Market News

JK Tyre, MRF, CEAT: What is the road ahead for tyre manufacturers?

3 min read | Updated on September 10, 2024, 15:34 IST

SUMMARY

Rising demand for vehicles and sharp focus on — and continuous government investments in — infrastructure bode well for tyre manufacturers in India. The stocks of these companies have performed well in recent years.

Stock list

Rubber prices are at multi-year highs due to rising raw material costs

As per news reports, domestic tyre manufacturers have raised their prices by around 1.5% to 2.5% starting July 1, 2024, given the extraordinary increase in natural rubber costs. Rubber is the major raw material in tyre manufacturing; hence the increase.

Reports say that the rubber prices are at multi-year highs due to rising raw material costs and supply constraints from key producers such as Thailand, Africa and Vietnam amid their wintering period. If the companies don't pass the price increase to the customers, it will hit their profitability.

Tyre sector outlook

Rising demand for vehicles and sharp focus on — and continuous government investments in — infrastructure bode well for tyre manufacturers in India. The stocks of the companies, most of which have given multibagger returns in the past five years, may continue to surge, as per analysts.

According to Expert Market Research, a research company, the India tyre market reached a volume of nearly 190.54 million units in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.6% between 2024 and 2032 to reach a volume of around 339.37 million units by 2032.

According to a report by Automotive Tyre Manufacturers’ Association (ATMA), the Indian tyre industry is on course to more than double its revenue to $22 billion by fiscal 2032 from $9 billion in fiscal 2022.

The domestic tyre manufacturers are witnessing an increase in capacity utilisation driven primarily by the replacement demand. The replacement sector constitutes about two-thirds of tyre demand, the report adds.

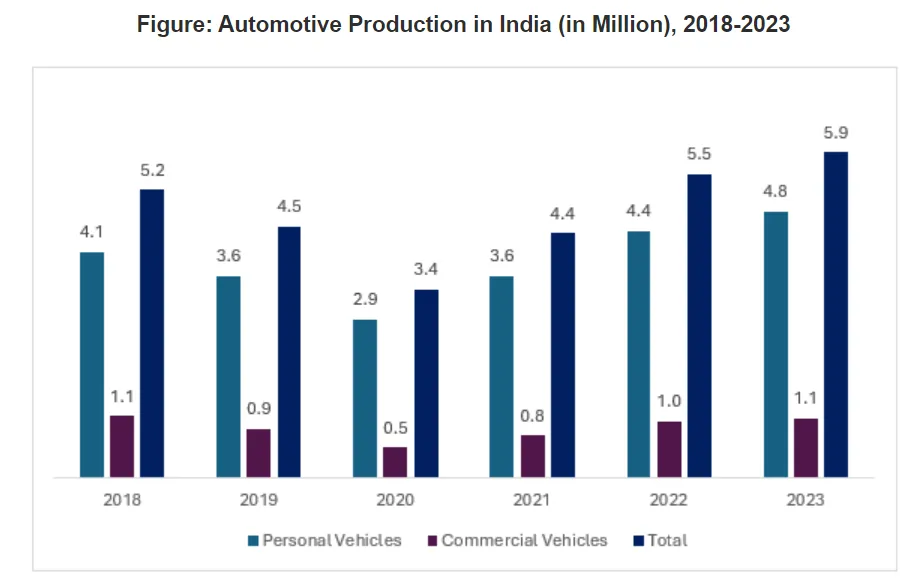

"The demand for tyres is driven by the robust growth of the automotive industry. As the Indian population continues to grow, there is an increasing demand for personal transportation solutions, which has led to a rise in the number of cars, trucks, and motorcycles on the roads. The growing disposable incomes, along with the increasing youth population, are significantly contributing to the growth of the automobile sector, propelling the India tyre market value," the research firm says.

Further, adoption of emerging technologies and Industry 4.0 concepts such as artificial intelligence and machine learning to improve efficiencies, along with technical and safety regulations, has prompted tyre makers to allocate significant expenditure towards Research and Development, notes Crisil in its report issued on July 3, 2023. It adds that R&D expenditure of the industry is forecast to more than double to $151 million from $64 million, after growing threefold in the past five fiscal years.

Stocks' performance

Shares of JK Tyre & Industries have jumped 98% in the past 12 months and a whopping 553% in five years. Balkrishna Industries, too, have rewarded their loyal investors generously. The stock has surged 332% over the past five years and 30% in one year. CEAT shares have risen over 216% in five years, whereas MRF has risen over 146% during the window.

In comparison, the benchmark NIFTY50 index has rallied over 115% during the period under study.

About The Author

Next Story