Market News

Trade Setup for Sept 25: BANK NIFTY halts eight-day rally, consolidates around 54,000 level

.png)

5 min read | Updated on September 25, 2024, 09:07 IST

SUMMARY

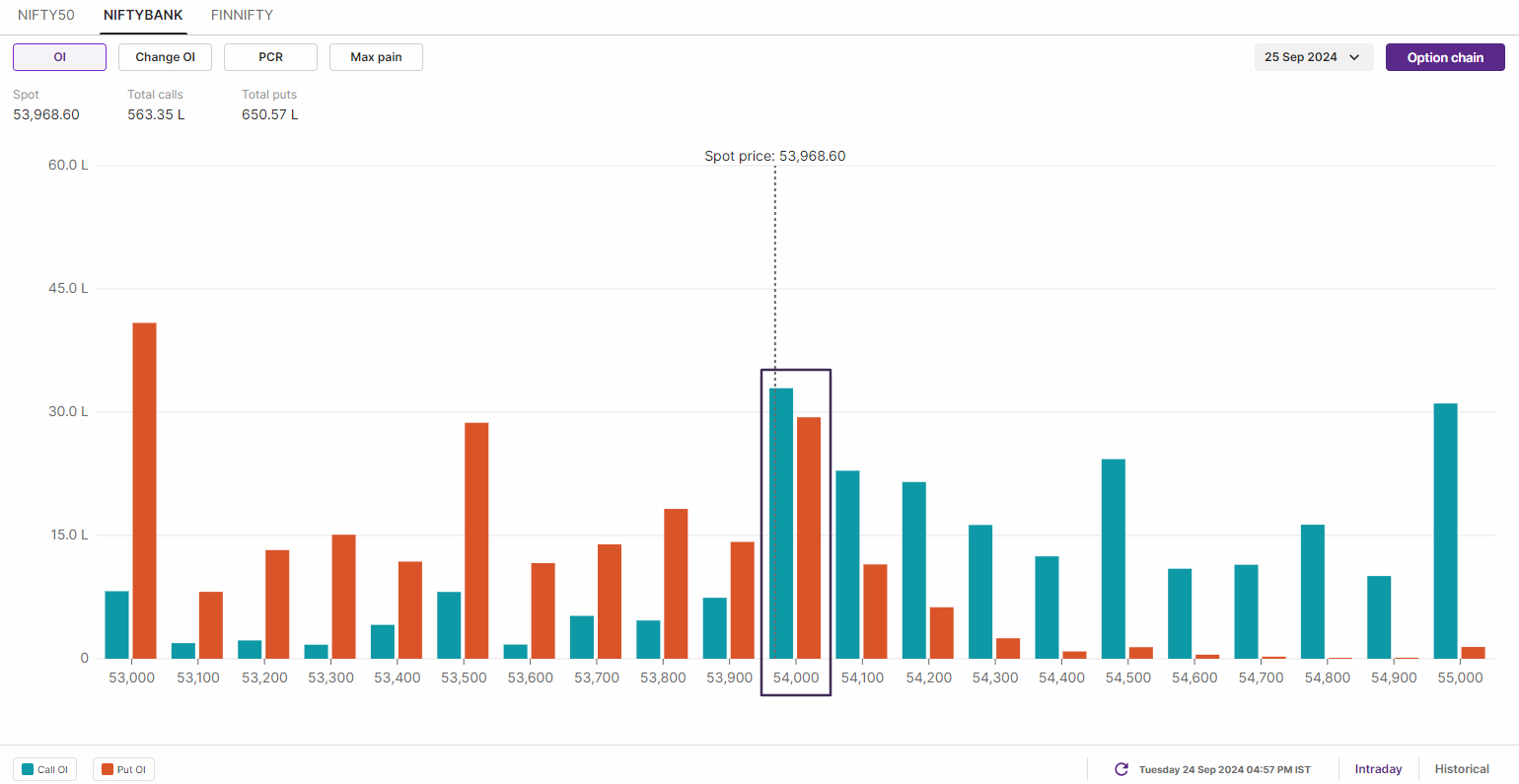

Options data for today's monthly expiry shows significant build-up in both call and put options at the 54,000 strike, indicating range-bound movement. However, traders should stay cautious of potential sharp swings and intraday volatility due to the expiry.

Stock list

BANK NIFTY is consolidating its gains around the 54,000 level, signaling a pause in momentum.

Asian markets update at 7 am

The GIFT NIFTY is down 0.2%, indicating a flat to negative start for the Indian equities today. Meanwhile, the other Asian indices are trading in the green. Japan’s Nikkei 225 is up 0.1%, while Hong Kong’s Hang Seng index is up 3%.

Chinese and Hong Kong markets extended their gains. This came after China's central bank announced a stimulus package, including a cut in short-term interest rates and lower interest rates on existing mortgages, in a bid to restore confidence in the country's troubled housing market and stimulate the economy.

U.S. market update

- Dow Jones: 42,208 (▲0.2%)

- S&P 500: 5,732 (▲0.2%)

- Nasdaq Composite: 18,074 (▲0.5%)

U.S. indices ended Tuesday's session in the green, with the Dow Jones and S&P 500 closing at record highs, led by gains in technology stocks, particularly chipmaker Nvidia. Meanwhile, markets shrugged off weak consumer confidence data, which showed the biggest one-month decline in three years, falling to 98.7 against expectations of 104.

NIFTY50

- September Futures: 25,994 (▲0.1%)

- Open Interest: 3,59,093 (▼21.2%)

The NIFTY50 index extended the winning streak for the fourth consecutive day and scaled to 26,000 mark. The index failed to sustain the psychologically crucial mark on a closing basis as the profit booking emerged at higher levels, resulting in a flat close.

The index formed a doji candlestick pattern on the daily chart, signalling indecision or pause at current levels. This neutral pattern suggests that investors are assessing the next directional move. A break above or below the high and low of the doji on a closing basis could indicate either a continuation of the current trend or a potential reversal.

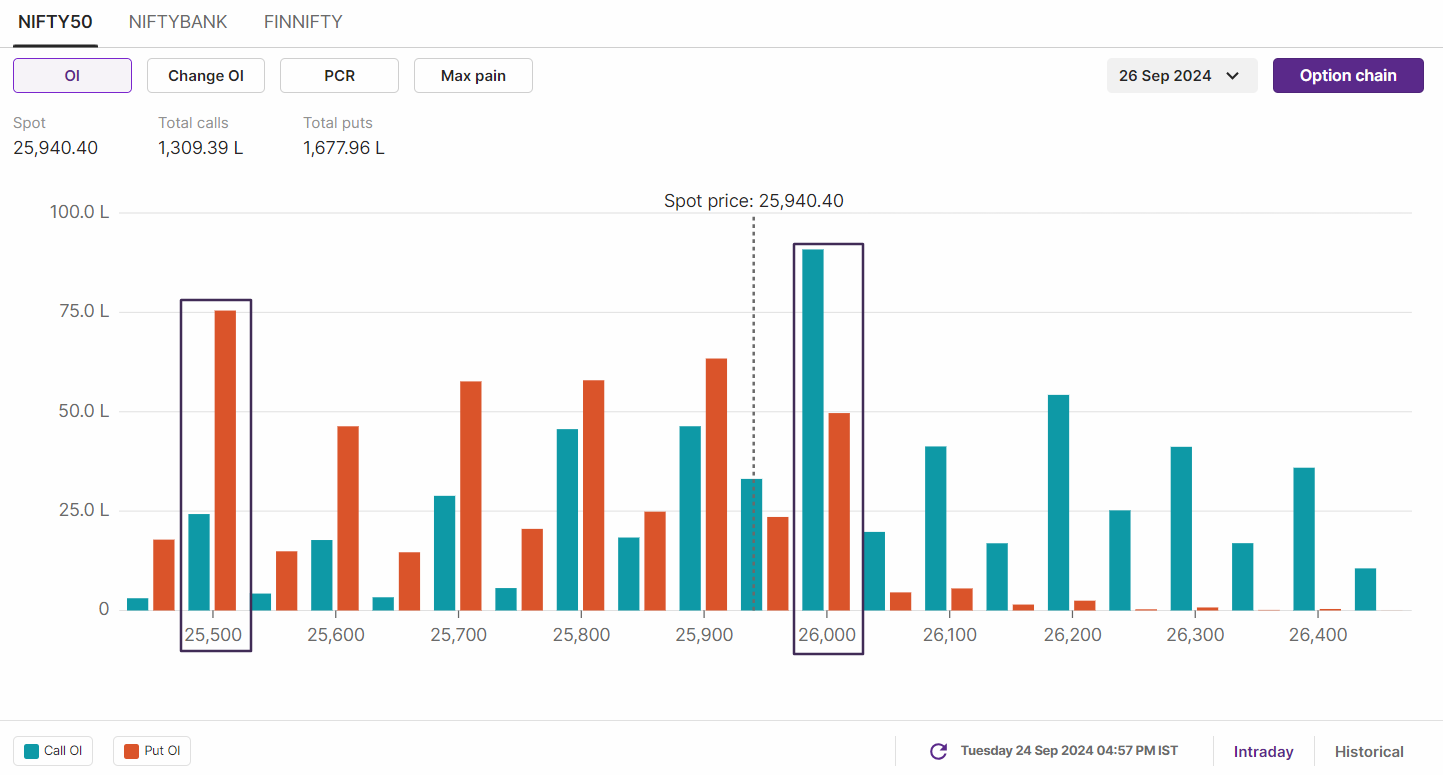

Meanwhile, the options data for 26 September expiry has the highest call base at 26,000 strike, hinting at resistance for NIFTY50 around this strike. Conversely, the put base was established at 25,500 and 25,900 strikes, hinting at support around these levels. However, it is important to note that ahead of the monthly expiry the index is confined within 100 points range between 25,900 and 26,000. A break of these strikes on an intraday basis can result in a sharp directional move.

BANK NIFTY

- September Futures: 54,026 (▼0.1%)

- Open Interest: 82,996 (▼15.8%)

The BANK NIFTY index snapped its eight day winning streak and ended Tuesday's session in red post the breakout of its all-time high. The index formed a small red candle on the daily chart, resembling doji and traded broadly within previous sessions range.

As shown in the chart below, after a strong one-way rally, BANK NIFTY is consolidating its gains around the 54,000 level, signaling a pause in momentum. Despite this consolidation, the broader trend remains bullish. If the index retraces towards its previous all-time high zone of 53,350, traders should closely observe the price action for potential reversal signals.

On the 15 minute chart, the BANK NIFTY has encountered resistance around the 54,200 level and is currently trading in a narrow range with immediate support in the 53,650 to 53,750 region. As long as the index remains within this range, the trend is likely to remain sideways. However, a breakout of this range, confirmed by a strong candle, could give traders a clear directional signal.

For today’s expiry, the open interest of BANK NIFTY is signalling a range-bound movement around 54,000 but with low volumes. Since it is the monthly expiry, traders should remain cautious of sharp intraday swings and volatility and act as per the price action.

FII-DII activity

Stock scanner

Long build-up: Tata Steel, Tata Power, Hindalco Industries, Vedanta, Hindustan Copper and Power Grid

Short build-up: Indian Energy Exchange, Page Industries and IndiaMART InterMESH

Under F&O ban: Aditya Birla Fashion and Retail, Granules India, Hindustan Copper, Vodafone-Idea and Indian Energy Exchange

Out of F&O ban: Aarti Industries, Biocon, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), LIC Housing Finance, National Aluminium, Oracle Financial Services Software, Punjab National Bank and Steel Authority of India

Added under F&O ban: Hindustan Copper and Indian Energy Exchange

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story