Market News

Week ahead: India-US trade talks, H-1B visa changes, US economy data among key market triggers to watch out

.png)

6 min read | Updated on September 21, 2025, 13:12 IST

SUMMARY

This week, ongoing US-India trade talks and the impact of the Trump administration's overhaul of the H-1B visa system remain central to investor interest. Investors will also be closely monitoring the performance of PSU bank stocks, given their recent strength. The activity of Foreign Institutional Investors (FIIs) will continue to influence market flows and contribute to next week's volatility and directional cues.

Stock list

NIFTY PSU Bank index gained strong momentum last week, surging by almost 4.8% | Image source: Shutterstock.

Indian markets had a mixed week, extending the winning streak for the third week in a row. However, investors became more cautious ahead of the weekend, resulting in profit-booking. Nevertheless, positive factors such as progress in U.S.–India trade talks, a rate cut by the U.S. Federal Reserve and decline in the dollar index continued to bolster market confidence.

Meanwhile, the broader markets also extended the bullish momentum for the third week in a row. The NIFTY Midcap 150 index advanced 1.5%, while the Smallcap 250 index gained 2.1%, reflecting renewed investor confidence and broad-based buying interest.

In terms of sectors, PSU banks and Real Estate led the gains with robust advances of 4% each. Meanwhile, the Defence sector also performed strongly, rising by over 3%. In contrast, defensive sectors such as FMCG and Consumer Durables faced profit-taking pressures, falling slightly by 0.5% and 0.2% respectively, as investors took profits following recent rallies.

Market breadth

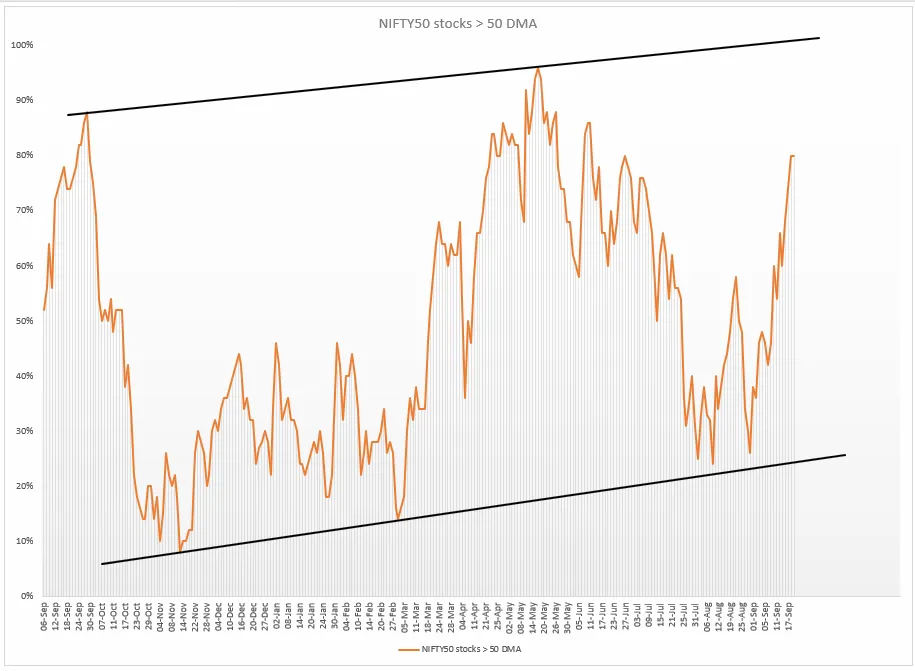

The NIFTY50 index continued to strengthen this week, with the percentage of stocks trading above their 50-day moving average rising to around 80%. This sharp improvement signals a robust continuation of the recovery from earlier oversold conditions, pushing the breadth into the upper range of its historical channel.

The strong upward movement signals that underlying sentiment remains positive, with more sectors participating in the rally. However, such elevated readings could also suggest the possibility of short-term exhaustion if momentum fails to increase further. It will be crucial to monitor sustained moves at these levels to confirm the durability of the market’s current advance.

FIIs positioning in the index

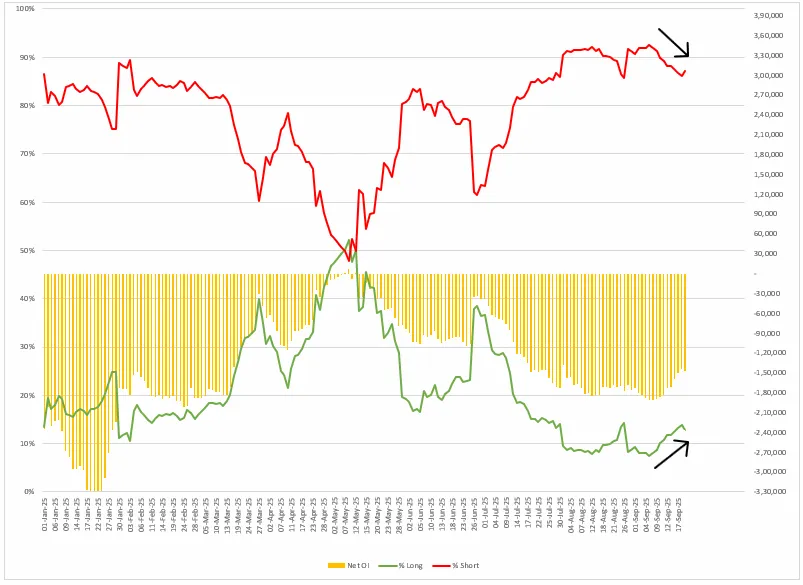

This week, Foreign Institutional investors (FIIs) predominantly remained bearish in index futures, but there were signs of incremental change in their positioning. The percentage of short positions has moderated slightly from last week’s peak, now hovering just below 87%, while long positions have edged up to around 13%.

FIIs' net open interest in index futures also dipped by 15% to -1.46 lakh contracts. This points to a gradual reduction in short future contracts. Overall, while FIIs still have a negative outlook, the reduction in net short exposure suggests a cautious rebalancing as market sentiment and domestic cues become more positive.

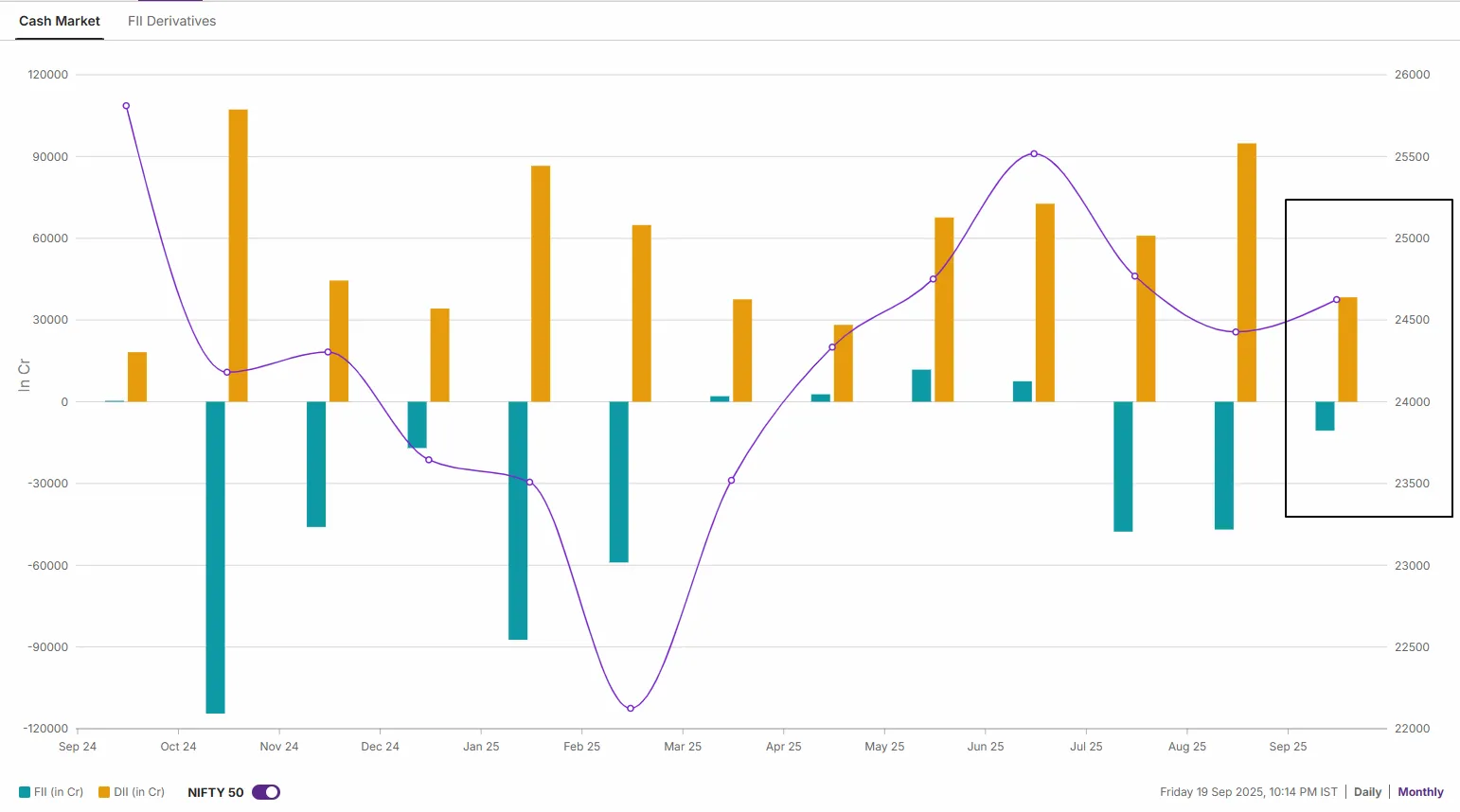

In September, Foreign Institutional Investors (FIIs) continued to sell shares in the cash market, offloading stocks worth ₹10,572 crore. In contrast, Domestic Institutional Investors (DIIs) were strong net buyers, purchasing shares worth ₹38,324 crore. Overall, the interplay between consistent DIIs purchases and ongoing FIIs sales has contributed to the market’s resilience.

NIFTY 50 index

The NIFTY50 index experienced profit-booking after rallying by over 4% in September, encountering resistance at the trendline connecting previous all-time highs. On 18 September, the index formed a hanging man candlestick pattern, which is a bearish reversal signal. This bearish outlook was confirmed when the index closed below the low of this reversal pattern, indicating emerging weakness and the potential for further downside in the near term.

For short-term clues, traders can monitor the immediate support zones of 25,150 and 21-day exponential moving average (EMA). Unless the index slips below these zones on a closing basis, it may sustain its bullish momentum. However, a close below this zone will signal weakness.

However, technical indicators such as the 21-day EMA continue to provide support. As long as NIFTY remains above this level, support-based buying is likely to persist. Conversely, the first sign of weakness would be if the index surrenders its 21-day EMA on a closing basis.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story