Market News

Trade setup for June 3: Will NIFTY50 sustain a sharp rebound after holding support near 24,500?

.png)

3 min read | Updated on June 03, 2025, 07:26 IST

SUMMARY

NIFTY50 and SENSEX closed nearly flat on June 02, after recovering from a negative start triggered by Donald Trump’s tariff statements and FII sell-off at the end of the previous month. This rebound reflects the continued resilience of buyers in the benchmark indices.

Stock list

NIFTY50 closed with a minor loss of 0.1% after a sharp intraday bounce on Monday. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 24,860 (+0.37%)

- Nikkei 225: 37,693 (+0.59%)

- Hang Seng: 23,281 (+0.53%)

U.S. market update

Dow Jones: 42,305 (+0.08%) S&P 500: 5,935.9 (+0.1%) Nasdaq Composite: 19,242.6 (+0.67%)

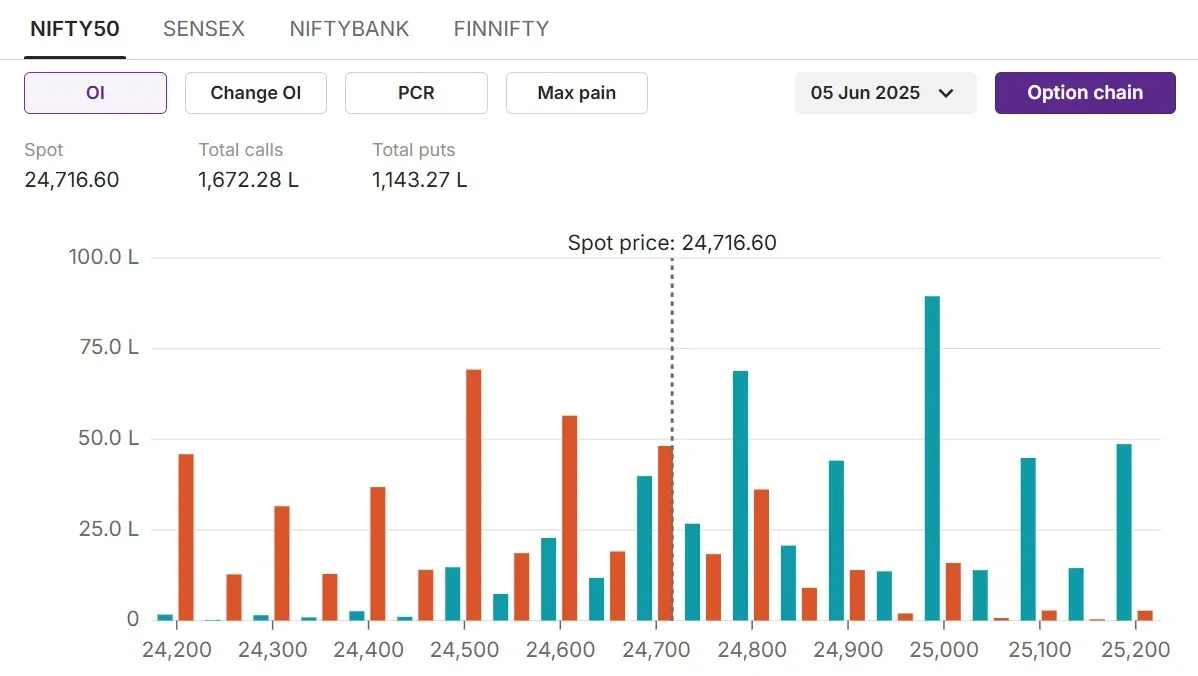

NIFTY50

- Max call OI: 25,000

- Max put OI: 24,500

- (Ten strikes to ATM, 5th June expiry)

The week started on a negative note for NIFTY50, continuing the jitters from Donald Trump’s threat to double tariffs on the import of steel and aluminium to 50% and FIIs sell-off on the last trading day of May 2025. NIFY50 witnessed high volatility during the day but managed to bounce back sharply and recoup the losses from early trade. Consequently, NIFTY50 closed with a minor loss of 0.1% after a sharp intraday bounce.

The index took support near its multiple support area of 24,500 and witnessed a sharp bounce. Thus, NIFTY50 has formed a bullish hammer candlestick on June 02, indicating buyers' dominance. On the daily chart, the support is placed at 24,500 and on the upside 24,900, a prior swing high acts as a resistance.

On the options data front, the 25,000 calls hold the highest open interest for the 5th June expiry, indicating a strong resistance at these levels. On the downside, the index holds the highest open interest at 24,500 puts, indicating strong support at these levels.

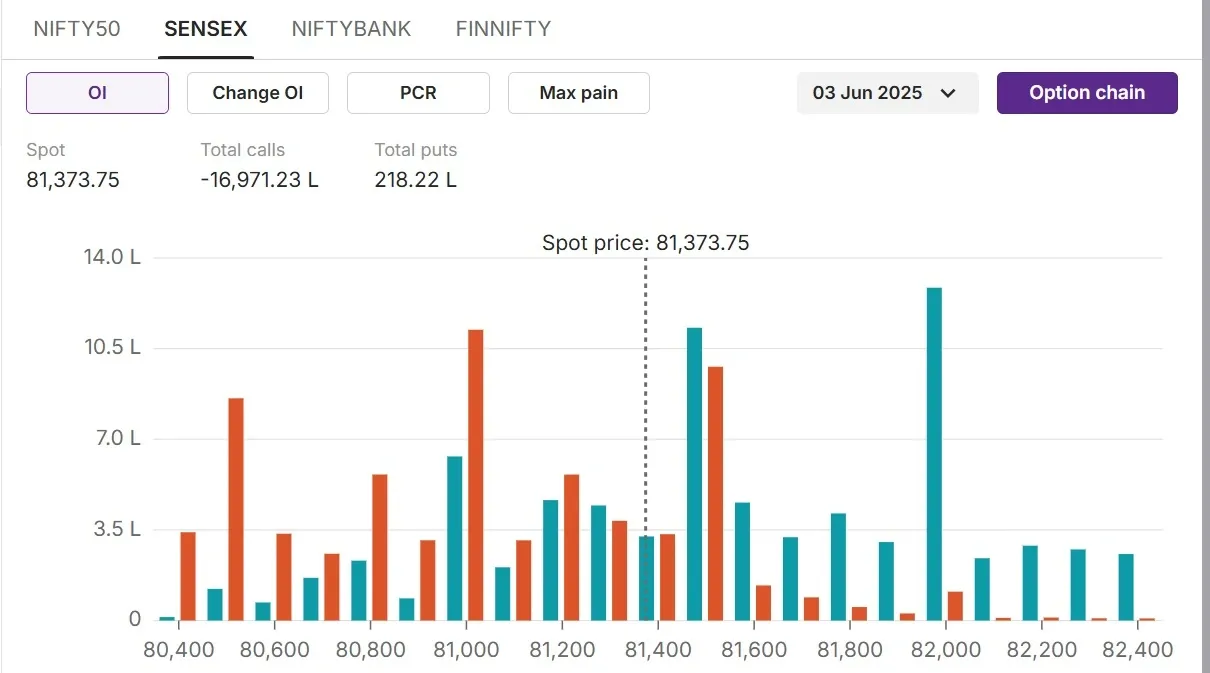

SENSEX

- Max call OI: 82,000

- Max put OI: 81,000

- (Ten strikes to ATM, 3rd June expiry)

After 3 consecutive days of consolidation, SENSEX opened Monday’s i.e. 2nd June’s session, on a negative note and continued selling in the early trade. However, SENSEX too bounced back sharply but closed on a flat to positive note with 0.1% gain.

SENSEX took support at its multiple support zone of 80500-80700 and bounced back sharply, forming a bullish hammer on the daily charts. This indicates that buyers overpowered the sellers at the end of the session, showing some optimism. The charts maintain 80500-80700 as the support zone while 81800 as the resistance for now.

On the options data front, the index continued to face heavy resistance at the 82,000 levels due to the highest open interest on the call side. On the downside, the 81,000 puts hold the highest open interest, indicating strong support for the current weekly expiry.

Stock scanner

- Short buildup: Hero MotoCorp

- Top traded futures contracts: SBIN FUT, HDFCBANK FUT

- Top traded options contracts: CDSL 1680CE, CDSL 1600CE, BSE 2700CE

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story