Market News

Stock Market Weekly Recap: NIFTY, SENSEX close lower for second week dragged by IT stocks

.png)

5 min read | Updated on January 17, 2025, 20:46 IST

SUMMARY

Benchmark indices, SENSEX and NIFTY, dropped 1% in a see-saw trade this week. Stock markets witnessed some volatility amid the ongoing Q3 results season, weakening rupee and global cues.

Stock list

On a weekly basis, SENSEX tanked 759.58 points, or 1%, while NIFTY shed 228.3 points, or 0.99%.

- The FIIs sold shares worth nearly ₹25,000 crore this week in the cash segment.

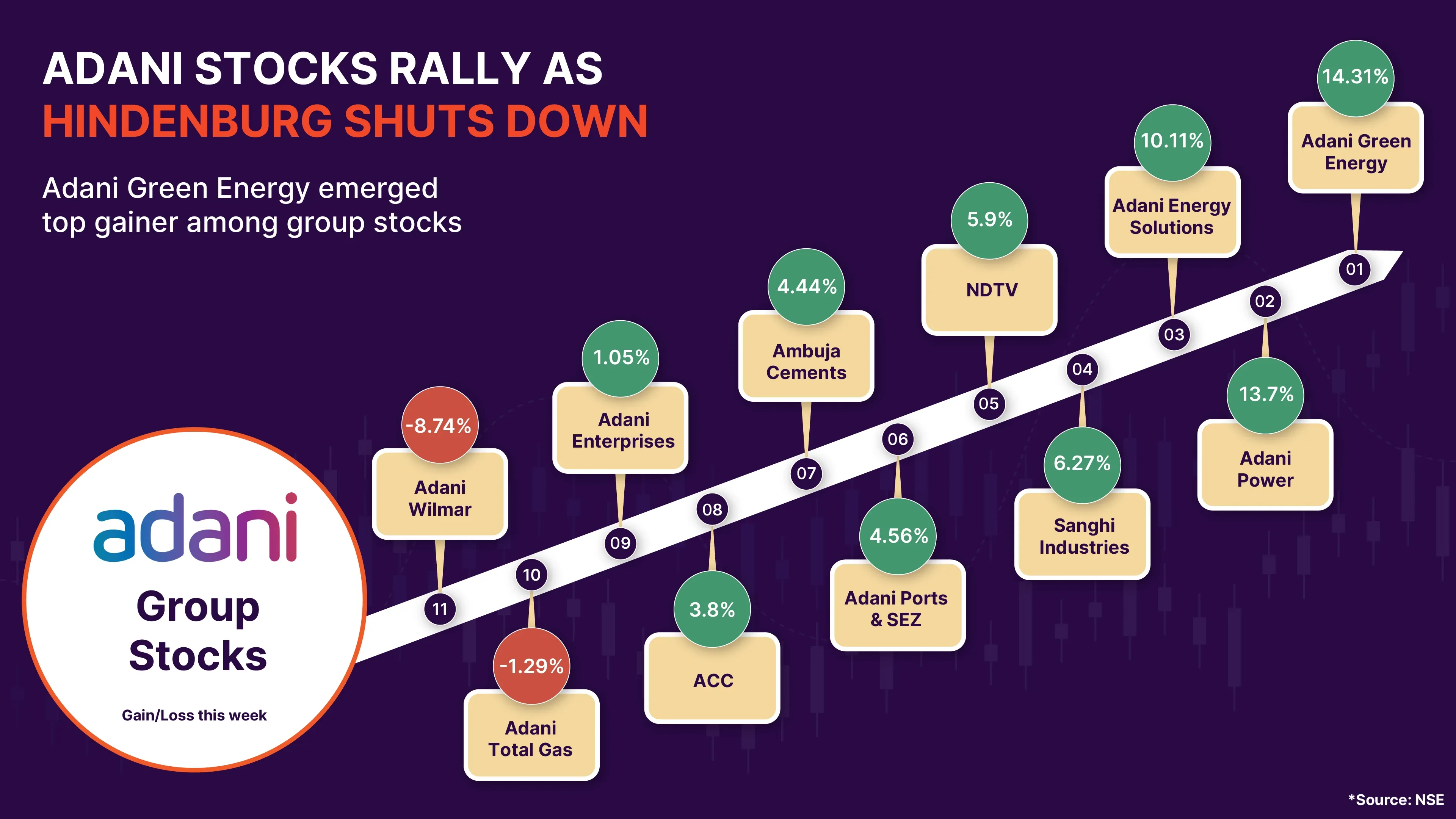

- Adani Group shares rallied up to 14% this week after Hindenburg Research shut down.

- HCL Technologies, and Infosys dropped up to 9% this week after Q3 results.

Hi folks! We are back with a wrap of stock markets in an eventful week, marked by key indices extending weekly losses.

Benchmark indices, SENSEX and NIFTY, dropped 1% in a see-saw trade this week. Stock markets witnessed some volatility amid the ongoing Q3 results season, weakening rupee and global cues.

On a weekly basis, SENSEX tanked 759.58 points, or 1%, while NIFTY shed 228.3 points, or 0.99%.

The foreign institutional investors (FIIs) sold shares worth nearly ₹25,000 crore this week in the cash segment.

A spike in global crude oil price, strong US jobs data denting hopes of early rate cuts, and the rupee falling to record low levels dampened investor sentiment.

However, easing consumer inflation numbers in India and the US were welcomed by investors, who now see some room for at least two rate cuts by the US Federal Reserve this year.

Continuing the falling streak for the fourth day, stock markets started the week on a weak footing. Benchmark indices tanked more than 1.5% on Monday due to selling across sectors. NIFTY dropped 345 points to settle near the day’s low at 23,085.95, while SENSEX shed nearly 1,049 points to close at 76,330.01.

The broader indices plunged nearly 4% each as the rupee logged its biggest single-day fall in two years. The four-day slide to Monday led to erosion of around ₹24 lakh crore of investors’ wealth.

Stock markets found some relief on Tuesday after easing inflation and global stock recovery. NIFTY recovered 90 points and SENSEX 169 points to end their falling streak as metal, energy ,and financials shares advanced. Retail inflation falling to a 4-month low of 5.22% in December was also a breather for investors.

The key indices advanced for the next two days in range-bound trade, with NIFTY regaining 23,300 levels on Thursday. Lower-than-expected CPI inflation in the US rekindled rate-cut hopes and supported riskier assets.

The recovery, however, was short-lived as selling in IT and banking shares on Friday ended the three-day gaining streak. While a pullback in bond yields was welcomed by investors, persistent FII selling weighed on the sentiment.

SENSEX dropped 423 points, or 0.55%, to settle at 76,619.33. NIFTY declined 108.6 points, or 0.47%, to close at 23,203.2.

NIFTY IT lead loser among sectoral indices

The broader market saw negative trends, with mid-cap and small-cap indices falling 1% this week.

Among the sectors, the IT index declined the most, losing over 5%. FMCG (-2.1%), Consumer Durable (-2.7%), Realty (-2.5%) and Pharma (-1.3%) also dropped. On the other hand, Power (4.42%), Metals (3.75%), PSU Bank (3%), Capital goods (1.3%), and Oil and Gas (0.5%) advanced.

Adani stocks shine after Hindenburg Research announces closure

Adani Group shares rallied up to 14% this week on market buzz around Gautam Adani getting relief in the bribery charges indictment after Donald Trump took over as the US President. Hindenburg Research, which caused a meltdown in Adani Group shares and wiped billions of investors’ wealth due to its hard-hitting reports, also announced the closure on Thursday. This led to a rally in Adani Group stocks.

HCL, Infosys tanks up to 9% after Q3 results

Shares of IT major HCL Tech and Infosys dropped following the announcement of their quarterly financial results. HCL Tech dropped 9% on Tuesday, even as the company announced a 5.54% rise in consolidated net profit to ₹4,591 crore for the October-December quarter. Experts termed the Q3 numbers and its outlook underwhelming. HCL Tech stocks closed 10% lower this week.

Its close rival Infosys dropped nearly 6% to emerge as the lead loser among NIFTY shares on Friday. Infosys Q3 revenue was above estimates, while EBIT margin was in line with expectations. Fertiliser, chemical shares gain on soda ash price rise

What lies ahead?

Markets may remain cautious in the short term due to moderate Q3 expectations. FII outflows could also increase volatility. Investors will be watchful of the new US government’s policies and comments next week.

About The Author

Next Story