Upstox Originals

Dependency to dominance: India's mobile phone manufacturing journey

.png)

4 min read | Updated on August 06, 2024, 16:47 IST

SUMMARY

From a net importer, India has emerged as a net exporter of mobile handsets. Smartphones are now the fourth largest export from India. In this chartbook, we track this evolution, look at the market share of key players, and provide a list of stocks that could benefit from this growing industry.

Smartphones are India's fourth largest export

India's smartphone market was valued at $44.2 billion in 2023 and is expected to reach $89.1 billion by 2032, a CAGR of 8.1%.

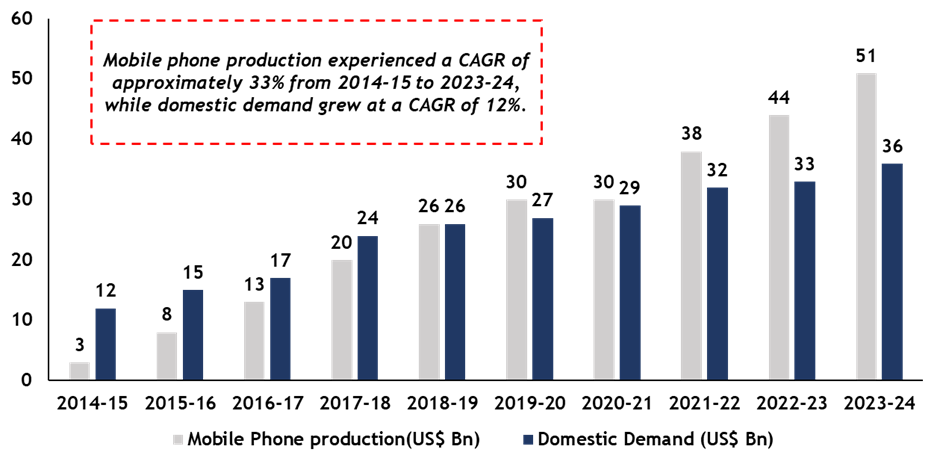

Mobile phone production has expanded due to rising internal demand, higher digital literacy, and government-sponsored schemes like the Phased Manufacturing Program (PMP) and Production Linked Incentives (PLI).

Domestic production and demand for mobile phones

Source: ICEA

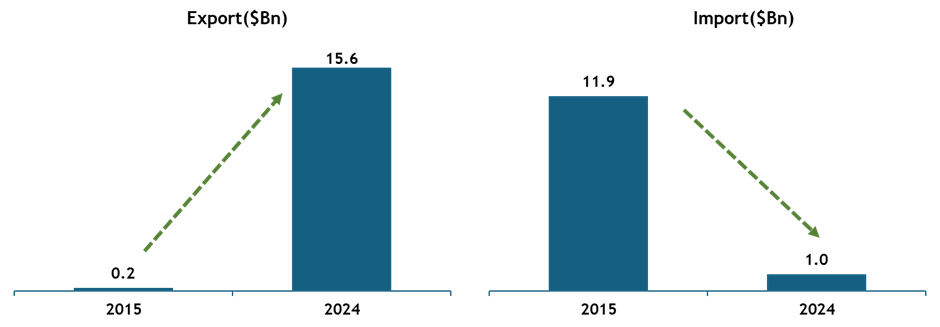

This boost in domestic production has also translated into a robust export market from India.

Export and import of mobile phones

Source: ICEA, The Economic Times

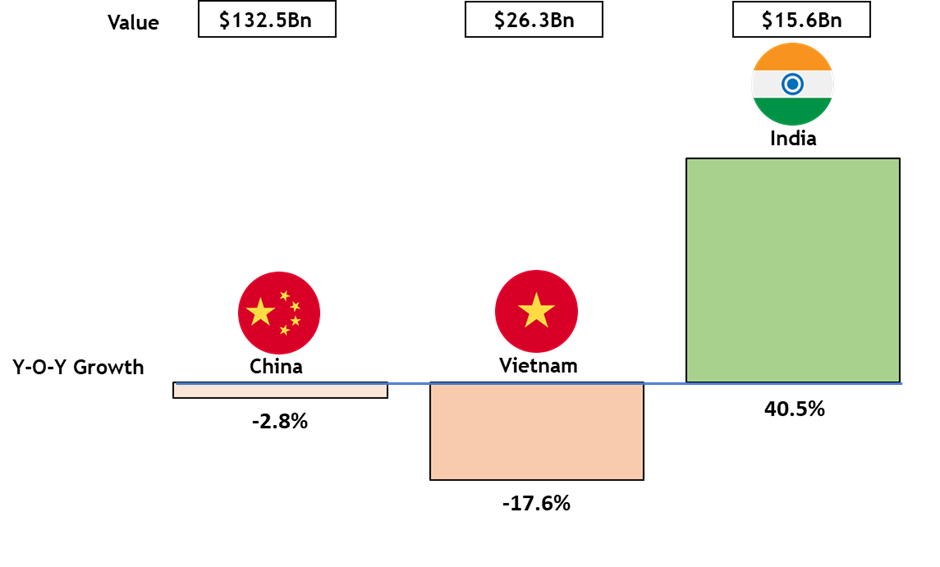

Source: ICEA, The Economic TimesThis has helped India make huge forays into the global markets. While China and Vietnam, both traditionally strong export markets, have seen a decline in FY24, Indian exports have surged.

A report by ITC (a joint agency of the UN and WTO) estimates that over 50% of the decline in the volume of these two countries has been captured by India.

Change in mobile exports (FY3-24)

Source: ITC Trade map, Ministry of Commerce & Industry Data

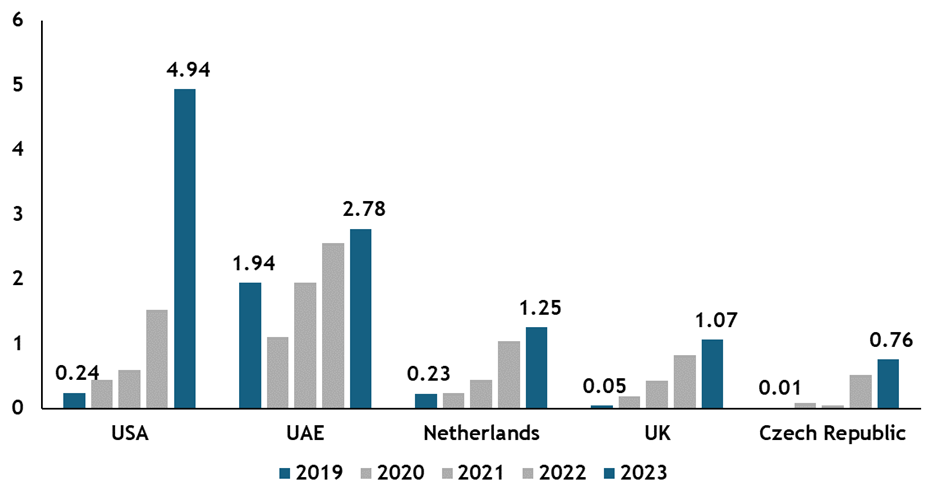

India has a highly diversified and fast-growing export market. The chart shows a significant increase in exports from India in 2023 compared to 2019, with the most notable growth in the USA.

India's major mobile phone export destinations ($Mn)*

Source: Trademap.org; *latest available data

Source: Trademap.org; *latest available dataFinally, let’s turn our attention to the domestic markets

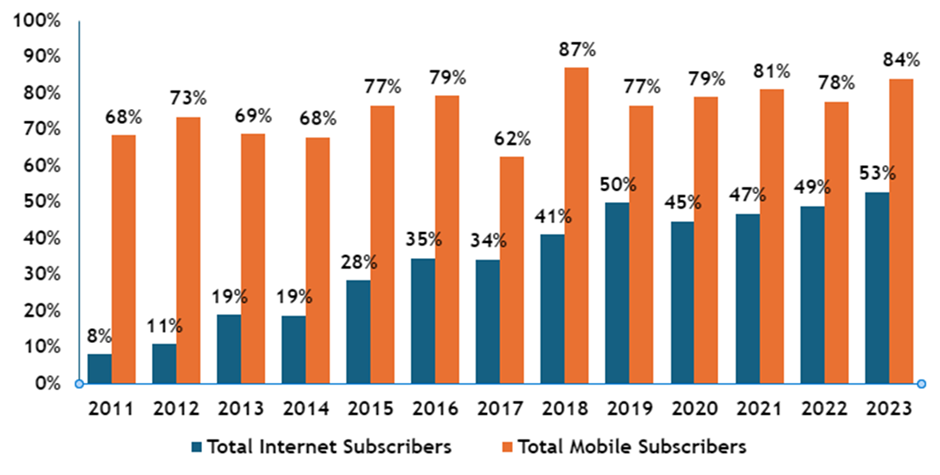

The chart shows a significant increase in both internet and mobile subscriptions. By 2023, internet subscriptions have reached 53%, while mobile subscriptions have risen to 84%.

Trends in internet and mobile subscriptions (as a % of the total population)*

Source: Datareportal.com; *latest available data

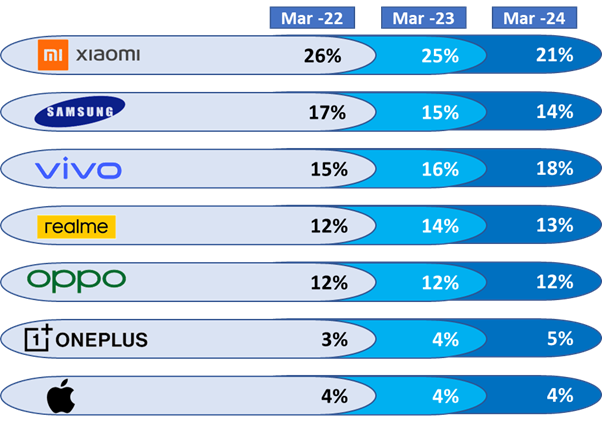

The domestic market still remains a huge addressable and very competitive market, with major players vying to carve out their own niche. While Xiaomi and Samsung remain market leaders, their market share remains under pressure.

Market share of major smartphone brands in India (%)

Source: Statcounter GlobalStats

A non-exhaustive list of stocks in this sector

Telecom Equipment & Infra Services

| # | Stock | Market Cap. (₹ Crore) | ROE (%) | EBITDA Margin (%) | 3-year stock price CAGR (%)* |

|---|---|---|---|---|---|

| 1 | ITI | 27,000.9 | -27.8 | -25.3 | 31.0 |

| 2 | Tejas Networks | 19,754.7 | 2.1 | 14.2 | 52.0 |

| 3 | Avantel | 4,409.2 | 39.2 | 40.8 | 145.0 |

| 4 | GTL Infrastructure | 3,393.9 | NA | 26.7 | -3.0 |

| 5 | NELCO | 1,843.1 | 20.7 | 18.2 | 30.0 |

| 6 | ADC India | 851.5 | 33.7 | 14.6 | 96.0 |

| 7 | Frog Cellsat | 506.3 | 11.0 | 12.2 | NA |

Source: Screener; Data as of August 05, 2024; *Rounded up numbers

Telecommunications - Service Provider

| # | Stock | Market Cap. (₹ Crore) | ROE (%) | EBITDA Margin (%) | ~3-year stock price CAGR (%)* |

|---|---|---|---|---|---|

| 1 | Reliance Industry | 19,70,273 | 9.2% | 18.0 | 15.0 |

| 2 | Bharti Airtel | 8,62,542.6 | 14.9 | 51.9 | 35.0 |

| 3 | Vodafone Idea | 1,03,243.7 | NA | 40.1 | 29.0 |

| 4 | Bharti Hexacom | 54,950.0 | 14.4 | 47.4 | NA |

| 5 | Tata Communications | 52,605.3 | 65.2 | 19.8 | 8.0 |

| 6 | Railtel Corporation | 14,529.0 | 15.2 | 17.5 | 52.0 |

Source: Screener; Data as of August 05, 2024; *Rounded up numbers

Gaming

| # | Stock | Market Cap. (₹ Crore) | ROE (%) | EBITDA Margin (%) | ~3-year stock price CAGR (%)* |

|---|---|---|---|---|---|

| 1 | Nazara Technologies | 6,943.5 | 4.4 | 8.6 | NA |

Source: Screener; Data as of August 05, 2024; *Rounded up numbers

By signing up you agree to Upstox’s Terms & Conditions

About The Author