Market News

Six stocks from NIFTY 500 universe give over 100% returns in 12 months; check the list and key details

.png)

4 min read | Updated on February 21, 2025, 14:23 IST

SUMMARY

Stock market today: Other notable names that have given over 80% returns during the past 12 months are One97 Communications (up 93%), Kirloskar Brothers (up 89%), Hitachi Energy India (up 97%), and Suven Pharma (up 82%).

Bharti Hexacom shares have also given over 130% returns since their listing on the bourses on April 12, 2024. Image: Freepik

According to Trendlyne data, six stocks from the NIFTY 500 index have delivered over 100% returns in the past year.

-

BSE: 159% returns

-

Godfrey Philips India: 121% returns

-

Dixon Technologies: 110% returns

-

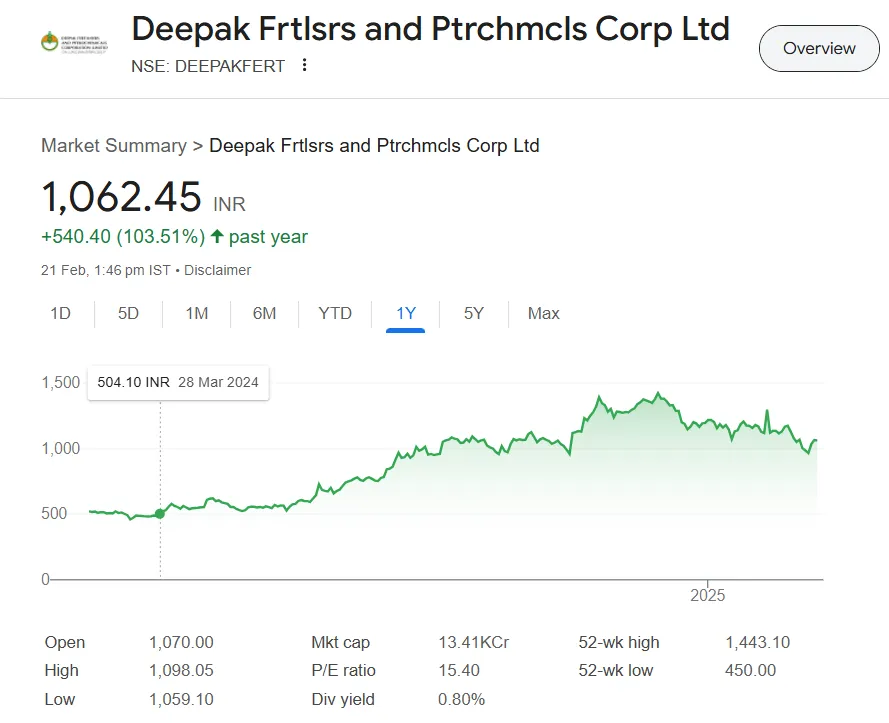

Deepak Fertilisers: 103% returns

-

Lloyds Metals & Energy: 106.5%

-

Mazagon Dock Shipbuilders: 105% returns

Other notable names that have given over 80% returns during the said period are One97 Communications (up 93%), Kirloskar Brothers (up 89%), Hitachi Energy India (up 97%), and Suven Pharma (up 82%).

How companies fared in Q3 FY25

BSE, the leading stock exchange, reported its net profit doubling to ₹220 crore for the three months ended December 2024 (Q3 FY25).

It posted a net profit of ₹108.2 crore in the same quarter of the preceding fiscal year, BSE said in a statement.

The exchange recorded its highest-ever quarterly revenue of ₹835.4 crore in the October-December quarter of the current financial year (FY25), a 94% jump from ₹431.4 crore registered in the same period last fiscal year.

BSE witnessed an average daily turnover of ₹6,800 crore for the quarter under review compared to ₹6,643 crore a year ago.

Its derivatives segment sustained its growth trajectory in the quarter with a daily premium turnover of ₹8,758 crore against ₹2,550 crore in the year-ago period.

The cigarette manufacturer reported a 27.4% rise in its net revenue at ₹1,592 crore, up 27.4% against ₹1,250 crore logged in the corresponding quarter of the previous fiscal year (Q3 FY24).

The company's cost of goods sold (COGS) during the quarter under review came in at ₹959 crore, up 30.5% YoY.

EBITDA (operating) jumped 56.8% to ₹359 crore. The figure stood at ₹229 crore in the year-ago period.

EBITDA stands for earnings before interest, taxes, depreciation, and amortisation.

Net profit for the company jumped 48.7% YoY to ₹316 crore.

The company had logged a net profit of ₹60.53 crore in the year-ago period.

Total income rose 39% to ₹2,591.58 crore during the third quarter of the 2024-25 fiscal, from ₹1,863.76 crore logged a year ago, according to a regulatory filing.

The company's orders at ₹11,594.3 crore were up 838.8% year-on-year (YoY).

Revenue for the company came in at ₹1,672.4 crore, up 31% YoY against ₹1,276.4 crore in the year-ago period.

The company added that the increase in revenue was on the back of the execution mix and improving operational efficiencies. A concerted focus on collections has borne fruit, which, in addition to the advance from the HVDC project, has led to a solid cash position and the company becoming debt-free as of December 31, 2024.

Profit after tax (PAT) came in at ₹137.4 crore, up 498.1% YoY, while operating EBITDA (earnings before interest, taxes, depreciation, and amortisation) jumped 108.5% YoY to ₹168.9 crore.

Operating EBITDA margin increased to 10.1% against 6.3% in the year-ago period.

Fintech firm One97 Communications, which owns the Paytm brand, reported a narrowing of consolidated loss to ₹ 208.5 crore in the third quarter ended December 31, 2024.

The company had posted a loss of ₹221.7 crore in the same period a year ago, the company said.

The revenue from operations of Paytm declined by 35.8% to ₹1,827.8 crore during the reported quarter, from ₹2,850.5 crore in the December 2024 quarter.

The revenue was, however, up 10% on a quarter-on-quarter basis, the company added.

Related News

About The Author

Next Story