Upstox Originals

Promoters’ playbook: Who’s buying and selling amid market turbulence?

.png)

14 min read | Updated on March 18, 2025, 14:35 IST

SUMMARY

Indian equities kicked off 2025 on a rough note, with benchmarks under pressure—Nifty has fallen ~6.6%, mid-caps by ~15.7%, and small-caps have plunged ~21.6%. Yet, in times of uncertainty, tracking promoter activity can provide an opportunity. We track how promoters and corporate groups have responded to the volatility. Did they use the dip to raise their stakes, or have they offloaded shares?

Stock list

Tracking companies which have seen promoter buying and selling amidst the market correction.

-- Peter Lynch

This simple yet powerful statement captures the essence of why promoters decide to buy. It’s usually because they have a positive outlook on the future. When they sell, however, it might be a sign of caution, uncertainty, or other reasons not immediately clear to the market.

So, in this current climate, which companies are seeing promoter buying?

Important note for investors

Promoter buying and selling is just one of the important fundamental factors and should be considered as a recommendation to buy/sell. Investors should consider other fundamental factors before making a decision.

Companies seeing promoter/director/insider buying

List of companies where promoters/owners have been actively buying shares.

| Name | Market Cap (₹ Cr.) | Buying value (₹ Cr.) | Buying price (Weighted average) | CMP | % from 52W high |

|---|---|---|---|---|---|

| Jindal Steel & Power | 88,156 | 862 | 818 | 922 | -17 |

| Godrej Properties | 60,162 | 100 | 1,942 | 2,000 | -41 |

| Maharashtra Seamless | 9,142 | 47 | 609 | 682 | -30 |

| Quess Corp | 8,740 | 46 | 610 | 584 | -33 |

| Zee Entertainment | 9,666 | 26 | 96 | 102 | 40 |

| Jindal Stainless | 48,808 | 24 | 695 | 595 | -30 |

| D.B.Corp | 3,923 | 24 | 217 | 219 | -45 |

| Solara Active Pharma Sciences | 2,021 | 24 | 486 | 481 | -46 |

| Cosmo First | 1,647 | 22 | 660 | 624 | -42 |

| Mtar Technologies | 3,854 | 15 | 1,432 | 1,249 | -43 |

| Deepak Nitrite | 27,291 | 11 | 1,899 | 1,992 | -37 |

| Cyient | 13,612 | 10 | 1,377 | 1,220 | -44 |

| NCC | 11,819 | 10 | 185 | 190 | -48 |

| Religare Enterprises | 7,911 | 10 | 221 | 237 | -25 |

| Sobha | 13,124 | 9 | 1,178 | 1,225 | -44 |

| Usha Martin | 9,618 | 9 | 328 | 321 | -30 |

| Agro Tech Foods | 3,125 | 9 | 786 | 846 | -28 |

| Texmaco Rail & Engineering | 5,149 | 8 | 164 | 129 | -56 |

| GNA Axles | 1,334 | 8 | 313 | 321 | -35 |

| Ador Welding | 1,494 | 8 | 992 | 859 | -48 |

| Alembic Pharmaceuticals | 16,413 | 8 | 801 | 836 | -36 |

| Paisalo Digital | 3,142 | 7 | 41 | 35 | -60 |

| TARC | 3,097 | 6 | 128 | 105 | -61 |

| Borosil Renewables | 6,594 | 5 | 561 | 506 | -22 |

| Ramkrishna Forgings | 12,969 | 5 | 650 | 721 | -32 |

Source: NSE, Bloomberg. Data as on March 17, 2025.

Period considered: January 1 to March 17, 2025. The above list is not an exhaustive list of promoter buying during this period. You can access the full list on the NSE website.

From the above list, we have focused on select companies to understand why their promoters could have been actively buying shares. These companies have been chosen based on clear potential business tailwinds.

Jindal Steel & Power

The company has laid out an ₹23,900 crore expansion plan across the value chain with a focus on building more capacities for finished steels and value-added products. Additionally, it has said it will invest another ₹15,000 crore as capex in the next 3-4 years. Despite undertaking large-sized capex activity, the management plans to maintain net debt to EBITDA below 1.5x.

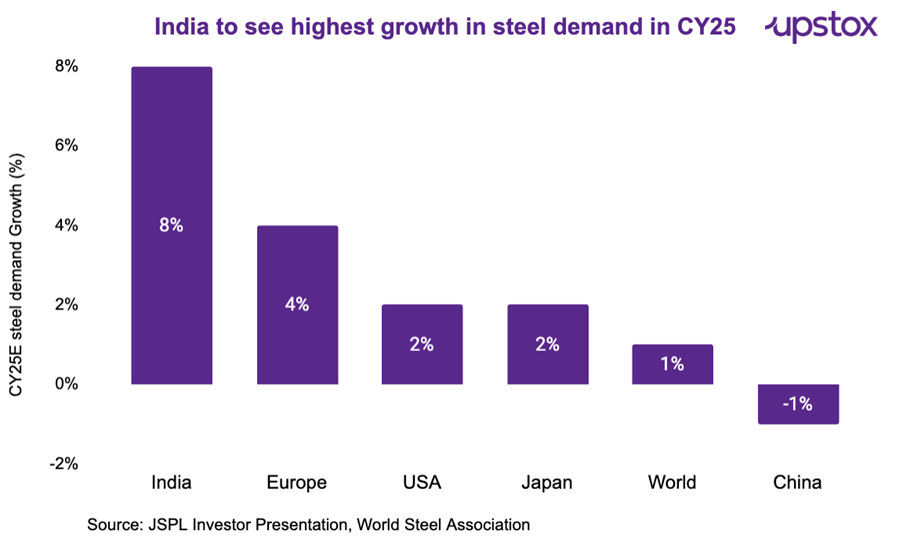

In 2025, India’s steel demand is expected to grow at 8%, outpacing most major markets.

Key risk(s) A decline in steel prices due to further dumping by Chinese players could negatively impact the company, as steel prices are determined by prevailing global market conditions. If the capex is not able to generate incremental demand, it may impact long-term growth. Furthermore, the US tariffs could also lead to uncertainty impacting steel prices.

Maharashtra Seamless

| Year | Target (₹ crore) | Achievement (₹ crore) | Achievement in % |

|---|---|---|---|

| FY20 | 93,639 | 105,603 | 112.8% |

| FY21 | 98,552 | 111,542 | 113.2% |

| FY22 | 104,369 | 107,996 | 103.5% |

| FY23 | 107,649 | 110,027 | 102.2% |

| FY24 | 105,186 | 136,821 | 130.1% |

| FY25* | 118,499 | 116,000 | 97.9% |

Source: Ministry of Oil & Gas. *FY25 data as on 31st Dec 2024

To ride this opportunity, the company is planning for ₹852 crore capex (fully funded through internal accruals) which is expected to generate additional revenue of ₹1,900 crore as per management estimates.

Key risk(s) The removal of anti-dumping duties or a slowdown in the O&G sector could negatively impact the company along with falling steel prices.

Solara Active Pharma

Solara Active Pharma is on the path to deleveraging its balance sheet to reduce interest costs, primarily through a rights issue. The management expects this move to bring down debt from ₹9,99.4 crore to ₹559.8 crore.

| Particulars | Amount (₹ crore) |

|---|---|

| Gross Debt as on April 1, 2024 | 999.4 |

| Less: Repayment from operations | -74.8 |

| Less: Repayment from Rights issue application money | -118.6 |

| Gross Debt as on December 31, 2024 | 806.0 |

| Less: Repayment for rest of the year | -24.7 |

| Less: Uncalled Rights issue money in which 75% will be used for debt repayment* | -221.6 |

| Net Debt by end of FY25 after adjusting for Uncalled Rights issue money | 559.8 |

Source: Investor Presentation. *Solara has issued partly paid right shares. Only 25% of right issue amount is required to be given on application and rest amount is being called up by the company whenever required, which is refelcted in the above line item.

The company is resetting its strategy, which includes revamping the Visakhapatnam plant, focusing on margins rather than revenue growth. It is also planning to revive certain dormant drugs which are not commercialised but have potential to become commercial once approved by the regulator.

Key risk(s) It is experiencing pricing pressure from Chinese players, creating a competitive challenge. Also, the business revival is dependent on drug approvals by regulators.

Agro Tech Foods

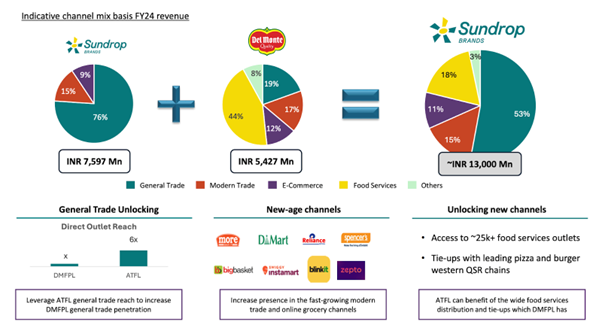

Agro Tech Foods (maker of famous Act II popcorn) has seen a change in hands of management and promoter. The previous investor, Conagra Brands, sold its 51% stake to PE investors, namely Samara Capital and Convergent Finance. Following this, it has announced an acquisition of Del Monte, a western cuisine packaged food brand.

The management expects this acquisition to increase the revenue of Agro Tech Foods by almost 72%. Moving forward, it aims to focus on growing its brands, Sundrop and ACT II, in addition to expanding the acquired brands.

Source: Agro Tech Foods Investor Presentation

Key risk(s) The business might be at risk if the recently acquired FMCG business could not be scaled up or no synergies have been developed between different product categories. Overall, the company is facing the risk of slowdown due to urban consumption and also competition from newly emerging D2C brands.

Borosil Renewables

Borosil Renewables is currently the leading manufacturer of solar glass in India, which is being installed on the surface of solar panels. For the last few years, the solar glass industry in India has been facing huge pricing pressure owing to cheap imports from China after the anti-dumping duty was removed in 2022.

In February 2025, the Indian government imposed a countervailing duty on imports from China and Vietnam, providing relief to domestic manufacturers. Also, the company shut down its loss-making plant in Europe in January 2025 to improve overall profitability.

Interestingly, apart from open market buys, promoters have infused ₹100 crore via equity in the recent fundraise at ₹530 per share.

Key risk(s) The removal of anti-dumping duties or any changes in solar policies could have a significant impact on the company. It may also be facing competition as the facilities of solar glass will be commissioned by Adani, Reliance and Tata.

Godrej Properties

Godrej Properties stands out as a top real estate player in India, especially as demand continues to outpace supply across key markets.

What sets it apart?

- Lowest borrowing cost in the sector (under 8%)

- Appointed as development manager for a large land bank owned by the Godrej Group—ensuring strong long-term project visibility.

- Plans to launch ₹30,000 crore worth of projects in 2025, nearly 2x of 2024 launches.

- Management has also guided for higher margins in upcoming projects.

Key risk(s) Urban consumption slowdown might lead to spillover impact for housing. The company might face a challenge in scaling up if interest rates rise significantly. A failure or delay in commencement can impact the company.

Ramkrishna Forgings

Ramkrishna Forgings, a key player in the auto component space, is now expanding its footprint across multiple high-growth sectors:

- Railways: Partnered with Titagarh Rail Systems for a ₹2,000 crore forged wheels project for Indian Railways, with operations starting Jan 2026.

- EVs & Aluminium Forging: Entering the EV space through a planned foray into aluminium forgings.

- Two-Wheelers: Acquired ACIL to tap into the two-wheeler segment.

- North America expansion: Acquired a Mexico-based firm to deepen presence in North America and Canada.

- Capacity Expansion: Multiple facilities being scaled up, with operations set to commence through 2025.

Key risks(s) The Company being a global auto-component player relies on global economic policies for its business operations, which might be a risk if global slowdown and uncertainty around tariffs negatively impact the company’s customers or products. Further expansion into other newer segments might not succeed due to a lack of expertise in those segments.

Religare Enterprises

Religare Enterprises is undergoing a strategic transformation, with several catalysts aligning for future growth:

- Care Health Insurance, in which Religare holds a 64% stake, is expected to launch its IPO soon at an estimated valuation of ₹10,000 crore—translating to a ₹6,400 crore for Religare, which is almost near to conglomerate’s current market cap of ₹8,000 crore as per CNBC

- The Burman family (Dabur promoters) have taken a 25% stake and plan to raise it to 51%, aiming to become the new promoters. They also bought ₹10 crore worth of shares in March 2025, reaffirming their commitment.

Major risk(s) A potential delay in the IPO of Care Health Insurance might impact the company’s business and its potential value unlocking.

Cosmo First

-

Packaging: Company aims to derive 80%+ volumes from high-margin specialty films by 2026 and is targeting a 20% CAGR revenue growth over the next 3 years with stable margins.

-

Petcare: Plans to demerge the D2C Petcare vertical into a separate entity in the near term, unlocking value from this fast-growing consumer segment.

Key risk(s) Significant capacity expansion in both India and China might cause a situation of oversupply causing supply to outstrip demand. A fall in prices of key products like BOPP and BOPET films can impact a company's margin.

Deepak Nitrite

Deepak Nitrite has two main businesses, which advance intermediates (used in agrochemicals) and chemical business (mainly phenolics). In Q3FY25 (quarter ended December 2025) both businesses simultaneously faced headwinds due to destocking in agrochemicals, planned shutdown in phenolics, and delay in commissioning of certain capacities. This is one of the few times when both businesses have been simultaneously impacted.

Management expects this situation to be normalised in the next two quarters.

| Q3 FY24 | Q2 FY25 | Q3 FY25 | YoY (%) | |

|---|---|---|---|---|

| Revenue (₹ crore) | ||||

| Advanced Intermediates | 674 | 606 | 552 | -18% |

| Phenolics | 1,349 | 1,443 | 1,366 | 1% |

| Less - Inter segment | 14 | 17 | 14 | -3% |

| Total | 2,009 | 2,032 | 1,903 | -5% |

| EBIT (₹ crore) | ||||

| Advanced Intermediates | 94 | 47 | 17 | -82% |

| Phenolics | 180 | 215 | 121 | -33% |

| EBIT % | ||||

| Advanced Intermediates | 14% | 8% | 3% | -78% |

| Phenolics | 13% | 15% | 9% | -33% |

Source: Deepak Nitrite Investor Presentation

Additionally, Deepak Nitrite is expanding into the fluorination and electronic chemicals (polycarbonate) sectors, where it aims to play a pivotal role in import substitution—similar to its successful entry into the phenolics segment. This strategy involves producing locally what has traditionally been imported, reducing dependence on foreign suppliers, and fostering self-reliance in critical industries.

Key risk(s) The company experienced temporary idling of plant capacities due to a lag in demand for agrochemical intermediates and higher raw material prices, which impacted its EBITDA margins. Additionally, delays in the commissioning of new capacities could hinder growth.

Companies where promoter/director/insider are selling

But, what happens when insiders decide to sell? While it can be a regular part of financial planning, below is a list of companies which have seen promoter selling :

| Name | Market cap (₹ Cr.) | Selling value (₹ Cr.) | Selling price (Weighted average) | CMP | % chg since transaction | % from 52W high |

|---|---|---|---|---|---|---|

| Onesource Specialty Pharma | 17,076 | -620 | 1,534 | 1,492 | -3 | -17 |

| Bajaj Finance | 535,121 | -183 | 8,267 | 8,648 | 5 | -8 |

| Vipul | 163 | -60 | 33 | 12 | -65 | -80 |

| Tejas Networks | 11,644 | -59 | 856 | 666 | -22 | -55 |

| Pidilite Industries | 139,071 | -70 | 2,729 | 2,734 | 0 | -19 |

| 360 ONE WAM | 35,412 | -40 | 1,042 | 911 | -13 | -32 |

| Avenue Supermarts | 249,276 | -24 | 3,758 | 3,832 | 2 | -31 |

| Birlasoft | 10,970 | -22 | 485 | 398 | -18 | -50 |

| Zydus Wellness | 10,481 | -21 | 1,892 | 1,647 | -13 | -34 |

| AGS Transact Technologies | 145 | -18 | 64 | 11 | -82 | -91 |

| Sigachi Industries | 1,232 | -15 | 44 | 37 | -16 | -51 |

| Ethos | 6,306 | -13 | 3,028 | 2,576 | -15 | -28 |

Source: NSE, Bloomberg. Data as on March 17, 2025. Period considered: January 1 to March 17, 2025. The above list is not an exhaustive list of promoter buying during this period. You can access the full list on the NSE website.

In summary

The strategy of promoter trading is widely used for idea generation. While this exercise provides valuable insight into the company, it should serve as a starting point rather than the foundation for an entire thesis based on promoter trades. There have been instances where promoters were wrong, and stock prices moved in the opposite direction of their expectations.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story