Upstox Originals

Demerger & Capex: Could Vedanta capitalise on India’s energy transition?

7 min read | Updated on December 29, 2025, 12:17 IST

SUMMARY

Vedanta Ltd. could be entering a structurally important phase, aligned with India’s accelerating commodity demand driven by energy transition and infrastructure build-out. This is backed by a ₹81,743 crore capex cycle and a value-unlocking demerger. However, with majority of the spend ahead of us and the inherent cyclicality of commodities pose meaningful risks for the company.

Stock list

Vedanta has announced a multi-year capital expenditure program worth ₹81,743 crore

India’s commodity demand is entering a transformative phase driven by energy transition and rising industrial demand. While global cycles are driven by external factors, India’s demand is increasingly rooted in domestic growth, driven by infrastructure expansion and the energy transition.

Vedanta Ltd —with its diversified asset base across aluminium, zinc, oil & gas, power, iron ore, steel, and silver—is an integrated player that could potentially benefit from the increasing demand for these commodities, all of which are crucial for India’s growth story.

Why now?

Vedanta could benefit from two major structural events:

- A multi-year capital expenditure plan worth ₹81,743 crore (~$10 billion), which is almost 50% of its gross block of ₹1,94,198 crore.

- The company’s demerger could unlock hidden value and improve transparency.

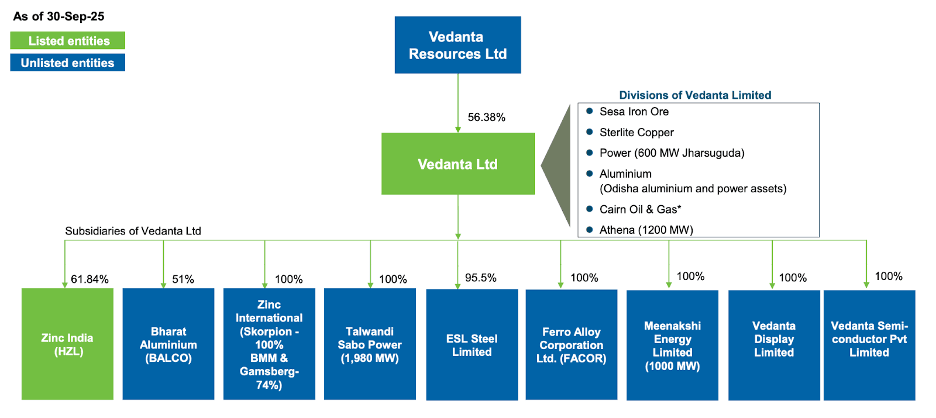

Vedanta: Company structure

The company operates across most of the metals and resources that are central to India’s energy transition and infrastructure push. Its portfolio spans aluminium, zinc, oil and gas, power, iron ore, steel, and silver.

Source: Vedanta Limited Investor Presentation

Capex strategy: Aligning capacity with India’s demand curve

The company has announced a multi-year capital expenditure programme worth ₹81,743 crore, which includes big investments in aluminium, zinc, power, and steel.

| (Amount in ₹ crores) | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

|---|---|---|---|---|---|

| Net Fixed Assets | 90,470 | 93,466 | 95,744 | 98,963 | 99,905 |

| Gross Fixed Assets | 151,127 | 1,62,900 | 1,73,237 | 1,84,286 | 1,94,198 |

| CWIP | 16,314 | 15,879 | 19,529 | 22,889 | 33,896 |

Source: BSE, Company filing

Per the company, this capital expenditure fits with India's shift to cleaner energy sources, which is being driven by more power lines, more renewable energy sources, more electric vehicles, and more spending on infrastructure.

Vedanta is expected to finish most of its growth in aluminium, power, steel, and zinc between FY26 and FY28. Some of the most important projects are:

-

Aluminium: Expansion of the BALCO smelter and the Lanjigarh refinery, increasing VAP capacity to 2.8 MTPA.

-

Zinc: Zinc India projects like Debari Roaster and Cell House debottlenecking, and Zinc International’s Gamsberg Phase II.

-

Power: 1000 MW at Meenakshi Power and 1200 MW at Athena Power.

-

Steel: Doubling of VAP capacity and hot metal expansion to 3.5 MTPA at ESL Steel.

| Business | Project | Approved / Estimated Capex | Spent up to 1QFY26 | Unspent as on 30 Jun 2025 |

|---|---|---|---|---|

| Aluminium | Aluminium value-added products; Coal & Bauxite Mine expansion | 29,860 | 16,634 | 13,226 |

| Zinc & Other Base Metals (India) | Integrated Zinc Metal Complex | 16,277 | 2,711 | 13,566 |

| Zinc International | Gamsberg Phase II Project | 4,676 | 338 | 4,337 |

| Copper & Nicomet | KSA Rod Plant | 176 | 43 | 134 |

| Oil & Gas | Mangala, Bhagyam & Aishwariya Exploration (OALP & PSC) | 15,709 | 6,245 | 9,464 |

| Iron, Steel & Ferro Chrome | Hot metal, DI pipe, Ferro Chrome | 5,888 | 2,198 | 3,690 |

| Power | Athena & Meenakshi Power Project expansion | 5,335 | 2,828 | 2,507 |

| Total | 81,743 | 30,997 | 50,747 |

Source: Vedanta Limited Exchange Filing

Past track record

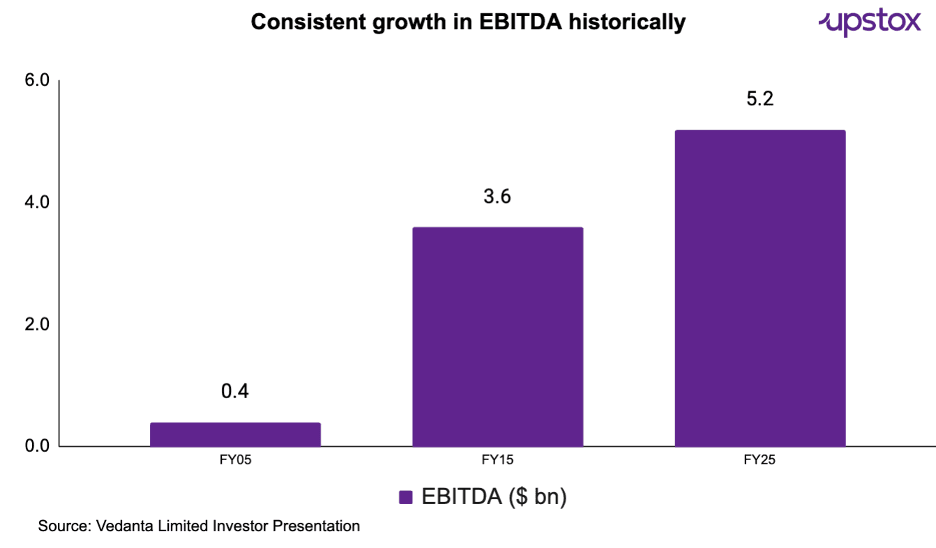

Vedanta’s strategy includes backward integration, energy optimisation, and economies of scale, helping in controlling costs while maintaining strong cash flow. This approach, among others, has helped Vedanta deliver an annual EBITDA growth rate of 15% for the past 20 years.

Source: Vedanta Limited Investor Presentation

Earnings expectation: Management guidance

Management has guided the company's EBITDA to reach $8 to $10 billion over the next few years, thanks to the start of important projects in the aluminium, power, zinc, and steel industries. This means that the consolidated EBITDA will grow at a healthy 18% on a CAGR basis from FY25 to FY28

Demerger: Focused business units set for re-rating

Vedanta is breaking up its business into separate, sector-focused companies that are each tied to a different commodity cycle and group of investors. Shareholders of Vedanta Limited will receive equity shares in each of the four resulting listed entities (in addition to their shareholding in Vedanta Limited) in proportion to their existing shareholding.

-

After the split, the group will run five listed platforms:

-

Vedanta Aluminium will be home to the aluminium business, including BALCO, and will still be directly linked to demand for electrification, renewables, and infrastructure.

-

Vedanta Oil & Gas will include the assets of Cairn India, which will give the company steady cash flows and exposure to the domestic energy market.

-

Vedanta Power will combine the group's independent power plants, which will give them steady income from long-term power purchase agreements (PPAs) and rising demand for power.

-

Vedanta Steel and Ferrous Materials will merge iron ore and steel activities to coincide with India's building and infrastructure cycle.

-

Vedanta Limited will keep Hindustan Zinc, worldwide zinc assets, silver exposure, and other investments that look to the future.

Timeline for completion of the demerger is expected to be around March-26, as certain government approvals are yet to be received before the company proceeds with announcing the record date for the demerger and listing of the demerged entities.

Key Risk Factors

-

Execution risk on large capex: With a significant portion capex yet to be spent, delays, cost overruns or commissioning slippages could push out the expected earnings inflection.

-

Commodity price volatility: While integration reduces risk, Vedanta’s earnings remain sensitive to aluminium, zinc, oil and steel prices, which are influenced by global supply–demand dynamics and geopolitical events.

-

Regulatory and environmental risk: Mining, power and oil & gas operations are exposed to environmental clearances, royalty changes, and evolving ESG regulations, which could impact project timelines and costs.

-

Demerger execution and market perception risk: While value-unlocking is the intent, demergers can face temporary valuation mismatches, liquidity issues, or weaker standalone multiples if execution or investor communication falls short.

-

Leverage and cash flow dependency: Although deleveraging is underway, sustained free cash flow generation is essential to fund capex, service debt and support shareholder returns simultaneously. Running a standalone business on a sustainable basis which is currently dependent on the group might be impacted if standalone profitability is not achieved.

Marco picture: India’s energy transition

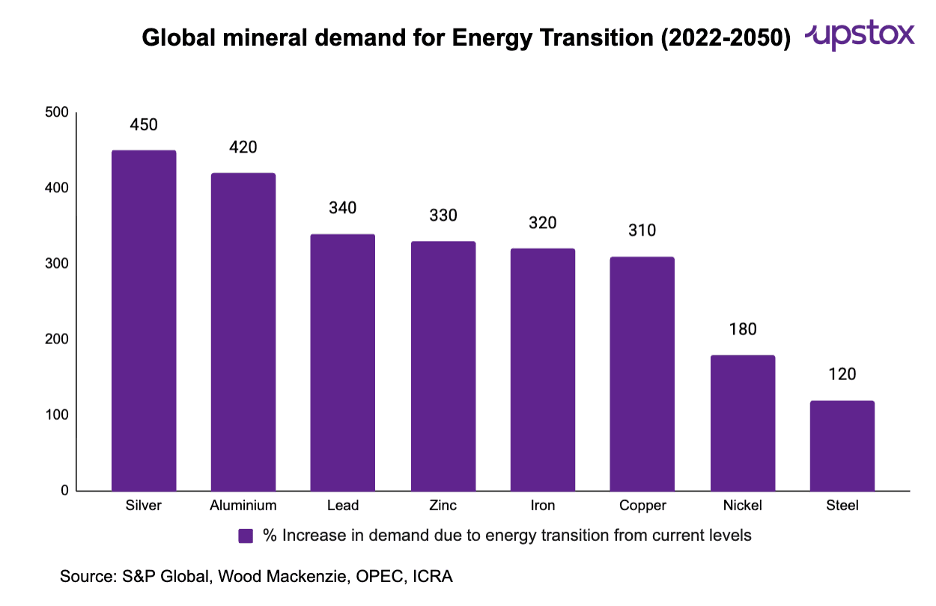

India’s energy transition is fundamentally changing the demand landscape. Electrification, renewable energy capacity, grid expansion, electric vehicles (EVs), and storage infrastructure all need a lot of materials and metals, which is going to be a key driver of commodity demand:

-

Aluminium: Demand is set to rise 4.2x, driven by power transmission, renewables, and EVs.

-

Zinc: Demand will grow 3.3x, supporting infrastructure and renewable installations.

-

Copper and silver: Demand will rise with electrification, growing 3.1x and 1.8x, respectively.

-

Steel: Demand is projected to rise 3.4x, driven by urbanisation and transportation

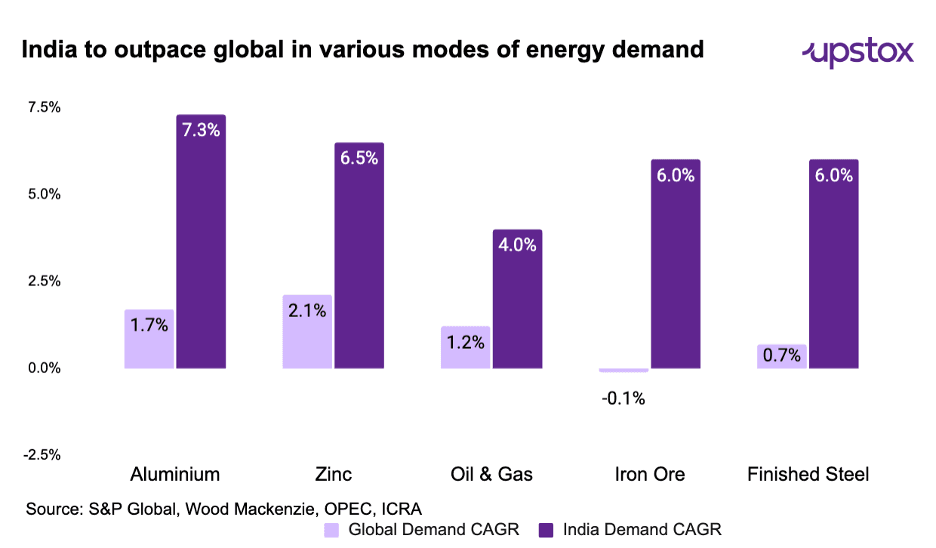

India's commodity cycle is different from developed markets in three important ways: low per-person metal use drives growth, government-backed spending on infrastructure in power, transport, and renewables, and an energy transition that adds demand instead of replacing it.

India's demand for goods will grow faster than the global average from 2024 to 2030. aluminium demand in India is expected to rise by 7.3%, zinc by 6.5%, power by 6.5%, and finished steel by 6%.

Parting thought:

Vedanta’s push appears to be more than just a cosmetic change. By bringing together focused operating entities, the group is making attempts to unlock hidden value in its assets. As the execution moves forward and the businesses that were split off start to build their own reputations, the ability to re-rate becomes more and more tied to delivery, capital discipline, and operating performance.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story