Market News

Will Indian blockbuster movies revive PVR INOX stock in the long run?

.png)

4 min read | Updated on December 11, 2024, 18:18 IST

SUMMARY

'Pushpa 2: The Rule' is increasing attendance at PVR INOX theatres. Despite recent financial difficulties, tactical initiatives such as re-releases, the addition of new screens, and collaborations are focused on increasing revenue. Encouraging developments in advance ticket sales indicate a rising consumer enthusiasm for movies, pointing towards a possible rebound for the multiplex chain.

Stock list

PVR INOX added 71 new screens in H1FY25, with plans to open 110 to 120 new screens by year-end.

This is positive news for the multiplex chain operator PVR INOX, as the excitement surrounding Allu Arjun’s return is likely to increase footfall and drive revenue growth.

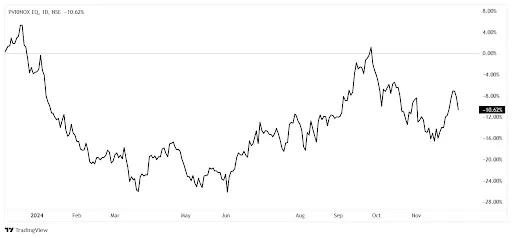

The stock price of PVR INOX has declined over 11% since 1 October 2024, while it had negative returns of 10.58% in the last one year. In the long run of 14 years, the stock price has shown a compounded annual growth rate (CAGR) of 18.83%.

Since the pandemic outbreak, PVR has been grappling with challenges. In FY25, for the first two quarters, the company recorded losses. The April-June quarter was affected by general elections coinciding with the IPL, resulting in many producers delaying their film releases. Nevertheless, the company experienced some improvement in the second quarter.

In Q2FY25, the company reported a total revenue of ₹1,642 crore, an EBITDA of ₹207 crore, and a loss of ₹12 crore. This represents a decrease from the Q2FY24 when revenue was ₹2,020 crore, EBITDA was ₹447 crore, and PAT was ₹166 crore. During the quarter, the company welcomed 38.8 million guests, with a notable 40% sequential rise in box office collections, driven by strong Bollywood releases.

Box office highlights:

- "Stree 2" became the highest-grossing Hindi film of all time.

- "Deadpool & Wolverine" achieved $1.3 billion at the global box office.

- Successful re-releases contributed nearly 6% of admissions.

Re-release strategy

Successful re-releases have been a tactical move to enhance cinema attendance during lean periods. The management indicated that re-releases are profitable, particularly during weeks with fewer new releases. It also said that internal teams are continuously scouting for opportunities to curate content for re-releases.

The company added 71 new screens in H1FY25, with plans to open 110 to 120 new screens by year-end. Currently, it has a screened portfolio of 1,747 screens across 356 cinemas in 111 cities in India and Sri Lanka.

The occupancy rate for Q2 FY25 is currently at 25.7%. The management is striving to boost this figure by focusing on improved film line-ups and strategic planning. They are also making efforts to renegotiate rental terms, especially for properties that are not performing well, to manage costs. Controlling fixed expenses remains a crucial focus for increasing profitability for the company.

Film production is anticipated to rise significantly in FY26 as filmmakers become more active after COVID-19, leading to a healthier slate of releases. There is an increasing consumer interest in cinematic experiences, evidenced by a high turnout for initiatives such as National Cinema Day.

Management identifies growth potential in Food & Beverage (F&B) expenditures per guest and is investigating creative options to boost sales. The collaboration with Devyani International is on track, with the first food court anticipated to open in December. Moreover, the PVR Cinemagic concept is being enhanced based on customer feedback, with plans for further expansion.

Will Indian blockbuster movies revive PVR INOX stock in the long run?

Potentially strong and capable of becoming a blockbuster film like “Pushpa 2: The Rule” can positively influence PVR INOX stock over time by increasing attendance and revenue growth. Although FY25 has brought some difficulties, the company’s strategic plans, including re-releases, the addition of new screens, and partnerships, combined with an expected rise in film production in FY26, put it in a strong position for recovery.

However, a sustained long-term recovery will rely on consistent content success, improvements in occupancy rates, and effective cost management. If these elements converge, Indian blockbusters could significantly contribute to the stock's long-term growth trajectory.

About The Author

Next Story