Market News

SBI Q2 results: Net profit expected to decline, NII to stay flat amid margin pressure; check key technical levels

.png)

4 min read | Updated on November 04, 2025, 10:34 IST

SUMMARY

India’s largest public sector bank, SBI, is expected to post mixed Q2 results on 4 November 2025, with net profit likely to decline 3–5% year-on-year due to margin pressure and rising funding costs. However, strong 9–12% loan growth and one-off treasury gains from the Yes Bank stake sale may help offset the impact.

Stock list

The options data for SBI's 25 November expiry shows a potential price movement of ±4.4% | Image: Shutterstock

India’s largest public sector bank, State Bank of India (SBI), will announce its second-quarter results on November 4, 2025. SBI is likely to report mixed quarterly earnings as profitability could take a hit amid margin pressure.

According to experts, SBI’s standalone net profit could decline by 3-5% YoY between ₹17,430 and ₹17,780 crore, compared to a net profit of ₹18,331 crore in Q2FY25. Meanwhile, the lender posted net profit of ₹19,160 crore in the previous quarter. SBI quarterly earnings may surprise investors amid higher loan growth and one-off treasury gain from Yes Bank stake sale to Japan-based Sumitomo Mitsui Banking Corp. in September month.

Net interest income (NII) is expected to remain flat around ₹41,250 to ₹41,370 crore. SBI reported an NII of ₹41,072 in the previous quarter. Despite subdued earnings, SBI could report healthy 9 to 12% YoY growth in loan books and deposits.

Meanwhile, net interest margin (NIM) is likely to decline by 25 to 30 basis points to 2.8% because of an increase in the cost of funds and the recent repo rate cut by the RBI.

During the quarterly result announcement, investors will track key performance metrics, including loan growth across retail and corporate segments, deposit growth, net interest margin, gross and net non-performing assets (NPAs). Management commentary on credit growth within the industry

Ahead of the Q2 result announcement, SBI shares hit a 52-week high of ₹953 on November 3. So far this year, shares of SBI have delivered 19% return to its shareholders.

Technical view

State Bank of India has given a breakout after sixteen months on the weekly chart and has hit a fresh all-time high. It decisively moved above the long-term descending trendline that has limited the stock's upward trajectory since mid-2024. The stock is trading well above its key exponential moving averages (EMA), the 21-week EMA (₹855) and the 50-week EMA (₹819). Additionally, the breakout candle has a solid body, signalling strong conviction among bulls.

In the upcoming sessions, the breakout zone near ₹899–₹912 will act as strong support and could attract new buyers if prices revisit this area. The overall trend remains bullish as long as the stock remains above the 21-week EMA.

.webp)

Options outlook

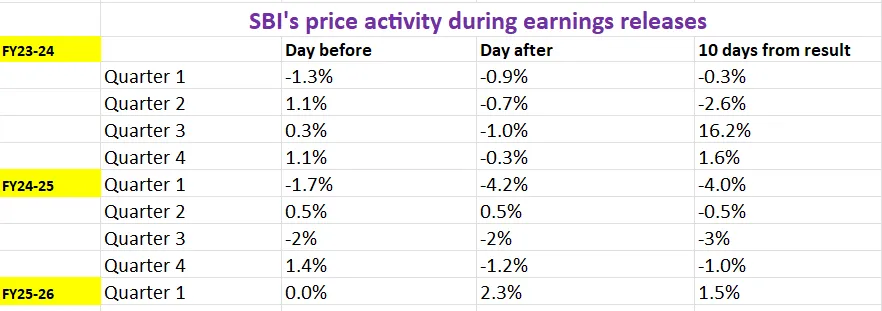

For further understanding, let’s take a look at the historical price behaviour of SBI around its earnings announcement.

Options strategy for State Bank of India

The options data for SBI's 25 November expiry shows a potential price movement of ±4.4%, providing strategic opportunities for traders based on their volatility expectations.

- Expectation of increased volatility: Traders who expect that the volatility in SBI may rise can consider a Long Straddle strategy. This strategy involves buying both an ATM call and an ATM put option with the same strike price and expiry date. This approach will benefit if the price of SBI moves significantly beyond the range of ±4.4% in either direction.

- Expectation of lower volatility: Traders who expect volatility will remain low, a Short Straddle may be more suitable. This strategy involves selling both an ATM call and an ATM put option with the same strike price and expiry, and profiting if the price of SBI stays within ±4.4%.

- Traders expecting further bullish momentum from its 52-week high zone, can consider a bull call spread. This strategy involves buying a call option and simultaneously selling another call option with a higher strike price of the same expiry. This approach lowers the initial cost but also limits potential profits.

About The Author

Next Story