Market News

Weekly wrap: NIFTY, SENSEX end 8-week gaining streak after breaching record highs

.png)

4 min read | Updated on August 02, 2024, 21:26 IST

SUMMARY

With the major trigger of the US Fed meeting over, stock markets may continue to see consolidation due to overvaluation concerns in the next week. Weak Q1 results and ongoing global market consolidation may also influence Indian markets.

- SENSEX breached the 82,000 level for the first time and hit a lifetime high of 82129.49 on Thursday, NIFTY scaled the 25,000 mark.

- On a weekly basis, NIFTY declined 117 points, marking its first decline in the past nine weeks.

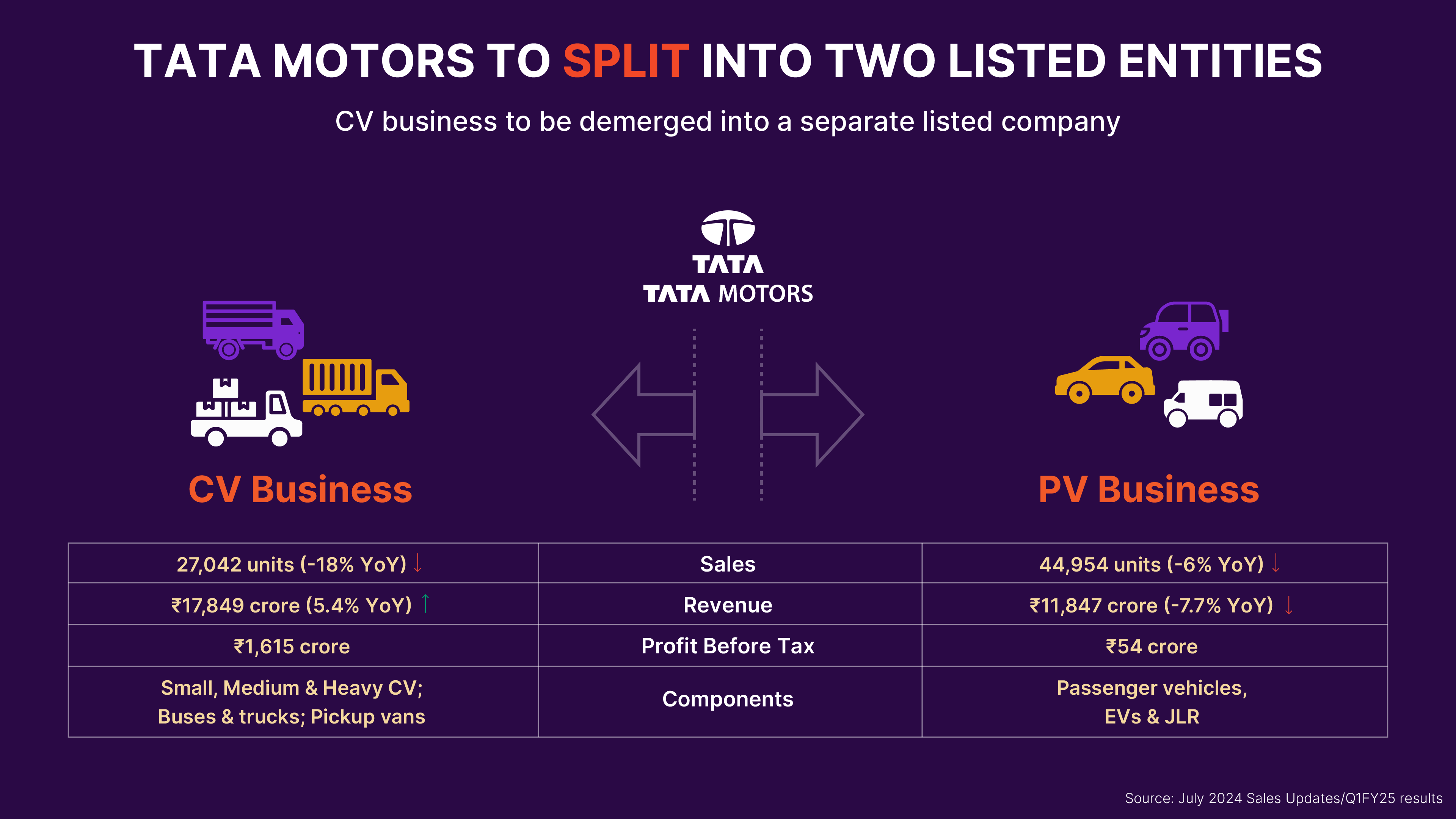

- Tata Motors Board approved the demerger of its commercial vehicles business.

- Zomato shares hit record high on multi-fold jump in Q1 net profit.

It’s that time of the week again! From key indices breaching record-high levels to stock markets witnessing a crash on the last trading day, here’s another quick recap of all the actions on Dalal Street this week.

Stock markets traded at all-time highs this week, with NIFTY scaling the 25,000 level for the first time and SENSEX breaching the 82,000 mark.

US Federal Reserve Chair Jerome Powell indicated a rate cut by September after the FOMC meeting, which helped boost investor sentiment. The US Fed kept the policy rates unchanged, but Powell’s comments on rate cuts curtailed US bond yields and the US dollar, making riskier assets appealing.

Key indices gained in most sessions this week despite facing profit booking and overvaluation concerns. Flaring tensions in West Asia following the death of Hamas chief in a blast in Tehran also weighed on stock markets.

Stock markets opened on a firm note on Monday. SENSEX and NIFTY traded at lifetime highs before settling almost flat due to profit-taking. Volatility ruled the markets on Tuesday as well, with NIFTY and SENSEX trading in a range before settling higher. NIFTY closed above the 24,850 level on Tuesday as the US Fed began its two-day meeting on policy action.

Positive global trends and sector rotation backed stock markets on Wednesday, with NIFTY nearing the 25,000 level. NIFTY closed above 24,900, and SENSEX was at 81,741 as media, metal, and pharma shares advanced. Banks, however, fell due to profit-taking.

Stock markets scaled historic high levels on Thursday on buying in banks, power and metal shares. Growing expectations of a lower interest rate cycle from the US Fed and the Reserve Bank of India boosted shares. SENSEX breached the 82,000 level for the first time and hit a lifetime high of 82129.49. NIFTY also scaled the 25,000 level for the first time and hit an all-time high of 25,078.3 on Thursday.

Stock markets experienced some correction on Friday, with the SENSEX declining by 885.6, or 1.08%, to 80,981.95. The NIFTY shed 293.20, or 1.17%, to settle at 24,717.70 due to profit taking in auto steel, oil, and select banking shares.

Weak manufacturing and job data brought back fears of recession in the US, which hit the world markets, including India.

On a weekly basis, NIFTY declined 117 points, marking its first decline in the past nine weeks. SENSEX also lost 350 points. The key indices were on the rise in the last eight weeks.

NIFTY Realty, IT, FMCG among major sectoral losers

NIFTY realty (-4%) was the biggest loser among NIFTY sectoral indices this week. NIFTY IT dropped 3% while FMCG and Auto declined by 2% each this week amid profit booking and rotational buying by investors.

Tata Motors Board approves demerger scheme

Tata Motors Board has approved the demerger scheme, allowing the company to split into two separate listed entities.

Tata Motors Limited (TML) will demerge its commercial vehicle undertaking involving the commercial vehicle business and all its related investments into TML Commercial Vehicles Limited (TMLCV). The existing passenger vehicle business in Tata Motors Passenger Vehicles Limited (TMPV) merged into TML. Tata Motors shares dropped 2.77% in the last five sessions.

Zomato shares rise after robust Q1 results

Food aggregator Zomato Ltd shares jumped more than 12% on Friday after the company reported a multi-fold jump in net profit and a 74% rise in revenue for the June quarter. Shares hit a 52-week high of ₹278.7 on Friday.

What lies ahead?

With the major trigger of the US Fed meeting over, stock markets may continue to see consolidation due to overvaluation concerns in the next week. Weak Q1 results and ongoing global market consolidation may also influence Indian markets. Investors will keep a watch on the RBI policy meeting next week and the outlook on interest rates.

About The Author

Next Story