Market News

HUL Q2: FMCG giant reiterates slowdown in consumer demand, posts weak nos; shares tumble 7%

5 min read | Updated on October 24, 2024, 12:00 IST

SUMMARY

HUL reported a 2.33% decline in consolidated net profit ₹Rs 2,595 crore for the second quarter ended on September 30, 2024, impacted by moderation in demand from the urban market. A third of the company's business comes from the rural market.

Stock list

HUL reported an underlying sales growth of 2% and underlying volume growth of 3%.

On Wednesday, October 23, when HUL unveiled its September quarter (Q2 FY25) results, it somewhere felt the redux of Nestle's results declaration and management commentary.

A week ago, Nestle India reported its September quarter results, which were much below Street expectations.

The company reported a consolidated net profit of ₹899.49 crore, down 0.94% YoY. Revenue from operations came in at ₹5,104 crore, up 1.3% against ₹5,036.8 crore recorded in the September 2023 quarter. The company's operating profit margin slipped 140 basis points YoY to 22.9%. Bloomberg had estimated the figure at 24.4%.

Further, Suresh Narayanan, Chairman and Managing Director of Nestlé India, underlined the growth pangs in the form of a challenging external environment with muted consumer demand and high commodity prices, especially for coffee and cocoa.

The chairman added that some key brands witnessed pressure due to softer consumer demand.

Nestle also witnessed a decline in volume against the estimates of up to 2% growth.

HUL, too, reiterated the pain of demand moderation in its results announcement.

-

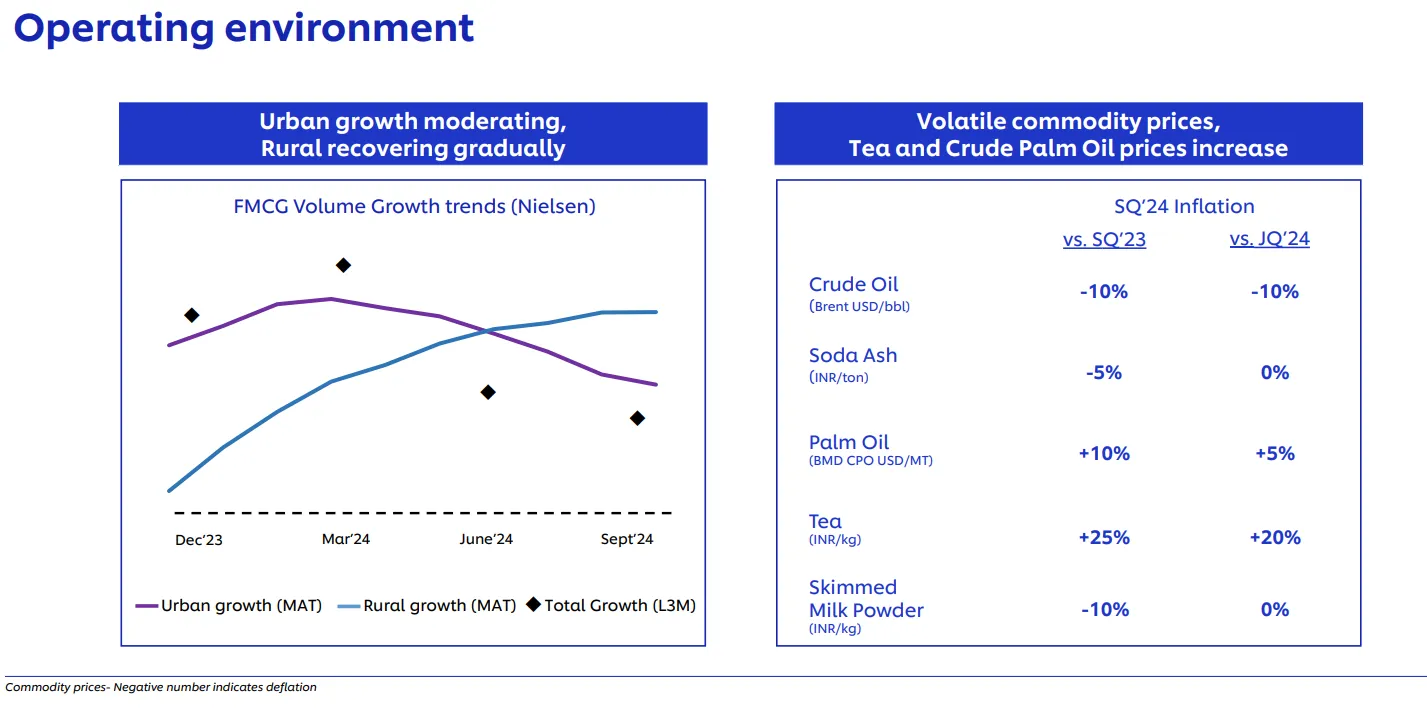

Urban growth is moderating while the rural market is recovering gradually;

-

The company expects low-single-digit price growth going ahead if commodity prices remain at current levels;

-

EBITDA margins to be maintained at current healthy levels. Even as gross margins could improve, they will reinvest gains in advertising;

-

Taking calibrated price increases in the tea and skin cleansing portfolio now;

-

The company has decided to separate its ice cream business, which is around 3% of sales.

As regards key headline numbers, HUL reported a 2.33% decline in consolidated net profit at ₹2,595 crore for the second quarter ended on September 30, 2024, impacted by moderation in demand from the urban market.

It must be noted here that two-thirds of HUL's business comes from urban areas and one-third from rural areas.

Revenue from product sales was up 2.36% at ₹15,703 crore in the September quarter, from ₹15,340 crore in the year-ago period, HUL, which owns power brands such as Surf, Rin, Lux, Pond's, Lifebuoy, Lakmé, Brooke Bond, Lipton, and Horlicks, said.

HUL reported an underlying sales growth of 2% and underlying volume growth of 3%. Total expenses were at ₹12,581 crore in the September quarter, up 3.03% year-on-year.

When asked if there were structural issues for the slowdown in the urban market and the slow pace of recovery in the rural market, HUL CFO Ritesh Tiwari did not give a specific reply but said, "We know there are certain elements that will determine the pace of growth and pace of recovery going forward, be it monsoon, be it employment, be it, for that matter, food inflation."

Specific to the rural market, he said, "When the cumulative inflation was higher than the amount of wage increase that we had seen or income we had seen in rural areas, there was a deficit in disposable income."

As a result, the spending capacity was limited in rural areas, he said; however, adding that as macros have improved, some extent of recovery has happened there.

On the outlook, he said, "In the near term, we expect demand trends to be stable with no further acceleration in pace of growth."

In its earnings release, HUL said that in the base quarter, there was a one-off indirect tax credit from a favourable resolution of past litigation, which benefited both the topline and bottom line in the Beauty and Well-Being segment. Excluding this one-off, USG, UVG, and PAT (bei) growth is 3%, 3%, and 2%, respectively.

USG stands for underlying sales growth, and UVG stands for underlying volume growth.

PAT (bei) here is profit after tax (before exceptional items).

Segment-wise performance

Home Care segment grew 8% with high-single-digit UVG. Growth was broad-based, with both fabric wash and household care growing volumes in high single digits, the company said.

Beauty & Wellbeing grew 7% (1% reported) with mid-single-digit UVG. Hair Care continued its growth momentum and grew in high single digits, led by outperformance in Sunsilk, Dove, and Tresemme. Skin care and Colour cosmetics delivered a mid-single-digit growth. Premium Skin portfolio maintained its double-digit growth trajectory, HUL said.

Personal Care declined 5% with negative pricing and a low-single-digit volume decline. Skin cleansing declined primarily on account of pricing actions taken during the year. Premium portfolio grew ahead of the segment, and within that bodywash continued to strengthen its market leadership with high double-digit growth. Oral Care delivered competitive high-single-digit growth led by Closeup, it added.

Foods & Refreshment declined 2% with a low-single-digit volume decline. Tea continued to cement its market leadership through value and volume share gains. Green and Functional Tea maintained their strong volume growth; however, overall category volumes remained subdued. Coffee grew in double digits.

About The Author

Next Story