Tariffs may sting in the short run, but they also force India to rethink the playbook, cut costs, widen markets, and upgrade capacity. The shift from being just an exporter of goods to an exporter of ideas is already underway. If India leans into this moment, what looks like a trade setback today could well script tomorrow’s competitive edge.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story