Market News

Trent Q1 results: Revenue likely to see double-digit growth; check earnings preview and key technical levels

.png)

4 min read | Updated on August 06, 2025, 08:43 IST

SUMMARY

Trent is set to announce its Q1 FY26 results today. Analysts are expecting a 20–30% increase in revenue and a modest 3–8% rise in net profit. Investors will be watching for information on same-store sales growth and margins, as well as management's outlook on demand. Meanwhile, the stock remains technically weak, trading below its 200-day moving average (DMA) in a symmetrical triangle pattern.

Stock list

Trent technical structure remains in a range, forming a classical symmetrical triangle pattern on the weekly and daily charts.

Trent, the parent company of Zudio and Westside, is set to announce its results for the June quarter (Q1 FY26) today. The company is expected to report decent quarterly earnings, with a double-digit rise in revenue, while net profit is expected to grow by a low single digit.

During its quarterly business update, the Tata Group company reported a 20% year-on-year increase in standalone revenue to ₹5,061 crore, and a total of 1,043 stores (248 Westside, 766 Zudio, and 29 other lifestyle concepts). During the quarter, the company opened 11 Zudio stores and one Westside store.

According to experts, the Tata Group-owned company could report standalone revenue growth of 20–30% year on year to ₹4,750–5,150 crore. In Q1FY25, the company registered revenue of ₹3,992 crore, while this figure stood at ₹4,106 crore in the previous quarter.

Meanwhile, Trent's net profit could rise by 3–8% year on year to ₹351–380 crore. Trent's net profit was ₹342 crore in the June quarter of FY25 and ₹350 crore in the previous quarter. However, experts believe that Trent's net profit is likely to be impacted by weak demand, softness in same-store sales growth (SSSG) and rising competition.

Investors will be looking at key performance metrics, such as same-store sales growth and margins. They will also be interested in management's commentary on future growth estimates and the overall demand outlook, particularly in urban areas.

Ahead of the Q4 results announcement on 6 August, Trent shares ended the session 1.3% higher at ₹5,320. So far this year, the stock has fallen by over 25% amid moderation in topline growth compared to market expectations.

Technical view

The technical structure of Trent remains in a range and is forming a classical symmetrical triangle pattern on the weekly and daily charts. Additionally, the stock is currently trading below its 200-day exponential moving average, indicating weakness in the structure.

For short-term clues, traders can monitor the trendline support connecting April and July swing low. A decisive break below or a rebound from this zone can provide further directional clues. Meanwhile, immediate resistance for the stock remains at ₹5,800.

.webp)

Options outlook

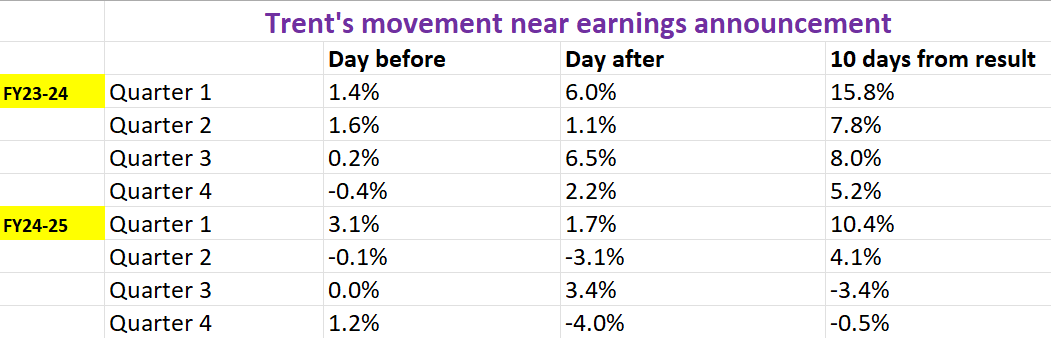

On 5 August, the options market for Trent indicated a possible price swing of about ±7.1% before the 28 August expiry, as open interest and at-the-money straddle prices pointed to significant volatility. This suggests that the market is anticipating significant volatility around earnings announcement. However, before exploring potential option trading strategies that leverage this expected volatility, it is useful to analyse how Trent's stock has historically reacted to earnings announcements.

Options strategies for Trent

With the market anticipating a potential move of ±7.1% for Trent before 29 August, volatility-based strategies are in focus. A long straddle, buying both an at-the-money call and put, targets big swings in either direction. If Trent breaks out beyond the ±7.1% threshold, this strategy could be profitable.

Conversely, if you expect Trent to remain stable, a short straddle could be effective. This involves selling the same at-the-money (ATM) call and put options, banking on the stock staying within that (±7.1%) range. It's an approach which anticipates decline in volatility, but it carries a higher risk if the market becomes too volatile.

If you have a directional bias, bullish or bearish, spreads offer a better risk profile. A bull call spread (buy a low strike call and sell a higher strike call) limits both cost and potential profit, but is suitable for a steady increase in price. Similarly, a bear put spread (buy a higher strike put and sell a lower strike put) limits risk and return without taking too much of a gamble.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story