Market News

Trade setup for August 7: BANK NIFTY ends below 50,000, approaches 100 DMA as bears take control

.png)

5 min read | Updated on August 07, 2024, 08:03 IST

SUMMARY

The BANK NIFTY index has corrected nearly 7% from its recent all-time high and is now trading below its 20 and 50-day moving averages. The index has formed a lower low structure on the daily chart with immediate resistance at the 52,000 mark.

Stock list

The BANK NIFTY extended the decline for the third consecutive day and closed the Tuesday’s session below the crucial 50,000 mark.

Asian markets update at 7 am

After a rebound on Wall Street, the GIFT NIFTY is up 0.6%, pointing to a gap up start for Indian equities today. Meanwhile, other Asian markets are also trading in the green. Japan's Nikkei 225 is up 0.7%, while Hong Kong's Hang Seng is up 0.6%.

U.S. market update

- Dow Jones: 38,997 (▲0.7%)

- S&P 500: 5,240 (▲1.0%)

- Nasdaq Composite: 16,366 (▲1.0%)

U.S. stocks rebounded on Tuesday, ending a three-day rout that wiped out a healthy chunk of 2024's gains. All sectors ended in the green as investors seem to be shrugging off recession fears. A rebound in Japanese equities also added to the positive sentiment.

Meanwhile, Wall Street's volatility index, the CBOE Volatility Index, cooled to 27, down 28%, after hitting its highest level since the early days of the COVID-19 pandemic on Monday.

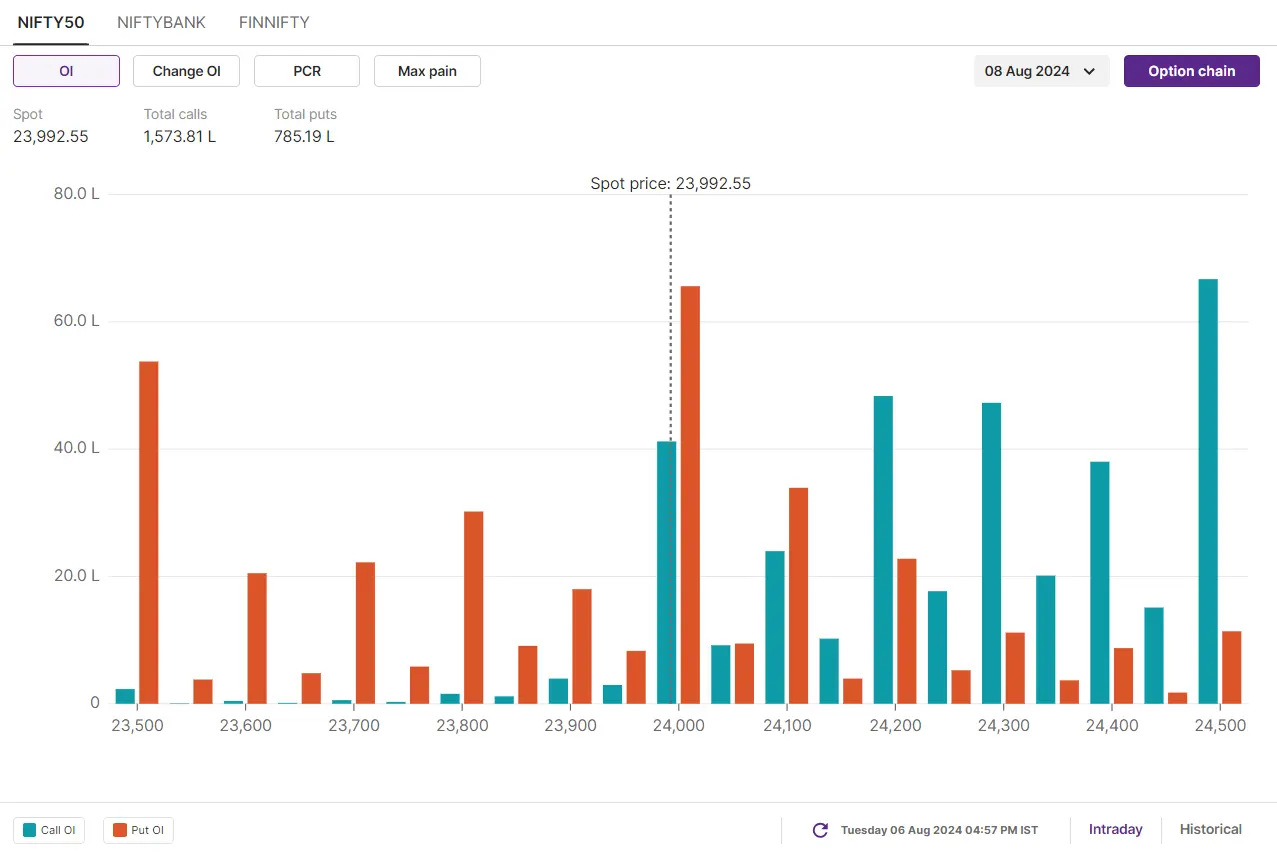

NIFTY50

- August Futures: 24,056 (▼0.0%)

- Open Interest: 5,37,747 (▼8.3%)

The NIFTY50 started the day on a positive note, mirroring positive cues from the Asian markets. However, the index failed to hold on to its opening gains and closed below the psychologically important 24,000 level.

As you can see on the chart below, the index is trading near its 50-day moving average (DMA) and has formed a negative candlestick on the daily chart. The short term trend on the NIFTY50 remains weak and if the index closes below its 50 DMA, the next major support level will be around 23,600. However, if the index rebounds, resistance will come in at 24,400 and 24,500.

On the options front, significant call open interest was seen at the 24,800 and 24,500 strikes, indicating resistance around these levels. Meanwhile, significant put open interest was seen at the 24,000 and 23,500 strikes, indicating support for the index around these levels.

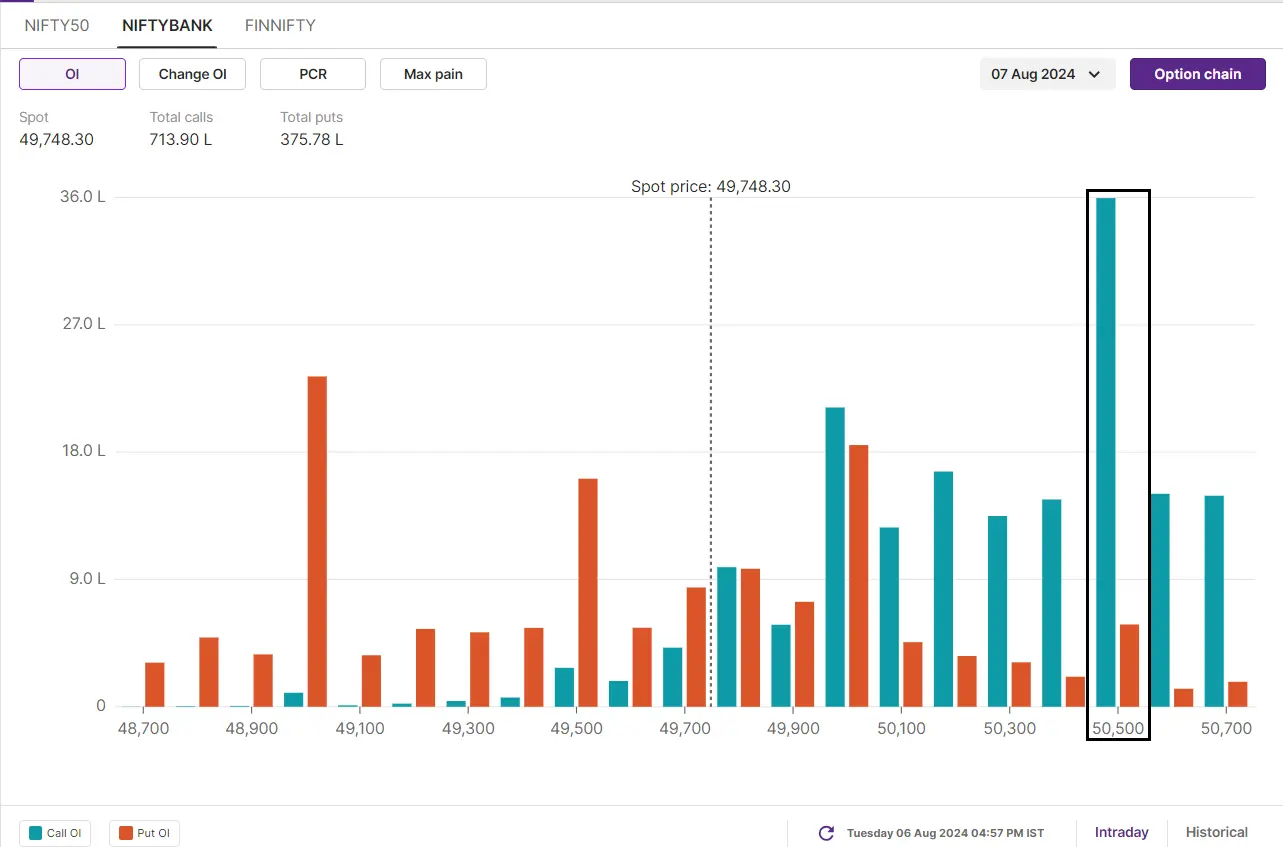

BANK NIFTY

- August Futures: 49,919 (▼0.6%)

- Open Interest: 2,04,465 (▲3.3%)

The BANK NIFTY extended the decline for the third consecutive day and closed the Tuesday’s session below the crucial 50,000 mark. Amid broad based sell-off in the overall banking stocks, the index formed a negative candle on the daily chart and closed near the day’s low.

On the daily chart, the index is approaching two crucial support levels, 100 day moving average and previous all time high zone of 48,600 and 48,900. Since the index has corrected nearly 7% from its all-time high and over 3% in last two days, the risk reward for the fresh short trade seems unfavourable on BANK NIFTY. Positional traders should wait for pull back upto 50,500 and plan the trades as per the price action.

Meanwhile, for today’s expiry the chart on 15 minute time frame indicates a trading range between 50,500 and 49,700. Until BANK NIFTY breaks out of this range, traders might consider implementing non-directional strategies. Conversely, traders can wait for a breakout or breakdown of this range to execute a directional strategy.

The open interest build-up for today’s expiry has highest call accumulation at 51,000 and 50,500 strikes. On the other hand, the put base was established at 50,000 and 49,000 strikes. In additions, the significant call and put addition at 50,000 strike also indicate range-bound activity around this strike.

FII-DII activity

Stock scanner

Under F&O ban: Aditya Birla Capital, Birlasoft, Birla Soft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, India Cements, IndiaMART InterMESH, LIC Housing Finance,Manappuram Finance and RBL Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story