Market News

Vishal Mega Mart gains 40% on Listing: A comparative analysis of Trent, DMart, and Vishal Mega Mart

.png)

5 min read | Updated on December 26, 2024, 16:49 IST

SUMMARY

After Vishal Mega Mart’s stellar entry on the bourse with 41% gains. Competition in the rapidly growing retail sector intensifies among organised players like Trent, DMart, and the new debutant Vishal Mega Mart. Here’s a brief comparison between Trent, DMart and Vishal Mega Mart.

Vishal Mega Mart Gains 40% on Listing: A Comparative Analysis of Trent, DMart, and Vishal Mega Mart

Vishal Mega Mart’s stellar listing on the stock exchange with a 41% gain. The IPO of Vishal Mega Mart was valued at ₹8,000 crore and received strong participation from investors, with the issue being oversubscribed 28x.

The overall retail market, estimated at ₹93 trillion in FY24, is poised to grow at a CAGR of 10-11% through 2028, reaching $2 trillion by 2032, according to an analysis by the Boston Consulting Group (BCG). Organised retail accounts for ₹11 trillion (12% of the market) and is expanding rapidly, particularly in food and grocery, representing 20% of the segment. Rising disposable income, a shifting consumer preference towards branded products, increased quality expectations, and a wide variety of product offerings give an edge to organised players in the retail sector.

Here's a comparison of popular retail stocks- Trent Ltd, Avenue Supermart (DMart) Ltd, and Vishal Mega Mart Ltd.

Trent, a Tata Group company, provides diverse retail brands like Westside and Zudio for fashion and Star supermarkets for groceries with exclusive brands. DMart is a supermarket retail chain offering value-retailing across food, FMCG, and apparel. Vishal Mega Mart is a hypermarket that cater to varied needs, including groceries, electronics, and home essentials.

Valuation

| Stocks | Trent | DMart | Vishal Mega Mart |

|---|---|---|---|

| Market Cap | ₹2,50,974 crore | ₹2,27,242 crore | ₹48,017 crore |

| EV/EBITDA Multiple | 92.3x | 50.6x | 38.5x |

| P/E Ratio | 186x | 85.1x | 106x |

| ROE | 27.2% | 14.5% | 8.41% |

| (Source - Screener.in) |

Trent is the largest retail chain company by market cap, closely followed by DMart. Trent and DMart’s size reflects their maturity in the sector, compared with the new debut Vishal Mega Mart.

The EV/EBITDA multiple reflects the valuation of the company's core operations. Trent’s multiple at 93x is at a significant premium compared with DMart’s 50.6x and Vishal Mega Mart’s 38.5x. However the higher multiple also reflects on the market position of the company.

In terms of the P/E ratio, DMart trades at a lower valuation of 85.1x, while Trent and Vishal Mega Mart trade at a premium with a P/E multiple of 186x and 108x, respectively. DMart valuation gap is amid the rise of the quick commerce model giving a hard time for DMart’s value play.

However, it must be noted that Trent’s premium valuation is supported by its superior RoE of 27.2%, indicating stable profitability. In comparison, DMart’s RoE of 14.5% is good but almost half of the Trent. At the same time, Vishal Mega Mart, which trades higher than Dmar,t has a lower RoE of 8.41%.

Share price performance

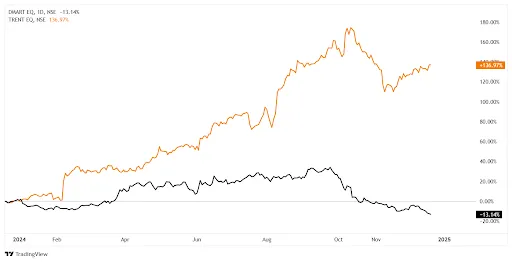

In the last year, Trent has delivered a 136.97% return and DMart (-)13.14%, Whereas newly debutant Vishal Mega Mart on listing day ended with a 43.5% gain.

(Source -Tradingview.com)

Q2FY25’s Financials

| Stocks | Trent | DMart | Vishal Mega Mart |

|---|---|---|---|

| Sales | ₹4,157 crore | ₹14,444 crore | ₹5,033 crore |

| EBITDA | ₹643 crore | ₹1,094 crore | ₹668 crore |

| Profit After Tax (PAT) | ₹335 crore | ₹659 crore | ₹254 crore |

| (Source- Screener.com) |

In Q2FY25, Trent's sales grew 39.37% YoY, DMart's sales grew 14.42% YoY, and Vishal Mega Mart’s sales grew 19.29% YoY.

Trent’s profitability was led by an EBITDA margin of 15%, resulting in a PAT margin of 8.06%. DMart displayed a single-digit increase in PAT YoY of 5.78% with a steady EBITDA margin of 8% and a PAT margin of 4.56%. Vishal Mega Mart showed strong sales growth with an EBITDA margin of 13% but reported a weaker PAT margin of 5.05% due to higher non-operating expenses.

Q2FY25 Business performance

Asset utilisation

Trent and D’Mart both lead in efficiency. Trent has the highest return on capital employed (ROCE) of 23.8%, whereas D’Mart has the highest Return on Assets (ROA) of 12.8%. Trent’s ROA is 11.9%, and D’Mart’s ROCE is 19.4%, representing better capital utilisation. However, Vishal Mega Mart lagged with an ROCE of 11.4% and an ROA of 5.40%.

Conclusion

The Retail sector remains fast-growing, with urbanisation and premiumisation driving growth. However, this sector will likely see dynamic competition with the entry of asset-light Vishal Mega Mart. Trent leads with profitability and rapid expansion. DMart edges with efficiency and cost management. It will be interesting to see how Vishal Mega Mart plays in this investor's favourite sectors.

About The Author

Next Story