Market News

Trade Setup for Oct 28: Will NIFTY50 find support around August month low?

.png)

4 min read | Updated on October 28, 2024, 07:20 IST

SUMMARY

The NIFTY50 index fell over 8% in the last four weeks and closed below the September month low, indicating weakness. However, after a sharp fall, the index has entered the crucial support zone of 23,800 and 24,000. Unless the index slips below this zone, it may consolidate around this level.

The NIFTY50 index ended Friday’s session in the red, extending the losing streak for the fifth day in a row.

Asian markets update

The GIFT NIFTY is flat, suggesting a subdued start for the NIFTY50 today. Meanwhile, other Asian markets are trading mixed. Japan's Nikkei 225 is up 1.7%, while Hong Kong's Hang Seng Index is down 0.1%.

NIFTY50

- October Futures: 24,192 (▼0.9%)

- Open Interest: 4,79,628 (▼6.3%)

The NIFTY50 index ended Friday’s session in the red, extending the losing streak for the fifth day in a row. The index formed bearish candle on the daily chart and slipped towards the crucial support zone of 24,000 zone.

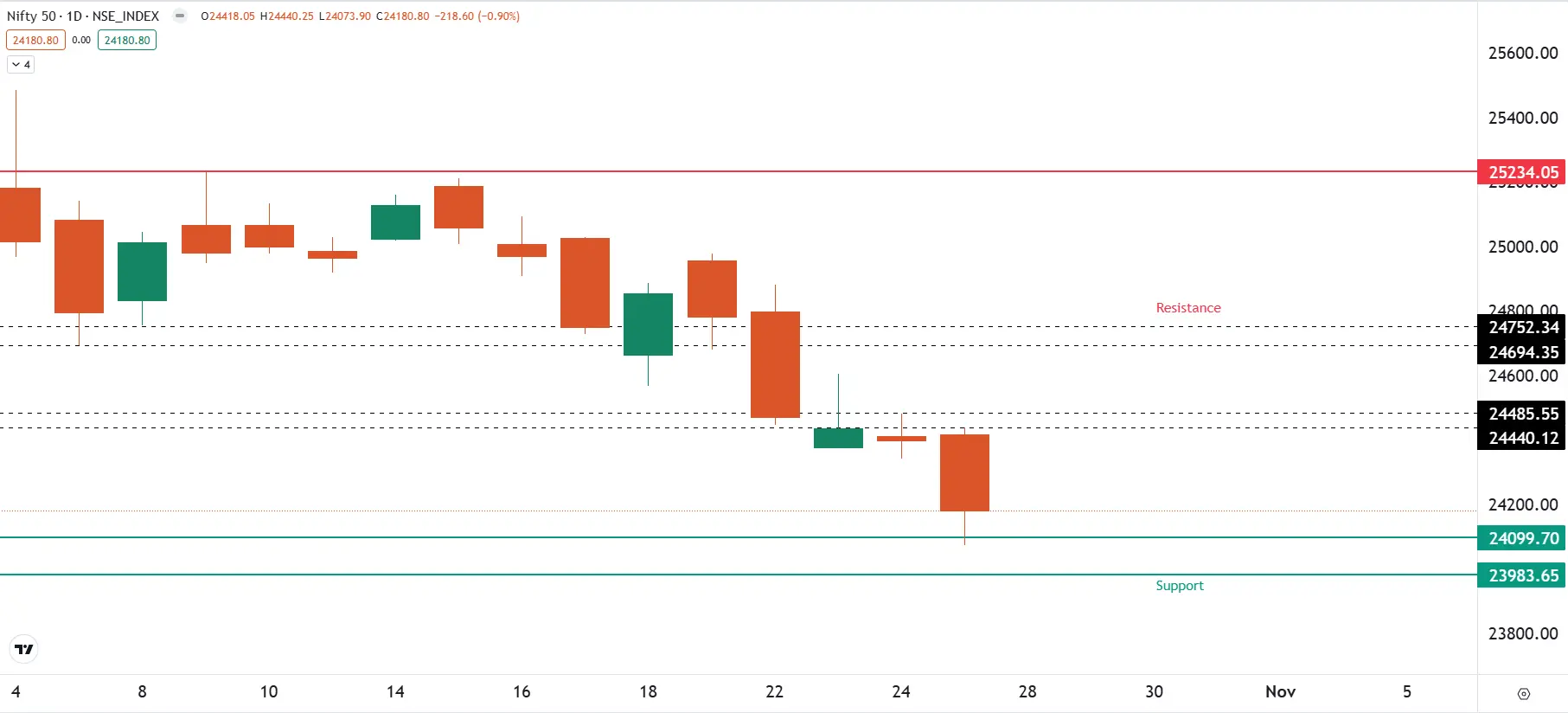

As you shown in the chart below, the index has slipped over 8% in the past four weeks and is currently placed at a crucial support zone of 24,000 and 23,800, which is also the low of the August month. In the upcoming week, unless the index slips below this zone on closing basis, it may consolidate around this zone and may witness a short-term bounce. On the other hand, the immediate resiatance is visible at 24,700 and 24,800 region.

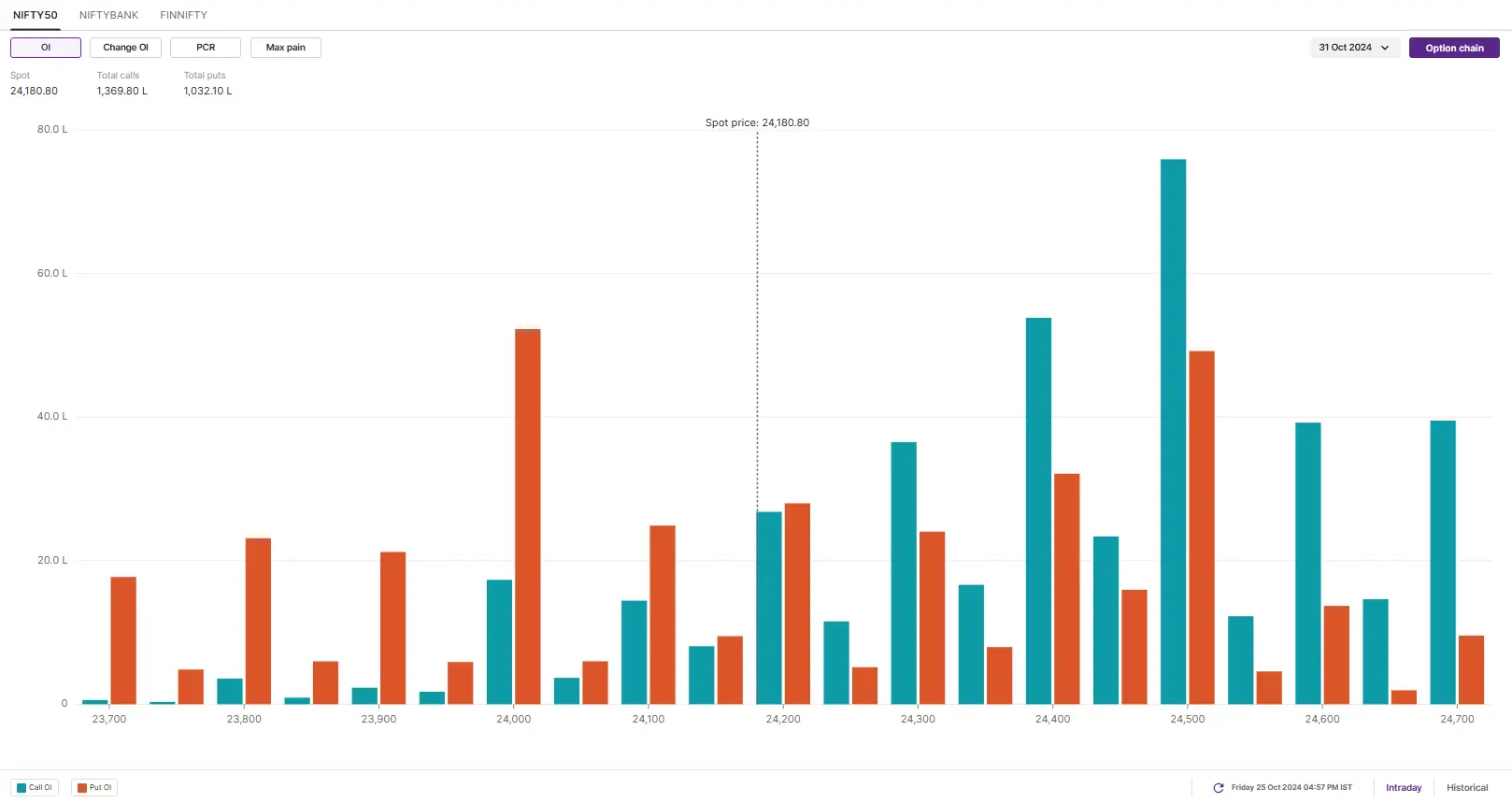

The open interest data for the monthly expiry has highest call open interest was seen at 24,500 strike, indicating resistance for the index around this level. On the contrary, the put base was seen at 24,000 strike, suggesting support for the index around this zone. Additionally, traders should also monitor the change in open interest and plan strategies accordingly.

BANK NIFTY

- October Futures: 50,846 (▼1.3%)

- Open Interest: 1,36,545 (▼7.4%)

The BANK NIFTY index also came under selling pressure on Friday, forming a bearish candlestick on the daily chart, and breaching the key support level of 51,000 on a closing basis. However, towards the end of the session, the index rebounded nearly 1%, sending mixed signals on the daily chart.

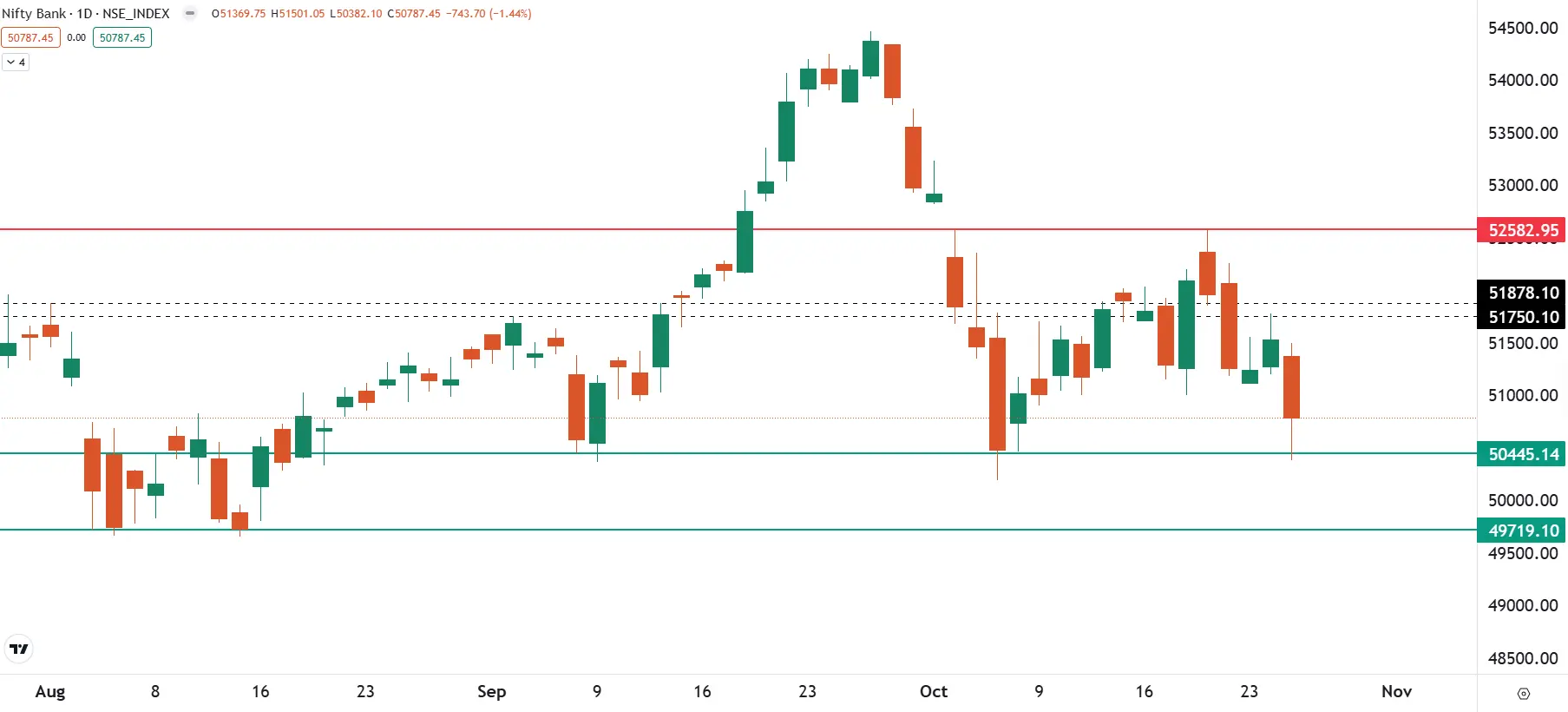

The technical struture of the index remains weak as per the daily chart, with immediate support zone between 49,700 and 50,000. As shown in the chart below, the index consoldaited in this area in the month of August for nearly 9 trading sessions. In the near-term, the index may consolidate around this zone and remain range-bound with support around 51,800 area.

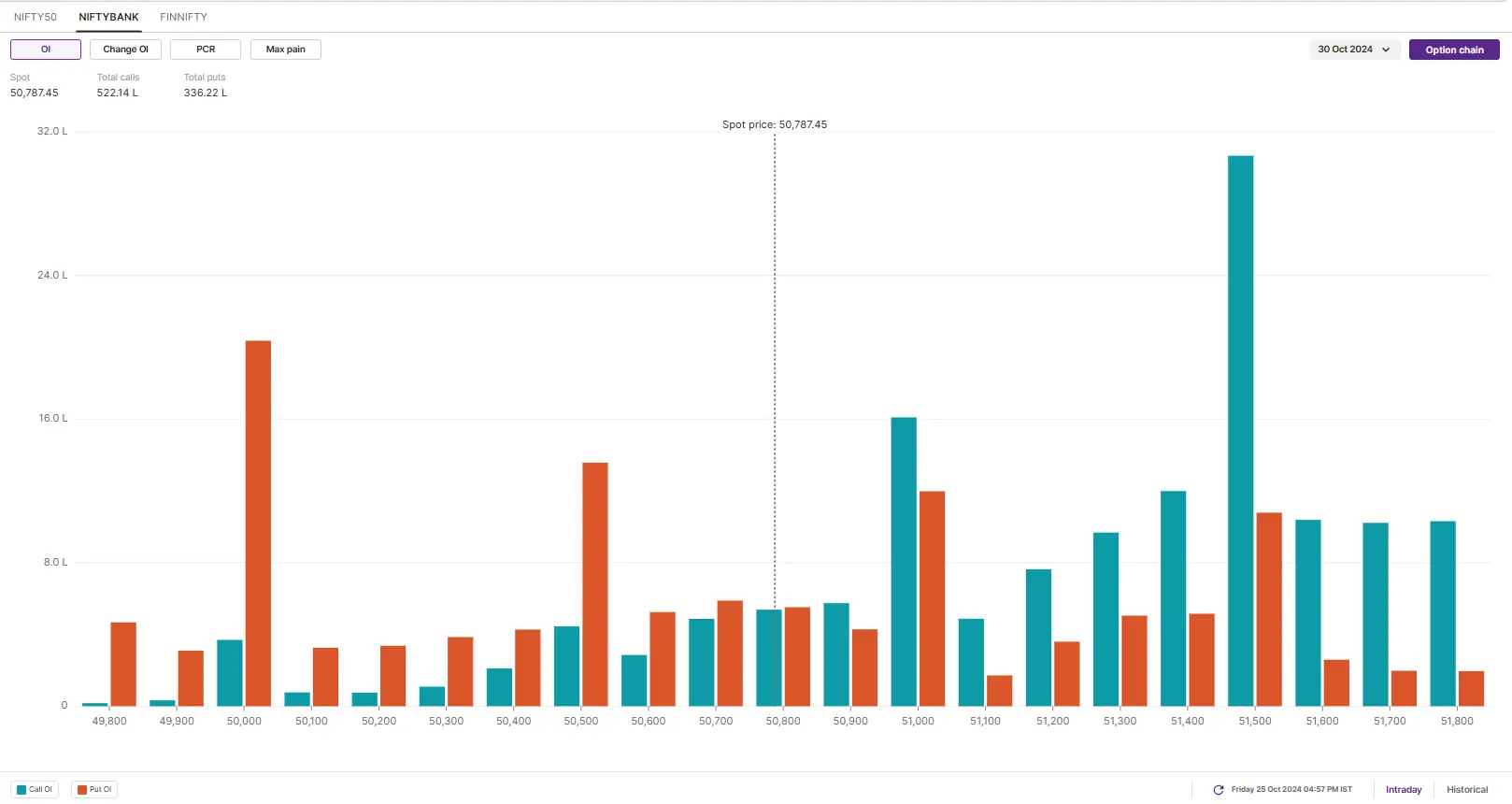

The open interest data for the monthly expiry of BANK NIFTY saw a significant call base at 51,500 strike, marking this as immediate resistance. On the flip side, the put base was visible at 50,000 strike, indicating support for the index at this strike. Similar to NIFTY50, traders should also monitor the change in open interest and execute strategies accordingly along with price action.

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries, Bandhan Bank, Dixon Technologies, Escorts Kubota, IDFC First Bank, Indiamart Intermesh, L&T Finance, Manappuram Finance, NMDC and RBL Bank

Out of F&O ban: IEX and Piramal Enterprises

Added under F&O ban: Dixon Technologies, IDFC First Bank and L&T Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story