Upstox Originals

Analysing the factors that impact the price-to-earnings ratio

.png)

6 min read | Updated on June 20, 2024, 19:08 IST

SUMMARY

Think you know all about the price-to-earnings ratio (P/E)? What earnings growth rate will any company have to generate and for how many years, to justify its current P/E? In this article, we evaluate various factors that impact the PE ratio and investors typically might not consider while making decisions.

PE ratios are often only analysed superficially

Let’s start with a simple question: If an investor buys a stock trading at 20x P/E, what exactly is he/she betting on? What does it mean for her?

Does it simply mean that he/she is paying ₹20 for every ₹1 of the company’s earnings? Is that all?

In this article, we take a closer look at the P/E ratio. These are the questions we will seek to answer:

-

What does it mean beyond the connection between the stock price and earnings per share of a company?

-

Is there a deeper meaning? Are there more factors at play?

Let’s talk about the concept of a justified P/E. It is a theoretical measure that helps you calculate the “fair P/E ratio.”

Simply put, if a company's justified P/E is higher than its market P/E, the stock is undervalued and vice versa.

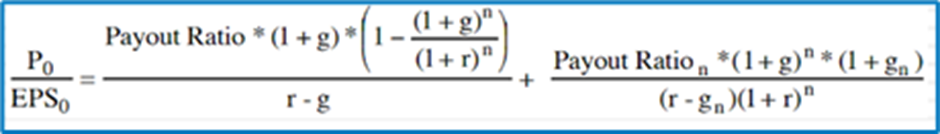

Source: Aswath Damodaran

Looks complicated, doesn’t it?

Without getting into the minutia, let’s try and understand what it’s trying to say: The formula considers a few important factors:

- Dividend payout ratio: Value that accrues to investors in the form of regular income

- Earnings growth rate: How much does a company need to grow its earnings to achieve that particular P/E level). This formula divides expected growth rates into two parts—growth rate during the years of high growth and the growth rate during the mature phase

- Number of years: For how many years will the company need to grow its earnings at a particular P/E level?

Why is this critical?

This formula breaks down the P/E ratio beyond the typical market price and earnings per share factors. It helps take a deeper look at multiple other factors that impact the value of a stock and their relationship with valuations. This is explained in detail below:

| Factor | Relationship with P/E | Interpretation |

|---|---|---|

| Earnings growth rate | Direct correlation | Higher the earnings growth, ideally higher the P/E Flipped inversely, for a company to justify a higher P/E, it will have to consistently deliver a higher growth rate for the years under consideration Lower growth stocks take longer to justify their investment because earnings grow slowly, delaying the point at which the stock's intrinsic value equals its purchase price. |

| Cost of equity | Inverse correlation | As the cost of equity increases, P/E will shrink. So, if you enter a 75x P/E stock (already highly valued), and interest rates rise, so will the cost of equity. This will hinder future P/E expansion and thus impact performance |

| Number of years | Direct correlation | The number of years a company will have to maintain the growth rate. One interpretation of P/E also is the number of years a company will have to grow its earnings at the current cost of equity So, the next time you buy a stock, remember the company will have to maintain the current growth rate for those many number of years |

| Dividend growth rate | Direct correlation | Higher the payout - higher the P/E |

Let’s look at some examples to understand this better. In the table below, we take different P/E ratios, keeping all the other factors constant, we try to arrive at the number of years for which the company will have to grow its earnings.

What does it mean? If you enter a stock at 50x P/E, based on assumptions in this table, the company will have to grow its earnings by 25% for 10 years and then 11% in perpetuity to justify the PE ratio.

| P/E scenarios | ||||

|---|---|---|---|---|

| Factor | 20x P/E | 50x P/E | 75x P/E | 100x P/E |

| Expected growth rate (expansion phase) | 25% | 25% | 25% | 25% |

| Expected growth rate (mature phase) | 11% | 11% | 11% | 11% |

| Dividend payout ratio | 30% | 30% | 30% | 30% |

| Cost of equity | 13% | 13% | 13% | 13% |

| Implied number of year* | 2 | 10 | 14 | 16 |

*rounded off

The next time you are buying a stock, give it a deeper thought! Change the assumptions in the table above and try to arrive at some results, before making decisions.

As markets continue to make new highs, stock valuations are becoming steeper. However, despite any deterrence, investors continue to “invest” in stocks that are trading at valuations well above 50x P/E. We hope that this analysis provides you with tools for a deeper analysis.

Is there something called a good P/E?

All this talk of a P/E ratio will raise the next question: Is there really something called a good P/E ratio? One that would signify a good time to buy?

Unfortunately no. Looked at in isolation, a P/E ratio does not suggest much. Let’s look at two case studies to understand this better.

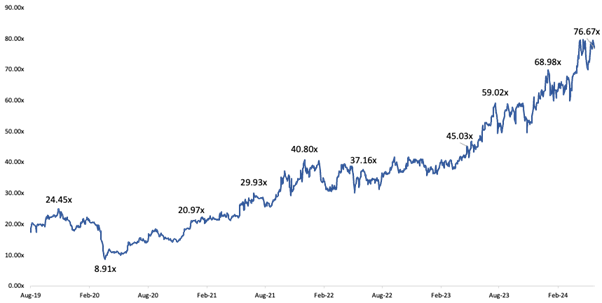

Source: S&P Capital IQ

KEI Industries Ltd manufactures wires and cables. The share price has done very well in recent years, and the P/E ratio has expanded dramatically, as shown in the chart above. One of the reasons for this potential price increase and P/E expansion is the company's recent earnings growth, which has been in line with market expectations.

The company's profit has grown at a CAGR of 29% over the last three years, which is higher than the industry growth rate.

Even at 25x or 30x P/E, the company managed to deliver earnings growth that helped justify the market valuation. This explains how P/E expansion can result from a series of strong earnings or a positive fundamental change in business dynamics.

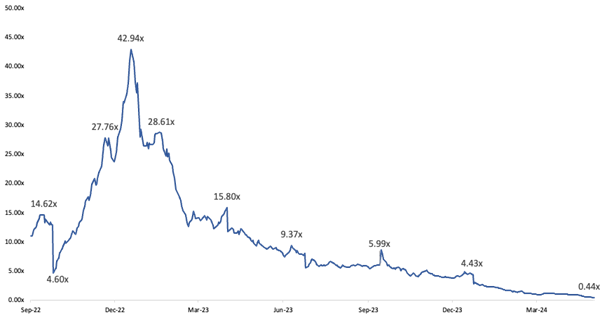

Source: S&P Capital IQ

When Varanium Cloud Ltd., first went public on September 27, 2022. A governance and regulatory investigation was later launched into the company. SEBI accused the cloud services and digital transformation company of financial transparency violations and cash embezzlement from its IPO. The P/E ratio contracted because of investor scepticism induced by these issues, which impacted the company's stock price.

So, even at a P/E of 15.8x - something that would normally be considered cheap -investors would have lost money.

Please note:

This is not a buy or sell recommendation on either of the stocks above. We are simply reporting facts as they happened!

Conclusion

The P/E ratio isn't a standalone investment strategy; it's a key metric used during stock screening. While incredibly useful for assessing stocks, relying solely on the P/E ratio won't provide a comprehensive picture.

The P/E ratio reflects how the stock is perceived by the markets. For investors to make informed decisions, they need to consider additional factors like the business model, revenue streams, industry dynamics, and the quality of management, among others.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story