Market News

Trade Setup for 20 August: BANK NIFTY to end the 10-day consolidation?

.png)

5 min read | Updated on August 20, 2024, 08:48 IST

SUMMARY

The GIFT NIFTY is up 0.3%, pointing to a positive opening for the NIFTY50 today. Across Asia, market performance is also positive. Japan's Nikkei 225 is up over 1%, while Hong Kong's Hang Seng Index is up 0.3%.

On Monday, the BANK NIFTY index extended the consolidation for the tenth day in a row

The BANK NIFTY index is trading within the range of the 5 August candle and has not yet filled the bearish gap formed on the same day. Currently, the index is placed between its 20 DMA and 100 DMA. A break of this consolidation and levels will result in a strong directional move.

Asian markets update at 7 am

The GIFT NIFTY is up 0.3%, pointing to a positive opening for the NIFTY50 today. Across Asia, market performance is also positive. Japan's Nikkei 225 is up over 1%, while Hong Kong's Hang Seng Index is up 0.3%.

U.S. market update

Dow Jones: 40,896 (▲0.5%) S&P 500: 5,608 (▲0.9%) Nasdaq Composite: 17,876 (▲1.3%)

U.S. indices extended the last week’s winning streak and closed the Monday’s session in green. Technology and Consumer Discretionary stocks led the gains, as the indices continued to rally after sell-off in August.

Focus will now shift to Federal Reserves’s Jackson Hole Symposium, where the Fed Chair Jerome Powell will deliver a speech. As of Monday, the traders are expecting a 75% chance of 0.25% rate cut in September and 25% for a 0.5% cut, according to CME FedWatch tool.

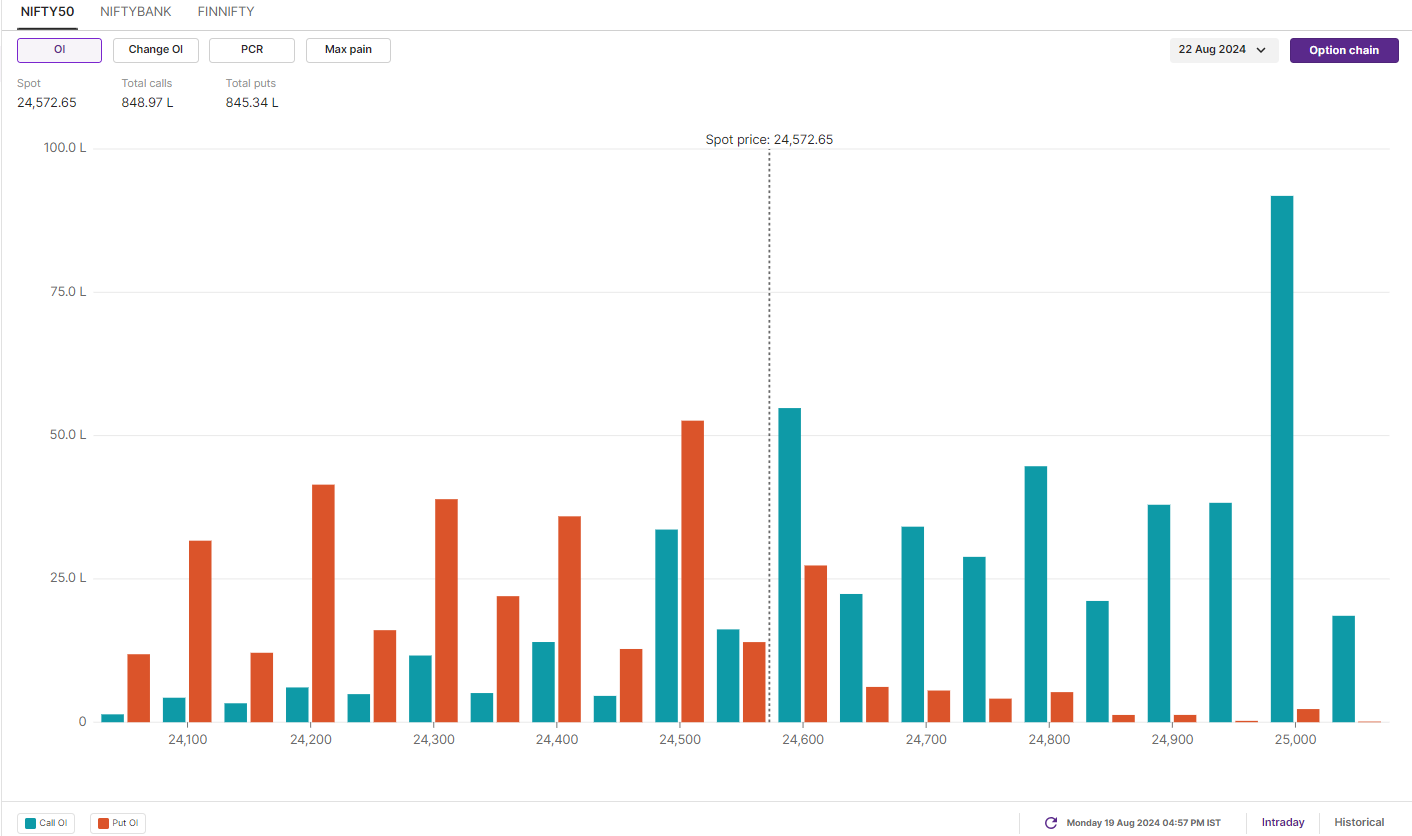

NIFTY50

August Futures: 24,595 (▲0.0%) Open Interest: 4,38,669 (▼2.9%)

The NIFTY50 index traded in a narrow range after a positive start and failed to build on to its opening gains, due to selling pressure in private banks. After the breakout on 16 August, the index retested Friday’s close and ended the day flat.

The index has filled the bearish gap formed on 5 August and is now at a crucial juncture. As we said in our blog on 19 August, the NIFTY50 could remain bullish until it breaks below the 24,350 and 24,400 zones. The index has immediate resistance at 24,700 and 24,800. Until the index breaches this area, it may remain range bound. However, a break of this move on either side may take the index to 25,000 or 24,000 levels.

The open interest data of 22 August expiry saw emergence of call writer at 24,600 and 24,800 strikes after the weekend. Traders may witness some resistance around this zone. On the other hand, put base remains stable at 24,500 and 24,000 strikes.

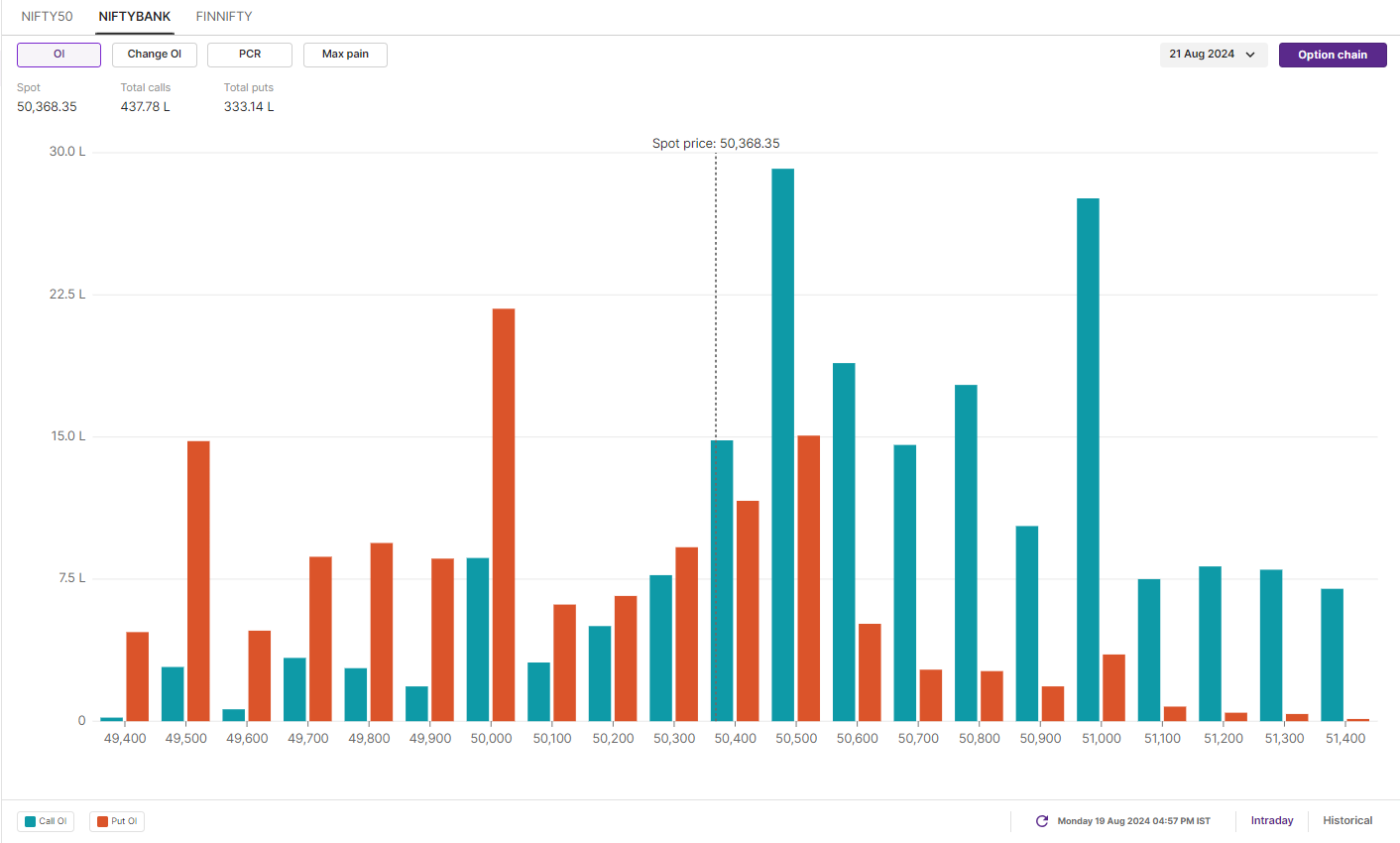

BANK NIFTY

August Futures: 50,485 (▼0.2%) Open Interest:2,02,142 (▲2.7%)

The BANK NIFTY index extended the consolidation for the tenth day in a row and failed to build on to opening gains, dragged by index heavyweight private banks.

The index is consolidating between 50,800 and 49,600 range for the past ten days, which broadly aligns with the 20-day and 100-day moving averages (DMAs) of BANK NIFTY. Additionally, the NIFTY50 index has filled the bearish gap formed on 5 August but the gap remains unfilled for BANK NIFTY.

Traders planning non-directional and directional strategies should closely monitor the 20 DMA and 100 DMA of BANK NIFTY. A break of these crucial levels on intraday or closing basis will result in a strong directional move.

Meanwhile, the open interest build-up for the 21 August expiry saw significant call writing at 50,500 and 51,000 strikes. The index may face resistance around these levels. On the flip side, the put base is established at 50,000 and 49,500 strikes, indicating a support for the index in these zones.

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini, Bandhan Bank, Birlasoft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, India Cements, IndiaMART InterMESH, LIC Housing Finance, Manappuram Finance, NMDC, Piramal Enterprises, Punjab National Bank, RBL Bank, Steel Authority of India and Sun TV

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story