Upstox Originals

With Indian EV industry in the fast lane, foreign players want to join the race

7 min read | Updated on February 12, 2025, 21:53 IST

SUMMARY

India is the world’s third-largest automobile market and the electric vehicle (EV) industry is one of the fastest-growing segments, expected to grow at a 30% CAGR in the near term. Besides favourable cost economics, this growth is further supported by conducive government policies. This rapidly growing industry is also catching the eye of foreign players who are looking to make their mark in the Indian markets.

The EV industry is expected to grow at 30% annually till 2030

The electric vehicle (EV) industry is currently the talk of the town. It is the horse on which everyone is willing to bet. And why wouldn't it be? According to the Indian government, India's EV market is set to hit the ₹20 trillion mark by 2030. India is the world’s third-largest automobile market. And, it is also on track to become the largest EV market by 2030 as the demand for electric vehicles is growing tremendously.

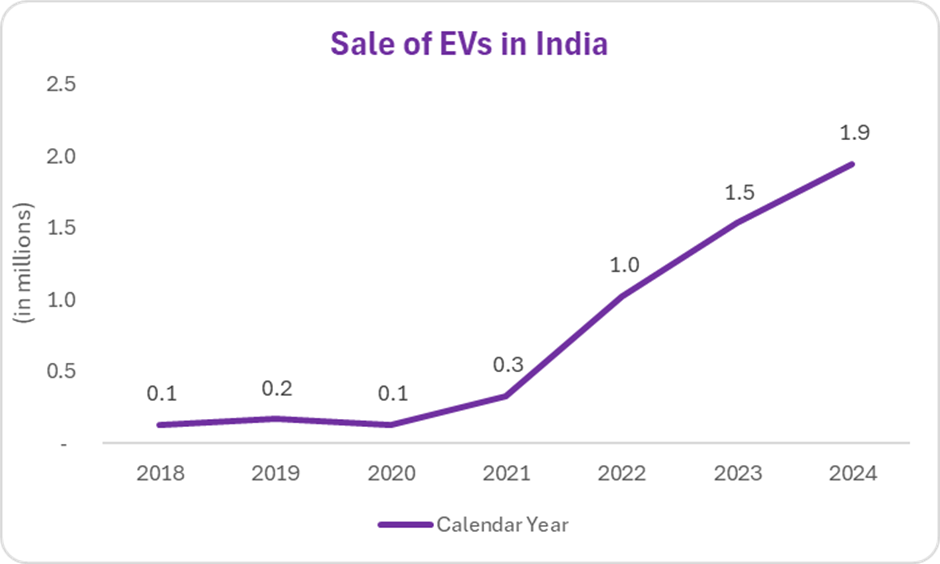

Source: Vahan

Where does India's EV market currently stand

As we can see the EV market in India is rising steadily. In CY2024, India’s EV sales came within sniffing distance of the record 2 million (20 lakh) retail sales mark. In fact, the Indian passenger vehicle segment recorded its best-ever annual EV sales in CY2024.

That said, the current EV sales only account for 7.4% of total vehicle sales in India.

So, imagine the potential this industry has!

The government also predicts EV sales to rise to 30% by 2030. As per Grand View Research, India's EV market was valued at $8.5 billion in 2024 and is expected to grow at a significant CAGR of 40.7% from 2025 to 2030.

So, what is driving this growth?

Well, the growth in the EV sector is majorly fueled by government incentives, rising environmental concerns, growing demand for cleaner and affordable transportation, and technological advancements.

Rising fuel prices have made the economics of EVs more favourable than internal combustion engine (ICE) vehicles. The cost of petrol and diesel has made traditional ICE vehicles more expensive than EVs that run on electricity. For instance, in India, electricity costs about ₹7 per kWh on average. With an average efficiency of 6 km per kWh, EV owners spend approximately ₹1.17 per km. In contrast, with petrol prices around ₹100 per litre and an average fuel efficiency of 15 km per litre, ICE vehicle owners incur fuel expenses of about ₹6.67 per km. The significant cost savings (₹5.50 per km) also contribute to the high demand for EVs.

Government's initiatives driving India's EV future

The growing global focus on green energy is creating significant opportunities for the country's EV sector. As a result, the government is implementing major initiatives to encourage EV manufacturing and sales.

In the past, the government rolled out Faster Adoption and Manufacturing of Electric Vehicles (FAME) and FAME II schemes to make EVs more affordable and accessible.

But that’s not all.

Recently, the government introduced new initiatives like the Electric Mobility Promotion Scheme (EMPS) and the PM E-Drive scheme to promote EV sales and production in India. Through these schemes, the government has committed a budget allocation of ₹10,900 crores over two and a half years effective from October 1, 2024, to March 31, 2026. The initiative aims to accelerate the adoption of EVs, establish charging infrastructure, and develop an EV manufacturing ecosystem in India.

Through recent schemes, the government has managed to keep the EV buzz going strong by offering subsidies for electric two- and three-wheelers (e2Ws and e3Ws).

How have these subsidies helped India adopt EVs?

Let's find out! So, in 2024 alone, the PM E-Drive scheme accounted for over 6 lakh e2Ws and e3Ws sales. And, it's because of these subsidies that India now is the world’s 2nd largest market for e2Ws and the largest market for e3Ws.

India's flourishing EV market is drawing global players who are keenly setting their sights on this emerging hotspot.

What is luring international EV manufacturers to India?

One major reason is the government’s new EV policy, which has significantly slashed import duty on EVs. This is not only helping boost the EV sector further but also encouraging foreign investment in India’s EV industry.

Below is the breakdown of import duty reduction.

| Import Duty Before New EV Policy | Import Duty After New EV Policy |

|---|---|

| 70% for EVs costing up to $40,000 | 15% for the first 5 years for EVs costing up to $35,000 |

| 100% for EVs costing above $40,000 | 15% for the first 5 years for EVs costing above $35,000 |

However, the benefit of import duty reduction can only be availed by companies that invest $500 million in EV manufacturing setups in India.

This move has attracted a lot of foreign companies to India. There is speculation about Tesla entering India. Vietnam's VinFast is also set to enter India with two premium electric SUVs, VF6 and VF7, which were displayed at the Bharat Mobility Expo 2025 in New Delhi.

VinFast Eyes India as a global export base

VinFast is Vietnam’s leading EV manufacturer and a Nasdaq-listed company. With North America and Vietnam as its primary markets, the company will now hit the Indian market later this year to mark its foray into the country.

The company is investing $500 million over 5 years to set up an integrated facility in Tamil Nadu, India with the aim to develop an entire EV eco-system, including battery manufacturing and setting up of charging stations across the country.

VinFast is set to make India a global export hub by establishing an automobile manufacturing factory with an initial output of 50,000 vehicles annually, with room to grow.

FYI: VinFast is a renowned automaker brand globally, with a market capitalization of $8.8 billion. The company sold over 20,000 electric cars in the Vietnamese market in December 2024, achieving a monthly delivery record in the history of their domestic auto market. In CY2024, the company was the best-selling vehicle brand in Vietnam selling more than 87,000 EVs in the domestic market.

The impact of new players

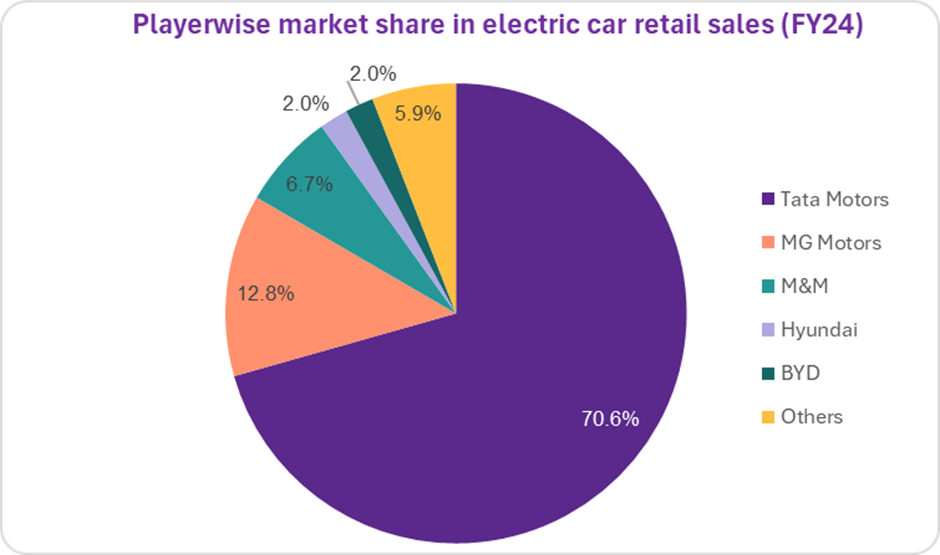

Homegrown carmaker Tata Motors has so far been the dominating EV car manufacturer in the country, followed by Mahindra and MG Motors.

Source: Hyundai Motor India Limited RHP

But with the country's aim to have 30% electrification by 2030 and the government’s favourable policies supporting the EV industry, India has become an attractive market for global EV players.

We are seeing new companies like Tesla and VinFast actively working to enter India. Even Chinese players BYD and MG Motor are looking to expand their presence in the country with their EV models. Similarly, South Korea’s Hyundai Motor has also started bringing its EVs to the Indian market.

Not just these companies, Ford, which previously had left the Indian market is also eyeing to re-enter India to tap into immense growth potential.

Will the new players change the dynamics of existing players?

Might be yes!

They may reduce the market share of existing players. And to compete with these emerging companies, the already established EV companies might have to execute new strategies.

Also, it is worth noting that foreign original equipment manufacturers (OEMs) have often struggled to succeed in the Indian market because of the difficulty in understanding the unique consumer demands and the overall market. We have seen that with General Motors, Renault, Nissan, Ford, Chevrolet, and Peugeot in the past. Hyundai and Kia are the only exceptions.

But there is more to it!

The EV Industry Expansion Could Benefit India in Many Ways The expanding EV industry with the entry of foreign automakers is a catalyst for change, potentially reshaping the entire Indian EV industry. It will benefit EV component manufacturers as well as charging infrastructure providers with more demand for their products.

The investment in India’s EV sector will also accelerate infrastructure development, boost technology advancements, and improve vehicle offerings with innovative features that benefit consumers and the industry.

The efforts from the government to promote EVs and the massive local and global investments will collectively shape India's electric future and contribute to India's position as an EV hub in the global EV landscape.

About The Author

Next Story