Market News

Trade Setup for August 28: BANK NIFTY stalls near 51,000, can it reclaim 50 DMA on expiry day?

.png)

5 min read | Updated on August 28, 2024, 08:24 IST

SUMMARY

For today’s BANK NIFTY expiry, traders should closely monitor the 50-day and 20-day moving averages. A move above or below these levels, either intraday or at the close, could indicate a potential directional shift in the index.

Stock list

As NIFTY50 has formed a doji candle on the daily chart, it is indicating a pause and not a reversal at record high levels.

Asian markets update at 7 am

The GIFT NIFTY is showing little movement, suggesting a flat start for the NIFTY50 today. Meanwhile, key Asian markets are slightly down, with Japan’s Nikkei 225 dipping 0.2% and Hong Kong’s Hang Seng index slipping 0.1%

U.S. market update

- Dow Jones: 41,250 (▲0.0%)

- S&P 500: 5,625 (▲0.1%)

- Nasdaq Composite: 17,754 (▲0.1%)

U.S. indices ended the choppy session on a positive note, with the Dow Jones Industrial Average setting another record close. This comes ahead of chipmaker Nvidia's second quarter results, which will be released after market hours today.

Nvidia has become the key bellwether for technology stocks and artificial intelligence, and investors will be looking to its second-quarter results to gauge the health of the broader technology sector.

NIFTY50

- August Futures: 25,017 (▼0.1%)

- Open Interest: 3,21,187 (▼17.6%)

The NIFTY50 continued to build momentum for the ninth consecutive day, closing Friday's session at a second close. The index closed above the 25,000 level for the second consecutive session and formed a doji candlestick pattern on the daily chart, indicating indecision at higher levels.

As the index has formed a doji candle on the daily chart, it is indicating a pause and not a reversal at record high levels. In the short term, traders can keep an eye on the high and low of the doji candle formed on Tuesday. A close above the high of the doji will indicate a continuation of the uptrend, while a close below it will indicate short-term weakness.

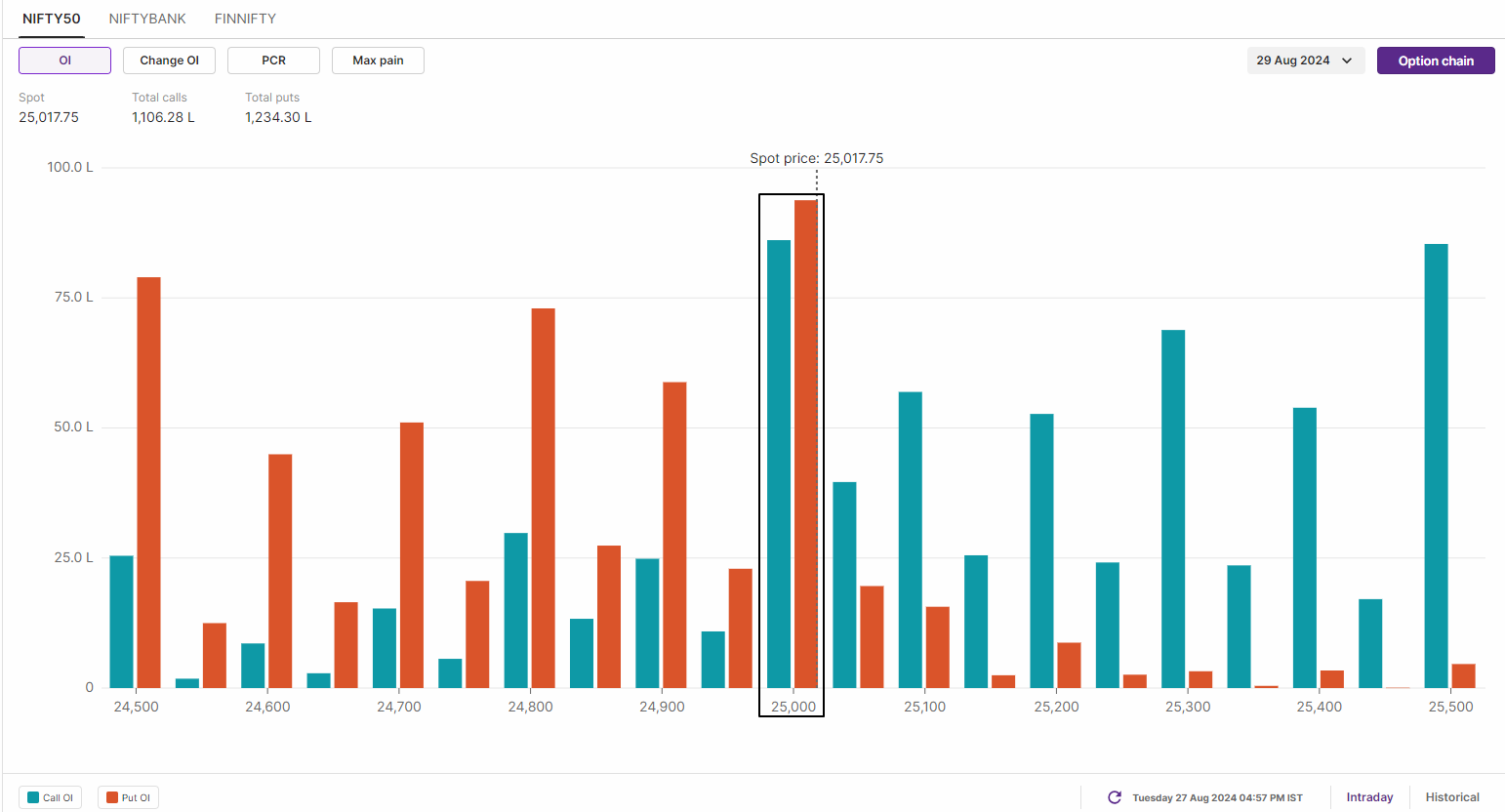

The open interest data for the 29 August expiry shows the highest call and put open interest at the 25,000 strike, indicating potential range-bound activity around this level. Additionally, there has been notable call addition at the 25,300 strike and a solid put base at 24,800. Traders should closely monitor the open interest movement, particularly if the index moves above 25,100 or below 24,900, as this could signal a shift in market sentiment.

BANK NIFTY

- August Futures: 51,219 (▼0.0%)

- Open Interest: 1,11,633 (▼24.4%)

The BANK NIFTY index extended the positive momentum for the second day in a row and filled the bearish gap formed on 2 August on closing basis. However, the index again faced selling pressure around its 50-day moving average (51,500) and failed to capture it on closing basis.

Technically, the short-term trend for BANK NIFTY remains positive following its breakout from a twelve-day consolidation. The index has reclaimed both its 20-day and 100-day moving averages on the daily chart, though it has yet to demonstrate sustained follow-through momentum.

As shown in the chart below, the index has also broken through the downward sloping trendline resistance originating from its previous all-time high. For today's session, traders should watch the 50-day and 20-day moving averages closely. A move above or below these levels, whether intraday or on a closing basis, could signal a directional shift in the index.

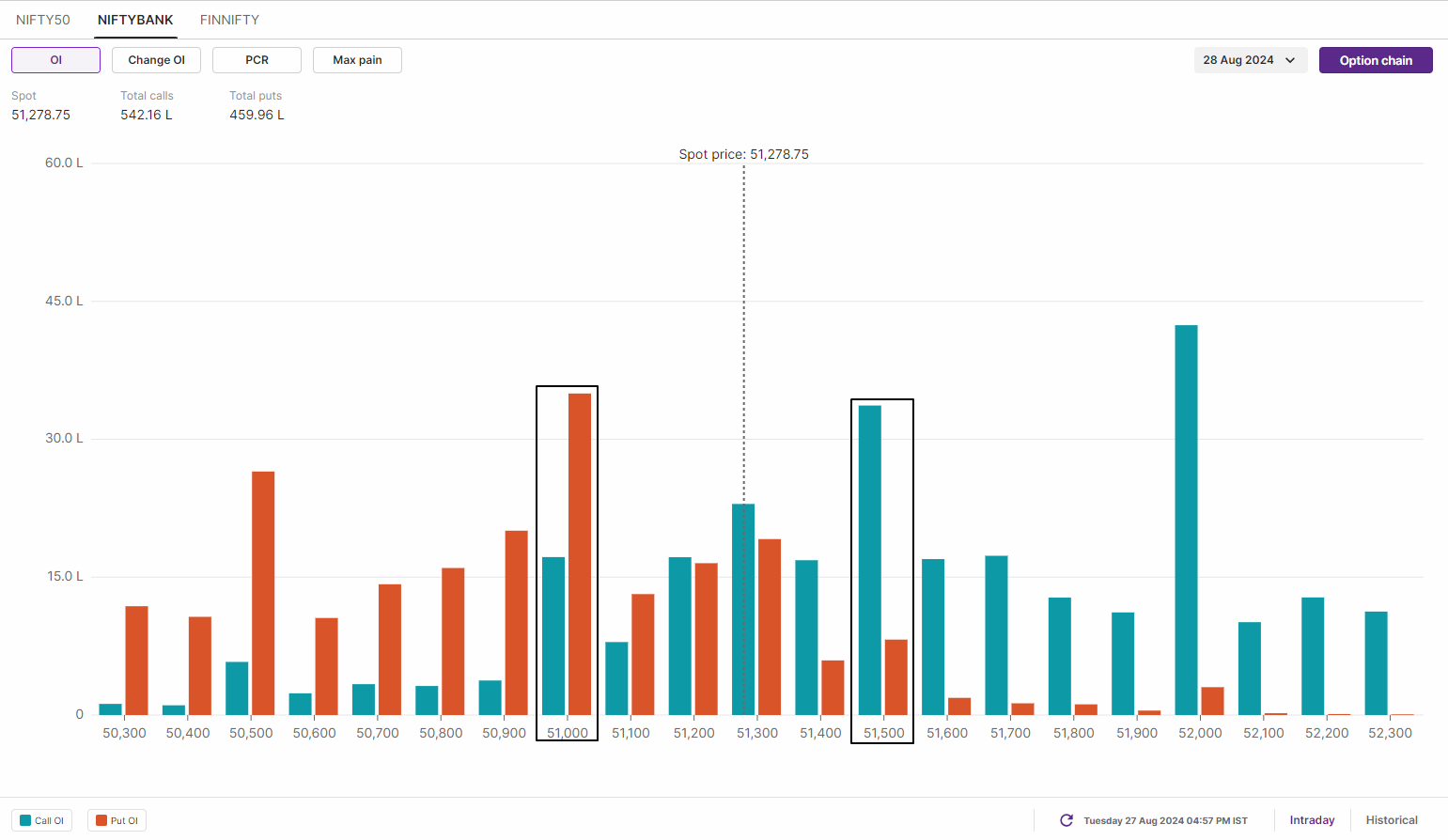

For today’s expiry, BANK NIFTY shows significant call open interest at the 51,500 strike and a strong put base at the 51,000 strike. The index has also seen notable call and put additions at the 51,300 strike, suggesting range-bound activity around this level. However, traders should closely monitor the price action around 51,500 and 51,000. A breakout above or below these levels could signal a shift in open interest, indicating a potential change in the index's direction.

FII-DII activity

Stock scanner

Short build-up: Syngene International, Cummins India, Titan and JSW Steel

Out of F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Chambal Fertilisers, IEX, and RBL Bank

Added under F&O ban: Hindustan Copper

Under F&O ban: Balrampur Chini, Birlasoft, Hindustan Copper and India Cements

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story