Market News

BSE IT index hits record high ahead of Nvidia Q2 results; what if firm fails to meet consensus estimates?

3 min read | Updated on August 29, 2024, 07:41 IST

SUMMARY

Nvidia is one of the hottest stocks in one of the hottest industries, witnessing the incredible AI boom and promising to change the world, just as the computers, internet, and mobile phones did. In the US listed options market, Nvidia contracts have been one of the most actively traded, analysts note.

Stock list

Analysts expect at least 100% growth in Nvidia's YoY revenue.

The domestic benchmark indices ended flat on Wednesday, August 28; however, the information technology stocks rallied in trade amid hopes of rate cuts by the Federal Reserve in September and ahead of Nvidia's earnings, due later today.

The S&P BSE IT index hit an all-time high of 43,582.02 in the intraday deals before settling at 43,218.64 levels, up 1.24%.

Nvidia's earnings hold significance here, as over the past 12 months, the US-based tech company has taken the financial world by storm given the company's massive demand for its AI chips and breakneck rally of its shares.

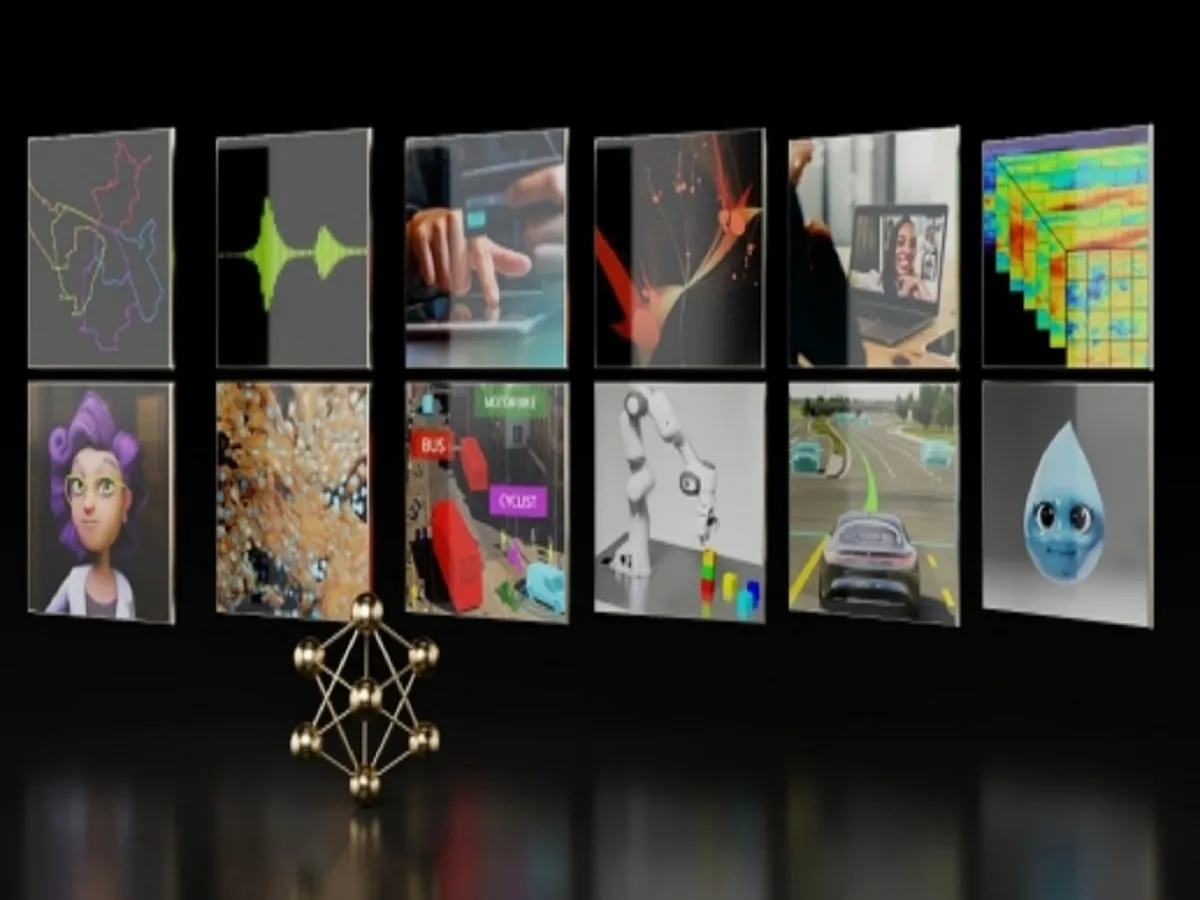

Nvidia is one of the hottest stocks in one of the hottest industries, witnessing the incredible AI boom and promising to change the world, just as the computers, internet, and mobile phones did. In the US listed options market, Nvidia contracts have been one of the most actively traded, analysts note.

Given the trend, reports say that going forward, AI will play a crucial role in the Indian IT company's topline too. As per Bloomberg Intelligence, IT service revenue generated through GenAI is expected to contribute 6.6% (USD 30.2 billion against USD 300 million in CY23) to the global GenAI revenue of USD 457 billion in CY27.

According to an EY report published on February 13, generative AI (GenAI) has fast become a strategic imperative for Indian tech-services companies. They are making significant investments to leverage the technology’s transformative potential for their customers and their own organisations.

According to the EY study, 68% of Indian tech-services CXOs believe that Gen AI will have a high to existential impact on their businesses.

Hence, stellar numbers by the AI chip manufacturer are expected to give direction to the Indian IT stocks as well as have a rub-off effect on them.

Bikram Gupta, a SEBI-registered research analyst at Northpull Capital, says that the wider consensus among the analysts points out at least 100% growth in Nvidia's YoY revenue. Further, the consensus earnings per share (EPS) growth estimates at 140% YoY growth.

"The growth expectations appear to be very rigidly baked into the stock price of Nvidia. If Nvidia fails to beat the wider consensus estimates, the stock may go for a hard fall, which may lead to cracking of the S&P 500 and NASDAQ," Gupta adds.

However, the analyst also added that beyond Nvidia's stock price and the direction of the markets, it is important to note that using Nvidia's chips requires huge investments in the hardware to train large language models, and thus the firms that are using Nvidia's chips are finding it difficult to recoup their investments.

Further, Nvidia will soon have to grapple with the competition that will emerge from players such as Amazon, Google, Meta Platforms, and Microsoft, who are designing their own chips.

About The Author

Next Story