Market News

Indian Hotels, Coforge among mid-cap stocks that outperformed despite market correction; check full list

.png)

4 min read | Updated on November 19, 2024, 18:02 IST

SUMMARY

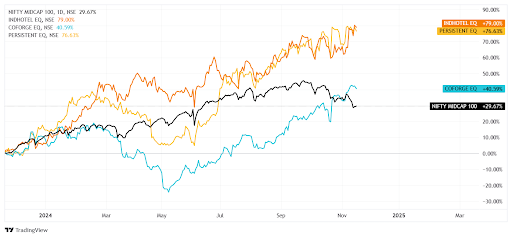

NIFTY50 and SENSEX experienced more than 10% drawdowns from their September peaks, due to this stocks have seen a major fall, especially in the broader market segment. But few stocks like Indian Hotels, Coforge, and Persistent Systems weathered the storm and trade close to their all-time highs. These stocks have displayed a positive performance amid Q2 performance.

Stock list

Amid sluggish market sentiment, these three stocks have performed well

Indian frontline indices NIFTY50 and SENSEX, have seen a correction from their all-time highs. The NIFTY50 index plunged over 10% from its all-time high peak in September amid concerns about FIIs' continuous selling in the Indian market due to weak Q2 earnings and stretched valuation. SENSEX hit its record peak of 85,978.25 level on September 27 this year, and NIFTY50 also reached a lifetime high of 26,277.35 mark on the same day.

The broader market index Nifty Mid-cap 100, also witnessed an 11% correction from its September peak. Currently, the Nifty Midcap index is holding above 200-DEMA, with a few of its constituents still trading near their respective all-time highs.

Despite a market correction exceeding 10%, some mid-cap stocks remain at all-time highs due to strong Q2 earnings performance.

Despite a market correction exceeding 10%, some mid-cap stocks remain at all-time highs due to strong Q2 earnings performance.Following are the top 3 stocks trading near their respective all-time high:

Indian Hotels Company (MTD stock return: 11.4%)

The company has posted a 232% YoY rise in Q2 consolidated net profit with an exceptional Item of ₹307 crore on the consolidation of TajSATS. Without exceptional items, the net profit has grown by 48%. The revenue from the operation has shown a growth of 28% YoY basis, with an EBITDA of ₹565 crore, resulting in a margin expansion of 270 basis points to 29.9%.

On the operational front, the hotel business saw double-digit RevPAR growth across all brands, with the Taj brand achieving 13% RevPAR growth.

The company signed 42 hotels and opened 14 hotels from April to October 2024. It also achieved a portfolio milestone of 350 hotels, with over 230 operational.

Coforge Ltd (MTD stock return: 6.4%)

The stock price of Coforge closed at ₹8,006 with a market cap of ₹53,585 crore The stock is 0.5% below its all-time high, holding above its key short and medium-term daily moving averages (20, 50, 100, and 200-day), indicating bullish strength. The stock has surged 40.59% in the last 12 months.

In Q2FY25, the company showcased impressive financial performance with a topline increase of 34.54% YoY basis and a profit rise of 11.71%. Compared to the previous quarter, revenue grew by 27.55%, while profit surged by 51.8%.

Coforge’s performance in Q2 FY25 showcases strong revenue growth, robust order intake, and successful integration of Cigniti, leading to optimistic projections for future growth despite potential macroeconomic headwinds. The management's confidence stems from a diversified service portfolio, strong client relationships, and a proactive approach to market demands.

Persistent Systems Ltd (MTD stock return: 6.2%)

The stock price of Persistent System closed ₹5,646.50, down 1.2% from its all-time high at a market capitalisation of ₹87,786 crore. The stock has shown a strong performance in the last year, with gains of 76.63%. Persistent Systems provides software engineering and strategy services to help companies implement and modernise their businesses. It has its own software and frameworks with pre-built integration and acceleration.

In Q2FY25, the company reported strong performance with the topline increasing by 20.13% YoY and profit surging by 23.45%. Compared to the previous quarter, revenue grew by 5.84%, while profit saw an increase of 6.06%.

Persistent Systems exhibits strong financial performance, strategic initiatives focused on AI and client engagement, and a commitment to sustainability, positioning itself favourably for future growth despite anticipated seasonal challenges.

About The Author

Next Story