Upstox Originals

India's global prescription: The rise of generic drugs

.png)

6 min read | Updated on November 20, 2024, 14:36 IST

SUMMARY

Did you know that India is the world's largest supplier of generic medications, accounting for 20% of the worldwide supply by volume? Their quality coupled with cost competitiveness has helped India become the "pharmacy of the world." In this article, we look at the industry landscape and some key drivers of the growth of the pharma sector.

India is the world's largest supplier of generic medications, accounting for 20% of global supply by volume

Did you know that India manufactures about 60,000 different generic brands across 60 therapeutic categories?

India’s generic drug industry is often called the “pharmacy of the world,” and for good reason. With its vast network of manufacturers and ability to produce affordable medicines, it’s been a lifesaver—literally—for millions across the globe. Let’s break down how this sector works and why it matters.

What are generic drugs?

Generic drugs are essentially copies of brand-name drugs but without the hefty price tags. Once the patent on a branded drug expires, other manufacturers can produce and sell the same drug under its chemical name. These drugs must meet strict regulatory standards to ensure they’re as effective and safe as their branded counterparts.

India plays a significant role here, accounting for around 20% of the global supply of generic medicines. Over 40% of India’s generic drug production is exported. From antibiotics to cancer treatments, the range is vast.

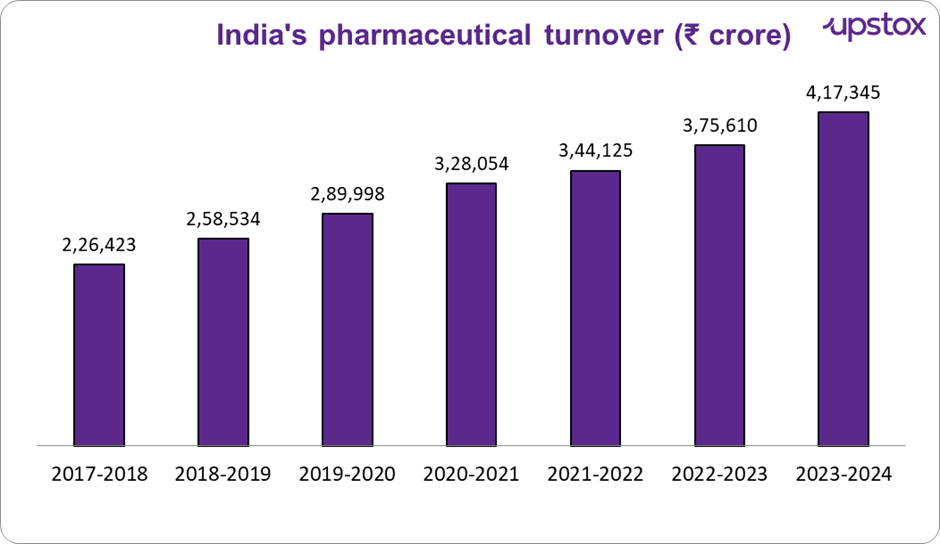

Moreover, the annual turnover of the total Indian pharmaceutical sector during the last 7 years has been growing at a steady CAGR of 9.1%, outpacing the overall GDP growth. The industry is expected to manage a healthy clip of ~10% growth for the foreseeable future. Currently, generic drugs have a ~70% market share in India’s overall pharmaceutical segment.

Source: Pharmaceuticals.gov.in

The business model

Indian pharmaceutical companies operate on a volume-driven business model. Here’s how it works:

Source: pharmaceuticals.gov.in

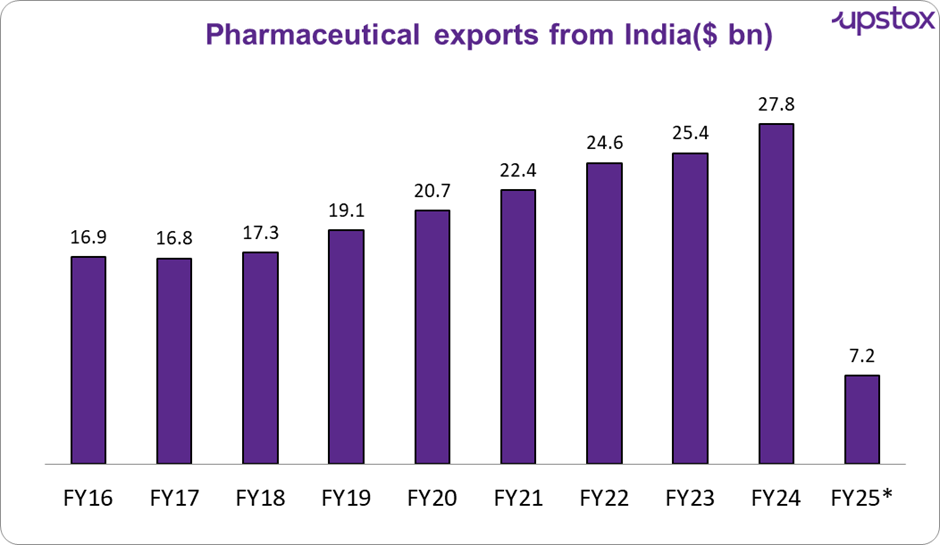

Strong export growth

As shown in the chart below, India's exports have been gradually expanding at ~6%, despite global supply chain interruptions, lockdowns, and other challenges. India's top five export destinations in FY23 were the USA, Belgium, South Africa, the United Kingdom, and Brazil.

Source: IBEF, Till FY25* (April-June)

What makes generic drugs so popular?

They are cheaper

Since generics don’t require the billions of dollars typically spent on developing new drugs, they are much cheaper and therefore more affordable.

In the table below, we have compared the MRP price of a few branded and generic medicines. Generally, generic medicines are ~57% cheaper than their brand peers.

India’s patent laws allow generic manufacturers to create alternatives as soon as a patent expires, ensuring competition and therefore keeping prices under check.

Generic versus branded medicines - price comparison*

| Brand name | Who makes it globally? | Who makes it in India? | Treatment | Brand MRP ₹ | Generic MRP ₹ | Difference % |

|---|---|---|---|---|---|---|

| PantodacDSR | Zydus Cadila | Mankind Pharma | Gastritis | 202 | 129 | 36% |

| Forxiga | AstraZeneca | Sun Pharma | Type 2 diabetes | 362 | 180 | 50% |

| Pansec | Cipla | Cadila Pharmaceuticals | Acid reflux | 144 | 70 | 51% |

| Calpol 650 | Glaxosmithkline | Micro Labs | Fever | 33 | 20 | 39% |

| Montair LC | Cipla | Sun Pharma | Blocked nose | 246 | 27 | 89% |

| Telma AM | Glenmark Pharma. | Dr Reddy's Laboratories | Hypertension | 307 | 22 | 93% |

| Glimy M2 PR | Dr Reddy's Laboratories | USV | Type 2 diabetes | 263 | 140 | 47% |

| Amlodac 5 | Zydus Cadila | Cipla | Arrhythmia | 42 | 32 | 24% |

| Vidala-M 50/500 | Akcent Healthcare | Cipla | Type 2 diabetes | 346 | 115 | 67% |

| Average | 216 | 82 | 57% |

Source: Sayacare.in, tata1mg

They have strong government support

Government support plays a crucial role in making Indian generics more affordable and competitive on a global scale. Tax incentives and subsidies further ease the financial burden on pharmaceutical companies, allowing them to focus on scaling operations and improving quality.

The government also provides several incentives, such as:

-

Production-linked incentive (PLI) scheme for pharmaceuticals which was launched in 2021 allocated ₹15,000 Cr over six years.

-

Scheme for strengthening of the medical device industry which has an outlay of ₹500 cr for the three years from 2025-2027.

-

Scheme for promotion of research and Innovation in the pharma medtech sector (PRIP) with a budget outlay of ₹5,000 cr over 5 years.

But what about quality?

India has the most FDA-approved facilities outside the USA, meeting stringent market standards. With over 262 US-FDA-compliant plants, around 1,400 WHO-GMP (World Health Organization-Good Manufacturing Practices) approved facilities, and 253 EDQM (European Directorate for the Quality of Medicines & Healthcare) approved plants, India has an extensive setup to produce a wide variety of formulations efficiently and competitively.

With decades of experience, Indian companies are skilled in manufacturing high-quality, cost-effective medications. They cater to both everyday health needs and complex therapies for diseases like oncology and AIDS, maintaining global standards without compromising quality.

Challenges along the way

While the industry thrives, it’s not without hurdles:

-

Quality concerns: India’s pharmaceutical industry, despite its global dominance, often finds itself under the scanner for quality and compliance issues. International regulators like the U.S. FDA and EMA have raised concerns about lapses in manufacturing practices, ranging from hygiene issues to data integrity violations.

-

Intense competition: Domestic players compete fiercely, often pushing profit margins razor-thin.

-

Import reliance: Despite reducing imports, India is still reliant on China for raw materials, which exposes supply chain vulnerabilities.

Finally, we look at some of the key players in this space in the table below

| Name | Mar cap (₹ Cr) | EV / EBITDA (x) | ROE % | 3-Year Profit Growth % (2019-24) | 3-Year Stock Return % (2019-24) |

|---|---|---|---|---|---|

| Sun Pharma.Inds. | 4,26,422 | 27 | 17 | 13 | 31 |

| Divi's Lab. | 1,56,649 | 52 | 12 | 4 | 7 |

| Cipla | 1,18,842 | 16 | 17 | 10 | 18 |

| Torrent Pharma. | 1,04,739 | 30 | 24 | 10 | 30 |

| Mankind Pharma | 1,03,142 | 37 | 20 | 19 | |

| Dr Reddy's Labs | 1,01,248 | 12 | 21 | 14 | 9 |

| Zydus Lifesci. | 95,351 | 14 | 21 | 11 | 27 |

| Lupin | 92,982 | 20 | 14 | 10 | 31 |

| Aurobindo Pharma | 73,248 | 11 | 12 | 5 | 25 |

| Average | 1,41,402 | 24 | 17 | 11 | 22 |

Source: Screener.in; Data as on 20-11-24

Conclusion

India’s generic drug industry is a testament to the power of affordability and innovation in healthcare. While it faces hurdles like regulatory scrutiny and supply chain challenges, its resilience and adaptability have made it a critical player in global medicine.

With continued support and advancements, the industry is poised to shape the future of accessible healthcare for millions around the world.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story