Market News

Will falling crude prices fuel more gain in oil & gas stocks? check technical levels and insights

.png)

4 min read | Updated on June 30, 2025, 09:34 IST

SUMMARY

The ceasefire between Iran and Israel has eased geopolitical tensions, driving crude oil prices lower, which is positive for downstream oil companies like HPCL, BPCL and Indian Oil.

Stock list

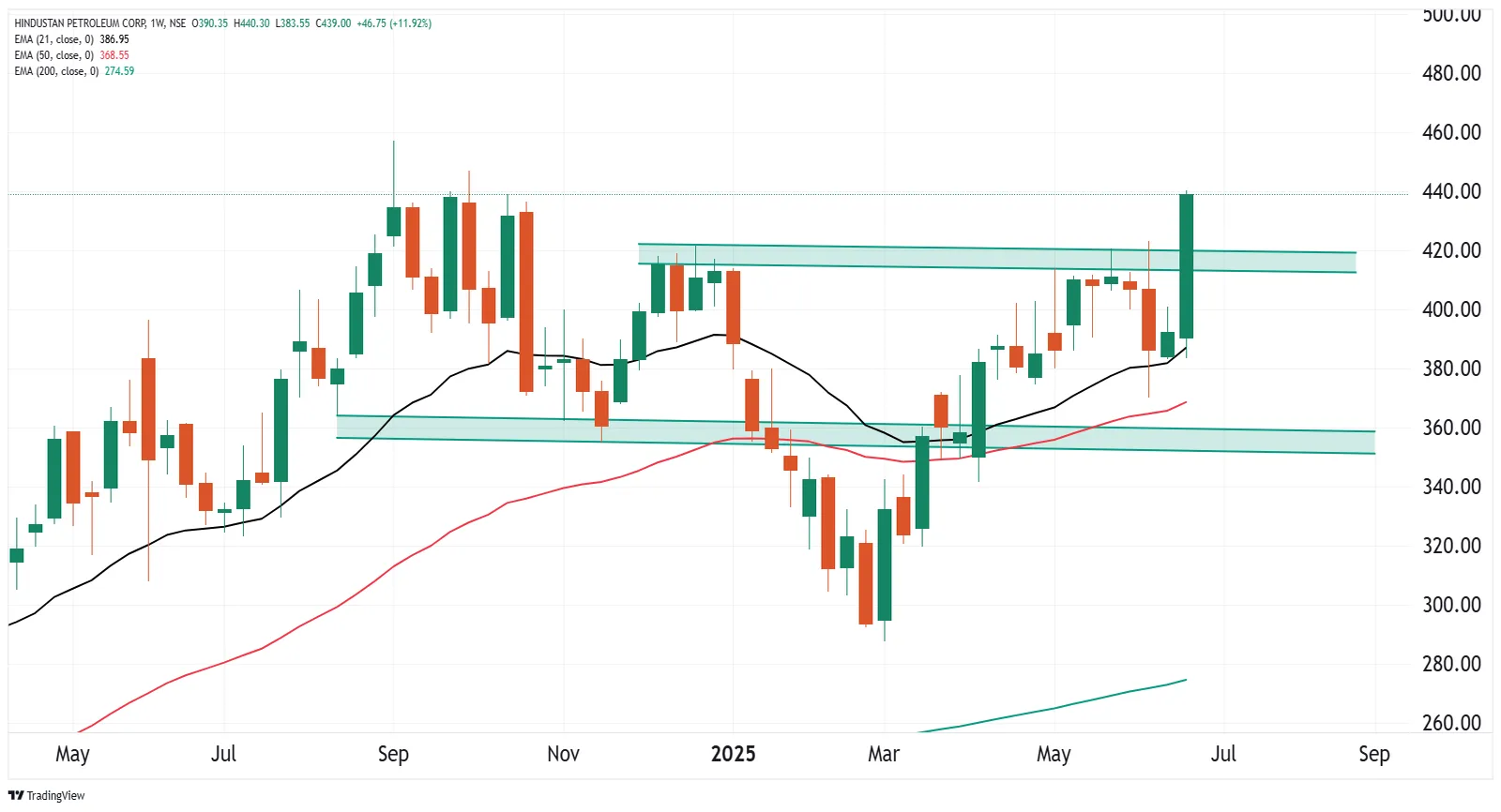

Hindustan Petroleum zoomed past its immediate resistance zone of ₹420 and formed a bullish candle on the weekly chart. | Image: Shutterstock

Oil and gas stocks were in focus last week as shares of major oil marketing companies—HPCL, BPCL, and Indian Oil—rose between 6% and 11% following a sharp drop in global crude oil prices after the Israel-Iran ceasefire. Reliance Industries and GAIL (India) also gained, closing 3.3% and 5% higher, respectively. The NIFTY Oil & Gas index ended the week up 3.2%.

Brent crude prices fell from $75 to around $65 per barrel as geopolitical tensions eased. According to analysts, lower crude prices are a positive for both oil and gas stocks and the broader economy. Meanwhile, cheaper oil helps keep domestic inflation and the Indian rupee in check.

Rising crude prices, on the other hand, hurt oil marketing companies like BPCL, HPCL, and IOCL, as higher input costs squeeze their profitability. These companies earn profits—known as marketing margins—from the gap between crude oil costs and retail fuel prices. When crude prices rise but pump prices remain unchanged, margins shrink. So, a decline in crude prices improves their earnings by boosting margins.

Technical view

From the technical standpoint, NIFTY Oil & Gas sector formed a bullish candle on the weekly chart and bullish candle on the weekly chart as it decisively broke out of a five-week consolidation. Additionally, the index experienced a bullish crossover of its 21-week and 50-week exponential moving averages, signaling a potential shift in momentum and suggesting that the sector is entering a sustained uptrend with increasing buying interest.

Stocks in focus

Hindustan Petroleum zoomed past its immediate resistance zone of ₹420 and formed a bullish candle on the weekly chart. The stock took support from its 21-week exponential moving average (EMA) and surged over 11% last week, indicating support based buying from lower levels. For short-term clues, traders can monitor the immediate support zone of ₹420 and a rebound from this zone after the breakout.

Indian oil corporation jumped over 6% and formed a bullish engulfing candle on the weekly chart. The stock also reclaimed its 21-week and 50-week EMAs and closed above the previous week’s high.

Mahanagar Gas also sustained the positive momentum for the second week in a row and closed at nine month high. The stock also reclaimed its weekly 21 and 50 EMAs but has now reached an immediate resistance zone of ₹1,560. Unless it reclaims this zone on a closing basis, the trend may remain rangebound to positive.

Outlook on HPCL, BPCL and Mahanagar Gas

Traders anticipating that Hindustan Petroleum, Bharat Petroleum and Mahanagar Gas will sustain their bullish momentum can plan strategies like bull call spread or a bull put spread.

For example, let’s look at the options structure of Hindustan Petroleum (HINDPETRO) to understand the strategy.

Hindustan Petroleum’s monthly contracts expiring in July have the at-the-money (ATM) strike at 440. On Friday, the stock closed at ₹439. Traders expecting a continuation of bullish momentum or the retesting of the crucial support zones can consider a bull call spread strategy.

The strategy involves buying an ATM call and selling a call option one strike above it. This implies the breakeven point of 442, which is 0.6% above Friday’s close. Meanwhile, the bull put spread involves selling the ATM put and buying a put option one strike below it.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story