Market News

Trade Setup for Oct 21: BANK NIFTY forms bullish engulfing pattern, reclaims 50 DMA

.png)

4 min read | Updated on October 21, 2024, 10:11 IST

SUMMARY

The BANK NIFTY has regained its 50- and 100-day moving averages on the daily chart, forming a bullish engulfing candle, a reversal pattern. A close above the candle's high would confirm the bullish pattern and suggest further upside potential.

Stock list

The NIFTY50 index snapped a three-day losing streak to end Friday's session on a positive note, up 0.4%.

Asian markets update

The GIFT NIFTY is trading flat, indicating a subdued start for the NIFTY50 today. Meanwhile, the other Asian indices are trading on a mixed note. Japan’s Nikkei 225 is trading flat, while Hong Kong’s Hang Seng index is down 0.2%.

U.S. market update

- Dow Jones: 43,275 (▲0.0%)

- S&P 500: 5,864 (▲0.4%)

- Nasdaq Composite: 18,489 (▲0.6%)

U.S. indices ended Friday's session in the green, led by strong gains in technology stocks. All three indices extended their winning streak to six weeks, the longest since 2023.

The strong rally in the indices was driven by Netflix's third quarter results, which beat Street estimates on both the EPS and revenue fronts. The company also raised its revenue guidance for the fourth quarter to $10.13 billion, which was above Street expectations.

NIFTY50

- October Futures: 24,949 (▲0.4%)

- Open Interest: 5,30,099 (▼2.0%)

The NIFTY50 index snapped a three-day losing streak to end Friday's session on a positive note, up 0.4%. The index protected the September monthly low, 24,700 level on a closing basis, and formed a bullish piercing candle on the daily chart.

As shown in the image below, the index negated the bearish engulfing pattern formed on the 17th and failed to follow through. A bullish piercing pattern formed on the daily chart, which is a two-candle reversal signal that shows the potential for further upside if the second candle closes above the mid-point of the previous bearish candle. However, the pattern will be confirmed if the close of the subsequent candle is above the high of the reversal pattern.

Options data for the 24 October expiry showed the highest call open interest at the 25,000 strike, suggesting resistance around this level. Conversely, put bases were seen at the 24,500 and 24,800 strikes, suggesting support for the index around these levels.

BANK NIFTY

- October Futures: 52,310 (▲1.6%)

- Open Interest: 1,70,841 (▼13.8%)

The BANK NIFTY also invalidated the bearish engulfing pattern on the daily chart and gained over 1% on Friday, led by a strong rebound in private banks. The index formed a bullish engulfing pattern on the daily chart and regained its 50 and 100 day moving averages.

As shown in the chart below, the index found support at the crucial 51,000 level and rallied over 2% from the day's low. This indicates that fresh buyers have emerged from the key support zones. For the coming sessions, immediate support for the index is around the 51,000 level, while resistance remains at the 20-day moving average, around 52,400. A break of these levels on a closing basis will provide further directional clues.

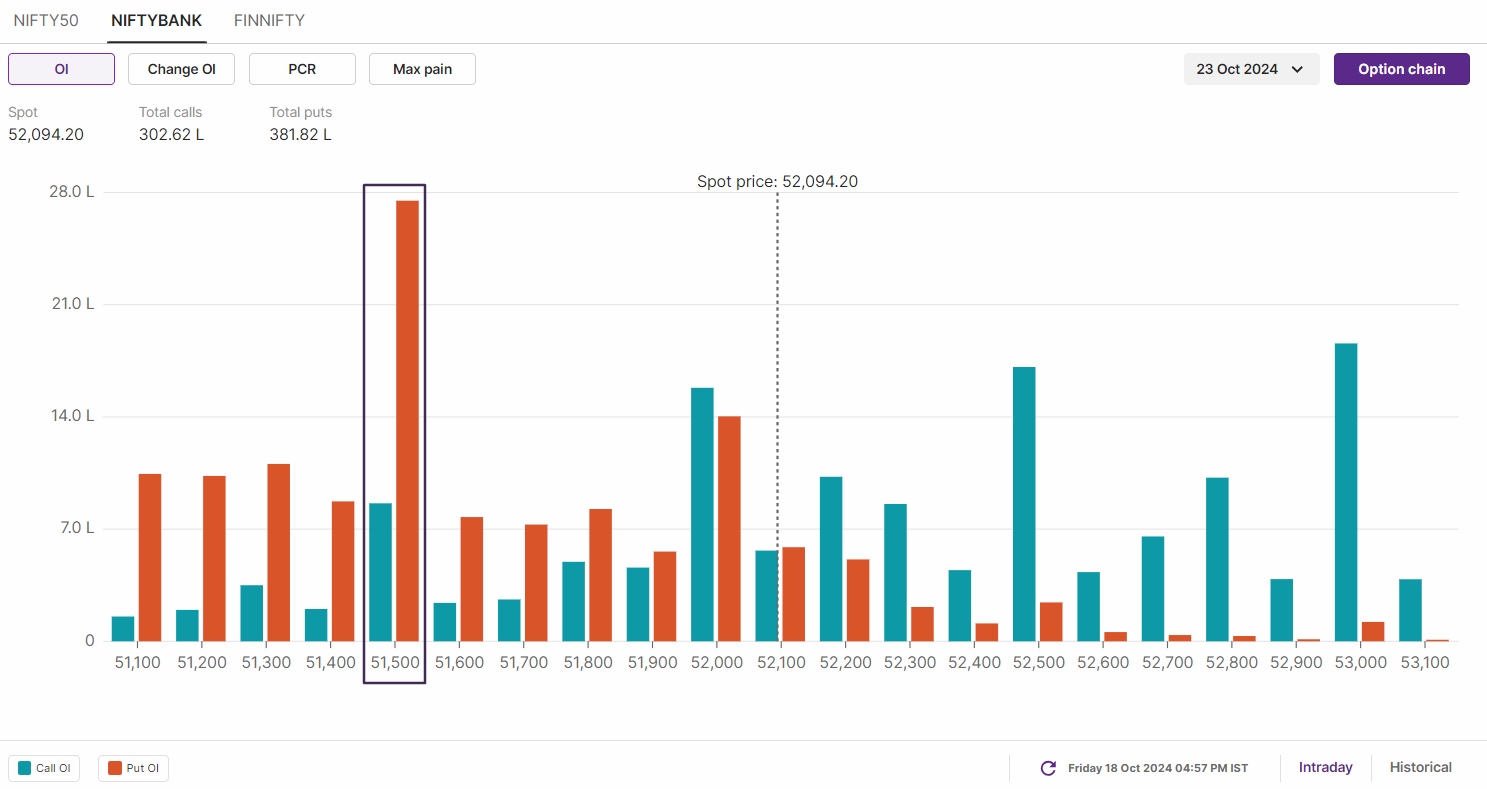

Meanwhile, the open interest positioning for the 23 October expiry witnessed a significant put base at the 51,500 strike, indicating support around this level. On the other hand, call bases were seen at 52,500 and 53,000, suggesting that the index may face resistance around these levels.

FII-DII activity

Stock scanner

Short build-up: Indraprastha Gas, Mahangar Gas and LTI Mindtree

Under F&O ban: Aarti Industries, Bandhan Bank, Birla Soft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, IDFC First Bank, IEX, L&T Finance, National Aluminium, Punjab National Bank, Steel Authority of India and Tata Chemicals

Out of F&O ban: Manappuram Finance and RBL Bank

Added under F&O ban: Aarti Industries and Birla Soft

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story