Upstox Originals

India's wool paradox: Abundance, waste, and missed opportunity

.png)

7 min read | Updated on June 12, 2025, 12:15 IST

SUMMARY

India doesn’t have a wool problem. It has a value problem. With 74 million sheep and nearly 37 million kg of wool produced each year, the country is rich in raw fibre. But here’s the catch—over 90% of it goes to waste. It's unprocessed, untraced, and unmonetised. This isn’t about capacity; it’s about systems, incentives, and a bit of imagination.

India produces 33.69 million kg of wool annually

India is the third-largest holder of sheep globally, producing 33.69 million kg of wool annually. Yet, we rank only ninth in wool production by value. Why? Because 85% of our wool is coarse, good only for carpets.

The average fleece yield, or the amount of wool harvested from one sheep, is just 0.9 kg per sheep, against the global benchmark of 2.4 kg. States like Rajasthan and Jammu & Kashmir are production powerhouses, but without an advanced value chain, we’re exporting raw effort and importing finished products.

This lack of value-chain sophistication means that, while we produce wool, we aren’t investing in the necessary infrastructure, technology, and expertise to process it into high-value goods. Instead, we export raw wool and import finished wool products.

The wool we produce is often manually sheared, improperly stored, and left ungraded, which significantly reduces its quality. As a result, farmers discard it, processors overlook it, and exporters bypass it, despite its potential value. Farmers see it as unprofitable, processors find it too coarse, and exporters prefer wool from countries with better quality and processing capabilities. This inefficiency leads to India, a wool-producing nation, being reliant on imports of raw wool every year, primarily from Australia and New Zealand.

The global market opportunity

The global wool market size was valued at $40.1 billion in 2023 and is poised to grow from $42.1 billion in 2024 to $61.6 billion by 2032, according to estimates by market research analysts. As demand for quality wool increases globally, India has a tremendous opportunity to capitalise on this growth, especially by improving its value chain.

An industry that produces and imports

The irony is striking. While India imports millions of kilos of fine wool, it exported over ₹15,500 crore worth of woolen products in FY25—82% of that in carpets. The US alone accounted for over ₹8,244 crore of this figure. But here's the kicker: this is commodity success, not capability strength. India’s presence in premium wool products like suiting wool, technical textiles, and wool-based apparel is still very limited.

What’s clear is that the market is there. Demand is growing, both at home and globally. What’s missing is India’s ability to move quickly with the supply chain and the strategic foresight to seize the opportunity.

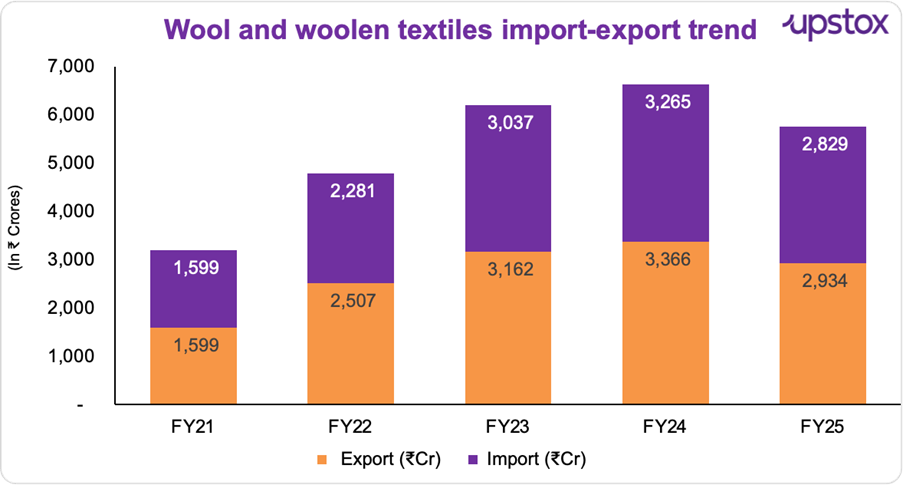

Exports and imports year-wise trend:

Here’s a quick look at India’s woolen product trade from FY21 to FY25. The data shows exports and imports and highlights the imbalance.

India’s total woolen products trade - FY21–FY25 (₹ crore)

| Year | Export | Import | Net |

|---|---|---|---|

| FY21 | 12,619 | 2,134 | 10,485 |

| FY22 | 15,846 | 3,026 | 12,820 |

| FY23 | 14,123 | 3,325 | 10,798 |

| FY24 | 14,919 | 3,543 | 11,376 |

| FY25 | 15,971 | 3,133 | 12,838 |

Source: https://dashboard.commerce.gov.in/commercedashboard.aspx

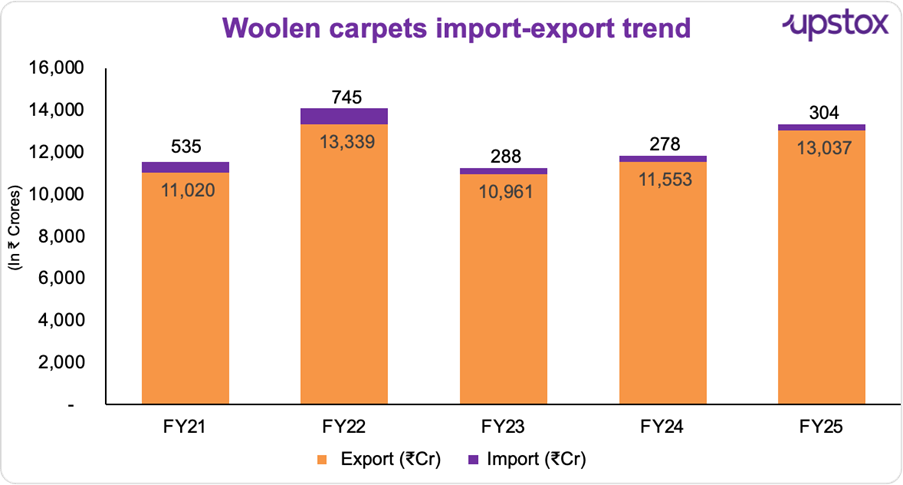

Now, let us take a closer look - the data is bifurcated into carpets and other woolen products to reveal the hidden stories!

The trend shows a steady increase in both wool and woolen textile exports and imports over FY21 to FY25, with exports only marginally exceeding imports.

Source: https://dashboard.commerce.gov.in/commercedashboard.aspx

India’s secret weapon: Carpet craftsmanship

A big chunk of India’s woolen exports is carpets, making up over 80% of the total. Let’s shine a light on that success.

Source: https://dashboard.commerce.gov.in/commercedashboard.aspx

The turning point: IWDP and policy realignment

The Ministry of Textiles has launched the Integrated Wool Development Programme (IWDP) to enhance India's wool sector, with a budget allocation of ₹126 crore for FY22 to FY26. This initiative focuses on improving wool quality, harmonizing the supply chain, providing marketing platforms for smaller producers, and offering skill development for hand-made manufacturers.

Key budget allocations include 63% for the Wool Processing Scheme, Human Resource Development, and the Pashmina Wool Development Scheme, with ₹20 crore for the Nodal Agency and ₹12.4 crore for the Wool Marketing Scheme. Its core interventions include:

-

Expanding machine-shearing to increase both yield and quality.

-

Establishing Common Facility Centres (CFCs) for carding, dyeing, spinning.

-

Supporting coarse wool R&D for technical applications—fireproofing, acoustic panels, and more.

-

Launching certifications like Indian Wool Mark and Kaleen Mark for traceability.

-

Enhancing branding and market access for Pashmina and handmade crafts.

-

Backing skill development to rejuvenate India’s dormant wool clusters.

The billion-dollar blind spot: Technical wool

India’s wool use has historically been one-dimensional—carpets and winterwear. But the world is expanding wool’s horizon. Technical textiles account for 30-70% of wool demand in mature markets. In India, it’s about 5-10%. There’s a reason for urgency:

-

Wool is naturally flame-retardant, ideal for aviation and defence

-

It has high nitrogen content, making it useful as eco-fertilizer

-

Wool panels are being used for acoustic insulation in construction

-

Biodegradable wool apparel is finding favour among eco-conscious luxury brands

This isn’t speculative. It’s already commercial in Europe. The opportunity for India is to scale what the West has prototyped.

Innovation at the edges: The Neeman’s case study

Startups like Neeman’s are rewriting the coarse wool playbook. By making eco-friendly footwear with local fibres, they’re proving two things:

-

Coarse doesn’t mean worthless. It means underutilized.

-

Consumers will pay for traceability and sustainability—if the story is told right.

The company has witnessed significant growth, with revenue exceeding ₹100 crore in FY24, up from ₹69 crore in FY23 and ₹47 crore in FY22. Currently, the brand has over 11 stores in cities like Hyderabad, Mumbai and Bengaluru. Having raised a Series B funding of $5.2 million, it plans to open over 20 new stores across all major metro cities.

India must now create an ecosystem where hundreds of such companies emerge—supported by design labs, incubation grants, and government procurement.

From soft fibre to strategic asset

Let’s take a macro view:

-

Textiles contribute 8.21% of India’s total exports

-

India employs 45 million people directly in the sector, and supports 100 million livelihoods indirectly

But wool barely features in this narrative—despite its rural reach and low water footprint

Now, imagine this: if even 30% of the 37 million kg of annual wool were value-added through skilling, certification, and innovation, India could unlock a ₹5,000–₹7,000 crore market, while potentially elevating over 20 lakh shepherds out of economic obscurity.

Investor view: Where the smart capital goes

Here’s where future capital should look:

-

Textile manufacturers are scaling up wool-blended suiting, jackets, or eco-apparel.

-

Tech enablers—AI grading, blockchain traceability, sustainable dyeing systems.

-

D2C brands with a sustainability-first narrative—wool-based home goods, wellness products, pet care.

-

Rural cooperatives that integrate craft with commerce via online platforms.

This isn’t just good business. It’s impact capital with exponential upside.

In summary

A strategic fibre for a strategic decade India’s wool sector is what strategy consultants call a “stranded asset”—high potential, low unlock. But in a world moving toward low-carbon materials, transparent sourcing, and rural inclusion, wool offers India a trifecta.

We don’t need another cotton revolution. We need a wool resurgence. And this time, the playbook isn’t just about exporting carpets. It’s about exporting credibility, creativity, and carbon-consciousness.

If we get this right, India won’t just be spinning wool. It will be spinning value, dignity, and global influence—one fleece at a time.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story