Market News

Stock Market Weekly Recap: NIFTY, SENSEX start 2025 on a positive note; Maruti Suzuki, Oil India lead gains

.png)

5 min read | Updated on January 03, 2025, 22:48 IST

SUMMARY

Stock markets have started the New Year on a firm note despite bouts of strong selling during the week. Key stock indices SENSEX and NIFTY saw a see-saw trade as investors booked profits at every rise.

FII outflows, a depreciating rupee and waning hopes of a rate cut in 2025 will likely impact the stock market in the short term.

- On a weekly basis, SENSEX advanced 0.6% while NIFTY gained 0.7%.

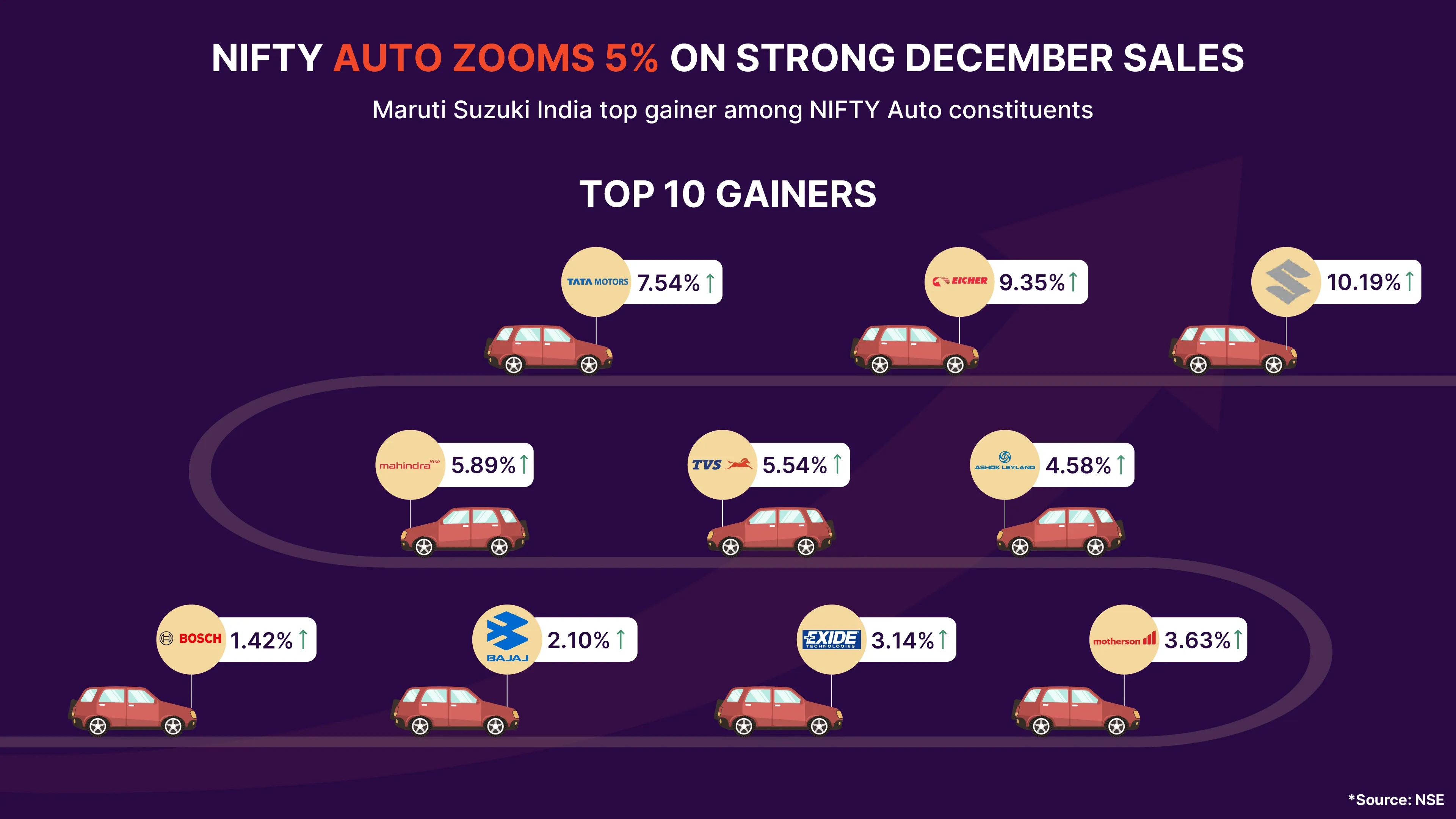

- Maruti Suzuki India rallied over 10% this week to emerge top gainer among NIFTY Auto constituents.

- Shares of state-run Oil India Limited surged 14% this week following a rebound in Brent crude prices.

Hey there! We are back with a quick recap of the markets in the first week of 2025.

Stock markets have started the New Year on a firm note despite bouts of strong selling during the week. Key stock indices SENSEX and NIFTY saw a see-saw trade as investors booked profits at every rise.

The US dollar breaching the 109 mark and rising 10-year bond yields triggered FII selling, which capped gains in key indices.

While better-than-expected December sales boosted auto and finance shares, a decline in India's manufacturing PMI in December and a month-on-month 2.97% decline in GST collections indicated a continued slowdown.

Slowing manufacturing growth raised fears that Q3 corporate earnings may not register a rebound, prompting investors to look for secure bets like IT and pharma stocks.

Stock markets turned volatile on Monday due to profit-taking at higher levels. Key indices gained in the first half but lost ground due to selling in blue-chips. Paring gains, NIFTY declined 168 points and SENSEX dropped 483 points.

The benchmark indices ended the last trading session of 2024 on Tuesday with minor losses after paring the day’s losses. FII selling, a strengthening dollar index and US bond yields dragged the indices. IT and realty shares dropped while other sectors advanced.

Stock markets started the New Year with a bang as key indices gained nearly half a per cent. Buying in blue-chips like HDFC Bank, Larsen & Toubro, Maruti Suzuki India, and Mahindra and Mahindra helped markets snap two days of losses. Encouraging December sales numbers from leading automakers aided the rally in NIFTY Auto.

SENSEX rose by 348 points while NIFTY gained 98 points to close above 23,700 level.

Continuing the fireworks on the second day of New Year, SENSEX rallied 1,436 points and NIFTY soared 445 points to mark their biggest single-day gains in more than a month. After scaling 80,000 levels, SENSEX closed at 79,943.71 and NIFTY settled at 24,188.65. Buying in financial, auto and IT shares amid FII inflows revived the markets.

However, investors preferred to book profit after a two-day rally on Friday, dragging key indices down up to 0.9%. SENSEX dropped by 0.9% to settle at 79,223.11 and NIFTY tanked 0.76% to close at 24,004.75. Energy and FMCG shares advanced while IT and pharma shares declined.

On a weekly basis, SENSEX advanced 0.6% while NIFTY gained 0.7%.

On the other hand, mid-cap and small-cap indices gained around 1.5%, outperforming large-caps.

Sector-wise, all sectoral indices ended in the green except for Realty (-1.8%) and Bank NIFTY (-0.5%). Oil and Gas (+4.3%), Auto (+3.9%), Consumer Durable (+3.3%), FMCG (2.3%,) and Pharma (+1%) were the major gainers.

Auto shares shine after December sales data

Auto shares, Eicher Motors, Maruti Suzuki India, M&M and Tata Motors rallied on Thursday after better sales data for December month. Gains in these shares took the sectoral NIFTY Auto index to a six month high and marked its best single-day gain in six months.

Eicher Motors rallied 7% following a 25% increase in December sales to 79,466 units. M&M, Maruti Suzuki India, and Tata Motors also gained by up to 7%.

Maruti reported a 30% rise in December sales powered by a rebound in its small car sales. M&M gained after better than expected December sales and on becoming eligible for government sops under EV scheme.

Maruti Suzuki India rallied over 10% this week to emerge top gainer among NIFTY Auto constituents.

Avenue Supermarts shares surge 15% after Q3 update

Oil India shares gain 14% this week

Shares of state-run Oil India Limited surged 14% this week following a rebound in Brent crude prices. The stock rose 1.5% on Wednesday followed by a 6% jump on Thursday. The stock hit an intraday high of ₹491.25 on the NSE on Friday, rising nearly 6%.

The PSU stock closed at ₹481.1 apiece on the NSE, extending the gains for the fourth straight day.

Railway stocks advance amid capex hopes ahead of Union Budget

Leading rail stocks such as RITES Ltd, RVNL Ltd IRFC, and IRCTC rose up to 7% this week following new order wins and expectations of increased government capex in the coming months. A higher allocation in the budget for railway infrastructure is also pushing the rail stocks.

What lies ahead?

FII outflows, a depreciating rupee and waning hopes of a rate cut in 2025 will likely impact the stock market in the short term. Reduced US jobless claims and potential policy shifts in the US suggest that the Fed Reserve may not cut interest rates as expected. The stock market is likely to focus on Q3 earnings, with expectations of improvement in earnings on a QoQ basis.

About The Author

Next Story