Market News

Budget 2024: BANK NIFTY historical trends and options strategies to consider on July 23

.png)

5 min read | Updated on July 22, 2024, 09:39 IST

SUMMARY

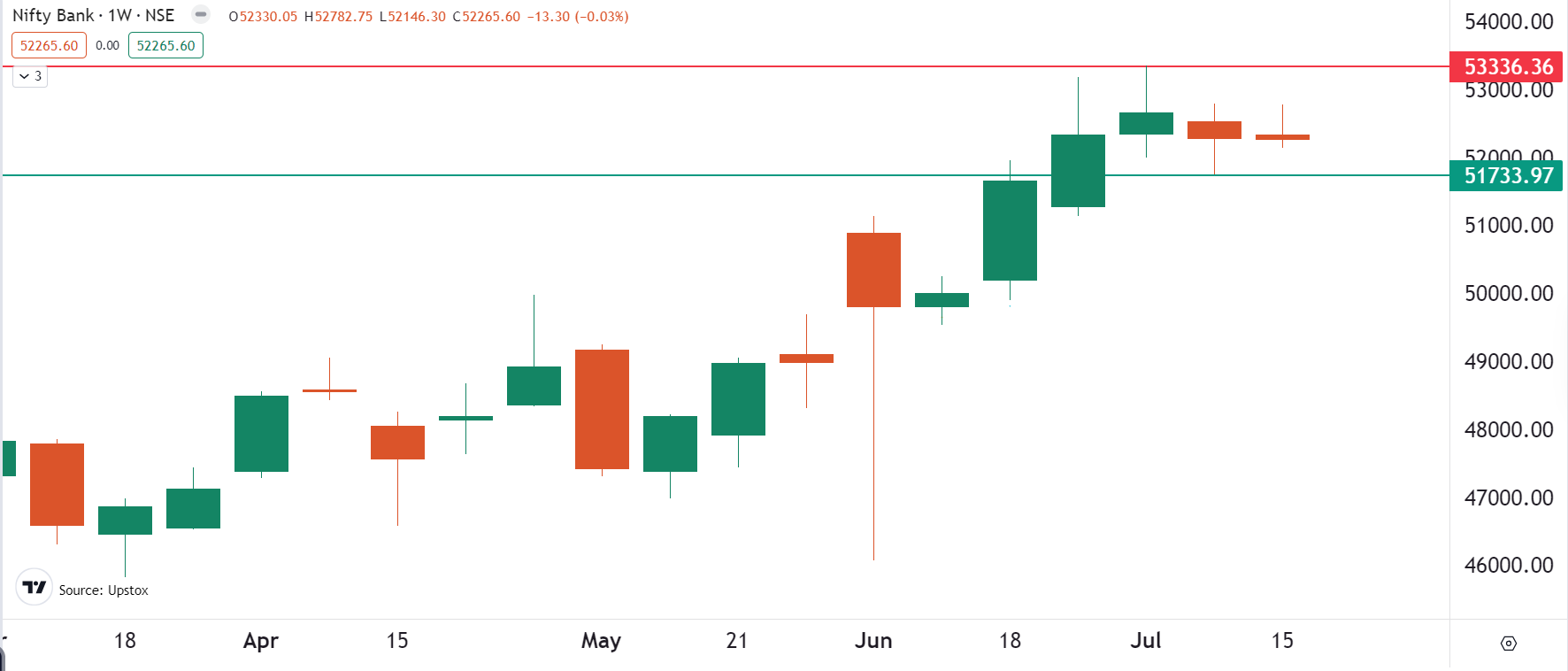

The BANK NIFTY has largely consolidated between 52,800 and 51,700 levels for the past 10 trading sessions. The index has also formed an inside candle on the weekly chart, indicating a contraction of the range ahead of the Union Budget announcement and HDFC Bank earnings.

Stock list

BANK NIFTY strategy: Budget day historical trends and options strategies to capture volatility

With Budget Day just around the corner, market participants will be closely watching the performance of the BANK NIFTY index. The banking index has risen over 13% since the outcome of the General Elections on June 4 and has been steadily rising. However, over the past two weeks, the index has lost some positive momentum and largely consolidated in a range. This has led to both caution and optimism.

In addition, the index will first react to the FY25 first-quarter results of heavyweights HDFC Bank and Kotak Mahindra Bank. Both banks' earnings and net profit were above or in line with street estimates. Following this, the attention will shift to the Union Budget.

It is important to examine the historical data and understand the patterns surrounding Budget Day movements in order to formulate strategies.

Historical performance of BANK NIFTY during budget days

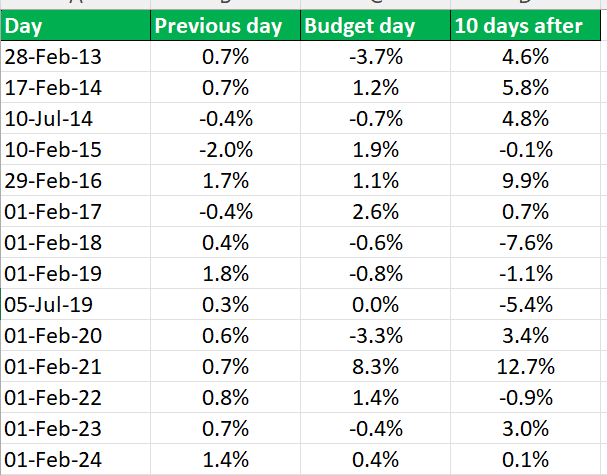

Looking at the historical data of the last 14 budget sessions, the BANK NIFTY has been anything but predictable. Over the last 14 budget sessions:

- BANK NIFTY closed in the green 8 out of 14 times, showing a balance between gains and losses.

- The average return of the BANK NIFTY on the budget day is around 0.5%.

- BANK NIFTY has shown a stronger tendency to rise after the budget day. The index has posted positive returns on 9 out of 14 occasions after the volatility around Budget Day.

- The average return after 10 days from the budget is approximately 2.1%.

- Considering the sharp negative momentum seen 10 days after the Budget in February 2018 and July 2019, the index shows a tendency to make significant moves in either direction. This occurs as it digests the details of the Union Budget.

Technical and options overview

For the past two weeks, ahead of Q1 results from banking heavyweights and the Union Budget, the BANK NIFTY has been consolidating between the 52,800 and 51,700 zones.

Amid this range-bound movement and contraction, the index has formed an inside candle on the weekly chart. For directional clues and a potential range expansion, traders are advised to closely monitor the break of the high and low of the inside candle on the daily chart. Additionally, a close above this area on the daily chart will provide traders with further directional insight.

Based on implied volatility and price movements as of 19 July, the options market expects the BANK NIFTY index to move ±2.1% by the time options expire on 24 July.

The Union Budget will be presented on 23 July, a day before the expiry of the BANK NIFTY options contracts. This indicates the potential for sharp swings in the index following the announcement of the Union Budget and ahead of the monthly expiry of its futures and options contracts on 31 July.

After reviewing the historical and implied movements of the index on Budget Day, let's look at the options strategies traders can use to navigate these expected market fluctuations.

Options strategies before the budget day

-

Short straddle: This strategy involves selling the at-the-money (ATM) call and put strikes of the index on the same date and expiry. In simple terms, this strategy is apt for traders who expect that BANK NIFTY will not move beyond ±2.1% until the expiry of its contracts on 24 July. Since it involves selling options, the strategy profits from the fall in implied volatility.

-

Long Straddle: Conversely, this strategy involves buying both the at-the-money call and put options of the same date and expiry. This strategy is suitable for traders who expect the BANK NIFTY index to make a significant move of more than ±2.1% before 24 July or the expiry of the monthly contracts. However, for monthly contracts, traders should select the ATM strikes of the 31 July expiry.

Options strategies after the Budget day

-

Bull call spread: This strategy involves purchasing a call option at a lower strike price while selling another call option at a higher strike price. It's suitable for traders who are bullish on the BANK NIFTY and expect it to move moderately to significantly higher.

-

Bear put spread: This strategy consists of buying a put option at a higher strike price and selling another put option at a lower strike price. It's a bearish approach, ideal for traders expecting a moderate decline in BANK NIFTY.

Interested in learning more about options strategies? Check out our UpLearn educational content for a deeper dive. If you're keen on exploring more historical data like the example above, join our community and get in touch—we'd be happy to share it with you!

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story