Market News

TCS Q2 results preview: Revenue, profit to remain flat QoQ, key focus on dividend, H-1B visa fees, and layoffs

.png)

4 min read | Updated on October 09, 2025, 09:17 IST

SUMMARY

TCS is currently trading near its key support zone of ₹2,900–3,000. It has shown a strong bounce here, but remains in an overall downtrend below the major moving averages. Immediate resistance lies at the 21-week EMA, which is currently around ₹3,180. Stronger hurdles lie at the 50- and 200-week EMAs, which are critical levels for any potential trend reversal.

Stock list

TCS is expected to report tepid Q2 results with low single digit growth in revenue and net profit.

IT major Tata Consultancy Services (TCS) will kickstart the second quarter earnings season on Thursday, October 9. TCS is expected to announce its results after market hours. Hence, the stock is likely to react to the Q2 earnings on Friday, October 10.

TCS is expected to report a marginal rise of 1% to 3% in revenue on a sequential basis. The revenue is expected to remain between ₹65,140 to ₹65,220 crore, compared to ₹63,437 crore in the previous quarter and ₹64,259 crore in Q2FY25. Revenue is likely to see low single-digit growth due to lower contribution from the BSNL project, which is nearing completion. Foreign exchange gains could provide some support to the topline, but likely to be offset by wage hikes during the quarter.

TCS net profit could see a 1 to 2% rise during the September quarter between ₹12,550 and ₹12,700 crore. The company reported a net profit of ₹12,760 crore in Q1FY26 and ₹11,909 crore in Q2FY25. Meanwhile, the EBIT margin is expected to remain flat in the range of 24.3% to 24.5%, while new deal wins are projected between $7 to $9 billion.

Investors will be watching the TCS results closely for any commentary from management on US tariffs and the recent changes to US H-1B visa fees. TCS accounts for a significant proportion of the H-1B visas granted to Indian IT companies and increase in fees could affects its cost structure.

The growth outlook in key verticals such as financial services, as well as the announcement of an interim dividend, will be key factors to watch out for. The Q2 attrition rate will also be in the spotlight, as the company plans to reduce its workforce by 2% in FY26.

Ahead of its Q2 earnings announcement, TCS shares are trading nearly 0.2% higher at ₹3,031 on Thursday, October 9. Despite the recent uptick, the stock remains down over 25% year-to-date.

Technical view

On the weekly chart, TCS has formed a crucial support zone around ₹2,900–₹3,000, where it recently staged a sharp rebound following sustained selling pressure. However, the overall trend remains bearish, with the price sustaining below all key moving averages. Immediate resistance is present at the 21-week EMA, which is located near ₹3,180, while a strong resistance cluster is found at the 50- and 200-week EMAs, which are located in the ₹3,450–3,470 range.

For a bullish reversal to be sustained, TCS must reclaim the 21-week EMA and sustain above it on a closing basis. Until then, rallies are likely to encounter selling pressure and the downtrend structure will remain dominant, so prudent risk management is crucial for traders in this situation.

.webp)

Options outlook

Open interest data for the 28 October expiry shows significant call writing at the 3,000 strike, signalling strong resistance at that level. Although there is some put writing at the same strike price, the volume is noticeably lower, compared to the bearish pressure exerted by call sellers.

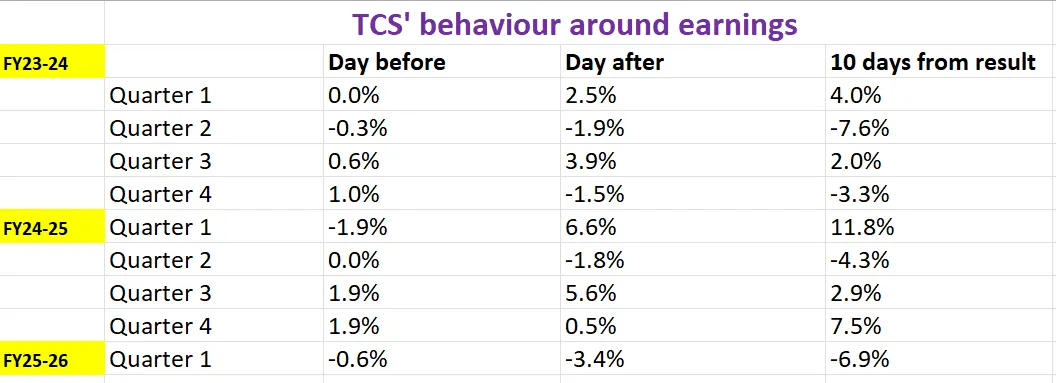

At 1:30 pm, the at-the-money (ATM) 3,020 strike for the 8 October contract was priced at ₹131, implying an expected price movement of ±4.3% before the 28 October expiry date. To judge whether this is realistic, it is helpful to consider how TCS has historically reacted around earnings announcements.

Options strategy for TCS

The options market is pricing in a ±4.3% move for TCS by 28 October. That opens the door for traders to play either side of the volatility.

Traders expecting a big move can consider a Long Straddle strategy. It involves buying at-the-money call and put options with the same strike and expiry. The strategy turns a profit if TCS swings more than 4.3% in either direction.

Conversely, traders expecting limited movement in TCS may consider a short straddle strategy. This involves selling an at-the-money call option and an at-the-money put option with the same strike price and expiry date. This strategy generates a profit if the stock price remains within a narrow range and moves less than 4.3% in either direction.

Related News

About The Author

Next Story