Market News

Trade setup for 9 July: NIFTY50 consolidates, doji formation signals volatility

.png)

4 min read | Updated on July 09, 2024, 10:50 IST

SUMMARY

Based on the options data, the NIFTY50 index is expected to trade between 24,500 and 24,000 zones. A break beyond this range will provide traders with further directional clues. Until then, index may experience volatility and consolidation within this zone.

The technical structure of the NIFTY50's daily chart indicates range-bound activity with volatility.

Asian markets update

The GIFT NIFTY is trading marginally in green, indicating a flat to positive start for Indian equities today. Meanwhile, Asian markets are trading mixed. Japan’s Nikkei 225 is up 1.4%, while Hong Kong’s Hang Seng index is down 0.1%.

U.S. market update

- Dow Jones: 39,344 (▼0.0%)

- S&P 500: 5,572 (▲0.1%)

- Nasdaq Composite: 18,403 (▲0.2%)

The U.S. market had a mixed closing on Monday, with the S&P 500 and Nasdaq Composite reaching record highs. This comes just before Fed Chair Jerome Powell's testimony to Congress and release of inflation data due on Thursday. In addition, banking heavyweights including JPMorgan Chase report their quarterly results on Friday, kicking off the earnings season.

NIFTY50

- July Futures: 24,375 (▼0.0%)

- Open Interest: 5,69,571 (▲0.4%)

The NIFTY50 started the week on a subdued note, trading in a narrow range of almost 100 points on the 8 June. The index formed a doji candlestick pattern on the daily chart, indicating indecision among investors at record highs.

The technical structure of the NIFTY50's daily chart indicates range-bound activity with volatility. Currently, the NIFTY50 is consolidating between 24,400 and 24,000 levels. A breach of this range will provide further directional clues. Until then, the index may oscillate within this range with sharp bouts of volatility.

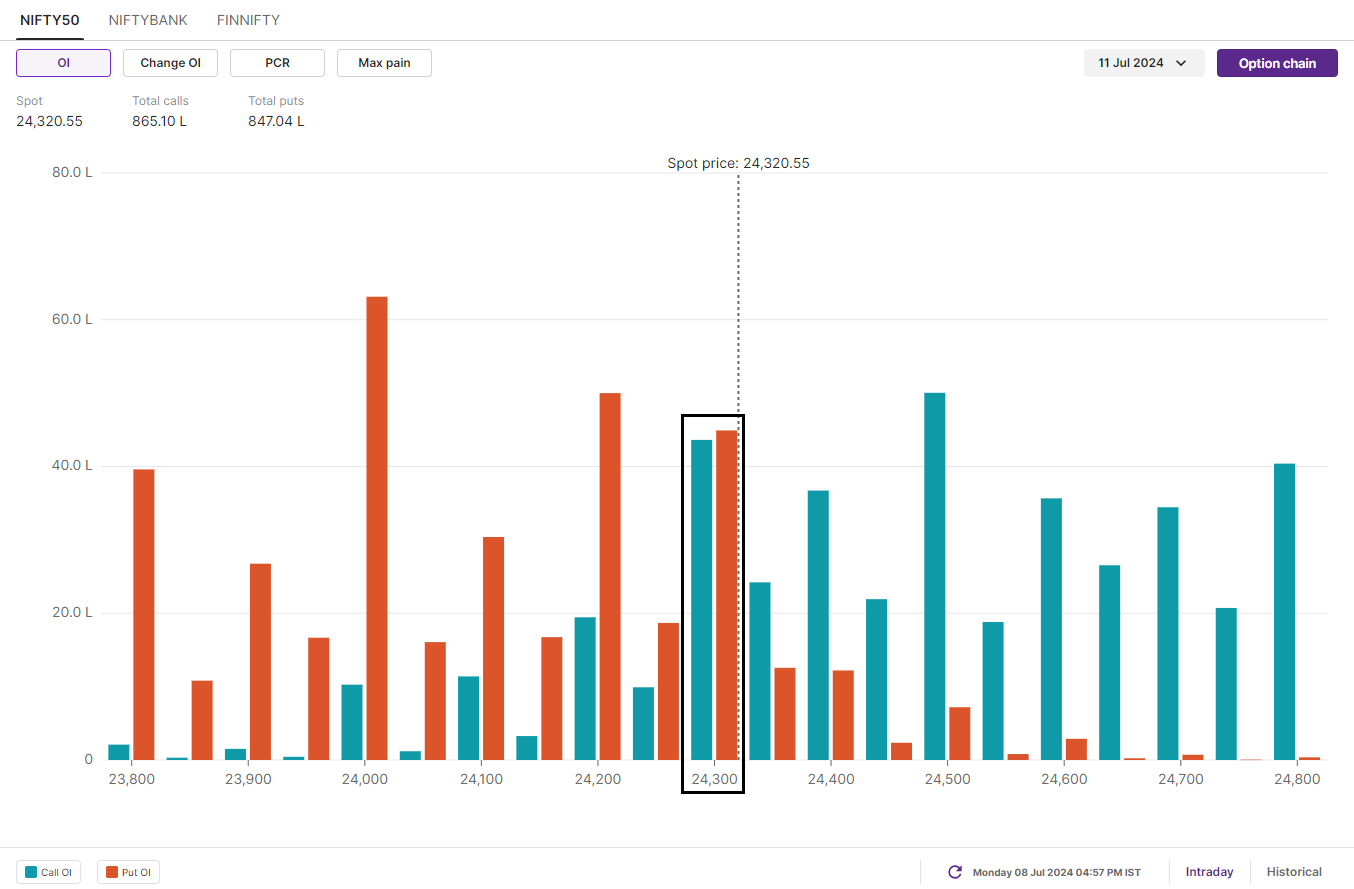

The open interest (OI) build-up for the 11 July expiry has a significant call and put OI at the 24,300 strike, indicating range-bound activity. In addition, the index has the highest call OI at 24,500 and put OI at 24,000, making these key resistance and support zones for the index.

BANK NIFTY

- July Futures: 52,560 (▼0.2%)

- Open Interest: 1,72,454 (▼0.8%)

The BANK NIFTY remained weak for the second consecutive day and closed lower below the key 52,500-mark. Amid selling pressure in index heavyweight HDFC Bank, the banking index witnessed significant volatility resulting in sharp swings in both directions.

Despite the weakness, the BANK NIFTY index is stuck in a range between 53,100 and 52,000. Until the index breaks out of this range, it may remain range-bound. It is important to note that the index has crucial support around the 52,000 level. Before initiating any strategy, traders can monitor the price action around this zone and plan their trading accordingly.

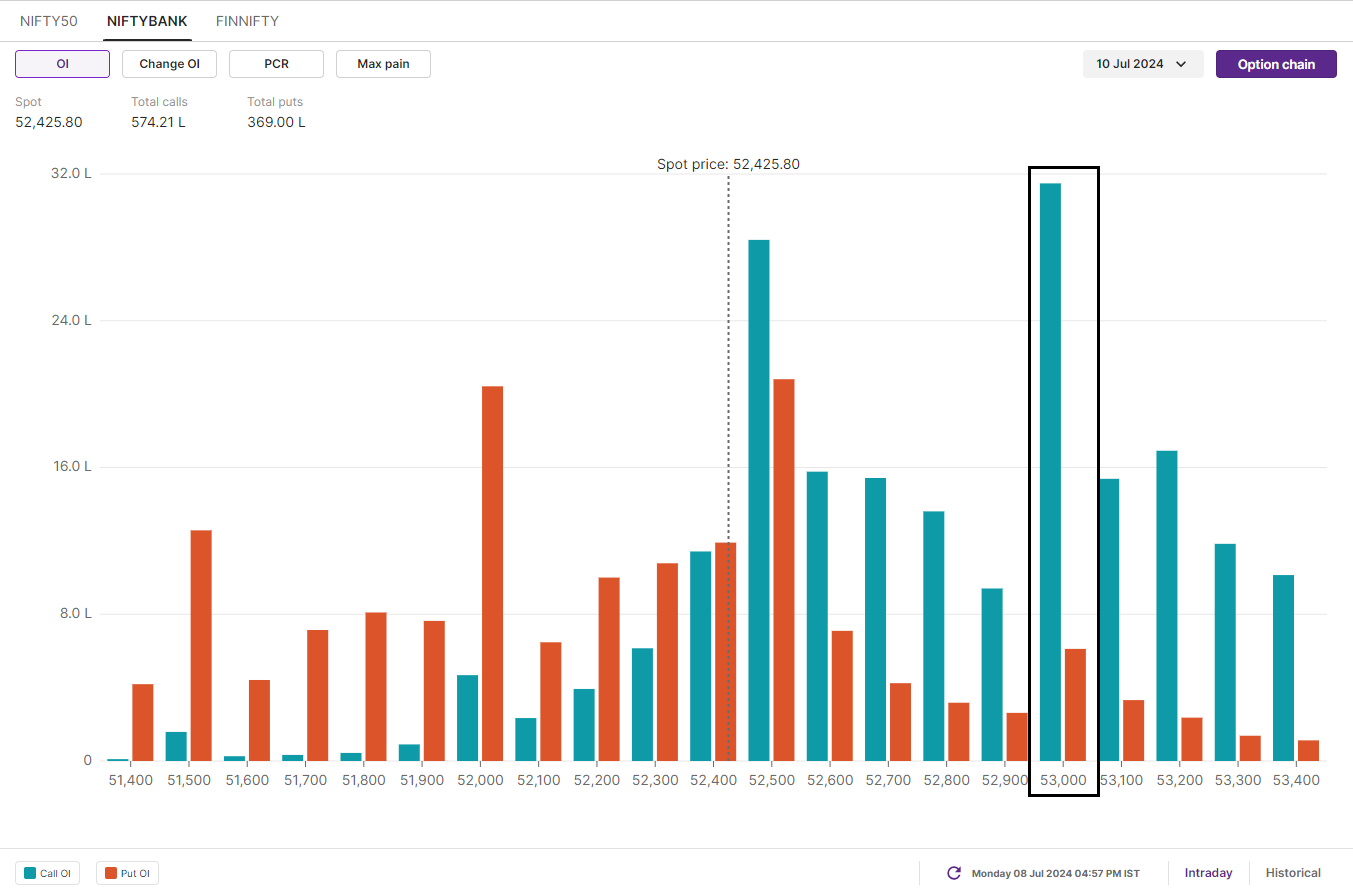

For 10 July expiry, the BANK NIFTY has highest call open interest at 53,000 mark, making this as a crucial resistance. On the flip side, the put base is accumulated at 52,500 and 52,000 strikes. Based on the open interest data, traders are expecting BANK NIFTY to trade between 51,900 and 53,100.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story