Market News

Trade Setup for Sept 10: Will BANK NIFTY confirm the bullish piercing pattern?

.png)

4 min read | Updated on September 10, 2024, 07:23 IST

SUMMARY

In a sharp rebound from the day’s low, BANK NIFTY recovered most of its Friday’s losses and reclaimed the 51,000 mark by the close. Traders should keep a close watch on today’s session, as a close above the bullish piercing pattern would confirm a bullish reversal, signalling potential further upside.

Stock list

As seen on the daily chart, following Friday’s sharp decline, NIFTY50 has attempted a recovery, maintaining its position above the 20 DMA.

Asian markets update at 7 am

The GIFT NIFTY is up 0.2%, indicating a flat-to-positive opening for the NIFTY50 today. Other Asian indices are also trading in the green, buoyed by a positive handover from the Wall Street. Japan’s Nikkei 225 has risen 0.8%, while Hong Kong’s Hang Seng index is up 0.3%.

U.S. market update

- Dow Jones: 40,829 (▲1.2%)

- S&P 500: 5,471 (▲1.1%)

- Nasdaq Composite: 16,884 (▲1.1%)

U.S. indices rebounded on Monday as focus shifted to inflation concerns, helping indices recover some losses from the August jobs report. Investors remain uncertain about the U.S. Fed's next move, debating a rate cut of 25 or 50 basis points ahead of this month’s policy meeting.

Attention now shifts to Wednesday's consumer inflation data for further rate clues. Meanwhile, Apple (AAPL) was in focus as the compnay unveiled its iPhone 16 and updates to its Apple Watch lineup at its annual event.

NIFTY50

- September Futures: 24,985 (▲0.3%)

- Open Interest: 5,48,571 (▼3.9%)

After a weak start, the NIFTY50 index rebounded from the day’s low, successfully holding its 20-day moving average (DMA) by the close. In a largely ange-bound session, the index found support at lower levels, buoyed by gains in FMCG and private banking stocks.

As seen on the daily chart, following Friday’s sharp decline, the index has attempted a recovery, maintaining its position above the 20 DMA. If the index sustains this momentum and closes above 25,100 mark, it could trigger a short-covering rally. However, if a reversal signal emerges near these levels, the index may extend its losses, shifting to a sideways to bearish trend.

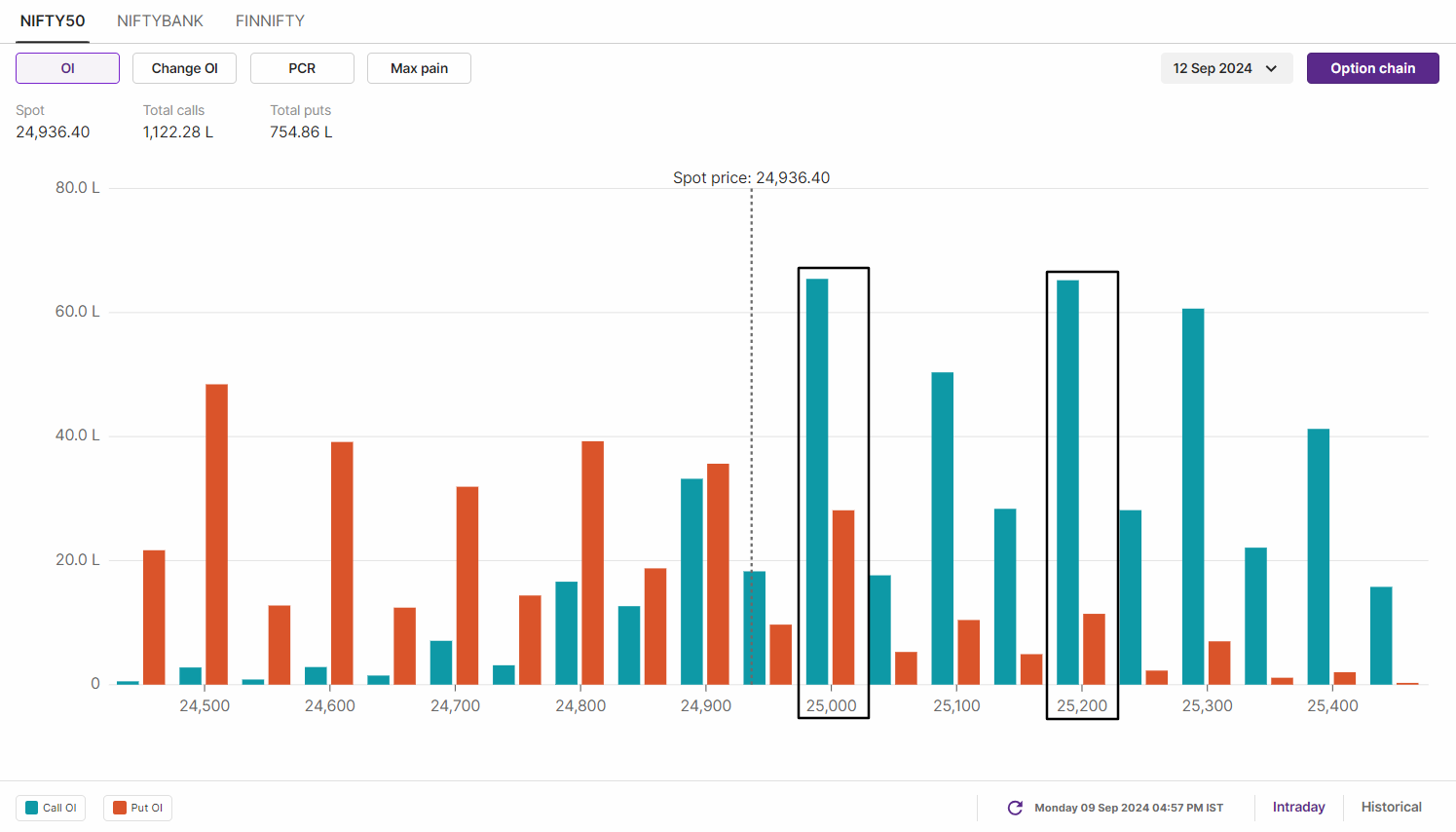

Meanwhile, open interest for the 12 September expiry was largely unchanged. The index has the highest call open interest at the 25,200 and 25,000 strikes, indicating resistance for the index around these levels. On the other hand, the significant put base was observed at 24,500 strikes, indicating support for the index around this level.

BANK NIFTY

- September Futures: 51,267 (▲1.0%)

- Open Interest: 1,57,408 (▼6.1%)

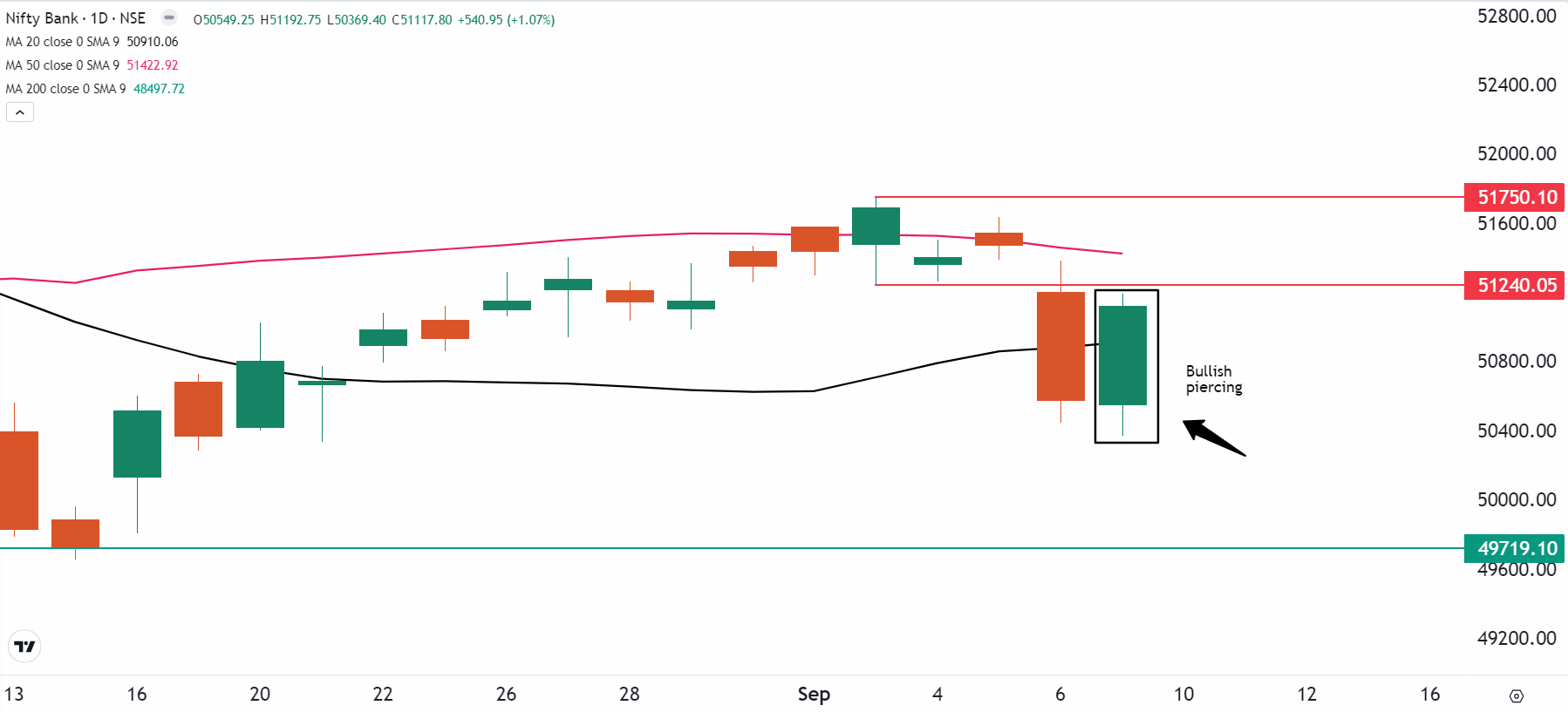

The BANK NIFTY index made a sharp u-turn from the day’s low, rebounding over 1.5%. It reclaimed the 51,000 level, along with its 20 day moving average. On the daily chart, the index formed a bullish piercing pattern, signaling emergence of fresh buyers from lower levels.

A bullish piercing is a two-candlestick pattern where the second candle opens lower but closes above the mid-point of the previous bearish candle, indicating a potential bullish reversal. If the index closes above Monday's reversal pattern, it will confirm the bullish signal. However, if the index slips below 51,500 level, it could signal renewed bearishness.

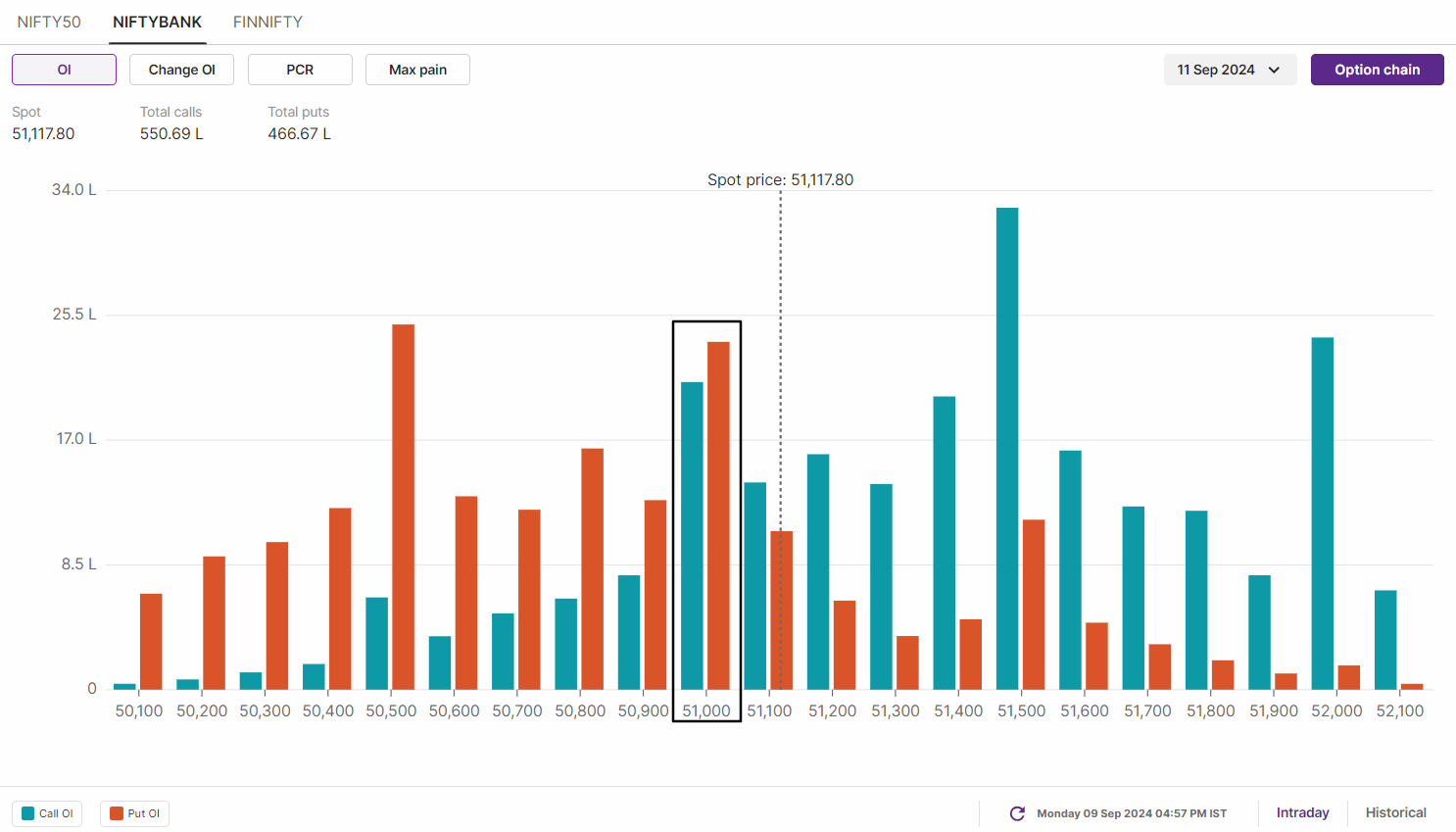

Open interest data for the 11 September BANK NIFTY expiry showed strong put writing at the 51,000 and 51,500 strikes, indicating support for the index around these strikes. Conversely, significant call writing at the 51,500 strike suggests that this level will act as immediate resistance for the index.

FII-DII activity

Stock scanner

Short build-up: Granules India, Birla Soft, Power Finance Corporation, Petronet LNG and ONGC

Under F&O ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Biocon, Chambal Fertilisers, Hindustan Copper and RBL Bank

Added under F&O ban: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story