Market News

Gold vs silver vs copper in 2025: Copper futures surge over 60%; here's how to invest | Explained

6 min read | Updated on January 06, 2026, 16:55 IST

SUMMARY

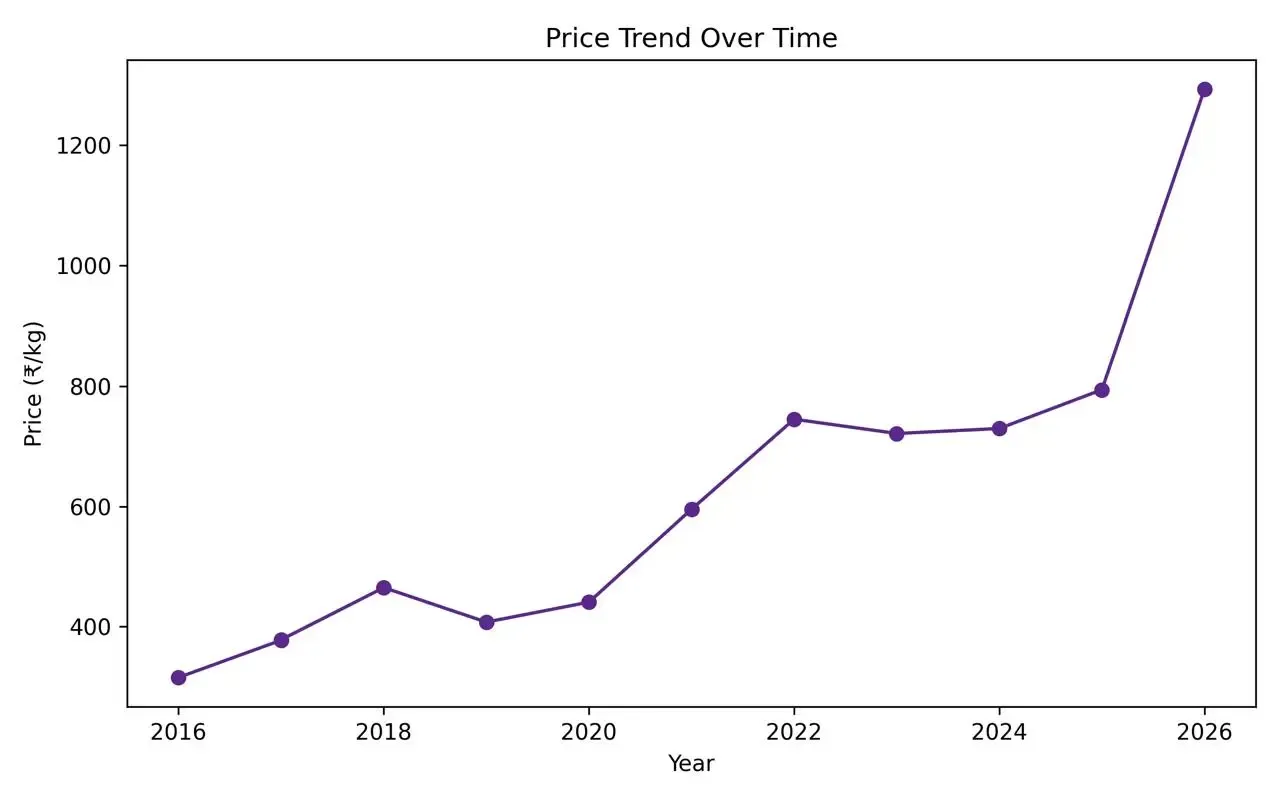

Copper was not adequately recognised for the more than 60% returns it delivered in 2025. Prices on the Multi Commodity Exchange (MCX) closed at around ₹793.85 per kg on January 1, 2025, and increased to ₹1,292.50 per kg on January 1, 2026, an increase of nearly 63%.

Copper prices are highly volatile due to fluctuations in global supply and demand cycles.

The year 2025 was marked by commodities that soared significantly due to strong industrial demand. While silver dominated the majority of discussions, the silence around copper does injustice to the current market situation.

Copper futures on the MCX delivered over 60% returns in 2025, outperforming major NIFTY indices in terms of returns, making it a critical commodity. To understand this undervalued rally, it is important to look at the broader rise in commodity prices during the year.

The rise of commodity prices in 2025

Silver prices soared over 150% in 2025: The white metal’s rally was driven partly by its safe-haven appeal, tracking gold amid heightened geopolitical uncertainty and market volatility, and partly by a pickup in industrial demand.

Silver’s demand for electronic equipment has made it crucial in sectors like EV, solar, circuits and 5G. Combined with supply shortages, the white metal was the centre of attention in both domestic and international markets last year.

Gold also delivered over 75% returns in 2025, making it one of the most profitable investment options. Due to heightened geopolitical uncertainties, weak currencies and increased gold buying by the central bank, prices of the yellow metal saw a remarkable bull run. This was also a key sentiment in market discussions during the previous calendar year.

Copper, on the other hand, was not adequately recognised for the more than 60% returns it delivered in 2025. Prices on the Multi Commodity Exchange (MCX) closed at around ₹793.85 per kg on January 1, 2025, and increased to ₹1,292.50 per kg on January 1, 2026, an increase of nearly 63%.

| Year | Date | Price (₹/kg) | % Change vs Previous Year |

|---|---|---|---|

| 2026 | Jan 1, 2026 | 1,292.50 | 62.83% |

| 2025 | Jan 1, 2025 | 793.85 | 8.84% |

| 2024 | Jan 1, 2024 | 729.40 | 1.14% |

| 2023 | Jan 2, 2023 | 721.15 | -3.18% |

| 2022 | Jan 3, 2022 | 744.85 | 25.14% |

| 2021 | Jan 1, 2021 | 595.20 | 35.03% |

| 2020 | Jan 1, 2020 | 440.80 | 8.12% |

| 2019 | Jan 1, 2019 | 407.70 | -12.32% |

| 2018 | Jan 1, 2018 | 465.00 | 22.92% |

| 2017 | Jan 2, 2017 | 378.30 | 19.60% |

| 2016 | Jan 1, 2016 | 316.30 | — |

Key reasons behind copper’s rise in 2025

- Industrial demand from new technologies

- Supply shortages due to mine closures

- Tariff concerns boosting commodity prices

- Investor speculation

- The US categorisation of copper as a critical mineral

| Year | Copper (₹/kg) | Copper YoY % | Gold (₹/10g) | Gold YoY % | Silver (₹/kg) | Silver YoY % |

|---|---|---|---|---|---|---|

| 2026 | 1,292.50 | 62.83% | 135,804 | 76.62% | 235,873 | 169.32% |

| 2025 | 793.85 | 8.84% | 76,893 | 21.42% | 87,578 | 17.73% |

| 2024 | 729.40 | 1.14% | 63,320 | 14.76% | 74,390 | 6.93% |

| 2023 | 721.15 | -3.18% | 55,178 | 15.64% | 69,571 | 12.66% |

| 2022 | 744.85 | 25.14% | 47,716 | -5.02% | 61,741 | -9.36% |

| 2021 | 595.20 | 35.03% | 50,244 | 28.61% | 68,123 | 45.99% |

| 2020 | 440.80 | 8.12% | 39,067 | 24.31% | 46,665 | 20.31% |

| 2019 | 407.70 | -12.32% | 31,422 | 7.89% | 38,786 | -0.99% |

| 2018 | 465.00 | 22.92% | 29,123 | 5.63% | 39,176 | 0.10% |

| 2017 | 378.30 | 19.60% | 27,570 | 10.45% | 39,136 | 17.41% |

| 2016 | 316.30 | — | 24,962 | — | 33,335 | — |

| Commodity | 2016 Price | 2026 Price | 10-Year CAGR |

|---|---|---|---|

| Copper (₹/kg) | 316.30 | 1,292.50 | 15.1% |

| Gold (₹/10g) | 24,962 | 135,804 | 18.5% |

| Silver (₹/kg) | 33,335 | 235,873 | 21.6% |

Key highlights

- Silver delivered the highest long-term returns, outperforming both gold and copper.

- Copper recorded an impressive CAGR for an industrial metal, marking competitive gains when compared with gold and silver.

- Copper’s growth is primarily linked to economic growth and supply and demand cycles.

- All three commodities outperformed NIFTY and SENSEX in 2025.

How can Indians invest in copper?

- Buy copper futures contracts on the MCX.

- Invest in international markets through copper-based ETFs and mining-focused funds.

- Buy shares of copper companies, such as Hindustan Copper.

Investing options in copper in India are limited, especially when compared to gold and silver. Investors can easily go for jewellery, coins, bars and even gold/silver-based ETFs for the yellow and white metals. But for broader exposure in copper, traders might have to explore the overseas markets. Before investing, investors should ensure they understand the risks associated with investing in copper.

Risks of investing in copper

Here are the key risks to keep in mind when considering copper investments:

- Copper prices are highly volatile due to fluctuations in global supply-demand cycles.

- Currency fluctuations in international markets also pose a risk to commodity prices.

- Chinese copper consumption, output and demand can hugely influence its rates in both domestic and international markets.

- Geopolitical issues in Chile and Peru, which make up over 35% of the global mined copper supply, along with global policy shifts and environmental regulations, can affect copper prices in the coming months.

Before investing in copper, investors should carefully assess the associated risks and understand the inherent volatility of commodity markets. It is also important to compare copper with other investment options and choose the one best suited to individual investment objectives, risk profile and return expectations.

Related News

About The Author

Next Story