Market News

Week ahead: US Fed meeting, global cues and FII activity among key market triggers to watch out

.png)

6 min read | Updated on December 15, 2024, 09:19 IST

SUMMARY

For the NIFTY50 index's December 19 expiry, options data revealed a significant call open interest at the 25,000 strike and a substantial put base at the 24,500 strike. These levels are likely to act as immediate resistance and support, respectively. A breakout above 25,000 or a breakdown below 24,500 could offer clearer directional cues for the index.

SENSEX extended its winning momentum for the fourth week, rebounding after taking support from its 20-week exponential moving average..

Markets extended their winning streak for the fourth consecutive week, buoyed by a sharp rebound in the indices on Friday. The week appeared poised for a negative close until a late-week recovery driven by foreign fund inflows, resulting in a positive finish. The NIFTY50 gained 0.3% to close at 24,768, while the SENSEX advanced 0.5%, ending at 82,133.

On a sectoral level, IT (+2.8%) and Consumer Durables (+1.7%) were the top performers, while PSU Bank (-1.8%) and Energy (-1.7%) registered the steepest declines among major indices. The broader markets showed mixed trends. The NIFTY Midcap100 index extended its winning streak to four weeks, rising 0.4%. Conversely, the NIFTY Smallcap100 index closed the week with a 0.4% decline.

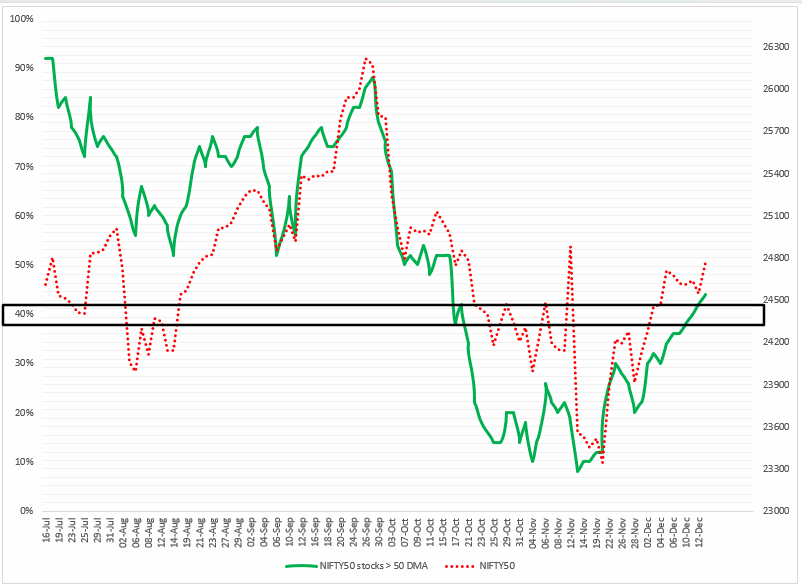

Index breadth

The breadth of the NIFTY50 index showed improvement last week, with an average of 40% of its stocks trading above their 50-day moving average (DMA). The week began with 36% of NIFTY50 stocks trading above their 50 DMA, but this gradually rose to 40%—a level last seen two months ago—indicating positive momentum for the index. As of December 13, the index breadth remained strong, with 44% of NIFTY50 stocks trading above their 50 DMA.

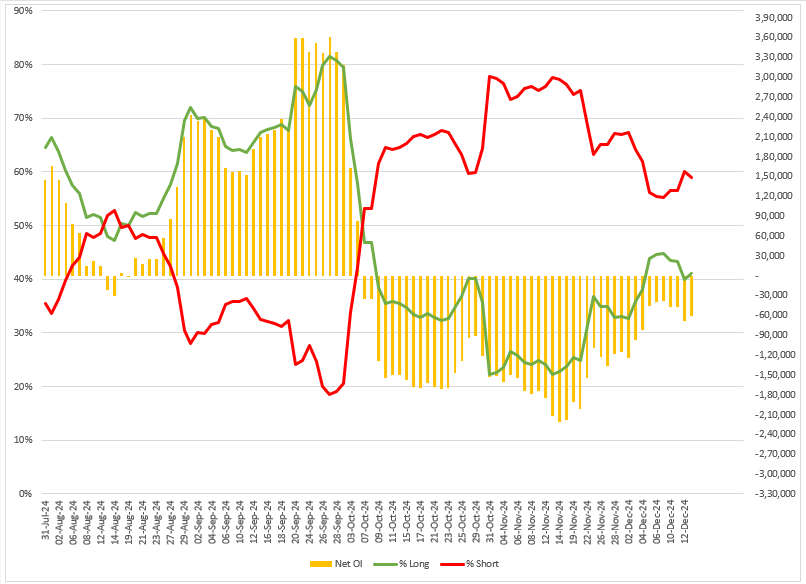

FIIs positioning in the index

Foreign Institutional Investor (FII) activity in index futures remained subdued last week. FIIs maintained a neutral stance in their long-to-short ratio while gradually reducing their long positions in index futures. At the start of the week, the long-to-short ratio stood at 45:55. This ratio remained steady during the week, closing at 41:59 with a net open interest of over -60,000 contracts.

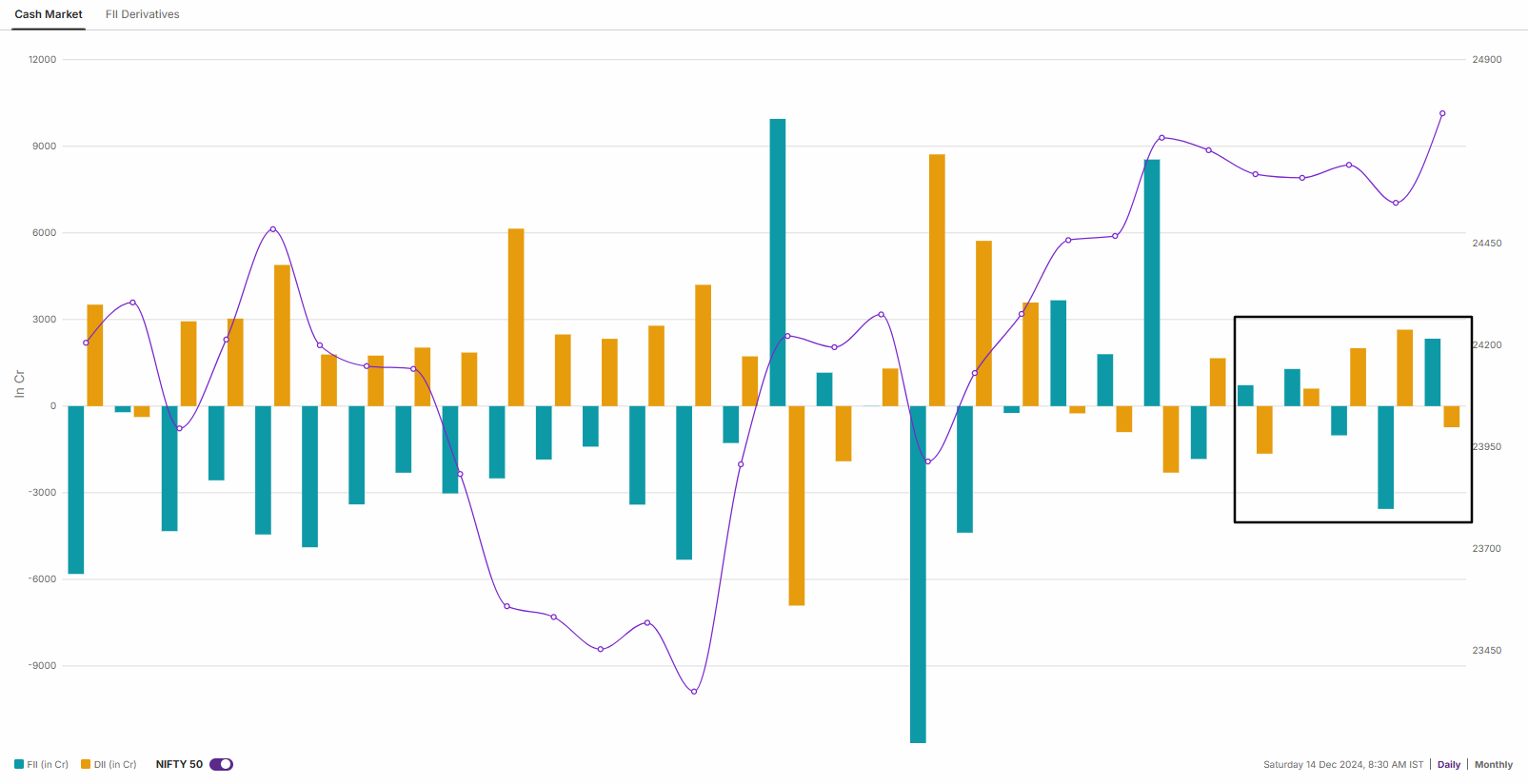

Meanwhile, the subdued activity of FIIs was also reflected in their cash market activity. The FIIs turned net sellers last week and offloaded shares worth ₹226 crore. On the flip side, the Domestic Institutional Investors (DIIs) remained net buyers and purchased shares worth ₹2,880 crore last week.

NIFTY50 outlook

The NIFTY50 index traded within a narrow range of nearly 200 points until the weekly expiry of its options contracts on December 12, consolidating within the previous week’s range. However, on December 13, the index turned volatile, expanding its trading range by 2.5%, well above its average. A similar pattern of price action and range expansion was observed on December 5, followed by four sessions of range-bound movement.

From a technical perspective, the index closed positively on the weekly chart but formed an inside candle. For directional traders, the 24,857 level—marked as the high of the weekly candle—is a key level to watch. A daily close above this level could signal a continuation of Friday’s upward momentum. Conversely, if the index slips below the 24,500 zone, it may revert to a range-bound trend, with immediate support around the 24,300 level.

SENSEX outlook

The SENSEX also extended its winning momentum for the fourth week and staged a rebound after taking support from its 20-week exponential moving average. It ended the week positively near the immediate resistance of the 82,300 zone, coinciding with the high of the previous week’s candle.

If the index reclaims the immediate resistance of 82,300 on a closing basis on the daily chart, then it may extend its positive momentum up to the 83,700 zone. However, if it slips below the 81,000 mark, the trend may turn sideways, with crucial support around the 80,300 zone.

The Federal Open Market Committee (FOMC) will wrap up its two-day meeting on Wednesday, with markets anticipating a quarter-point cut to the federal funds rate. The move would leave the Fed’s benchmark rate in a range of 4.25%-4.5%, a full percentage point drop from the peak in early September.

On Thursday, the Bank of England and Japan will also announce their monetary policy decisions. Meanwhile, the key companies reporting earnings are Accenture, FedEx, Nike and Micron Technology.

For the upcoming week, traders can monitor the range of 25,200 and 24,500. Unless the index breaks this range on a closing basis, the trend may remain range-bound. However, a break of this range may provide directional clues.

For intraday range updates and any revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story