Market News

Copper hits record high: Top stocks to keep your eyes on

.png)

4 min read | Updated on May 16, 2024, 14:10 IST

SUMMARY

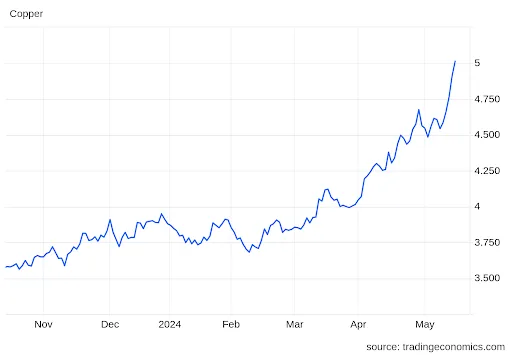

With copper hitting a record high of $5.07 per pound in May 2024 due to strong demand from China and global electrification trends, these four stocks could benefit from the surge in copper prices.

Stock list

Copper reached an all-time high of $5.07 per pound in May 2024.

Copper’s Recent Surge

Copper plays an important role in electrification, from electrical vehicle charging to grid-scale energy storage, and in automation infrastructure, showcasing the demand for the metal. Investors are also optimistic regarding copper. The growing use of clean energy technologies is expected to lead to a big increase in demand in the coming decades.

China’s Impact

China, a big importer of copper, continued importing more copper ore inputs despite prices rising sharply. This was due to demand from manufacturers. This is making it hard for smelters (who process copper) as the availability of the metal is low, which hampers the margin. Experts also predict that output from smelters might reduce by 10% this year..

M&A Trend

Hopes of mine supply are also dim, as giant miners are finding new commitments expensive, ultimately leading them to M&A activity instead of starting new projects. BHP's recent second attempt to purchase Anglo-American has made headlines.

These key factors fueled the rally in copper prices.

Copper Price Chart (Reached a new high)

Stocks that Could Benefit from Rising Copper Prices

Hindalco

It is one of the largest aluminium rolling and recycling companies in the world, as well as a major copper player. It produces LME-grade copper cathodes and continuous cast copper rods in various sizes used in wire, cable, transformative industries, manufacturing of copper tubes, consumer durables, etc.

In the last year, the stock has gone up by 59%. As of May 16, 2024, it is trading at ₹647 on the NSE.

Hindustan Copper

The company is engaged in the mining of copper ore and the production of copper, as well as the continuous cast of copper wire rods (a downstream product). It is the only vertically integrated copper producer in the country. The company is involved in mining, beneficiation, smelting, refining, and continuous cast rod manufacturing. Additionally, the company holds more than 80% of the mining reserves in the country.

The company has provided a return of 235% in the past one year. Currently, the stock is trading at ₹376 on the NSE, as of May 15, 2024.

Adani Enterprises

Kutch Copper, a subsidiary of the company, commissioned the first unit of a greenfield copper refinery project at Mundra by dispatching the maiden batch of cathodes to customers on March 28, 2024. Close to $1.2 billion is being invested to set up a copper smelter with a 0.5 MTPA capacity in the first phase. Upon completion of the second phase, the subsidiary will be the world’s largest single-location custom smelter.

The company has provided a 22% return in the past year and is currently trading at a price of ₹2,998 on the NSE as of May 15, 2024.

Vedanta

Vedanta’s Sterlite Copper, since its inception in 1996, has steadily grown to become one of India’s leading contributors to copper production, providing up to 36% of the country’s demand for refined copper. The business unit consists of a refinery, sulphuric acid plant, copper smelter, phosphoric acid plant, and copper rod plant.

The stock has provided a 56% return in the past year. Today, it is trading at ₹432 on the NSE.

Copper is known as 'Dr. Copper' because it's essential for almost everything, like construction, electronics, and automobiles. So, it serves as a proxy play of industrial activity, both internationally and domestically. Plus, as we switch to cleaner energy, copper will be even more valuable in the future. These are the stocks to keep an eye on to play the copper super cycle.

To trade and invest on Upstox, open a free demat account today.

About The Author

Next Story