Market News

Vedanta share price falls over 3% on January 8; Metal giant shares 5 key statistics that shareholders must know

.png)

4 min read | Updated on January 08, 2026, 13:52 IST

SUMMARY

Vedanta share price: Vedanta last week said it has reported a rise in production of aluminium, zinc and iron ore during the December quarter (Q3 FY26). However, production of steel and oil and gas dropped during the third quarter of the current fiscal year.

Stock list

Vedanta Group is a global leader in critical minerals, transition metals, energy, and technology. | image: Shutterstock

Apart from the weak global cues, the slide in metal stocks could be attributed to profit-booking in recent outperforming stocks such as Hindustan Copper, Hindustan Zinc (HZL), NALCO, Hindalco, and Vedanta, among others.

Besides, a sharp fall in commodity prices, such as copper and silver, after a spectacular rally, weighed on the investor sentiment.

Vedanta shares were trading 3.3% lower at ₹601.80 apiece on the NSE at the time of writing this report.

On Wednesday, Vedanta shared the latest updates for December 2025 in its report titled "Insights by Vedanta".

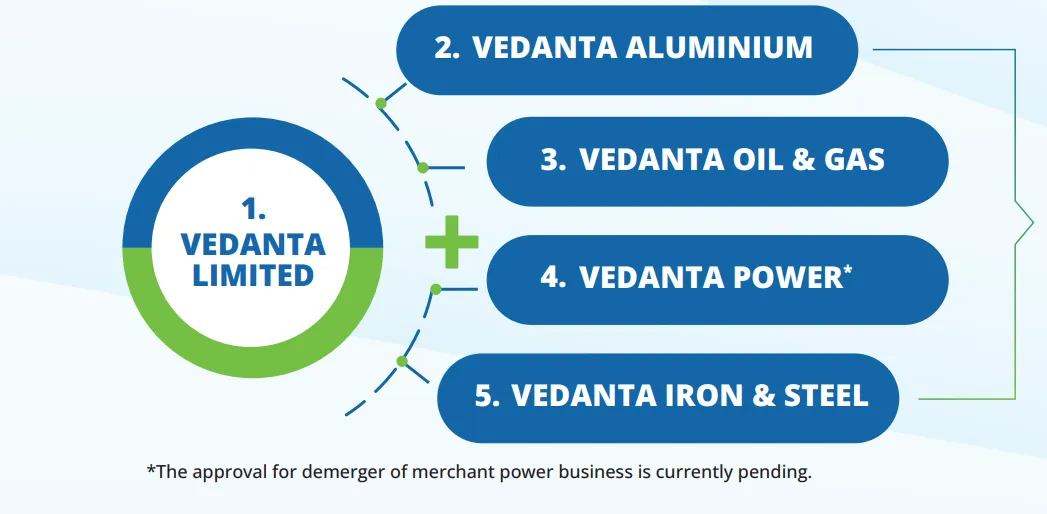

Vedanta said that in a landmark decision, the Mumbai Bench of the NCLT has approved the company’s demerger into independent, pure-play companies, marking a key milestone in Vedanta’s transformation into focused, sector-leading companies.

-

With this, Vedanta now enters the execution phase of a transformational demerger, leading to five separate listed companies.

-

Each entity will have a clear strategic mandate, focused leadership teams, and dedicated capital structures.

-

This transition strengthens "our ability to grow as focused businesses while creating long-term value aligned with rapidly growing global and Indian demand," the company said.

-

Vedanta Limited;

-

Vedanta Aluminium;

-

Vedanta Oil & Gas;

-

Vedanta Power; (The approval for the demerger of the merchant power business is currently pending)

-

Vedanta Iron & Steel.

Post demerger, for every share held in Vedanta Limited, shareholders will additionally receive one share each of the four newly demerged entities.

Commodity prices

Vedanta noted that 2025 was defined by heightened volatility, a major geopolitical focus on supply chain security, and the early stage of a global commodity supercycle driven by energy transition demand.

-

Precious metals, namely gold and silver, led sector performance with a YTD gain of +104%.

-

Industrial metals saw strong growth, as upside momentum rose through a combination of a structural rise in metals’ demand, stockpiling by manufacturers, and institutional and retail inflows into commodity-denominated funds.

Key annual trends and statistics

Vedanta Q3 updates

Mining giant Vedanta last week said it has reported a rise in production of aluminium, zinc and iron ore during the December quarter (Q3 FY26).

However, production of steel and oil and gas dropped during the third quarter of the current fiscal year.

The company's total aluminium production during the quarter rose marginally by 1%, mined metal production at Zinc India increased 4%, and mined metal production at Zinc International rose 28%.

In the oil and gas segment, Vedanta's average daily gross operated production dropped 15% during the quarter to 84,900 barrels of oil equivalent per day (boepd).

The production of saleable iron ore rose 3% to 1.6 million tonnes during the quarter.

The quarterly saleable ore production was "up 3% YoY and 49% Q-o-Q with improved operational efficiencies," Vedanta said in a regulatory filing.

The saleable steel production during the quarter declined marginally by 1%, the filing said.

Vedanta Group is a global leader in critical minerals, transition metals, energy, and technology, with operations spanning India, South Africa, Namibia, Liberia, the UAE, Saudi Arabia, Korea, Taiwan, and Japan.

Related News

About The Author

Next Story