Upstox Originals

15,000 planes on backorder, can India help ease the crunch?

7 min read | Updated on October 06, 2025, 18:17 IST

SUMMARY

Would it surprise you that Airbus now sources over $1.4 billion worth of parts annually from 100+ Indian suppliers? India is no longer just a small player in the aerospace supply chain, it’s becoming a serious partner for Airbus, Boeing, and GE. With massive backlogs, a China+1 push, and local firms stepping up, India could soon be the world’s engine room for building planes.

Stock list

Airbus now sources over $1.4 billion worth of parts annually from 100+ Indian suppliers

Imagine ordering a shiny new car today and being told it’ll arrive in 2035. In aviation, that kind of wait isn’t unusual; airlines have always planned a decade ahead.

But here’s what’s new, the fragile supply chain behind those jets has cracked. COVID wiped out many of the smaller suppliers, leaving Airbus and Boeing scrambling for parts. Add the Russia–Ukraine war, raw material shortages, and China+1 worries, and the once manageable backlog was turning into a crisis.

Take in the case of Airbus in 2021 and 2022, it repeatedly missed delivery targets as suppliers collapsed during the pandemic. Even in 2023, production forecasts had to be cut because critical components like engines and aerostructures were stuck in bottlenecks. Boeing hasn’t been spared either, shortages of engines and fuselage sections forced it to slow down production of the 737 MAX, leaving airlines waiting despite record orders.

The result? A ballooning backlog that locks in more than a decade of production work.

Global aircraft backlog & Indian orders

| Airline / Market | Pending aircraft orders | Backlog in production years* |

|---|---|---|

| Airbus (Aug 2025) | 8,716 | ~10.6 years |

| Boeing (Aug 2025) | 6,531 | ~11.5 years |

| Combined backlog | 15,247 | ~10–12 years |

| Orders placed by Indian airlines (2023–25) | ~1,359 | — |

Sources: Flightplan, Reuters, Times of India

So the problem isn’t just how long the queue is, it’s that clearing it is harder than ever. And this is where India comes in. India won’t magically shrink a 15,000-plane line overnight, but it can help OEMs build faster, cheaper, and more reliably.

India’s aerospace rise

Airbus now sources over $1.4 billion worth of parts annually from 100+ Indian suppliers. India’s aerospace exports jumped 224% YoY in Apr–Jan 2024–25, with the UAE, US, France, and Saudi Arabia as top buyers. This isn’t just about small parts anymore, fuselages, wing beams, and cabin doors are already leaving Indian factories for global assembly lines.

Why OEMs are betting on India

Global OEMs already know they can’t put all their eggs in one basket, the pandemic and China’s risks proved that. The real question now is: who steps in as the alternative? India who has three big things going for it:

-

Skilled talent:- India produces thousands of aerospace engineers and technicians each year.

-

Policy push:- Make in India incentives, tax reforms, and 100% FDI in aerospace manufacturing have made it easier for global players to set up partnerships.

-

Domestic scale:- India’s aviation market is growing so quickly that the country is on track to become the world’s third-largest aviation market in the next decade, and OEMs want to be close to this demand centre.

So what does this bet look like in practice? Here’s what the world’s biggest aerospace giants are already doing in India.

| OEM | What’s happening in India | Output / Delivery |

|---|---|---|

| Airbus | 100+ suppliers including Tata, Dynamatic, Mahindra, Aequs | Sources $1.4B annually; target $2B by 2030 |

| Boeing | Partnerships with Tata Advanced Systems, Dynamatic | Estimated ~$1B annually in sourcing (not officially disclosed) |

| Lockheed Martin | JV with Tata Advanced Systems (TLMAL) | 200+ empennages for C-130J Super Hercules delivered by Aug 2023 |

| GE Aerospace | Works with Tata, HAL, Godrej; expanding Pune & Bengaluru centres | Supplies F404 engines for Tejas; 113 engines contracted in 2025; co-producing F414 from 2027 |

| Safran | Multiple facilities in Hyderabad, Bengaluru, Goa, Chennai | Produces parts for CFM LEAP engines; new LEAP MRO hub operational in 2025 |

Sources: Airbus, Boeing, Lockheed, GE, Safran press releases & financial updates

What these numbers show is that India isn’t a fringe sourcing hub anymore. Airbus and Boeing alone funnel over $2 billion worth of orders into the country each year, while Lockheed, GE, and Safran have made India integral to their global programmes. This isn’t future talk, the 200th C-130 empennage and new engine contracts are proof of real deliveries happening now.

And it’s not just sourcing smaller assemblies. India is now moving up the ladder into the toughest part of the aircraft itself, the aerostructures.

Aerostructures: - Building the body of the plane

When you look at an airplane, the wings, tail, and fuselage (the main body) are called the aerostructures. They are like the skeleton of the plane, strong, light, and super-precise. For a long time, most of this work happened in the US or Europe. But now, global aerospace giants are slowly giving more of this work to India.

How big is the market?

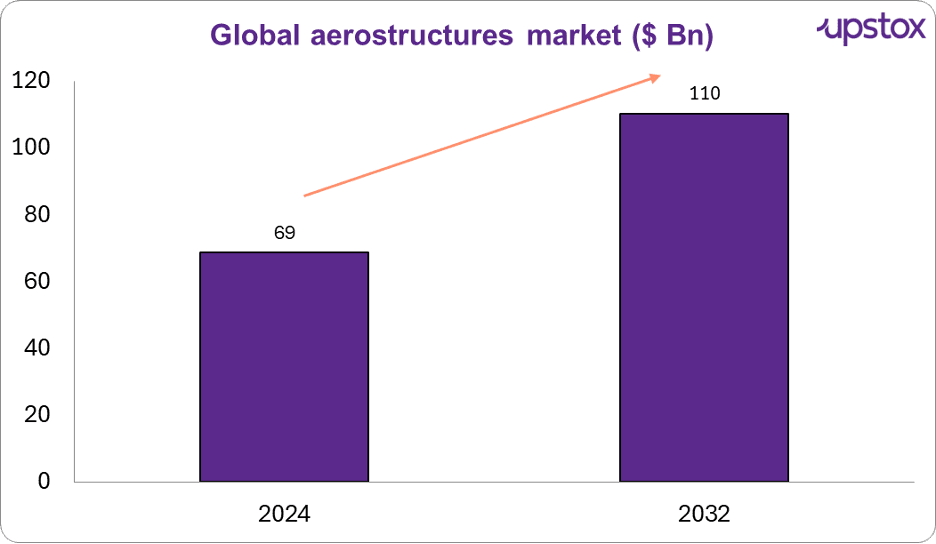

Sources: Markets & Data

By 2032, the aerostructures market will be worth $110 billion, nearly double India’s entire pharma industry today. That’s the scale of the opportunity India is plugging into.

What’s driving the shift

Regional expansion

Asia-Pacific is set to become the largest aviation market, with India on track to be the third-largest by 2042. This surge makes India an obvious part of the global supply chain story.

Material and manufacturing innovations

The aerospace composites market is set to nearly double from $29 Bn to $55 Bn in the next decade. Lighter, stronger materials like carbon-fiber are now a must-have to cut fuel costs. India is already stepping in, from carbon-fiber panels to 3D-printed metal parts, making it an attractive China+1 partner for OEMs

Fleet modernisation

Narrow-body aircraft like the Airbus A320neo and Boeing 737 MAX already make up over 60% of the global fleet. These are exactly the programs where Indian firms are active for example Tata builds fuselage sections and Dynamatic makes wing parts. As airlines keep replacing older jets, India’s role in the narrow-body supply chain only gets stronger.

What India is already doing

India’s suppliers aren’t dabbling anymore, they’re delivering major assemblies and parts that go straight into global aircraft programmes:

| Company | What they supply | Global programme link | Output / Scale |

|---|---|---|---|

| Tata Advanced Systems | Fuselage sections, empennages, cabins | Airbus C-295, Boeing Apache, Sikorsky S-92, Lockheed C-130J | Delivered 200+ C-130J empennages; running C-295 fuselage line |

| Dynamatic Technologies | Flap track beams, fuselage assemblies | Airbus A320, A220, Boeing 737 | Aerospace segment revenue ₹1,509M (~$18M) Q3 FY25; major assemblies in serial production |

| Aequs Aerospace | Precision machining, large assemblies | Airbus A320, Boeing 737/787 | FY2024 revenue ₹965 crore (~$116M); 1.7M machining hours annually |

| Mahindra Aerostructures | Helicopter fuselages, sub-assemblies | Airbus H125, Embraer, Airbus (via Aernnova) | Secured $300M+ contract in 2025; now supplying H125 fuselages |

| HAL | Full aircraft + components | Tejas, Sukhoi, Dornier 228, Airbus C-295 (with Tata) | Scheduled 12 Tejas deliveries in 2025; scaling to 24 per year |

Sources: Company reports, press releases, industry news

For Indian firms, this is the graduation moment. Instead of just small brackets and fasteners, companies like Tata, Dynamatic, and Aequs are delivering fuselages, wing beams, and sub-assemblies that bolt directly into Airbus and Boeing jets.

HAL, meanwhile, is scaling Tejas production and engine partnerships with GE, cementing India’s move up the value chain.

Why this is tricky work

Making aerostructures isn’t like making car parts. Aircraft components must be ultra-light, ultra-strong, and built to microscopic precision. Even a small flaw can ground an aircraft.

That’s why OEMs take years to certify suppliers. Scaling from small parts to full fuselages takes huge investments, clean rooms, composites, skilled labour, and patient capital.

India is on the map, but climbing further up the value chain will take sustained effort and deeper partnerships with global OEMs.

Parting thought

India’s aerospace story is no longer just about screws and brackets, it’s about fuselages, composites, and billion-dollar exports. Thanks to China+1, we’re at the boarding gate. The question is: can India turn this boarding pass into a seat at the head table of global aviation?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story