Market News

Trade Setup for Dec 10: NIFTY50 remains range-bound, consolidates around 24,600

.png)

4 min read | Updated on December 10, 2024, 07:22 IST

SUMMARY

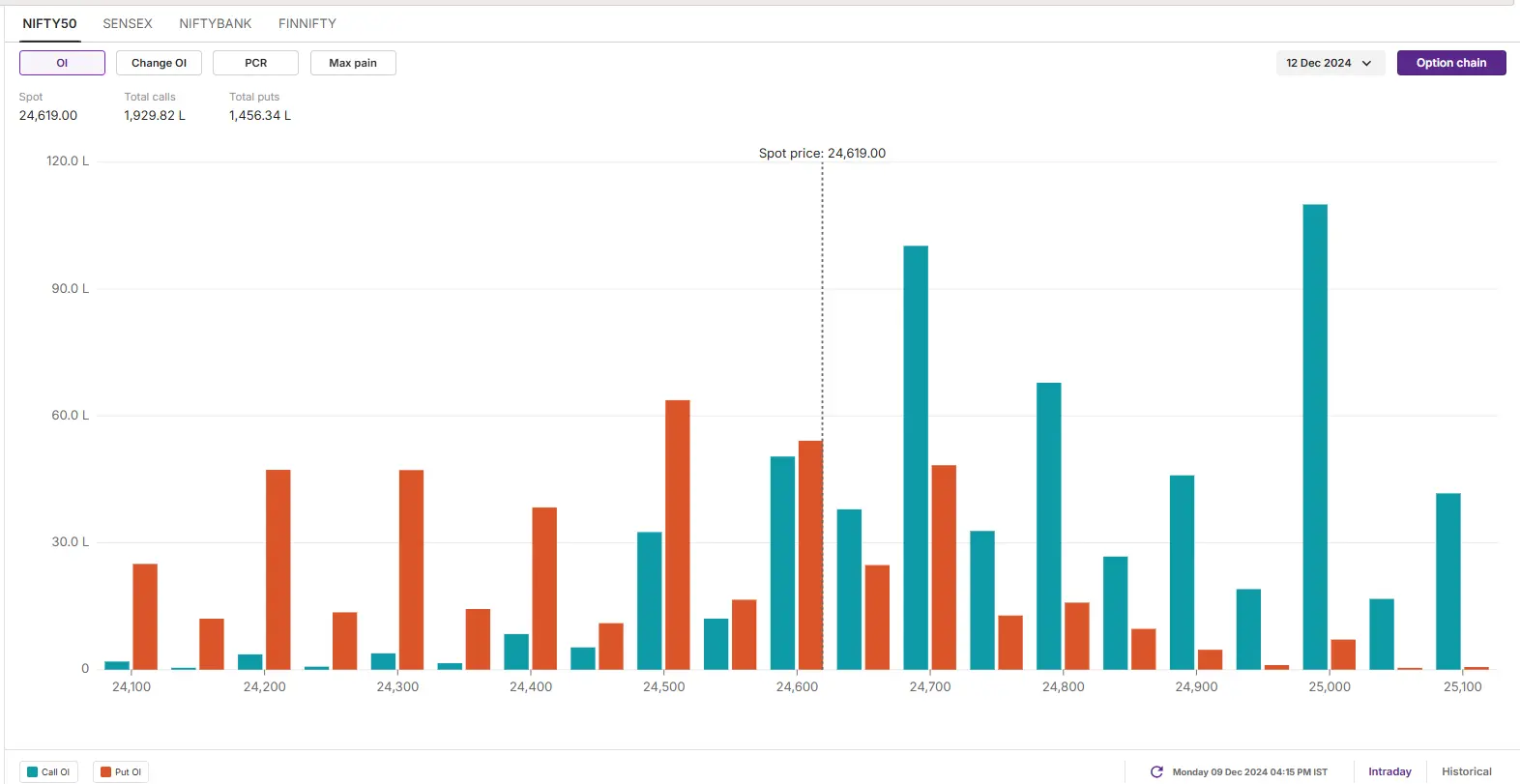

The NIFTY50 index remained range-bound for the second day in a row and consolidated around 24,600 zone. Additionally, the index also witnessed significant call and put additions at the similar 24,600 strike, suggesting that traders are expecting consolidation around this zone.

Stock list

The NIFTY50 index traded in a narrow range, extending the consolidation for the second day in a row inside the range of 5 December.

Asian markets @ 7 am

- GIFT NIFTY: 24,718.50 (+0.05%)

- Nikkei 225: 39,200.81 (+0.11%)

- Hang Seng: 21,070.05 (+3.21%)

U.S. market update

- Dow Jones: 44,401 (▼0.5%)

- S&P 500: 6,052 (▼0.6%)

- Nasdaq Composite: 19,736 (▼0.6%)

U.S. indices retreated from record highs as the technology stocks came under selling pressure ahead of the key inflation report due later this week. Shares of AI chipmaker Nvidia dropped over 3% after the chinese regulator announced that it's investigating the company for potentially violating the country’s antimonopoly law.

NIFTY50

- December Futures: 24,783 (▲0.0%)

- Open interest: 4,54,315 (▲1.6%)

The NIFTY50 index traded in a narrow range, extending the consolidation for the second day in a row inside the range of 5 December. The index remained confined in a range of 100 points around the 24,600 mark, ending the day in the red for the second consecutive day.

On the daily chart, the technical structure of the index broadly remains unchanged with immediate support around the 24,300 zone and the resistance was visible around the 24,850 zone, the high of the 5 December candle. Unless the index breaks this range, the trend may remain sideways.

The open interest structure for the 12 December expiry saw significant additions at 25,000 and 24,700 strikes, suggesting resistance for the index around this zone. Meanwhile, the put base remained around 24,000 strike, pointing support for the index around this zone.

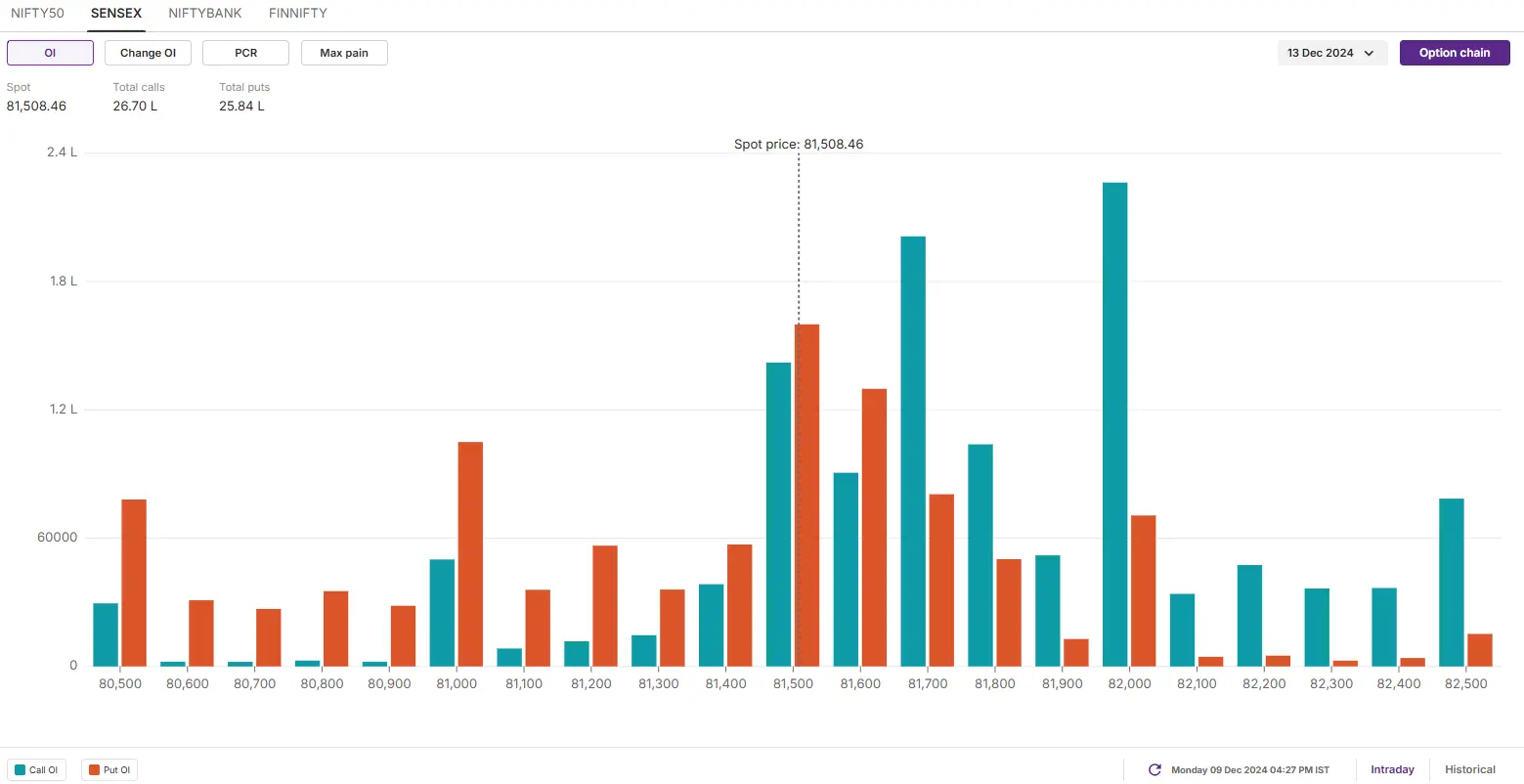

SENSEX

- Max call OI: 82,000

- Max put OI: 78,000

- (Expiry: 13 Dec)

The SENSEX also remained under pressure and traded within the range of 5 December candle, consolidating around the 81,500 mark. The broader structure of the index remains sideways to bullish with the immediate support for the index around the 80,300 zone. Unless the index slips below this zone, the trend may remain unchanged with the resistance around 82,300 mark. If the index breaks this range on a closing basis, the current structure of the index may change and provide further directional cues.

The open interest data for the 13 December saw significant additions at 82,000 and 81,700 strikes, indicating resistance for the index around these strikes. Meanwhile, a significant call and put base was also established at 81,500 strikes, suggesting that market participants are expecting consolidation around this level.

FII-DII activity

Stock scanner

- Long build-up: Kalyan Jewellers India, Angel One, KPIT Technologies, Computer Age Management Services (CAMS) and Metropolis

- Short build-up: Godrej Consumer Products, Laurus Labs, Syngene International, Divi's Laboratories and Biocon

- Under F&O ban: Granules India, Manappuram Finance, PVR Inox and RBL Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story