Upstox Originals

Reliance Jio gears up for the year's biggest IPO with a $120 billion valuation

5 min read | Updated on January 18, 2025, 00:50 IST

SUMMARY

Reliance Jio Infocomm Limited, part of Mukesh Ambani's Reliance Industries, is generating significant attention ahead of its highly anticipated IPO launch. Expected to be the largest IPO in India’s history, it is set to surpass Hyundai Motor India's ₹27,870 crore ($3.3 billion) IPO from October 2024. Jio's IPO could set new records on Dalal Street and boost investor confidence in India’s equity markets.

Reliance Jio's upcoming IPO is set to become India's largest, surpassing all records and boosting investor confidence.

Reliance Jio Infocomm Limited, the telecom arm of Mukesh Ambani-led conglomerate Reliance Industries Limited (RIL) and a subsidiary of Jio Platforms Limited is sparking conversations and grabbing market-wide attention for its highly anticipated Initial Public Offering (IPO) launch.

It is expected to be the largest IPO in the history of India, surpassing Hyundai Motor India’s IPO worth ₹27,870 crore ($3.3 billion) in October 2024. Reliance Jio’s IPO would not only break Dalal Street’s records but could also boost investor confidence in India’s equity markets.

IPO structure and timeline

According to media estimates, Reliance Jio may roll out an IPO of around ₹35,000 - ₹40,000 crore, marking a landmark event in the Indian capital markets. The telecom giant is targeting a massive ₹10 lakh crore ($120 billion) valuation. Other IPO specifics like issue size remain under wraps. RIL has not yet released an official statement regarding the IPO.

The IPO is expected to hit the markets in the second half of 2025. Media reports suggest that the IPO is likely to include a combination of both, a fresh issue and an offer-for-sale (OFS) from the promoters and existing shareholders of the company, with a pre-IPO placement for a closed group of investors.

Reliance Jio’s ambitious plans

The IPO buzz has come at an opportune time as Reliance Jio has recently emerged as India’s leading telecom company with a total subscriber base of 482 million as of December 2024.

By offering ultra-affordable data plans, Jio has successfully outperformed its competitors. The company now dominates the Indian telecom market and with the upcoming IPO, the company plans to attract global investors as well.

The IPO could also set the stage for Jio to scale its digital services ecosystem, boost AI-driven technologies and smart devices, and expand its 5G rollout, further strengthening its position in the telecom and tech space.

Ahead of the IPO, the company is reportedly intensifying its efforts in the 5G-based fixed wireless access (FWA) business through its Jio AirFiber service, with the aim to onboard one million AirFiber customers every month. This move will not only fuel substantial customer growth in the coming year but also help Jio boost its 5G monetization.

Rapid 5G monetization is projected to further strengthen Jio’s financial performance and enhance its investment appeal to both domestic and international investors.

Reliance Jio’s financial performance in Q3 FY25

Reliance Jio’s revenue saw a 19.4% YoY growth, supported by the tariff hike and strong growth in home connections. EBITDA grew by 19% YoY, with a strong margin of 50.1%, reflecting higher revenues and efficient operations.

Source: Company stock exchange filings

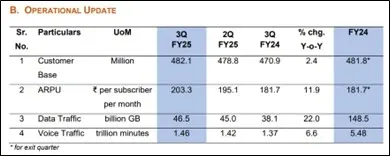

Source: Company stock exchange filingsIn Q3 FY25, Reliance Jio achieved an ARPU of ₹203.3, driven by the sustained impact of tariff hikes and a better subscriber mix. The rapid adoption of 5G and AirFiber boosted per capita data usage to 32.3 GB per month. Data traffic increased by 22% YoY, while voice traffic grew by 6.6% YoY. The customer base also increased by 3.3 million during the quarter, rebounding to pre-tariff-hike levels.

Source: Company stock exchange filings

Source: Company stock exchange filingsRecent challenges

Despite its dominance in the telecom space with a 40% subscriber market share, Reliance Jio is facing tough competition from its competitors like Airtel.

Following a tariff hike by private telecom players in July 2024, we saw all telecom players including Reliance Jio face significant subscriber losses, but Airtel was the sole gainer. Trai’s telco customer data shows that Airtel not only added 1.9 million subscribers but also strongly boosted its higher- paying 4G/5G user base by adding 2.08 million users in October 2024.

State-owned telecom provider BSNL also gained 0.5 million customers during the same period. In fact, BSNL has lately emerged as a strong competitor to Jio by launching competitive broadband and mobile plans.

Going forward, if Elon Musk’s Starlink gets regulatory approval to operate in India, it can give major competition to Jio and other Indian telecom giants with its groundbreaking Direct-to-Cell communication technology that allows users to access high-speed broadband directly on their mobile devices, without the need for cables, towers, or Wi-Fi receivers.

Growth Prospects

Fuelling its ambitious plans to disrupt the AI space with innovative solutions, Reliance Jio platforms announced its partnership with the global technology giant Nvidia to develop AI language models, which could give Reliance Jio a competitive edge over its competitors.

Besides, Jio has obtained regulatory approval to launch satellite internet services in the country, which could further contribute to its revenue stream.

Wrapping up

Reliance Jio is shaping India’s digital ecosystem with its wide range of services. And, with its highly anticipated IPO, it could also boost India’s stock market, drawing global investor appeal.

Will Reliance Jio’s IPO shift the spotlight onto Reliance Industries shares, which have seen a nearly 6% dip in the past year and reported their first loss in a decade?

Let’s see how these events unfold in the coming days!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story