Market News

Market weekly wrap: SENSEX, NIFTY extend gains to record eighth week

.png)

4 min read | Updated on July 27, 2024, 08:09 IST

SUMMARY

Except for Friday, key indices closed in red this week after the Budget presentation. The bearish trend could be attributed to the government's proposals on security transaction tax and short-term capital gains tax, and weak global cues.

Stock list

NIFTY and SENSEX staged a remarkable recovery on Friday, recouping the weekly losses (Image: PTI)

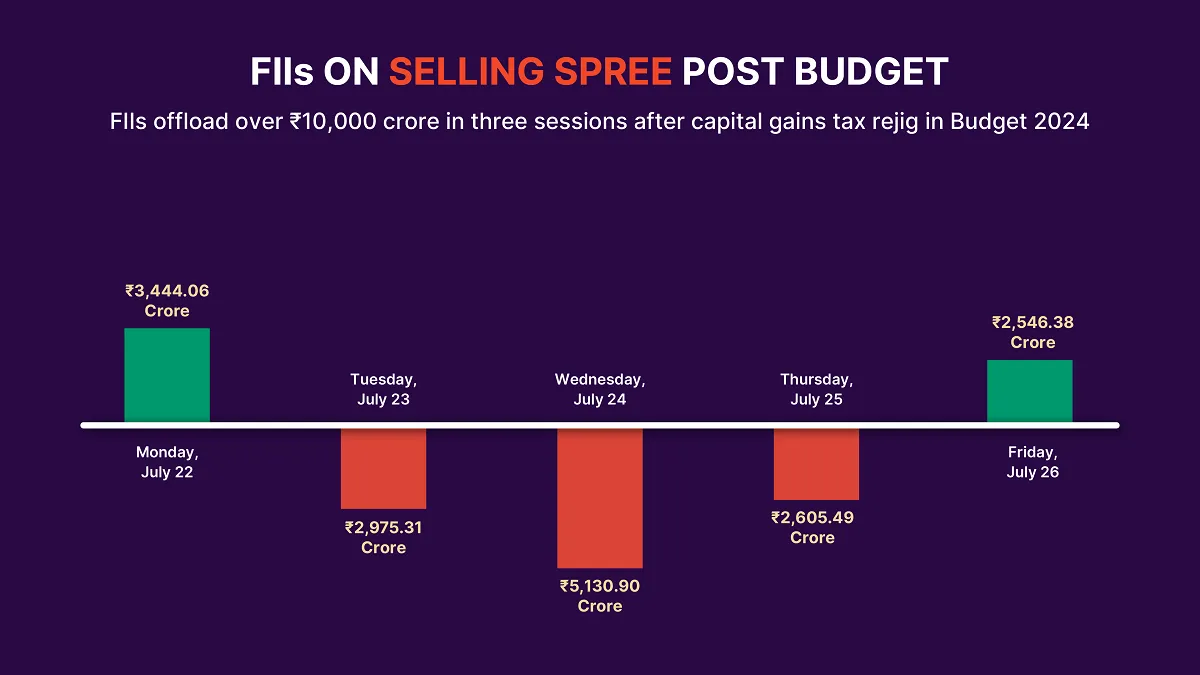

- Foreign institutional investors (FIIs) turned net sellers this week.

- FIIs offloaded more than ₹10,000 crore from Indian equities in just three sessions after Budget 2024.

- ITC led the gains in the FMCG segment this week rising up to 6%.

Benchmark indices SENSEX and NIFTY traded lower for the most part of the week before staging a smart rebound on Friday, recouping losses. On a weekly basis, SENSEX closed 728 points, or 0.9%, higher while NIFTY advanced 303 points, or 1.2%, marking their eighth consecutive week of gains.

Global markets were also mixed this week due to losses in technology shares.

Stock markets started the week on a cautious note ahead of the Union Budget. NIFTY opened lower and moved within a range before closing at 24,509.25 on Monday. A conservative growth forecast of 6.5 to 7% for 2024-25 in the Economic Survey also added to volatility. Below expectations June quarter results by Reliance Industries also weighed on market sentiment.

Stock markets witnessed wild swings on the eventful Budget day on Tuesday as Finance Minister Nirmala Sitharaman unveiled proposals for the current fiscal. Indices started the day higher but tanked more than 2% as soon as the finance minister announced a hike in security transaction tax on futures and options, and raised LTCG and STCG taxes.

Financial and banking shares took a hit. However, proposals on income tax sops and customs duty cuts came as a relief for FMCG and consumer durable goods.

Gains in consumer and FMCG shares like ITC helped restrict losses in indices. SENSEX and NIFTY ended the eventful day almost flat. NIFTY settled at 24,479.05 on Tuesday. The broader indices declined between 0.6% and 0.9%.

Stock markets saw a lacklustre trade on Wednesday and closed marginally lower.

NIFTY and SENSEX staged a remarkable recovery on Friday, recouping the weekly losses. Positive US GDP data fueled buying in IT shares while value buying in other bluechips like Airtel and Reliance Industries helped indices close higher by nearly 2%. The rebound was fueled by robust performances in IT and metal stocks, and significant rollovers to the August series. Broader indices also showed substantial gains.

NIFTY closed at 24,834.85, up by 428.75 points or 1.76% on Friday, while SENSEX closed 1.62% higher at 81,332.72.

FIIs turn net sellers in eventful week

Foreign institutional investors turned net sellers this week after remaining buyers in most of July. A hike in STT and STCG as well as conservative growth forecasts were the key triggers for FIIs to exit Indian equities. FIIs offloaded more than ₹10,000 crore from Indian equities in the cash segment in just three sessions after Budget 2024. However, FIIs remained net buyers this month so far, putting in nearly ₹17,000 crore in Indian shares.

ITC lead FMCG share rally after budget proposals

Hotels to cigarettes giant ITC led the gains in the FMCG segment this week, spurting up to 6%. The government announced no new tax on tobacco products in the Union Budget which helped lift the ITC shares. The Cigarette segment accounts for a significant portion of the FMCG major’s revenue as well as profits. Other proposals on tax and duty cuts, experts say, would drive demand for consumer products.

What lies ahead?

Stock markets will be guided by quarterly earnings next week. As the key event of the Union Budget is over, markets will focus on domestic triggers. Moving forward, the direction of the domestic market will likely be influenced by the progress of the earnings season. Additionally, global economic updates, including US Fed & BoE monetary policies, US employment data, and Eurozone GDP figures, are expected to impact market trends.

About The Author

Next Story