Upstox Originals

Tariffs: Economic leverage or market disruption?

.png)

6 min read | Updated on January 28, 2025, 16:58 IST

SUMMARY

The new US administration has used the threat of tariffs on numerous occasions, as a method to equalise perceived trade imbalances. What are tariffs and really how effective are they? In this article, we detail the impact of tariffs, and why they have caused an increase in global uncertainty. Finally, if these proposed tariffs come to pass, we highlight any spillover effects for India.

The threat of tariffs has escalated global uncertainty

Behind the buzz: What are tariffs?

At the World Economic Forum in Davos, “tariff” wasn’t just a buzzword; it took center stage in global economic discussions. It appeared a striking 23 times in the latest Chief Economists Outlook Report, released quarterly by the World Economic Forum. And it’s no surprise, that tariffs are powerful tools that can reshape trade routes, influence economies, and impact businesses worldwide.

But what exactly are tariffs? Simply put, they are taxes imposed by governments on imported goods and services. But their purpose goes far beyond just taxation. Tariffs act as a shield for domestic industries, offering protection from foreign competition. They also serve as a source of revenue and, perhaps most strategically, as a bargaining chip in global trade negotiations, influencing how countries interact on the world stage.

Why are we talking about this?

The new US President has repeatedly indicated the possibility of imposing tariffs on countries he opines are trading unfairly with the US. While we will avoid any political conversation around it, the fact is, the risk of tariffs has increased global uncertainty. Any imposition of tariffs by the US will likely result in retaliation, which could lead to a global trade war and dampen overall sentiment.

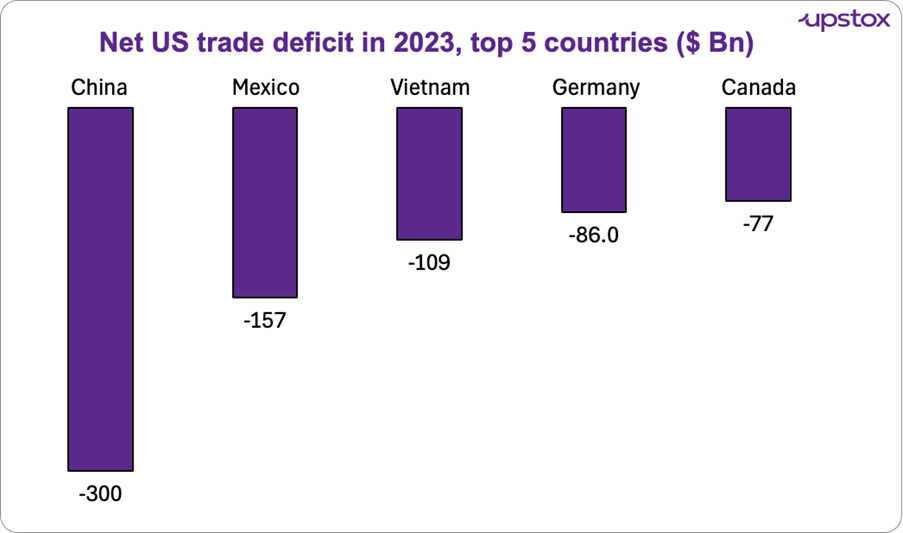

The spotlight is on Mexico, China, and Canada; three of the US’s largest trading partners with significant trade imbalances. He has plans to impose tariffs ranging from 10% to 60% on Chinese imports and a tariff of up to 25% on goods from Mexico and Canada. The chart below highlights why these countries are in Trump’s crosshairs:

Source: US Bureau of Economic Analysis; US Department of Commerce; McKinsey Global Institute analysis

China

In 2023, the US trade deficit with China reached a staggering $300 Bn, making it the largest among all trading partners. This imbalance is primarily driven by imports in electronics, machinery, and consumer goods, sectors where China holds significant manufacturing dominance.

Mexico

As the US’s second-largest trading partner, Mexico accounted for $475 Bn in imports in 2023, including automotive parts, machinery, and agricultural products. Beyond trade, Trump has tied tariffs on Mexico to concerns over various aspects of border security.

Canada

With an import value of $418 Bn, Canada ranks as the third-largest US trading partner, often grouped with Mexico as part of the USMCA agreement.

Together, Canada and Mexico represent 30% of all US imports, making them integral to the country’s supply chains.

When tariffs backfire

Tariffs have often proven ineffective and even counterproductive for several reasons:

-

Tariffs raise the prices of imported goods, leading to higher costs for consumers and businesses that rely on these products.

-

While intended to protect domestic jobs, tariffs can lead to job losses in industries that depend on imported materials.

-

Imposing tariffs often leads to retaliatory measures from other countries, which can harm domestic exporters by reducing their access to foreign markets. This tit-for-tat escalation can further disrupt global trade and economic stability.

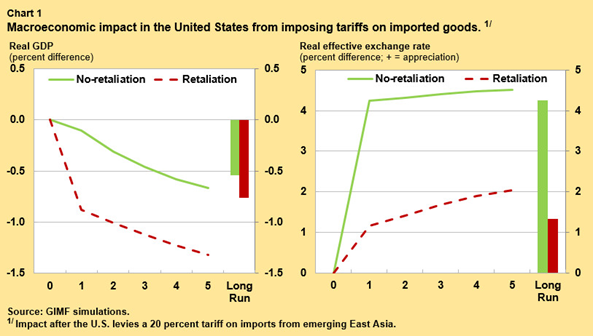

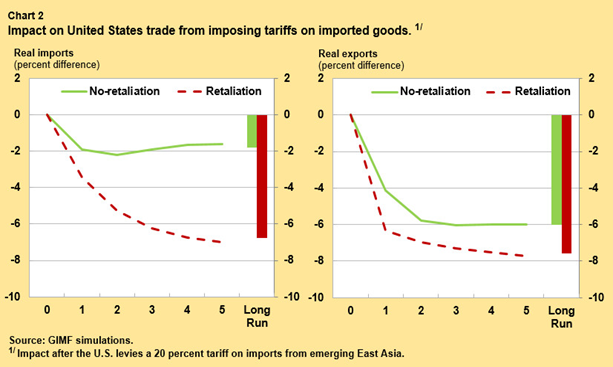

A 2016 IMF analysis using the Global Integrated Monetary and Fiscal model assessed the economic impact of a 20% U.S. tariff on East Asian imports. The findings, presented in two charts below, remain relevant today.

Chart 1:

This chart shows two scenarios - one where East Asia does not retaliate (green line) and one where it does (red line). In both cases, US real GDP declines, with a sharper drop under retaliation. A stronger dollar, triggered by the tariffs, reduces the competitiveness of US exports and disrupts global trade dynamics.

Source: IMF

Chart 2:

This chart highlights the effects on trade flows. U.S. imports from East Asia initially decline due to tariffs, but retaliation causes U.S. exports to fall even further. A stronger dollar makes alternative imports cheaper while taxing all exports, worsening the trade balance and reducing high-paying export jobs.

Source: IMF

These charts paint a clear picture: tariffs tend to have unintended consequences. While tariffs aim to safeguard domestic industries, the knock-on effects - higher prices, reduced trade, and job losses seem to have a larger impact in the end.

China’s global play

If US tariffs are enacted, China will have to redirect goods to markets like India and Southeast Asia. While consumers may benefit from lower prices, local industries would face stiff competition.

Here’s the twist: China could turn the tables. Strengthening ties with nations like the EU, Japan, and Australia, it could position itself as a dependable trade partner. While the US isolates itself, China might emerge stronger, with its influence stretching further across global markets.

For example in 2018, China imposed tariffs on US liquefied natural gas (LNG) imports into China (as a retaliation to US tariffs). This caused US LNG shipments to China to drop significantly, falling by about 80% from 3.5 Mn tons in 2017 to just 0.4 Mn tons in 2019, according to the US Energy Information Administration. To fill this gap, China increased LNG imports from other countries, including Australia, Qatar, and Russia. This example shows how tariffs can impact trade and influence global supply chains.

India spillover

What if a global trade shake-up could position India as the go-to manufacturing and export hub for US businesses? With the shift away from China, India could seize the opportunity to become a key partner for the US, boosting sectors like textiles, pharmaceuticals, and electronics. With its growing infrastructure and skilled workforce, India is poised to play a crucial role in reshaping global trade and strengthening its ties with the US.

However, there's a flip side. If more Chinese products make their way to India, local manufacturers might face serious competition. The lower prices of Chinese goods could put pressure on Indian businesses to lower their costs or risk losing market share.

In summary

Tariffs are shaking up global trade, and while challenges loom for some, they open a door of opportunity for others. India, with its booming economy and competitive edge, is well-positioned to capitalise on this disruption. If India acts swiftly with smart policies and investments, it could transform into a global manufacturing and export powerhouse. The question is, can India seize the moment and lead the next trade revolution?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story