Upstox Originals

From T-Shirts to triumph: Assessing Zudio’s growth journey

.png)

4 min read | Updated on July 30, 2024, 17:15 IST

SUMMARY

Every one minute, this store sells 90 T-shirts, 20 denims, 19 fragrances, and 17 lipsticks. Learn how Zudio became a key contributor to Trent’s financial success and has in a competitive marketplace.

Stock list

Zudio has quickly become one of the largest contributor to Trent's success

Tata’s venture into apparel began in 1998 with the launch of the first Westside store, aimed at providing affordable fashion to India’s urban middle-class people.

Despite that, Tata’s were still not present in the sub ₹500 fashion segment, which made up for ~60% of India’s fashion market. Westside's average price is ₹1,500.

This prompted the launch of Zudio - under the umbrella of Tata Trent. In September 2016, the first value fashion store was launched in Bengaluru.

Trent’s business overview

Zudio and Westside are not the only two major retail arms under Trent. Trent’s owned brands include:

- Westside: This offers a diverse collection, including fashion, home decor, and beauty products.

- Zudio: It provides affordable, trend-led fashion and home essentials.

- Misbu: This specialises in quality, budget-friendly cosmetics.

- Utsa: It features contemporary-traditional ethnic wear.

It has alliances with:

- Star Market: A supermarket chain catering to daily needs. Star is 50:50 JV with Trent and Tesco

- Zara: It brings global fashion trends through a strategic partnership. Trent owns 49%, while the Inditex group of Spain owns 51%

- Massimo Dutti: This focuses on sophisticated, upscale fashion and accessories. The ownership structure is the same as Zara.

Let’s look at Zudio’s contributions

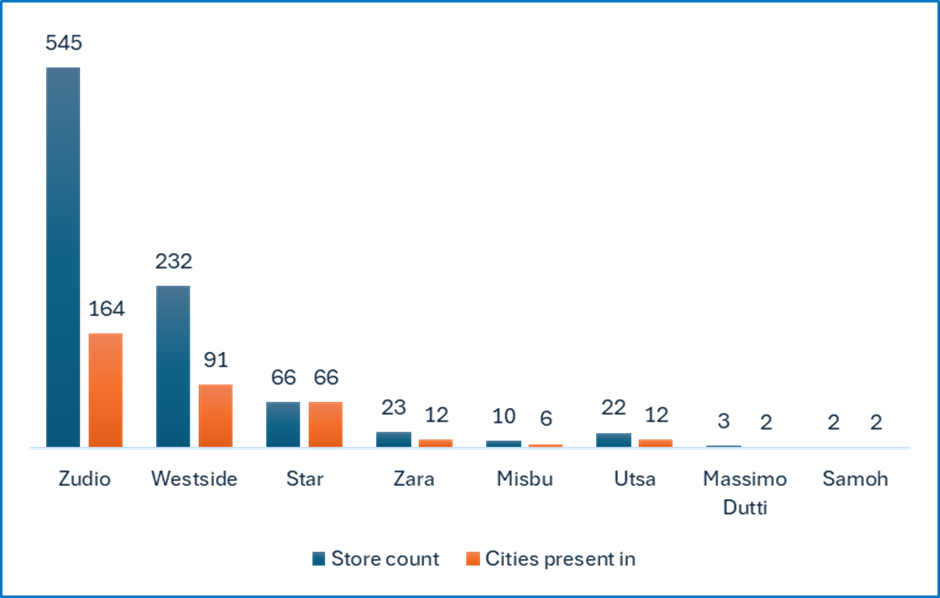

Increased reach

In the last 7-8 years, Zudio has opened up more than 500 stores, nearly 2x of that of Westside. Zudio covers an area of 5 million square feet compared to Westside’s 4.5 million square feet.

Source: Annual Report, 2024

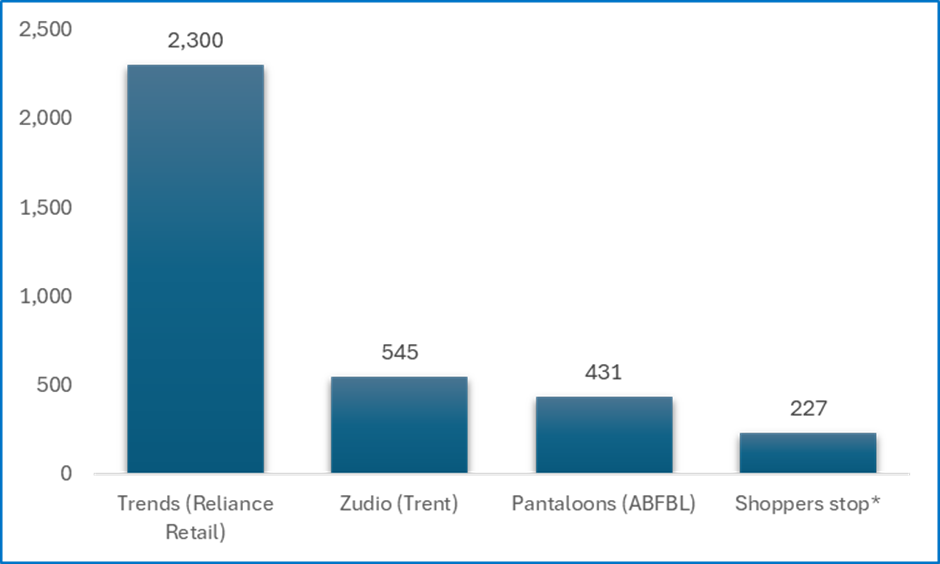

We also look at how competition stacks up against Zudio in the chart below.

Source: Company Annual report, News articles, *112 department stores, 13 standalone beauty stores, 74 ELCA standalone outlets, 7 HomeStop outlets, and 21 airport doors.

The Zudio differentiation

We look at some key factors that help Zudio stand apart from its stablemates.

| # | Segment | Differentiation |

|---|---|---|

| 1 | Marketing | Limited reliance on traditional (expensive) channels like billboards, celebrity endorsements, or TV ads Leverages social media influencers to promote its quality content at a reasonable cost. |

| 2 | Offline Stores | Zudio’s operations are offline only - this helps it avoid costs relating to return charges. Online sales typically see a return of as high as 25% of the sales |

| 3 | No Discounts | Mostly maintains consistent prices below ₹999, which promotes immediate purchases without relying on seasonal discounts. This helps with smart inventory management and reduces need for any “clearance sales”. With this, it minimizes wastage and protects profitability. |

Zudio’s financials - Largest revenue contributor

As can be seen from the table below, in a short period, it has become the largest revenue contributor for Trent. Its revenue share rose to 55.8% in FY24 from 46% in FY23 and less than 10% in FY19.

Trent: FY24 Financials Performance (in ₹ crore)*

| Westside | Zudio | Star | Zara | Consolidated | |

|---|---|---|---|---|---|

| Revenue | 4,950.2 | 6,909.7 | 2,188.9 | 2,768.9 | 12,375.1 |

| Gross margins | 55% | 38% | 20% | 38% | 44% |

| EBITDA margin | 15% | 9% | 1% | 15% | 10% |

| EBIT Margin | 13% | 8% | -4% | 12% | 8% |

| ROCE (pre-tax) | 24.3% | 32.8% | -14.2% | 54.3% | 24.9% |

Source: Trendlyne; *Please note: Star, Zara are alliances / JVs. The complete revenue is not added to the consolidated result, it is just shown here to help compare each brand completely

What has driven this financial performance?

Key drivers of this performance are:

- Pricing and Cost: Competitive pricing has helped it succeed. The company has an average selling price (ASP) of ₹ 500, with most products priced at less than ₹999. These prices appeal to the affordable fashion-conscious Tier II-IV consumers.

- Managing rent: By targeting emerging areas, Zudio can keep its rental expenses in check. In FY24, Typically opening a store required an investment of ~₹3-4 crore (including capex, deposit, and inventory).

- Volume driven: With lower ASP, profitability is under pressure. To manage this, it focuses on volume maximization.

In conclusion

In a remarkably short period, Zudio has skyrocketed to become Trent’s top revenue generator, outpacing all other brands and rapidly expanding its store footprint. With the highest store count and explosive revenue growth, Zudio has helped Trent capture a dominant share of India's value fashion market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story