Market News

Week ahead: U.S. Jobs Data, Auto Sales, and Reliance Board Meeting in focus

.png)

7 min read | Updated on September 02, 2024, 09:12 IST

SUMMARY

Markets will be reacting to Q1 GDP and automobiles sales figures on Monday. The GDP figures contracted to 6.7% in Q1 of FY25 and were in line with street estimates.

Stock list

The breadth of the NIFTY50 remained positive last week, with almost 70% of the NIFTY50 stocks trading above their 50-day moving average (DMA).

Markets extended the winning momentum for the third consecutive week and reclaimed its all-time high after a gap of a month. The NIFTY50 index zoomed past the 25,000 mark and ended the August series above the psychologically crucial mark, ending the series in green.

The rally was led by positive global cues on expectations of a September interest rate cut by the U.S. Federal Reserve. The biggest impact of the expectation was seen in the IT index which gained over 4% this week along with the Realty and Pharma indices which gained over 3% each. FMCG and PSU Banks remained subdued, falling in the range of 0.4% to 0.5% respectively.

The broader markets also extended the winning momentum for the third week in a row and hit fresh record highs. The NIFTY Mid cap 100 index rose 1.2% and the Small cap 100 index jumped 1.1%.

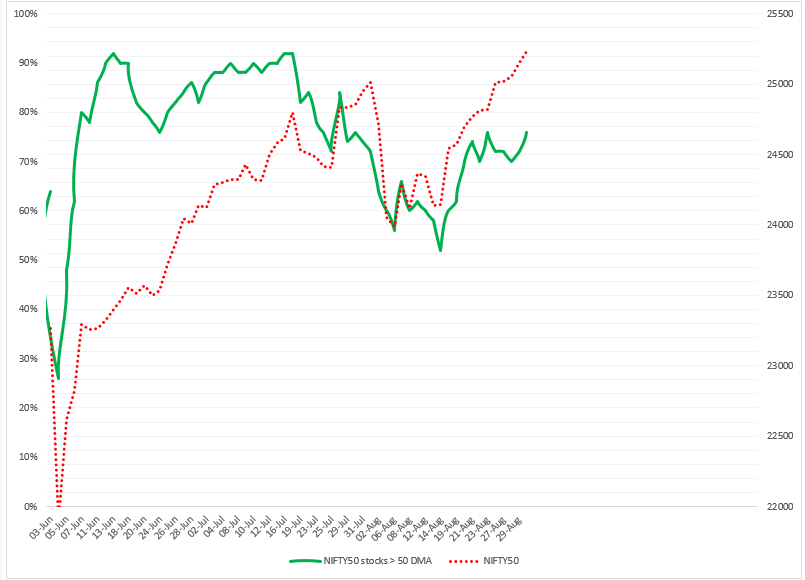

Index breadth- NIFTY50

The breadth of the NIFTY50 remained positive last week, with almost 70% of the NIFTY50 stocks trading above their 50-day moving average (DMA). As of 30 August, over 75% of the NIFTY50 stocks are trading above their 50 DMA, indicating a continuation and strong momentum in the trend.

As you can see in the chart below, a sustained reading above 70% of the breadth indicator shows momentum in the trend, while an oscillation between 70% and 50% indicates range-bound movement in the index.

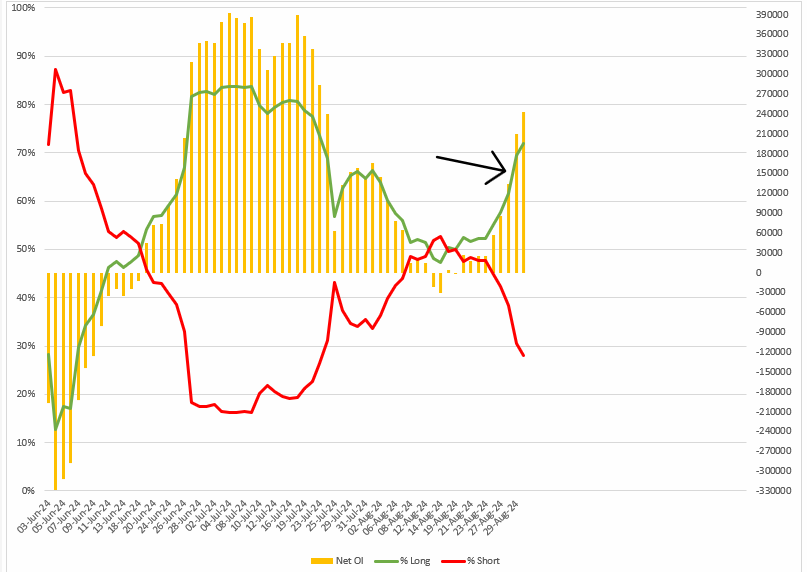

FIIs positioning in the index

After the rollovers in the August series, Foreign Institutional Investors (FIIs) started the September series on a bullish note, establishing a long-to-short ratio of 72:28 in index futures. The initial build indicates a positive stance from FIIs with net open interest (yellow bars) reaching above average levels.

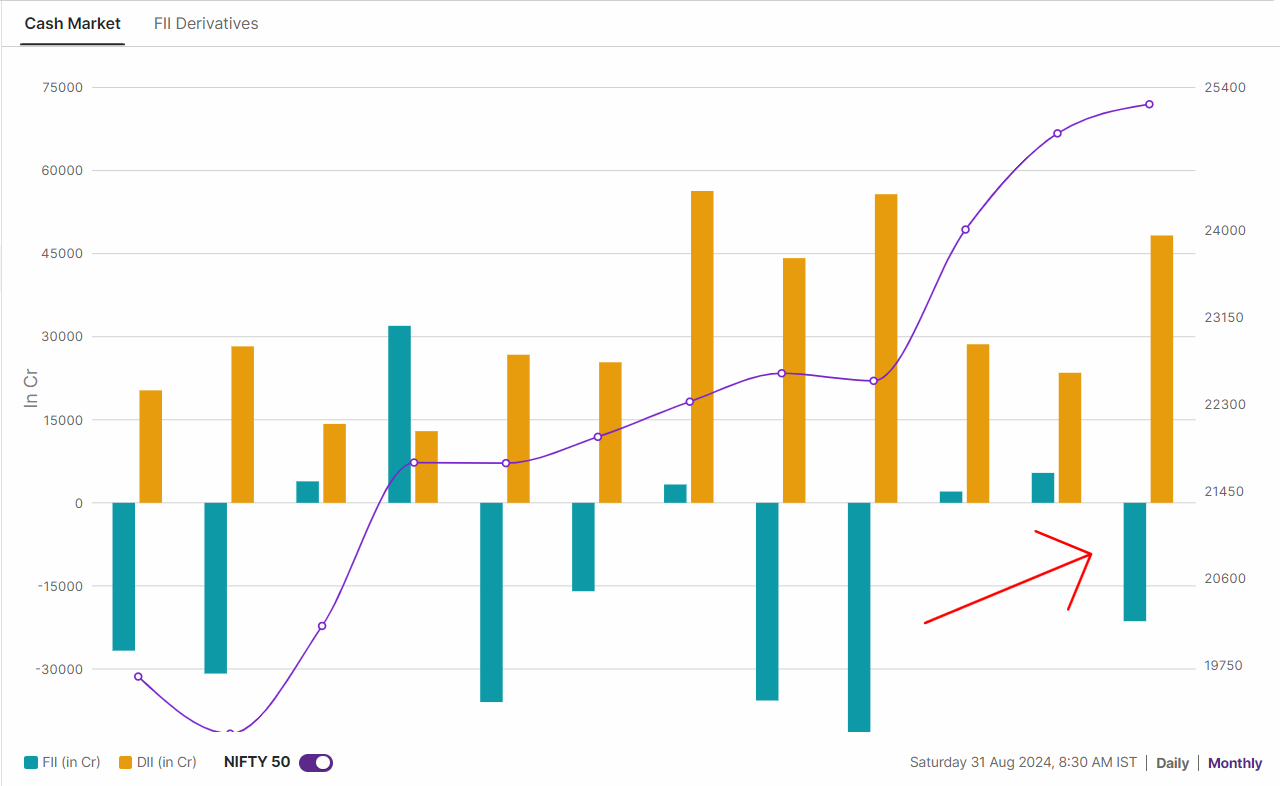

Meanwhile, the cash market activity of Foreign Institutional Investors (FIIs) remained negative during August 2024 as they sold shares worth ₹21,368 crore. Conversely, the Domestic Institutional Investors remained net buyers for the 13th consecutive week, buying shares worth ₹48,278 crore, taking the net institutional inflow to ₹26,910 crore.

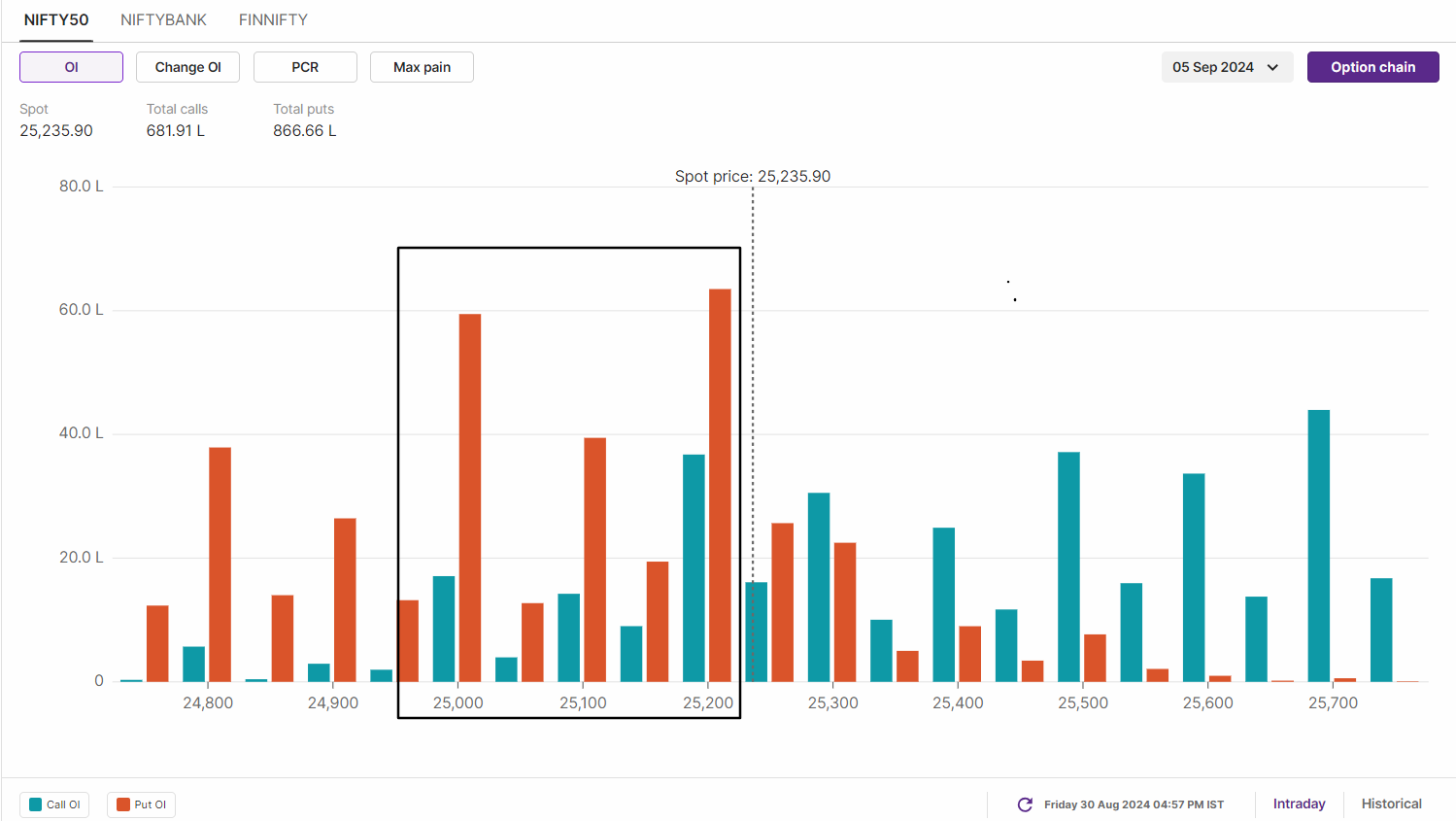

F&O - NIFTY50 outlook

The open interest data for the 5 September expiry shows support build-up at key levels. The 25,000 and 25,200 strike holds highest put base, indicating support for the index around these levels. Conversely, the volume on call options was significantly lower with maximum open interest at 26,000, making it as psychological resistance.

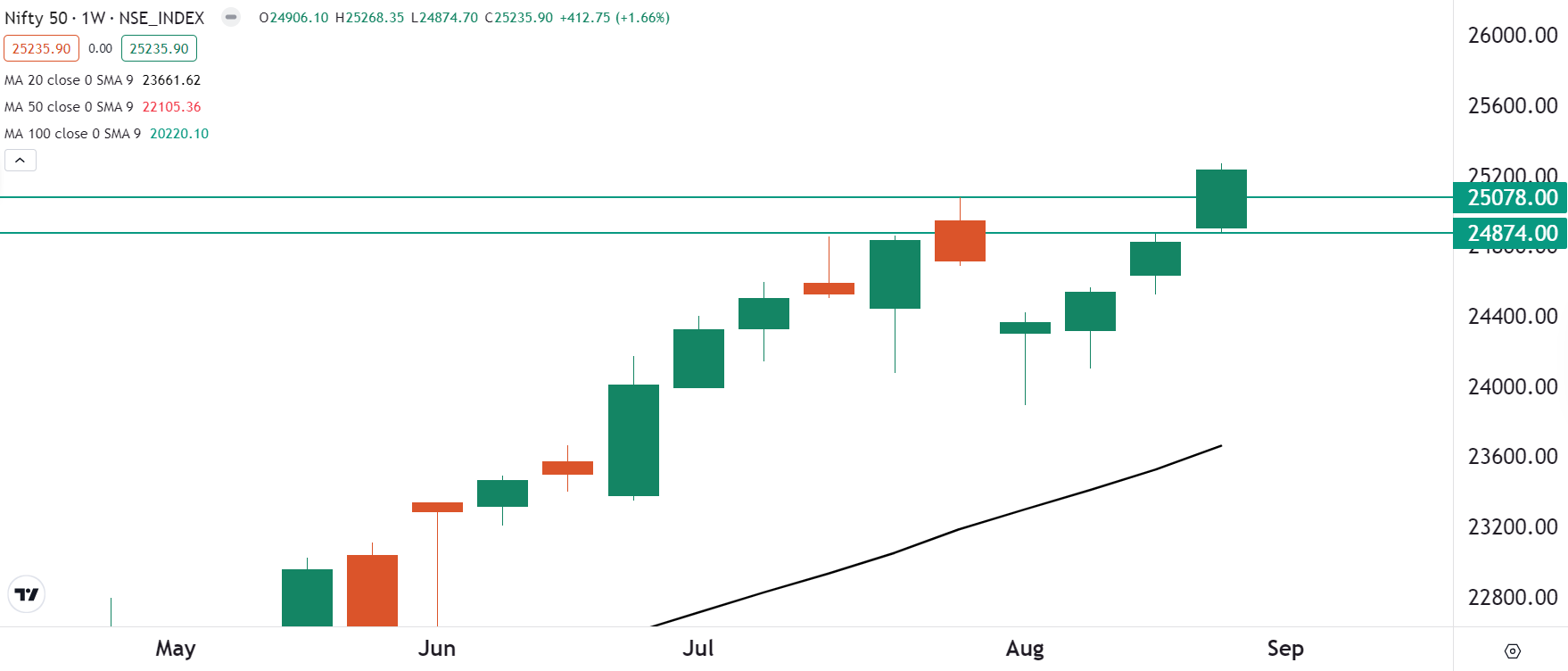

The technical structure of the NIFTY50 is in line with the build-up of weekly open interest. The index closed above the previous week's high, indicating strong momentum. In the coming sessions, immediate support for the NIFTY50 will come from the 25,100 level, which is in line with its previous all-time high zone. In addition, the 24,800 level will act as a strong support for the index. Until the index breaches the 24,800 level, the trend may remain positive.

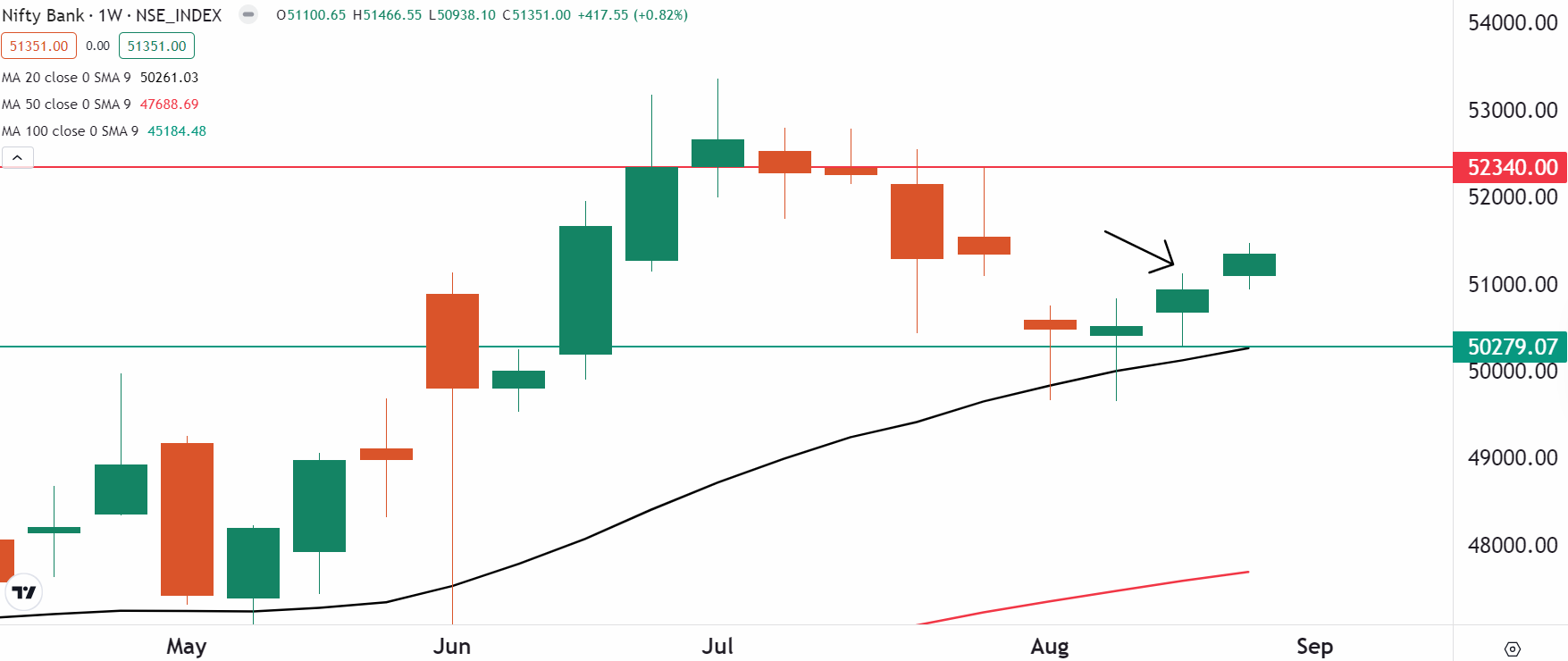

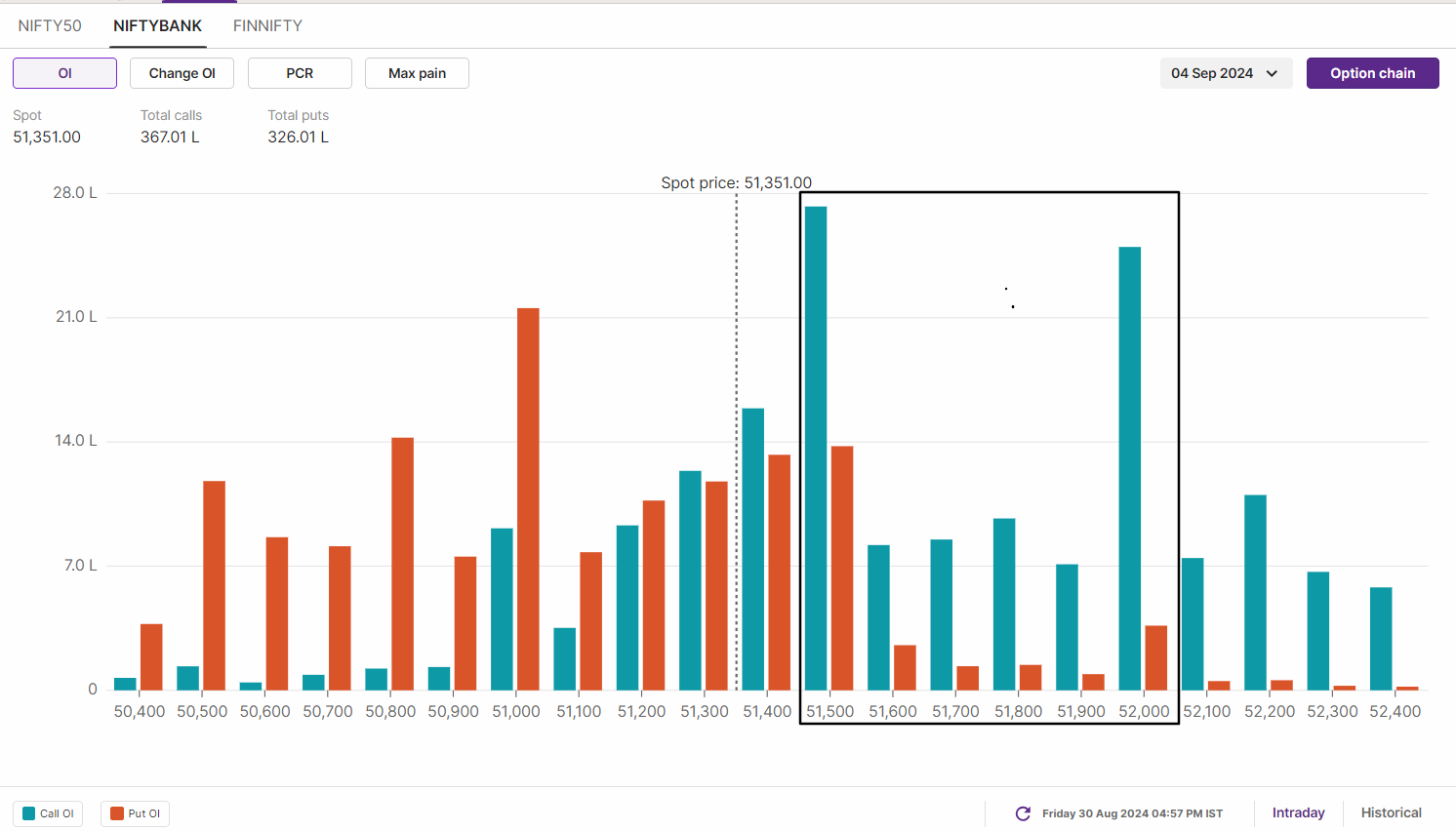

F&O - BANK NIFTY outlook

The positioning of open interest in the BANK NIFTY in the run-up to the expiry on 4 September remains in contrast to that of the NIFTY50. The index has highest call open interest at 51,500 and 52,000 strike, making it crucial resistance zones for the index. On the other hand, the put base was visible at 51,000 and 50,000 strike, indicating support for the index around these levels.

Meanwhile, the technical structure of the BANK NIFTY presents a contrasting set-up. The index extended the winning streak for the second week in a row and managed a close above previous week’s high. However, it still faces selling pressure from the 51,500 zone. In the coming sessions, traders can monitor the 51,500 and 51,000 zones. A close above or below these levels on daily chart will provide directional clues.

🗓️Key events in focus: On the global front, investors and traders will closely watch the jobs report data which will be released on 6 September. Experts are anticpating the number of new jobs added in August (known as nonfarm payrolls) will be around 1,55,000, which would be an improvement from the 1,14,000 jobs added in July. Additionally, the unemployment rate, which measures the percentage of people actively looking for work, is expected to decrease slightly from 4.3% to 4.2%.

🛢️Oil: Oil prices remained under pressure as investors anticipated increased supply from the Organisation of the Petroleum Exporting Countries and its allies OPEC+ from October. The Brent Crude ended the week at $76 a barrel, down 2.2%, while the U.S. West Texas Intermediate Crude closed at $74 a barreled, down 3%.

⚡Mark your calendars: U.S markets will remain closed on 2 September in observance of Labour Day.

📊Stocks in focus: Based on the price and open interest on 30 August, AU Small Finance Bank, Balrampur Chini Mills, Bandhan Bank, Persistent Systems, Lupin and Glenmark Pharmaceuticals saw long build-up. Similarly, to track the OI and price losers, log in to Upstox ➡️F&O➡️Futures smart list ➡️OI gainers/losers/most active.

📓✏️Takeaway: In last week's blog, we advised our readers that the NIFTY50 index could continue its bullish momentum following the confirmation of the bullish hammer on the week ending 13 August. The index remained in an uptrend throughout the week and reclaimed its previous all-time high (25,078) on a closing basis.

Looking ahead to coming week, the outlook of NIFTY50 remains bullish with immediate support at 24,800. As long as the index remains above this level, the bulls may try to re-enter on any dips. However, a close below this area on the daily chart could signal short-term weakness.

Experts believe that the index has seen a broad-based recovery, driven by strength in the technology and pharmaceutical sectors, which have maintained positive momentum. However, the sustainability of the momentum will depend on the active participation of the banking sector.

To stay updated on any changes in these levels and all intraday developments, be sure to check out our daily morning trade setup blog, available before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story